Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Early retirement packages can provide extra benefits, but they may also lead to higher expenses and reduced Social Security or pension income.

Severance pay is taxable and can push you into higher brackets, making tax planning a key part of the decision.

The right choice depends on your savings, age, health coverage, and retirement income needs, so every offer should be carefully evaluated.

You have spent decades planning for retirement. Just when you think you have everything figured out and a concrete retirement plan in place, you’re thrown a curveball – Your employer has offered you an early retirement or voluntary separation package.

You were planning on retiring in a few years. Now what?

Sure, the offer comes with extra pay. But what else should you consider? How do you begin to evaluate a voluntary severance package offer?

Whether your employer calls it a voluntary severance or separation package, a retirement buyout, or an early retirement offer, your options are the same. You can accept the offer and retire soon with added benefits, or reject the offer and continue working.

We’ve summarized a few of the most important factors to consider when weighing a voluntary severance package below.

We’ve helped clients who were employed by Collins Aerospace, John Deere, P&G, and other Iowa corridor companies evaluate their severance agreements.

Learn more: Watch our webinar replay below about evaluating voluntary separation packages. Simply click play on the video below and enter your email when prompted:

Want a complimentary assessment of your offer and financial situation? Schedule your free assessment.

The early retirement incentives provided by the voluntary separation agreement may include extended health benefits, a lump sum bonus, future annual payments, added years of service for pension benefits, and more. For someone close to their planned retirement date and in a good position to retire today, an early retirement offer can put them in better financial shape than they would have been otherwise.

However, accepting the retirement offer can also mean lower Social Security benefits, lower pension plan benefits, increased 401(k) or IRA withdrawals early in retirement, increased health care expenses, higher income tax bills, and many more complications. Therefore, accepting an offer before you are financially ready to retire can have severe consequences.

The Most Important Factors To Weigh in Your Decision to Accept a Voluntary Separation Offer

When weighing an early retirement offer, the most important considerations are your:

Let’s drill down into some of the most significant aspects of these factors.

Accepting an early retirement offer or voluntary severance package may require you to begin withdrawals from your 401(k), IRA, or other retirement accounts sooner than you originally expected.

Although you do not face any 10% early withdrawal penalties if you are age 55 or older and become separated from employment (this is commonly known as the “Age of 55 Rule”), withdrawing from your retirement accounts early could have a material impact on your long-term net worth.

Extra years of retirement can take a toll on your retirement nest egg. In fact, retiring earlier than planned can result in hundreds of thousands of dollars in extra expenses that your retirement portfolio must now support. It may also limit the growth of your assets already invested since you have to spend instead of save.

Can your retirement portfolio withstand fewer years of contributions and more years of withdrawals? This is the first question you need to answer when making your decision.

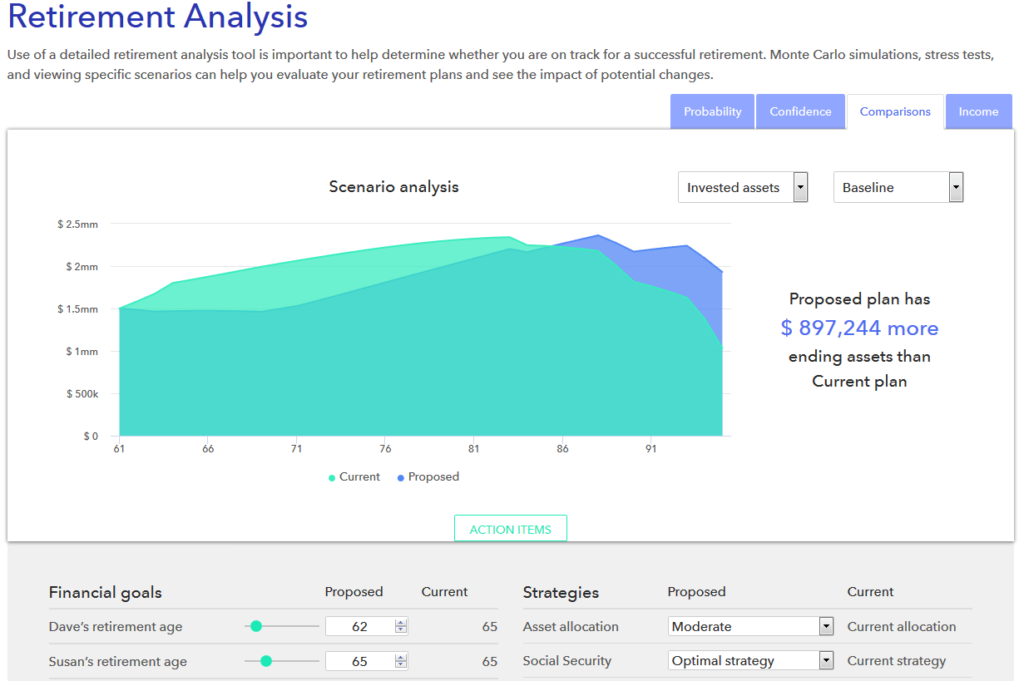

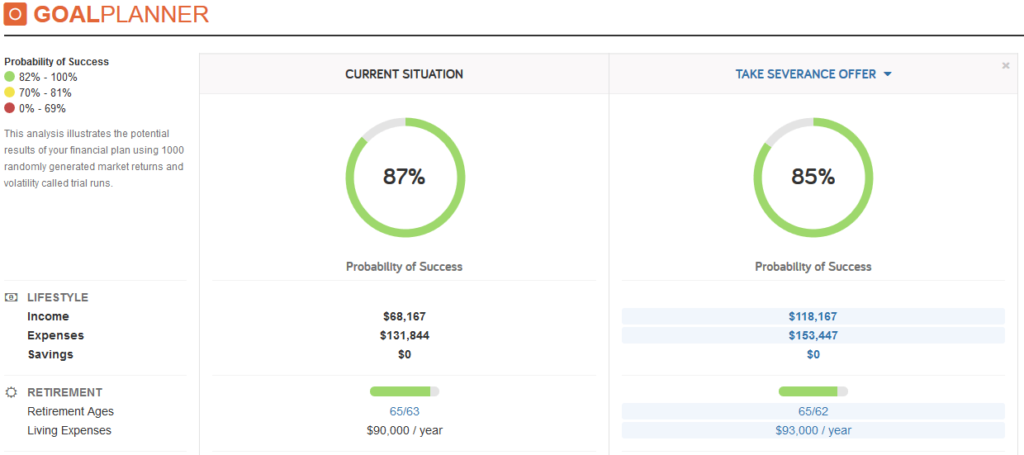

When we help clients answer this question, we commonly use Monte Carlo analysis. This allows us to simulate different scenarios side-by-side and quickly see the impact accepting or declining an early severance offer will have on your financial plan.

One overlooked aspect of an early retirement or severance offer is the income tax impact—and the added tax liability that can result. Here are key areas to evaluate before accepting or rejecting an offer:

Severance pay is considered ordinary income and taxed in the year you receive it. If your severance comes in the form of a large lump sum payment, it can easily push you into a higher marginal tax bracket, resulting in a larger portion of your income being taxed at elevated rates.

If you were already earning a full year’s salary and your lump sum severance is paid in the same calendar year, you may find yourself paying more in taxes than if the income were spread over time.

While the gross amount of your severance payment may be attractive, realize that if the payment pushes you into the 24% or 32% Federal income tax bracket, a large portion of the payment will not go towards funding your retirement goals.

If your severance payment will result in a significant jump in tax brackets, there are a few strategies to help mitigate the tax burden:

First, evaluate if you can defer and income. The severance payment may be able to be spread over two tax years rather than taken all at once. Some employers may offer this flexibility if you’re negotiating the terms.

Next, you should reconsider any planned retirement account withdrawals. You may want to delay withdrawals from retirement accounts like IRAs or 401(k)s if your severance significantly boosts your taxable income for the year.

Finally, if you are charitably inclined, consider bunching planned charitable gifts or utilize a Donor Advised Fund to added tax benefit. If you typically itemize deductions, you might be able to time certain deductions to maximize their tax benefit in a high-income year.

If you’ve received equity compensation—such as stock options or Restricted Stock Units (RSUs)—you’ll need to closely review what happens to those upon separation.

If you have vested stock options or RSUs, those will likely remain yours, though you may only have a limited window (often 90 days) to exercise stock options post-termination. Unvested shares, on the other hand, are usually forfeited unless your severance agreement says otherwise.

Exercising non-qualified stock options (NQSOs) can trigger immediate taxable income, while incentive stock options (ISOs) may have more favorable tax treatment but could be affected by the Alternative Minimum Tax (AMT). The timing of your departure and when you exercise and options can change the tax outcome significantly.

If you’re in a position to negotiate and have significant amounts of options or RSUs, consider asking for acceleration of unvested equity or cash compensation in lieu of forfeited awards.

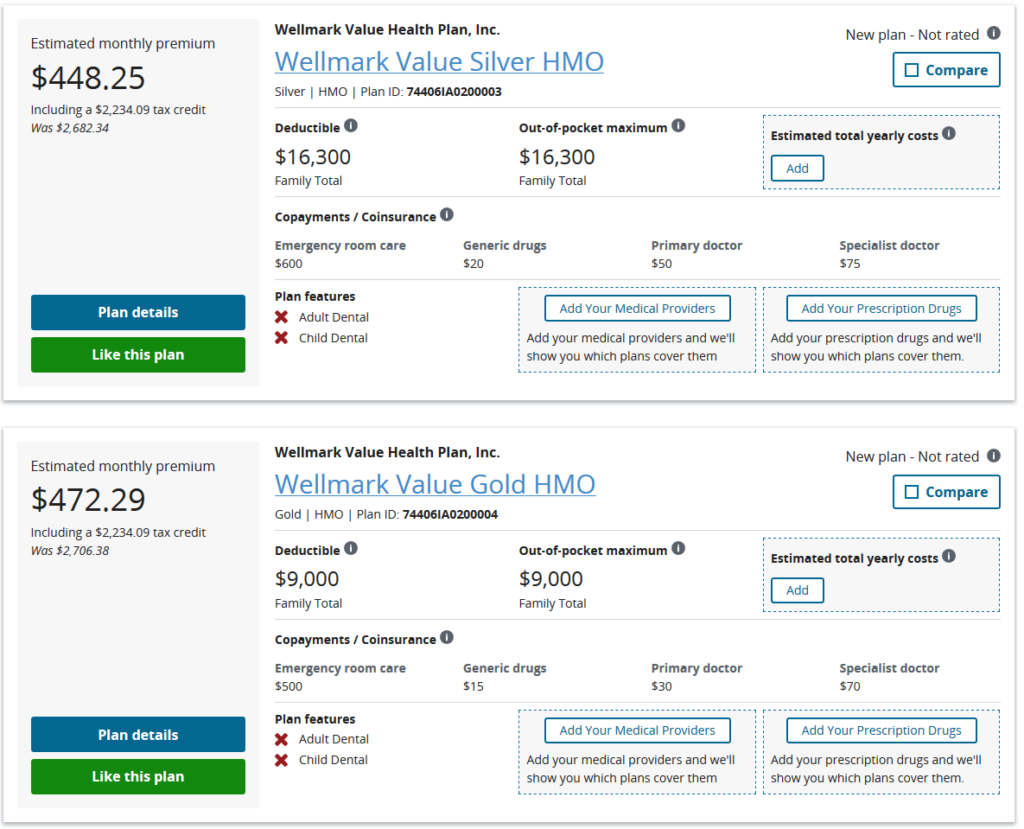

Health care has become one of the largest expenses for a retiree, even with good insurance. For many, a company’s contribution to your family’s health insurance premium is critical to keeping medical insurance and care affordable.

If you are lucky, your voluntary severance package will extend your health benefits. Health insurance will be needed until you are age 65 and become eligible for Medicare. However, not all those offered an early retirement package are so lucky.

If you will be on your own, paying for health insurance after accepting an early retirement offer, COBRA insurance is always available. COBRA may extend your family’s coverage for up to 18 months. But this coverage is expensive.

You also have the option of entering the open market for an insurance policy. You may want to consider this option if your separation package does not include health care, or only a small additional benefit to pay for health care. However, you may be faced with expensive premiums or high deductibles.

Before making a decision about an early retirement offer, determine if your severance package includes any health care benefits. If not, price out other health care options, such as those available on Heathcare.gov. Can the added expenses be supported with your retirement savings?

An HSA is one of the most powerful tax-advantaged tools you can carry into early retirement. And, unlike Flexible Spending Accounts (FSAs) you can take leftover money in HSAs with you. However, there are rules to know around how to use and fund your HSA once you separate from your employer.

If your company regularly funds part of your HSA, those contributions typically stop on the date your employment ends. Make sure you capture any final employer deposits (sometimes made on a payroll lag) and adjust your retirement budget to reflect the loss of that contribution. If you’re negotiating your severance, ask whether the employer will make a pro-rated HSA contribution for the remainder of the calendar year.

Withdrawals for qualified medical expenses are tax-free—an especially valuable benefit when you no longer have a paycheck.

HSAs can even be used to help cover some ongoing insurance costs you may have. The following expenses are generally considered qualified medical expenses for someone who is accepting a severance offer:

Because these withdrawals aren’t included in adjusted gross income, they can also help you control taxable income for things like Roth conversions or Affordable Care Act premium subsidies.

HSA contribution limits apply on a calendar-year basis. If you front-loaded contributions through payroll before accepting your offer, double-check how much you, and your employer, have already contributed to your HSA.

If your new health insurance does not make you eligible for an HSA, you may have to back out some amount of contributions.

Exceeding the limit triggers a 6 % excise tax on the excess every year it remains in the account. If you discover an over-contribution, withdraw the excess (and earnings) by the tax-filing deadline to avoid penalties.

Continue to Fund an HSA if You Can

However, accepting an offer does not necessarily mean you can no longer use your HSA. You can still contribute to an HSA for the months you remain in an eligible health insurance plan (i.e., covered by an HDHP and not enrolled in Medicare).

If you turn 55 or older by December 31, remember you’re entitled to an additional $1,000 catch-up contribution—but only to one HSA in your name, so coordinate with a spouse’s account if you’re both eligible.

Even if you do not have the cash flow to fully fund an HSA going forward, don’t forget about the one-time IRA to HSA rollover option available to you

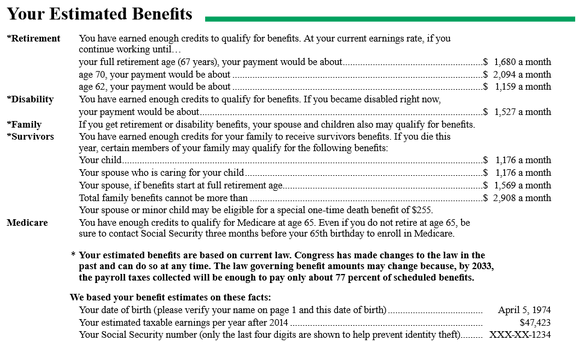

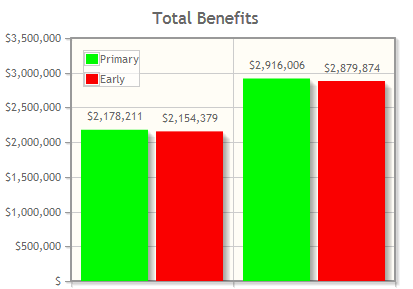

One potential consequence of accepting an early retirement offer is a reduction in Social Security benefits. Your future pension payments may also be reduced, depending on the language in your separation package.

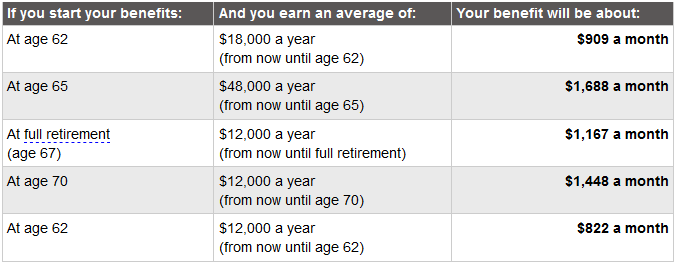

You have probably received your estimated Social Security retirement benefits from a statement that looks like this:

But, if you accept an early retirement package, the benefits listed on your statement is not what you will receive.

These estimated Social Security benefits assume that you continue to work and make your current salary. As a retiree who accepts an early voluntary severance package, your future income will likely be reduced. This means potentially lower future Social Security payments.

Likewise, your pension statement likely makes assumptions on years of service. If you accept an early retirement offer, your years of service may be less than what your pension statement assumes.

The first step is to determine what your Social Security or pension benefits will be if you accept the early retirement package.

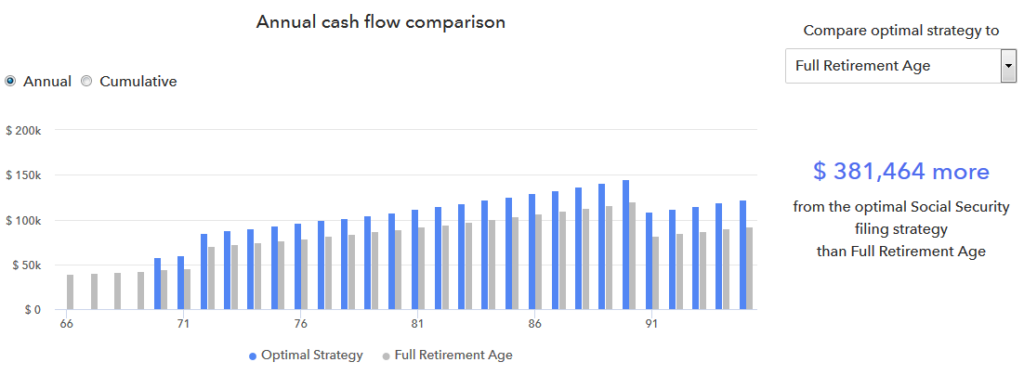

At Arnold & Mote Wealth Management, we use several different methods to determine your future pension benefits and your optimal Social Security selection.

Calculating your optimal Social Security and pension depends on the options you have available, your savings, and your spending needs.

Pensions, and particularly pension benefits for those who retire early, often have options for increased payments until the retiree reaches Social Security age. This is usually referred to as a ‘Social Security Offset’ option. This option adds more to your early benefits, but your lifetime benefits may be reduced.

You also will have to consider what portion of your pension would be left to your spouse if you were to pass away in retirement. For most, the peace of mind by ensuring their spouse will receive a sizeable pension, is best. However, this will leave you with lower monthly benefits.

You may know that your monthly Social Security benefit is increased the longer you delay beginning your benefit. But, that requires you to very likely draw down on your retirement savings more early on in retirement.

It may be tempting to begin your social security benefits at 62 if you are forced to retire early, but the permanent reduction in income can be devastating on a long-term financial plan.

Not only is it important to known which Social Security strategy gets you the most money in total, but also which options fits best with your retirement plan.

If you are evaluating the early retirement offer on your own, you can start by using the Social Security Administration’s Benefits Estimator.

From there, you can enter estimated future income to arrive at an estimated correct Social Security benefit.

Once you have this updated, compare your new estimate to your monthly expenses. What impact will this reduced benefit reduction will have on your retirement plan and anticipated retirement account withdrawals?

Accepting an early retirement offer may force you to tap into your retirement savings, such as your 401(k) or IRA earlier, or it may mean changing when you will need to begin Social Security.

Learn more: Watch our webinar above about evaluating voluntary separation packages, and read our interview in this The Wall Street Journal article, Should You Consider Early Retirement in a Recession?

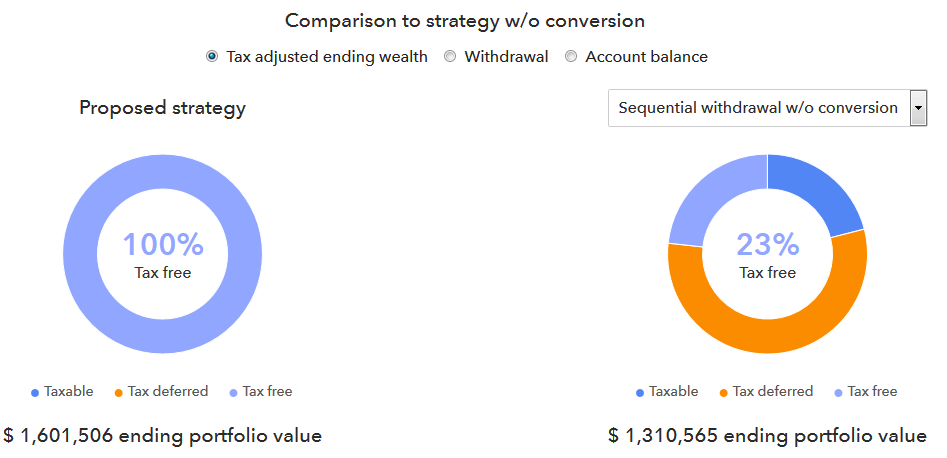

For those with retirement account assets in tax-deferred retirement savings accounts (like 401(k)s and IRAs), an early retirement offer opens up the potential to save significantly on future taxes.

Those who accept an early retirement buyout offer from their company will likely be facing a year or two of reduced income before Social Security benefits kick in. These years of reduced income leave you in a low tax bracket and can be the perfect time to convert some assets within your 401(k) or traditional IRA into a Roth IRA.

Roth conversions can be an incredibly valuable tool for those who accept an early retirement offer. They can increase asset longevity and reduce total taxes paid during their retirement.

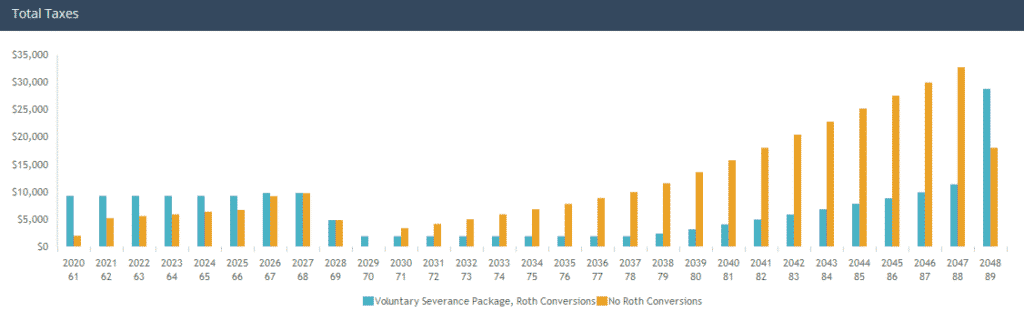

Below is a screenshot from our tax planning software we use to help retirees understand and reduce their future tax liability in retirement. Many times, we find those who retire early with a voluntary severance package have significant opportunities to take advantage of an extra low-earning years to perform Roth conversions and save on taxes.

These years of lower income will be a great opportunity for Roth conversions, but there are complex calculations to determine how much and when to convert to a Roth IRA.

Building a conversion schedule to optimize tax brackets and avoid unnecessary tax burdens.

A large enough severance and retirement savings balance might mean spreading conversions over multiple tax years. It is not unusual for our clients to have 5-10 years of Roth conversions to balance the tax benefits with the immediate tax burdens.

Another consequence of accepting an early retirement or severance offer is the potential loss of employer-provided life insurance.

Group life insurance is a common workplace benefit, and once your employment ends, so does your coverage unless the plan offers a conversion option (which is often expensive and limited in scope).

If you still have a significant financial need for life insurance (for example, to support a spouse, cover a mortgage, or provide for dependent children), you’ll want to explore replacement coverage before you leave.

Private insurers can offer term or permanent life insurance but be aware: if you’ve experienced major health issues, qualifying for a new policy could be difficult or come with higher premiums. In that case, the loss of your employer-sponsored coverage could have a real financial impact and should be factored into your decision about whether or not to accept the offer.

Even if you don’t need new coverage, this is a smart time to reassess your overall life insurance strategy.

If your financial responsibilities have changed—such as no longer having dependents or having sufficient assets—you may be able to reduce or cancel existing policies, lowering your ongoing expenses.

Alternatively, if you hold permanent life insurance with accumulated cash value, you might consider surrendering the policy to access those funds for retirement needs or exchanging it (via a 1035 exchange) into another policy or annuity that better aligns with your goals.

Early retirement can dramatically shift your life insurance needs and options. Make sure you understand what coverage is going away, and what you will need going forward.

Of course, you have the option to say no to voluntary severance payments.

If you want to continue working, or are unable to retire early, this may be your best option. Working additional years can lead to pay raises, promotions, increased Social Security and pension payments, and increased financial stability.

However, rejecting an early retirement offer has potential drawbacks too.

First, there is no guarantee that the company will repeat the early retirement offer in the future. Assuming that another offer will come later is not always a wise move.

Second, and more importantly, realize that a company offering an early severance package to its employees is doing so to cut costs. If the company’s finances do not improve, there may be much worse outcomes in the future. The company may make involuntary layoffs, reduce employee pay, or eliminate other benefits as allowed by employment laws.

Understanding the company’s motivation can help you better assess the timing and terms of any offer, and help you decide whether or not to accept or reject an offer.

Early retirement packages and voluntary separation offers aren’t just acts of generosity, they’re strategic business decisions. Companies use these reductions in force to manage workforce changes in a way that balances financial goals with employee relations.

The primary reason companies offer these packages to employees is for cost savings.

Senior employees often earn higher salaries and have more expensive benefit packages. Encouraging voluntary departures can free up budget space without the legal risks or morale issues that can come with involuntary layoffs.

These offers may also just be a way for the company to restructure its workforce. As companies adapt to new technologies, market demands, or business strategies, they may need different skills or fewer people in certain departments. Voluntary offers provide a softer way to realign staff without disrupting the entire organization.

Companies also hope that these offers maintain company morale. Layoffs can damage morale and maintain goodwill for those leaving and for those who remain. Offering early retirement allows employees to exit on more favorable terms and with a sense of control. This approach helps protect the company’s reputation and keeps teams more stable during transitions.

Finally, workforce reductions may also be done to create opportunities for internal promotions and bring in new talent. For organizations thinking long-term, these offers help refresh the workforce and ensure a pipeline of future leaders or employees with more current technical skills.

Understanding which of these reasons apply to your situation may help you make a decision on the best course of action for you.

The fiduciary, fee-only financial planners and retirement experts at Arnold and Mote Wealth Management are here to help you with this important decision.

We have helped employees of Procter and Gamble (P&G), Rockwell Collins (Collins Aerospace), Raytheon, John Deere, and other companies determine if a voluntary severance package is right for them. We work directly in-person with clients in the Cedar Rapids and Iowa City Corridor area, and we serve clients across the United States virtually.

Want a complimentary assessment with a fiduciary financial advisor of your offer and financial situation? Schedule your free assessment!

Important note: Although you have been planning for your retirement for decades, you often don’t have long to act on an early retirement offer. Collins Aerospace (formerly Rockwell Collins) employees who were offered a voluntary severance package in mid-December 2018 had just 45 days, with holidays in the middle, to decide. Don’t delay — schedule your free assessment now!

Get started on the right path with our free Retirement Guide with five important tips for successful retirement planning!

Be sure to see all the elements of our financial plans.

And check out our other retirement blog posts and videos that can help you better prepare for and get more enjoyment from retirement.

Note: This blog has been updated on May 22, 2025.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.