Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

As you think about your retirement, you may be naturally concerned about retirement risks, like outliving your savings, which we call longevity risk. We use five main strategies for ensuring that you don’t run out of retirement income, no matter how long you live:

We start with Guardrails on spending, which is a strategy to reevaluate your safe withdrawal rate each year as life changes or your investment balances go up or down unexpectedly.

We can provide clear guidance on when withdrawal amounts should be adjusted early on to ensure they remain sustainable.

Next, we look at tax-efficient withdrawal strategies to minimize how much you pay in income taxes so that your money can go further in years. We can advise you to do Roth conversions, or withdraw from pre-tax retirement accounts in low income years.

If you have $1 million in your 401(k), many people do not consider that a significant portion of that 401(k) balance will not go towards paying towards living expenses, but instead it will go towards taxes. Worse yet, we find that many retirees with large pre-tax 401(k) balances will end up being subject to higher tax rates later in retirement due to rising RMDs.

If we can create a tax plan that reduces your average tax rate in retirement from 30% to 20%, we can potentially leave you with the assets needed to pay for more years of living expenses.

Asset allocation between stocks and bonds is an important way to balance your need for regular income with the long-term performance of stocks. While stocks can be more volatile, they have historically returned above inflation over long periods of time.

Bonds, pensions, and annuities can certainly help protect against outliving your assets. But because Inflation over long periods contributes to significantly longevity risk, owning assets that counteract inflation is important.

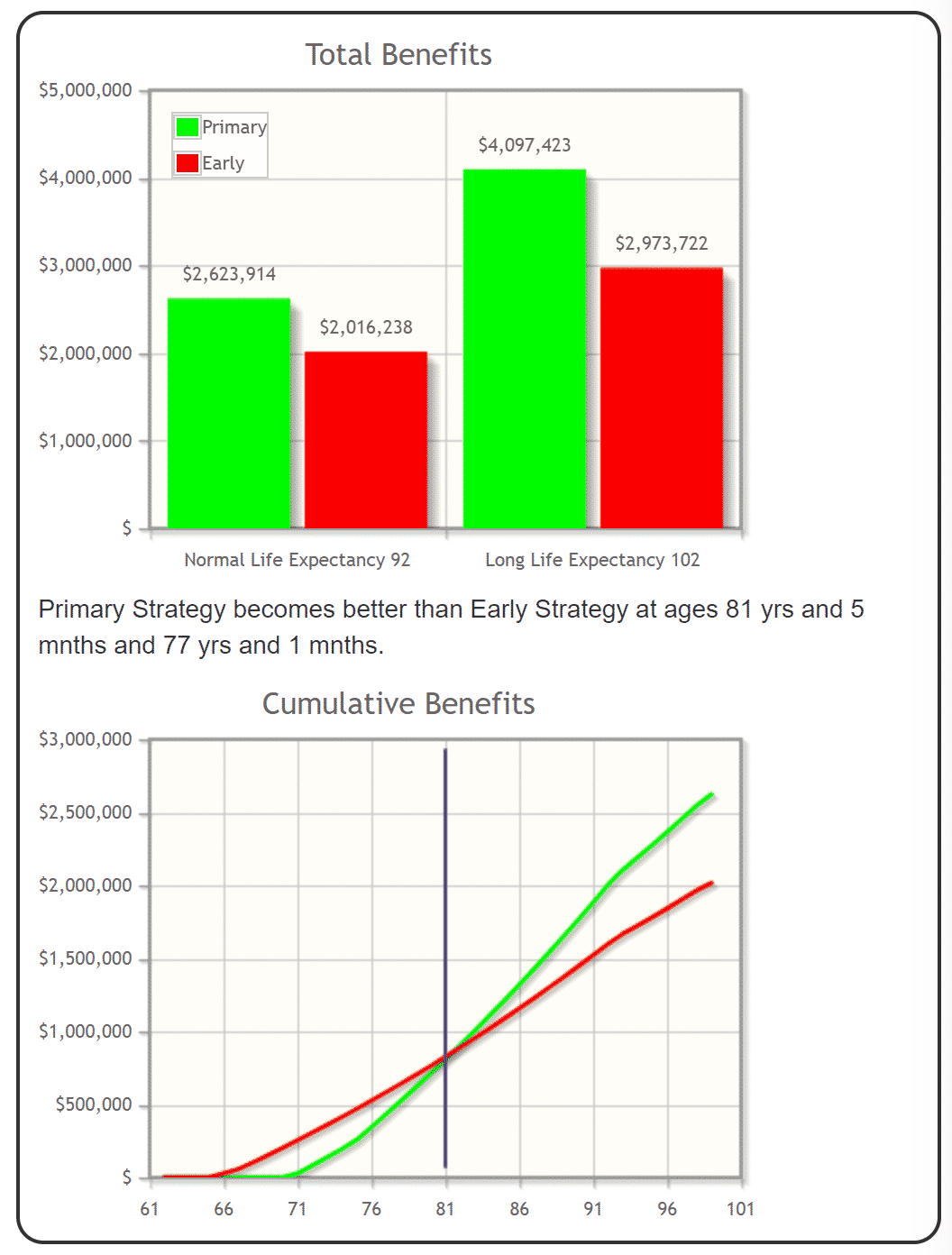

Fourth, choosing when to claim your Social Security can be a great way to boost your income over the long haul. Social Security has a built-in benefit increase if you wait past your full retirement age to start. Since Social Security also increases with inflation year year, it’s a good way to protect your income for your whole life.

For most households, we find a strategy that allows one or both spouses to delay Social Security until age 70 to be one of the most effective ways to protect against the risk of outliving your assets.

Finally, a low-cost, simple annuity can be a good strategy if you need more fixed income monthly. Annuities typically pay out for your whole life, regardless of how long you live.

Creating a retirement income plan that provides enough fixed income for essential expenses with Social Security and annuities can help you feel confident in your plan throughout retirement.

We discuss several annuity options in our webinar here: The Only 2 Types of Annuities We Recommend.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.