Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

For higher income retirees, Medicare adds a surcharge to your Part B and Part D premiums, called IRMAA, or the Income Related Monthly Adjustment Amount. The extra charge is determined by your Modified Adjusted Gross Income, and there are a couple important questions we’re often asked:

We have several other articles that go into detail about various aspects of IRMAA, including:

What Income Counts Towards IRMAA

and, How to Appeal IRMAA

In this article, we are just going to cover some common questions that we receive about IRMAA that can be answered without knowing a lot about your personal financial situation.

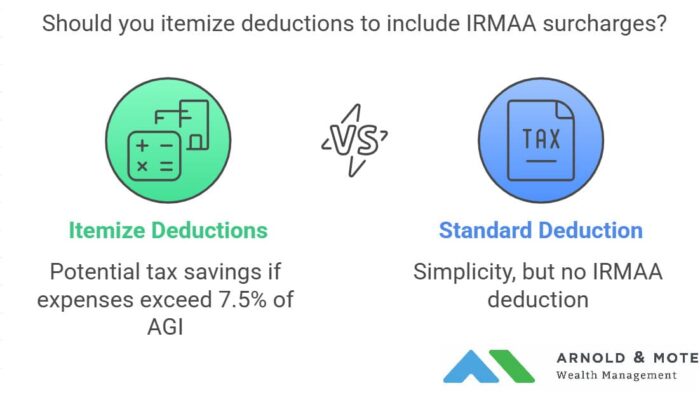

Yes, IRMAA surcharges are deductible as part of the medical expense deduction (as are other Medicare expenses). But, because of the relatively high standard deduction today, few taxpayers itemize their deductions and qualify for this.

If you do itemize on your taxes, you are able to deduct any medical and dental expense for you, your spouse, and your dependents that exceed 7.5% of your AGI, or Adjusted Gross Income. If your Medicare expenses, along with out of pocket expenses for medical and dental care exceed 7.5%, you may be able to take advantage of this and receive a tax deduction based on your Medicare surcharge.

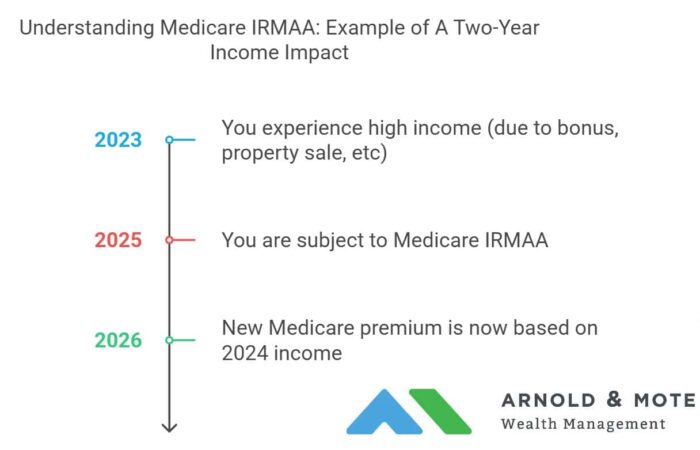

Your surcharge is determined each year, so if you’re only high income for one year, it will eventually be reduced in a future year. Typically, you will be notified by the Social Security Administration in November or early December if you will be subject to the Medicare surcharge for the next year.

There’s a two-year lookback for the charge. So your 2025 Medicare premium will be based on your 2023 income. Your 2026 Medicare premium would be based on your 2024 income.

For example, if you had very high income in 2023 due to a work bonus, sale of a rental property, Roth conversion, or large IRA withdrawal, that will only impact your 2025 Medicare premium. It will not impact you for the rest of your life as long as your income drops in future years.

If you have started your Social Security benefits, you will pay the Medicare surcharge through your monthly Social Security payment. You will receive a reduced net amount into your bank account each month as the Medicare premiums and surcharges are withheld.

If you have not begun your Social Security benefits yet, you may also pay via direct bill, as part of your regular Part B and Part D payment on a quarterly basis.

If you are being impacted, consult with a tax planner like Arnold & Mote on how to manage your Medicare IRMAA charges. We find that it is rare that a retiree is impacted by IRMAA only once. We help our clients create tax-efficient retirement plans to avoid unnecessarily triggering IRMAA. Since even one year of surcharges can amount to thousands of dollars in added fees, clients who find themselves subject to this surcharge can find great value in getting help crafting a tax-efficient plan for retirement.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.