Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Interest in Roth conversions has increased dramatically recently. As tax rates have declined, more and more baby boomers retire, and 401k balances grow, many are taking the opportunity to convert their 401k and IRAs into Roths for retirement.

While many investors understand the basic principal behind a Roth conversion, calculating exactly when, or how much, to convert can be much harder to figure out.

In this post, we cover the basic concept of a Roth IRA conversions, and detail the initial steps we take in calculating the potential benefit of Roth conversions for a client.

As a reminder, we are a Flat Fee financial advisor. We do not charge percent based fees, or earn commissions from any of our services. Our flat fee services include Roth conversion planning.

Bonus: We recently hosted a webinar on the topic of Roth Conversions and a recording of the webinar can be viewed below by clicking play and entering your email address when prompted:

Looking for more retirement tips, strategies, and resources? Sign up for our free Retirement Guide!

Since 401ks were created in 1978, more than $7 trillion has been saved in 401k accounts. Trillions more have already been rolled over into traditional IRAs.

Today’s 401k retirement system replaced the pension system from a generation before. Your parents likely grew up and retired in a very different world than you will.

Instead of large pensions, most recent or soon-to-be retirees today have been using 401ks and traditional IRAs to save for retirement.

While you are working, the 401k system seems to work great. 401k contributions are tax deductible, your company also contributes to your account, and the money in your 401k grows tax deferred for decades.

But now, as the first generation is beginning to retire exclusively on IRAs and 401ks, the downside of saving heavily in 401ks is becoming apparent:

That $7 trillion Americans have in 401k in savings? It does not all belong to the account owners – A big chunk of it belongs to the government.

Uncle Sam has been patiently waiting to collect all those taxes retirees have been deferring in their IRAs and 401ks for the last several decades. And once you retire, he will get his share.

Whenever you withdraw from your 401k or IRA, it is taxed – Just like the income from your job was taxed. So, when you are retired and need $80,000 from your IRA for living expenses, a new car, and a nice vacation, the IRS treats you just about the same as if you worked and had $80,000 in earned income.

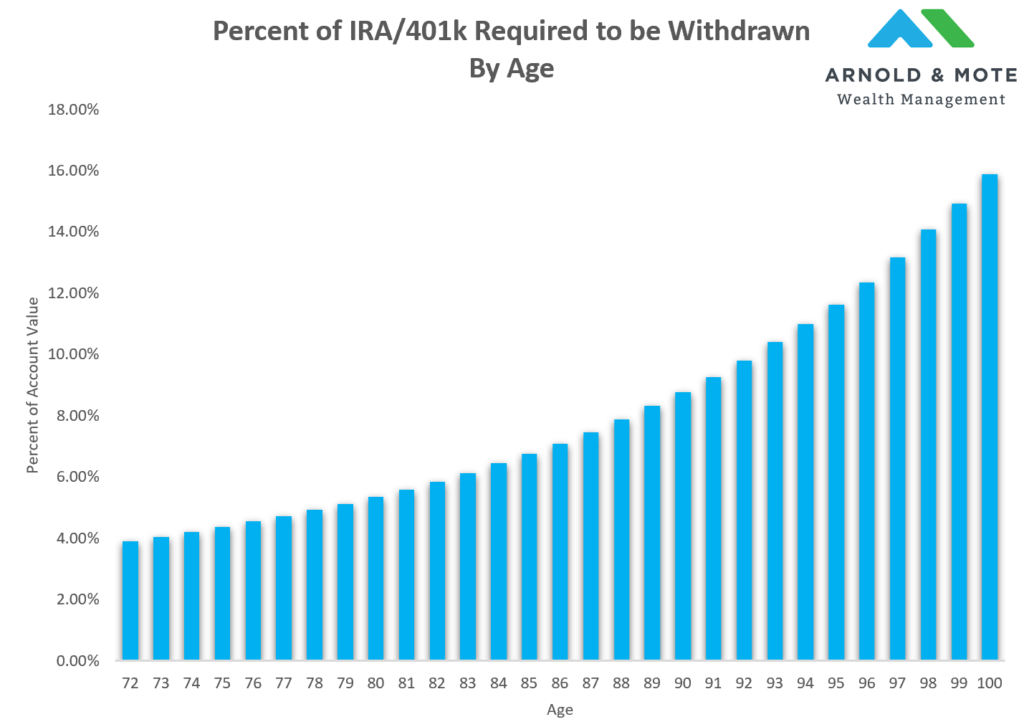

Worse yet, as you age the government will force you to withdraw more and more from your IRA and 401ks. This is known as RMDs, or required minimum distributions. They start small, but grow significantly during your retirement.

For this reason, we find that many retirees with IRA and 401k totals over $700,000 are in for a big surprise later in retirement.

If you have most of your savings in a 401k or rollover IRA – Being retired does not mean you will be in a low tax bracket!

Do Roth IRA conversions make sense for you? Tax planning is just one of the many services we offer.

The decades of tax deferral for millions of Americans is quickly coming to an end. Of that $7 trillion Americans have saved in their IRAs and 401ks – More than $1.5 trillion will likely go to the government in taxes.

But there are retirement accounts that are not taxed in this way – Roth IRAs.

20 years after 401ks were created, a new type of retirement account was born – The Roth IRA.

Unlike traditional IRAs, or your 401k, all money that goes into a Roth IRA is after-tax. There are no tax deductions for contributing to a Roth IRA. But, in exchange the money in a Roth IRA grows tax free. Better yet, when the money is withdrawn the account owner pays no taxes at all.

If Americans had $7 trillion in Roth IRAs, every single penny of that $7 trillion would be theirs and $0 would go to the government in taxes.

The problem is amassing assets in Roth accounts is hard.

If you don’t have a Roth 401k option, the IRS limits the amount you can contribute to a Roth IRA to $7,000 per year (for 2024, $8,000 if you are over age 50), and limits who can contribute that full amount to only those with a household modified adjusted gross income of $230,000 or less (if you are married filing jointly in 2024, $146,000 or less if your filing status is single).

But there is an additional way to get money into a Roth IRA besides regular annual contributions – Regardless of your gross income!

A Roth IRA conversion.

A Roth conversion moves assets from a traditional IRA to a Roth IRA. But, there is a catch – The conversion involves paying taxes today, since Roth conversions count as income.

How much in taxes will you pay when doing a Roth conversion? That depends on your other income and your effective tax rate. If we assume your effective tax rate is 15%, about where many retirees see themselves today, that means you will pay $15,000 in taxes to convert $100,000 from a traditional IRA to a Roth IRA.

Is that a smart move? Let’s take a look at an example to see the potential benefits of doing these Roth conversions.

Let’s consider a simplified example:

A married couple in Iowa, retired, both 67 years old, each with $500,000 in their rollover IRAs, invested in a 60/40 stock/bond split. Besides their $1 million in retirement assets, they have $100,000 in cash and CDs. Their IRA investments are projected to grow at 7.2% per year.

Their only retirement income is a monthly Social Security benefit of $2,500 per month for each spouse. We assume this benefit rises 2% per year.

They desire to spend $90,000 per year for the next 10 years, then plan for spending to decline to $75,000 per year thereafter. All living expenses increase 3% a year to keep up with assumed inflation.

This couple has done very well for themselves. Their diligent savings habits and responsibility to live below their means has led to them amassing a million dollars in their 401k retirement accounts!

But – Here’s what they don’t realize. In just a few years, their tax burden will skyrocket.

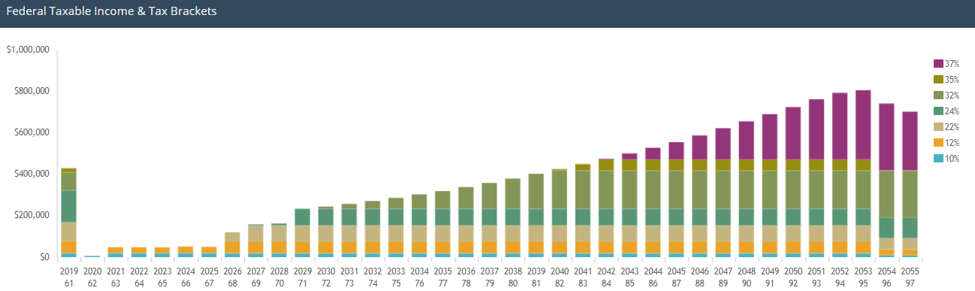

Assuming one spouse lives to be 95, how much do you think this retired couple will pay in taxes? (assuming no changes from today’s tax laws)

$1.1 million!

How can that be?

Using some of the same analysis we perform for clients, we can see that much of this tax burden occurs late in life, when the combination of RMDs and Social Security forces our retired couple into a high tax bracket. For our example couple, some of their withdrawals later in retirement are going to be taxed at a 32% rate!

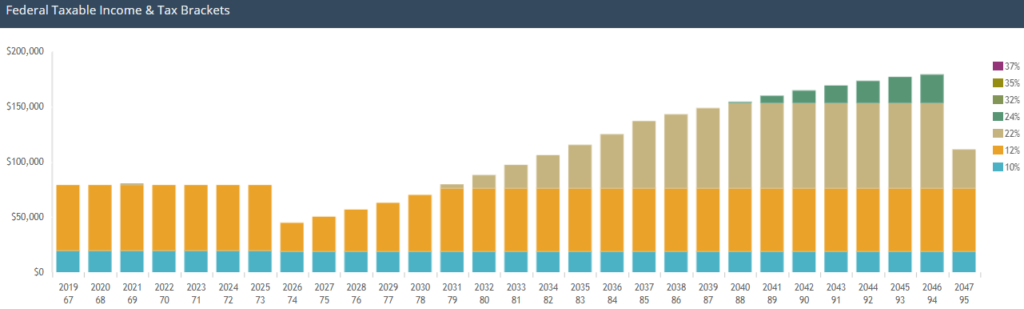

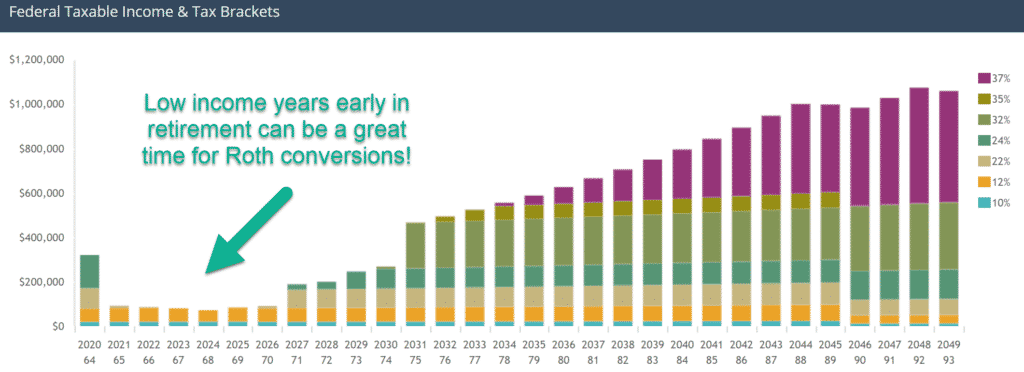

This hypothetical retired couple is in a very familiar position that we see many retirees today. While the first few years of retirement will result in a low tax rate – the future looks much different.

Notice that our retired couple has little to no tax burden early in retirement. At the onset of Social Security and RMDs, most of their income is taxed only at the 10% or 12% rate.

Many retirees today are looking at the early years of that chart, and celebrating over their low tax rate. But that can be a big mistake, because their tax rate is about to increase substantially.

As RMDs increase and Social Security benefits rise with inflation, so does our retired couple’s tax rate. By the time they are late in their retirement, money is being taxed as high as 32%!

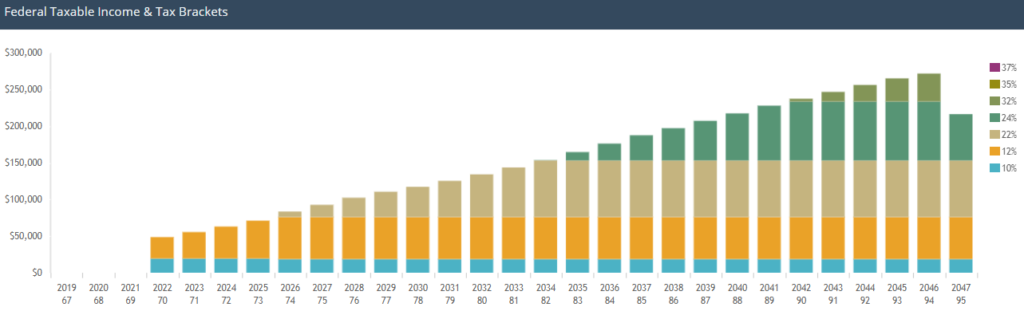

But, our retired couple can avoid some of these high tax rates by doing Roth IRA conversions early in retirement.

Remember that the couple’s tax rate was very low early in retirement? If that couple could convert assets from their Rollover IRAs to a Roth IRA in those early years, they would pay a very low tax rate.

For example, what if we had this couple convert just enough assets to be taxed at the 12% tax rate, but no higher?

Then their future tax burden looks something like this:

Notice that the couple’s taxes are higher for the next few years…

But, their tax rate later in life is greatly reduced. Gone are the years of a 32% marginal tax rate! They did pay a 12% tax rate for doing Roth conversions, but they prevented a 32% tax rate later in retirement.

With this simple Roth conversion schedule, our retired couple has reduced their total tax bill to just over $700,000 – a near $400,000 reduction in total taxes paid compared to if they did no conversions at all.

Here’s what a lot of retirees fail to consider: As you withdraw more from your IRAs, your taxable income increases – But it doesn’t stop there:

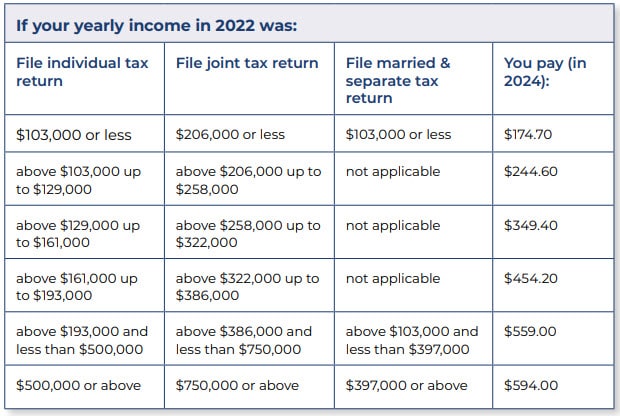

Source: Medicare.gov

This is known as the IRMAA (Income Related Monthly Adjustment Amount)

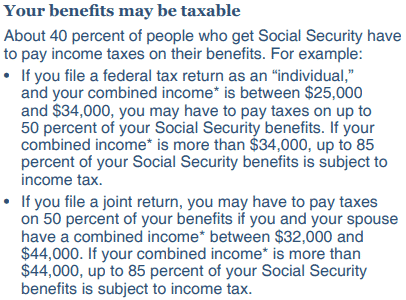

Source: https://www.ssa.gov/pubs/EN-05-10035.pdf

Then of course, as these taxes increase your need to withdraw more from your IRA to pay the taxes!

IRA conversions have the potential to help you avoid this.

In addition to helping you save on taxes, Roth IRA conversions can be tremendously beneficial for your heirs if they inherit your 401k or traditional IRA – Here’s why:

Each of your retirement and savings accounts have a beneficiary. This is the person that will inherit your account when you pass. For most, this is your spouse or your children.

If you pass along a traditional IRA, your beneficiary will have to pay taxes on every dollar they withdraw from the account- And the government will force them to take this money out. (And the new SECURE Act passed in December 2019 makes this even worse – More on that below)

If the account beneficiary has a high-income at the time the account owner passes, they are already in a high income tax bracket. Then, the income from the inherited IRA will push their total taxable income even higher – and it will all be subjected to a higher tax rate.

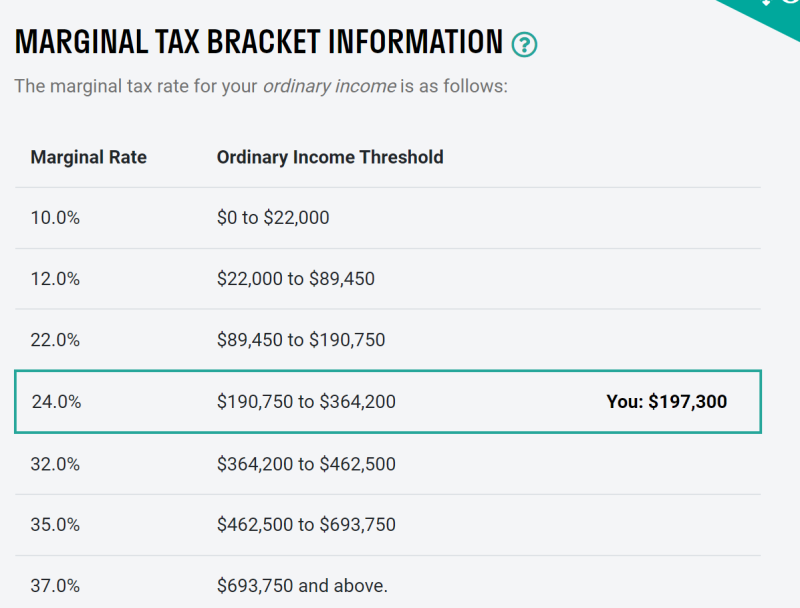

For example, if the inheriting household has a taxable income of around $190,000, they are in the 24% income tax bracket for 2023:

This means that if your heir inherits $100,000 in a traditional IRA – at least $24,000 of it will likely go to taxes! After taxes, that $100,000 inheritance is down to $76,000.

Roth conversions give you the chance to pay those taxes in advance, potentially at a much lower rate. Remember our example client above who was able to convert a significant portion of their traditional IRA into a Roth IRA just by filling up the 12% income tax bracket? That action would cut their family’s net tax bill by $12,000.

And that savings amount potentially increases as the value of the inherited account rises. If you could have similar savings on a larger Roth IRA balance, say $500,000, that tax savings for your heirs rises to $70,000!

Roth IRA conversions allow you an opportunity to pay taxes at a lower rate than your heirs would. For those expecting to leave a sizable inheritance, and whose children are professionals with a high income – This can be a tremendous benefit.

Roth conversions can be a valuable tool – But there is one more step. How to calculate the optimal amount to convert to a Roth IRA.

To evaluate the potential benefits of Roth conversions, we use a client’s projected tax liability, like that detailed above, and compare it to the tax cost of converting IRA assets to a Roth today.

When determining the optimal amount of IRA assets to convert to a Roth IRA, we typically target an amount that would “fill up” a specific tax bracket. For example, in 2024 household income between $94,300 and $201,050 is taxed at 22%. If you had $140,000 in income for a year, we may have looked to convert enough IRA assets to generate income to use up the rest of the space in the 22% tax bracket, or $61,050 in this case ($201,050 – $140,000 = $61,050).

We would refer to this as a “22% Roth Conversion Strategy”, meaning we would plan on converting enough assets each year that causes the client to recognize income that fills up the 22% income tax bracket.

Determining the optimal amount to convert to a Roth is not an easy calculation. It is heavily dependent on your future spending goals, your other income (pensions and social security for example), future tax laws, inflation, investment performance, charitable giving intentions, and more.

For some wealthy individuals likely to leave assets to their heirs, an aggressive conversion schedule may be ideal.

For a retiree with little savings, little to no Roth IRA conversions may be the better strategy.

Do Roth conversions make sense for you? Schedule a meeting for a free assessment.

Because Roth conversions generate income, there is some strategy on the optimal times to perform the conversions in order to avoid an unnecessarily large tax bill. For many retirees, finding a period of low income allows for larger conversions with smaller tax burdens. When is the best time to perform Roth conversions?

There is no single answer. It depends on your financial plan.

For example, if you retire at age 65 and are able to delay Social Security until age 70, you have 5 years with little to no income – And therefore lots of room to perform IRA conversions!

Others may work longer, take Social Security earlier, or have pensions that make the optimal time to perform IRA conversions earlier – Even if they are still working.

Younger savers may find other opportune times to convert. Young workers may see a short term reduction in income for various reasons – Going back to school, a sabbatical, changing jobs, maternity or paternity leave, starting a business, etc. All of these can be great times to recognize some additional income with a Roth conversion.

Roth conversions are not the right strategy for everyone and, like any investing decision, there are potential risks.

Since performing IRA conversions means paying taxes today, you are making a bet that future tax rates do not decline significantly in the future. If tax rates were to fall, it may mean you could convert or withdraw assets at a lower tax rate later.

There are other political risks with Roth IRAs as well. Congress may someday mandate required minimum distributions from Roths, or even potentially tax them. Although we believe that these actions are highly unlikely, there’s no guarantee the laws regarding Roths stay unchanged over the next few decades.

Next, Roth IRA conversions should typically only be done for long-term investments. Since the process of converting your IRA account to a Roth results in taxes, it is best to take advantage of the ROTH’s long term, tax free growth. If you convert and then need to immediately pull out the money, it may result in higher taxes than you would normally have paid.

Lastly, if you plan to contribute to any charities, or leave any assets to charity at the end of your life, fully converting your 401k and IRA to Roth IRAs may not be a good idea. Since charities do not pay taxes, it does not make sense for you to pay taxes (via a Roth conversion) prior to giving the money to charity.

The new Secure Act made some significant changes to the laws that govern our retirement.

One of the most significant was the reduction in the ‘Stretch IRA’, which allowed the inheritor of an IRA to slowly take the money out over many decades. This reduced their tax burden, and allowed the money to stay invested in a tax deferred account for a much longer period.

But the SECURE Act changed that.

Now, if you inherit an IRA, the money must be fully withdrawn in 10 years or less. That forces you, or your heirs, to withdraw the account faster and recognize more taxes sooner.

Roth IRAs were not excluded from this new SECURE Act change. But remember that Roth IRA withdrawals are not taxed. So, although the inherited Roth IRA must be emptied within 10 years, there is no significant tax burden for doing so.

This gives an even larger benefit to IRA conversions for those leaving a significant amount of assets to heirs, or for those with heirs already in a high tax bracket.

Yes! Anyone with a traditional IRA can do a Roth conversion. Roth conversions do not require earned income like regular Roth IRA contributions, and there are no income limitations to be eligible to do a conversion.

A Roth conversion is moving savings from a pre-tax, or tax-deferred retirement account to a Roth savings account. This requires you to pay taxes on the amount you are converting, however in exchange all future growth and withdrawals will be tax free.

Because doing a Roth conversion involves paying taxes, ideally you’d wait for low income years (typically in early retirement) in order to take advantage of low tax brackets. However, there will be benefits to doing Roth conversions anytime if you believe your future tax rate will be higher than it is the year you do the conversion.

While it is most common for retirees to do Roth conversions in their early years of retirement, there are also valid strategies for younger savers to do Roth conversions as well.

No, you are required to take an RMD even if you do Roth conversions. The amount that is converted does not count as a withdrawal and is instead classified as a “rollover”.

However, note that if you withhold taxes as part of your Roth conversion, that tax withholding can be done to count towards your RMD. For example, if your RMD is $20,000 for the year, and you do a $120,000 Roth conversion while doing a special distribution to withhold $20,000 for state and federal taxes, your RMD will be satisfied.

If you have earned income, you may be able to use the proceeds from your RMD to contribute to a Roth IRA if you meet all the requirements to be eligible for Roth IRA contributions.

If you are currently at a lower tax rate than you will be in the future, Roth conversions create value. That value will depend on your current and future tax rate, and the amount you convert.

For example, let’s say you can do a $20,000 Roth conversion and remain in the 12% income tax bracket. In this case, you will pay $2,400 in taxes to do the conversion. If in the future your IRA withdrawals would be subject to 22% income tax rate, you would pay $4,400 in taxes in the future. In this case, Roth conversions would be worth about $2,000 in tax savings every year you did them.

While a Roth conversion does require you to pay taxes today, it can significantly reduce your future tax liability. In general, we find that couples with more than $700,000 in IRA and 401(k) savings will benefit from a Roth conversion strategy.

This is because as you age, the IRS will require more and more money to be withdrawn from your IRA, which creates taxable income to you. By doing Roth conversions early in retirement, that required distribution is reduced.

Roth conversions may be beneficial for a 65 year old retired person who is delaying Social Security benefits and has a sizeable amount in a pre-tax retirement account such as an IRA or 401(k).

The exact amounts to convert will depend on your desired spending amount in retirement, retirement account balances, your other income (pensions, Social Security, etc), and how long you anticipate living.

Roth conversions have exploded in popularity over the last few years. Today’s low tax rates, and the changes in the tax laws have created significant benefits for those who convert their IRAs to Roth IRAs for retirement.

The trick is not so much determining if converting IRAs to Roth IRAs in retirement is right for you – but how much to convert, and when.

Unfortunately, a general answer to that is tough to give. It takes thorough analysis of your spending, income, goals, and more to determine the best Roth conversion strategy.

Do you have $700,000 or more in your 401ks and IRAs? From our experience, if you do, Roth conversions can be incredibly advantageous for you.

Let’s talk and see if Roth Conversions are right for you: Schedule a Free Roth Conversion Assessment

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.