Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Long term care insurance is important because the costs of long term care can be a burden on just about every retiree.

Because of the high costs, many people turn to long term care insurance to help pay the bills if the need arises. However, traditional long term care insurance is expensive.

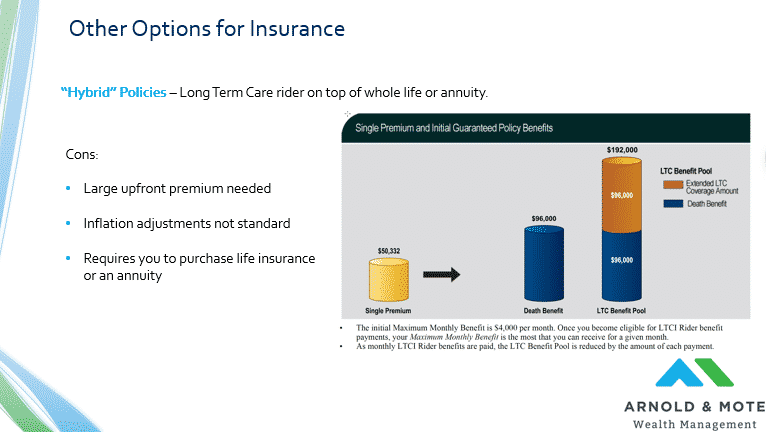

A lot of alternative types of insurance, commonly called “Hybrid long term care insurance” are sold to retirees in an attempt to make the costs look more manageable. What should you know about these policies?

These insurance policies usually involve permanent life insurance, such as whole or universal life insurance, with a special rider that allows for a portion of the death benefit of the policy to be used to cover long term care expenses while you are still alive.

The concept may sound great, but in reality we rarely find these policies to be better than traditional long term care insurance.

First of all, hybrid long term care requires you to purchase additional life insurance at a time when it is very expensive to do so, and when most people quite frankly just don’t have a need for life insurance.

Besides that, hybrid policies typically require very large lump sum payments to pay up the policies.

For example, we have recently seen a 53 year old that had to pay just over $50,000 upfront for a permanent life insurance policy with a $200,000 death benefit, of which $100,000 could be used for long term care.

In this case, the client simply keeping the $50,000 and investing it would likely be the much better option.

The image above is a screenshot from a webinar we did on Long Term Care Insurance – be sure to watch it if you are interested in learning more about Long Term Care Insurance options.

Also, these policies typically have no option for increases of the LTC benefit due to inflation.

Over time, this reduces the benefit significantly and makes hybrid policies very poor choices for expenses that may occur decades in the future. For the policy shown above, this $100,000 in coverage will most likely be needed in 15 or 20 years for this couple. Based on the current inflation rate in the costs for long term care, that $100,000 will only cover 4-6 months of care!

Traditional long term care policies can be purchased very easily with inflation riders that guarantee your benefit will increase each year. For someone in their 50s or 60s buying long term care insurance, this is very important.

However, there may be a select number of cases when these policies make sense. For example, we have found that these types of policies have less strict under writing requirements.

So, if you have less than perfect health, you may be more likely to qualify compared to traditional long term care insurance.

What’s right for you?

Ultimately, finding the right solution for potential long term care depends on your specific circumstances. If you’d like help finding the best solution for you, or just knowing if insurance is something you need at all, please reach out. We’re happy to help.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.