Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Updated February 2024 to amend any annual adjustments made to participation rate, tax rates, maximum wage income, and more. Note: There were no significant changes to IPERS and this post in 2024.

If you’re a public employee in the state of Iowa, you have IPERS – an excellent pension system available to you that can act as the foundation of your retirement plan. Pensions are all but a thing of the past, but IPERS is an excellent way to take advantage of this incredible retirement savings vehicle.

Combine your state pension, Social Security, and other retirement investments like 401(k), IRA, and additional investments, and you will find yourself in a great financial spot come time for retirement. Today, our team will demonstrate how IPERS works, a basic benefit calculation, how we build a retirement plan around your pension benefit, as well as costly mistakes you’ll want to avoid.

Bonus: We recently hosted a webinar on IPERS, where we covered in more detail how to create a retirement plan around IPERS, and how IPERS works with your other retirement assets. Simply click play on the video below and enter your email address when prompted.

The Iowa Public Employees’ Retirement System (IPERS) is available to permanent employees of public entities, like the state government and cities, Regent universities, community colleges, school districts, and sheriff’s departments.

Participation in the program is mandatory as long as you are working in a job covered by IPERS. Contribution limits are generous and are up for review every July. Most members contribute the maximum amount possible which for 2024 is 6.29% of their salary, while their employer kicks in 9.44%, for a maximum total annual contribution of 15.73%.

This rate is in place from July 1, 2023, through June 30, 2025, at which point the rate can be adjusted by no more than 1% up or down. Either way, that’s a pretty hefty savings rate, and if you can swing a 20-year career with that level of contribution, you’ll have a significant pension available to you.

Contributions are income tax-deferred aside from FICA and Medicare taxes which is 7.65% in 2024. This just means that you’ll pay Federal taxes once the pension starts in retirement. The maximum wage that counts towards the contribution percentage is $345,000 for 2024.

IPERS does have a vesting formula that was updated in July of 2012. This update stipulated that an employee had to accrue at least 7 years of service or who are at least age 65 working for a covered employer.

Vested members have access to an array of benefits such as disability benefits, death benefits, and many retirement benefits such as portability, access to employer contributions, and retirement benefits as early as 55 (at a reduced rate). Check out the IPERS website for more details on vested member benefits.

When you start to plan for retirement, you can do a quick calculation of your retirement benefit. To get the real value down to the dollar, you’ll have to contact IPERS directly. But suppose you want to know the ballpark amount, here’s how you do it:

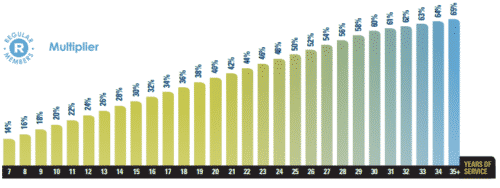

2. Multiply this by the Multiplier (catchy, eh?). Suppose you have 20 years of service, you’d use 40% in the chart below.

3. Factor in any early-retirement reduction. More on this below.

If you have no early retirement reductions, your annual benefit would be $60,000 x 40%, or $24,000

The calculation IPERS uses is a little more detailed, but this will get you close.

Your multiplier for step one above is determined by your employment class and your years of service. For most, your multiplier is:

So, if you have 20 years of service, your multiplier is 40%. If you have 21 years of service, your multiplier is 42%.

In order to be eligible for your full retirement benefit, you must meet at least 1 of the following rules:

The IPERS rule of 88 means that to be eligible for your retirement benefit with no reductions, your age plus years of service must equal 88 or higher.

For example, if you are 58 years old and have 30 years of service while enrolled in IPERS, you are eligible for your full benefit.

Whereas if you are age 56 with 22 years of service, you will need to wait 5 years (when you are age 61 with 27 years of service) to be able to retire with your full benefit.

If you do not meet the requirements of the Rule of 88, you have other options:

With this IPERS rule, you are eligible for your full retirement benefit if you are age 62 and have at least 20 years of service. This rule is beneficial for those who began their IPERS careers a little later and may not be able to meet the requirements of the Rule of 88 before they are age 65.

As long as you are vested in the IPERS system, you are eligible for your full retirement benefit if you are age 65 or older.

If you meet any of these 3 rules, you are considered to be of “Normal retirement age” by IPERS and will receive no reduction factor of your IPERS benefit.

If you do not meet one of the 3 rules above, your benefit will be reduced by 0.25% or 0.50% for each month you are short of full retirement age. The exact amount will depend on how long you have worked in an IPERS eligible position.

Now that you have your estimated IPERS benefit, let’s talk about the rest of your retirement income and your retirement plan as a whole. In our example above, our soon-to-be-retiree has replaced about 40% of her annual income. She will also receive a Social Security benefit, and though that system has its own complicated calculation, you can generally assume Social Security will also pay about 40% of your annual salary.

There are some important caveats here, like the length of employment, and how higher-income workers replace a smaller percentage. Also, one of the most important things to remember is that your situation is unique, have we mentioned that before? You’re reading this because you want general guidance, but if you want specific answers, schedule a free consultation to create a more detailed, custom plan.

Caveats aside, your IPERS and Social Security benefits could replace a significant amount of your annual income, around 80% in our example retiree’s case. This is the bedrock of your retirement plan—learn to love these two foundational pieces!

This foundation might not make for a “comfortable” retirement though, with fun extras like hobbies and vacations. For that, you’ll need additional savings. The last rule-of-thumb we’ll discuss today as we build the basic plan for your IPERS-based income is the 4% rule.

From your investments and savings, you can safely withdraw 4% per year during your retirement. If you have $100,000 in investments, that means you can safely take out $4,000 per year without hurting your long-term spending goals. Again, this is general advice, and not always useful for specific planning needs. Creating a custom, tailored plan designed to optimize your unique needs is a crucial part of this process.

But if you’re writing this estimate out on a napkin, you’re going to get pretty close:

IPERS + Social Security + 4% of investments = my (comfortable) retirement income

The great thing about IPERS is that once you have begun your benefit, it is easy to manage. You will simply receive your monthly payment automatically. However, that doesn’t mean you should not put any time or attention to creating a plan around your IPERS benefit initially in early retirement. Here’s a few parts of IPERS that deserve some analysis before you make your elections and retire.

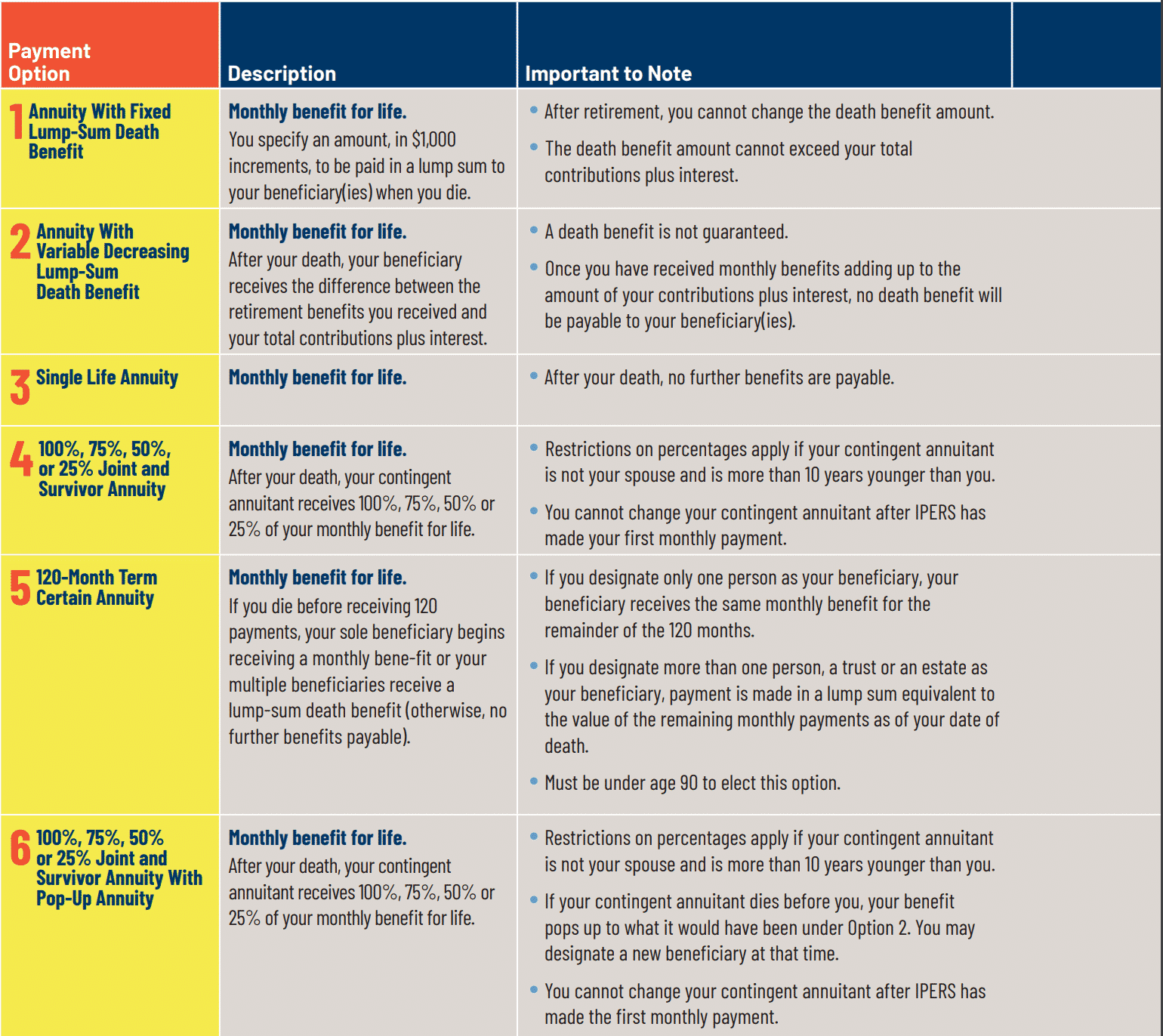

One of the decisions you make with IPERS is the type of annuity, which is just a fancy way of saying the pension features you get with your monthly benefit. There are a number of options, and one of the popular choices is a Joint & Survivor (J&S) Annuity, which pays a benefit while you’re alive, and a separate benefit to your survivor, usually your spouse, when you pass away.

Joint & Survivor annuities are fantastic ways to ensure a married couple can comfortably retire, but you need to pick the right percentage option (there are 100%, 75%, 50%, and 25% choices). Each percentage is reflective of how much your survivor gets: if you pick 100%, they get the same amount as while you were alive, and if you pick 25%, they get that amount percentage of your normal monthly check.

You have 6 options to choose from when taking IPERS:

Each choice comes with different monthly payments. In general, the lower the percentage that you choose, the higher your monthly payment will be. But a higher monthly payment at a lower percentage could cause some major cash flow issues for your dependent. Let’s take a look at an example.

John elects a 100% joint and survivor pension option which gives him $2,000 per month. With the 100% option, his wife, Elaine is eligible for the full $2,000 check to continue after John passes. If John were to select the 25% option, we can estimate that his monthly payments would increase to $2,400 per month. But when he passes, Elane will only be eligible for 25% of that check, or $600, decreasing her lifetime benefit significantly.

Remember that your IPERS pension is a foundational piece of your retirement income, for both you and your spouse. When one spouse passes away, household expenses don’t decrease by 50%. In reality, they usually only go down by 20-30%. Be sure to keep this in mind when choosing a pension election.

When you select your pension options, be sure to factor in your additional income streams, the reduction in your household Social Security benefits once one spouse passes, any spouse/dependent needs, and lifestyle goals to help you come up with the right balance.

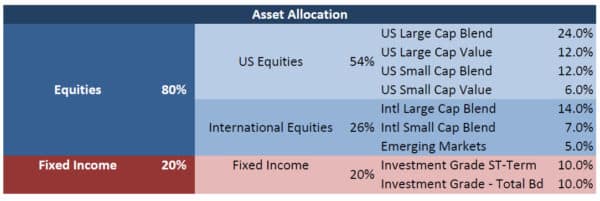

Many Iowa public employers offer another retirement benefit called the Retirement Investors Club or RIC. This is meant as an optional savings plan to supplement IPERS, which can significantly increase your savings. That’s good, let’s use it!

When you invest in RIC, you will be able to pick from a menu of stock and bond funds. Check it out, if you’re wondering what’s available.

But a word of warning—some of the fund choices aren’t productive! We have seen some expensive funds that are not designed to give you the most value as an investor. In place of those expensive funds that won’t advance your portfolio, there are less expensive, yet equally viable alternatives that do a better job. When you find assets with lower expense ratios, they give more of the fund returns back to you as the investor.

How do you know which funds will work best for you and which won’t? It’s not easy, but we do have a tip for how to avoid this costly mistake: invest in a target-date retirement fund. RIC offers two sets of target-date funds through Vanguard and Blackrock—both of which are sound options. But watch out for the other fund offering through American Funds. We have found it to be expensive and not efficient for your portfolio.

This is just one example of the specific details our team gets into with you while creating your retirement income strategy.

Note that your IPERS pension doesn’t have an annual “cost-of-living-adjustment” (aka COLA). That means your benefit will never go up during retirement, so the effect of inflation will erode your real benefit over time (what it buys when you’re 80 will be less than when you’re 60). This is unfortunate, but a common feature of most pensions.

This makes having other investments, such as those in stocks and bonds, incredibly important for a retiree with a pension. It also means the management of those investments should perhaps be done differently than for retirees without a pension like IPERS.

While your pension is great for providing monthly cash flow, it will not be able to provide for large one-time expenses. So, having additional liquid savings and investments is vital for a successful plan.

When we create an investment plan for our clients, we can test the success of a retirement plan based on various levels of inflation or stock market returns. Will your plan that relies on IPERS be successful even if health care costs continue to rise? Or if you need additional money for expenses such as long-term care?

You are able to “cash out” your IPERS benefit. However, in general we do not recommend this option. But, when could this be a good option?

First, if you have a relatively small benefit, it may be worth taking the lump sum offer. If your projected monthly benefit is a very small percentage of your monthly expenses, it may be worth cashing out. Cashing out your benefit will provide you with a lump sum that may be more useful in retirement than a small recurring monthly payment.

Next, if you have other sources of fixed income that meet a large portion of your spending needs. For example, if you and your spouse both have large Social Security benefits, or perhaps you or your spouse have another pension from other past employment.

While fixed income is great to have in retirement, too much of it could leave you susceptible to inflation or large expenses later in retirement.

If you decide to receive a lump sum payment from IPERS, you will be provided a total value of your benefits in your statement. The calculation is complex and will depend on your age, interest rates, the amount of your contributions, and more.

You will have the option to receive your benefit into your rollover IRA, which will prevent any taxes on your benefits until you withdraw the money, or you can elect to pay taxes and receive all the money outside of any retirement account. Just note that the tax burden for doing so may be extremely high.

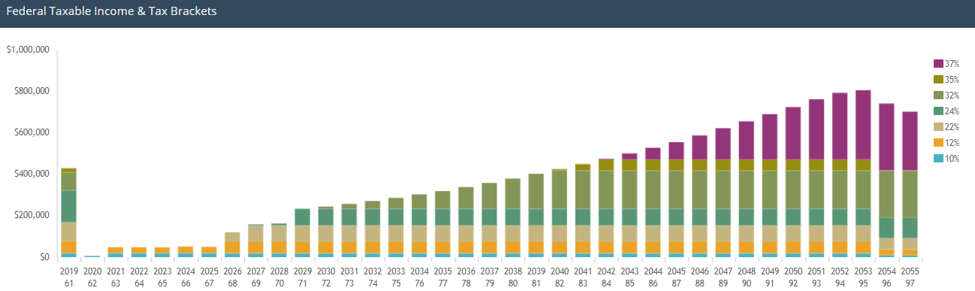

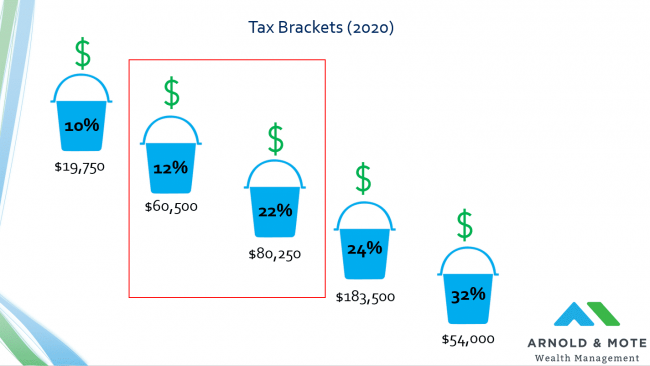

IPERS benefits are treated like income and taxed at Federal tax rates. The 2022 Iowa Flat Tax Law made it so IPERS payments are no longer taxed by the state of Iowa.

In ordinary years this may not pose much of a problem for a retiree, but we find two big opportunities for our clients with tax planning around their IPERS benefits:

First, if you have a pension benefit and also other pre-tax retirement accounts such as a 401(k), 403(b), or IRA, you will likely see your tax rate rise over time. This is because, as you age, the IRS requires you to begin Required Minimum Distributions (RMDs) from your retirement accounts. Distributions from these accounts also count towards your taxable income.

And once you consider 2 spouses’ Social Security benefits, IPERS or other pension benefits, and IRA distributions – You may find yourself in a (very!) high tax bracket.

One potentially valuable strategy is to create a Roth conversion plan early on in retirement to take advantage of the lower tax brackets and get money out of these taxable accounts into Roth IRAs or taxable brokerage accounts. Such a plan can help reduce future taxes from IPERS, Social Security, and your investments.

We also find that large one-time expenses in retirement for those with a high IPERS benefit can lead to excessively high tax rates. This is because pensions and Social Security benefits tend to fill up the lower income tax brackets, leaving any additional IRA or investment account withdrawals to be taxed at high income tax rates. These large one-time withdrawals can also trigger a multitude of other surcharges and additional taxes, such as IRMAA – An extra charge on your Medicare premium based on your income.

It will be well worth your time to create a retirement plan to help navigate large one-time expenses while in retirement to avoid the tax hit. For example, you may want to spread IRA withdrawals out over multiple tax years for a large purchase, such as a car. Or, if interest rates are low, you may want to consider loans to avoid taking large withdrawals.

For additional examples about creating a tax efficient withdrawal plan in retirement, visit our post here.

IPERS is a tremendous system designed to ensure you can retire comfortably. It is an important piece of your retirement income planning along with Social Security and other savings vehicles.

Once you know the basics of how to use IPERS in your retirement income plan, and a couple of costly mistakes to avoid, you’ll be well on your way to the retirement plan of your dreams!

If you’d like to discuss your specific retirement scenario in more detail, let’s talk!

Want to learn more about our comprehensive approach to retirement planning? Here’s a summary of the topics we advise our clients about.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.