Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Life insurance is incredibly important protection for families, but it can be hard to determine just how much is enough, and why type of insurance is best for you. Here’s how we help our clients make sure they are protected without breaking the bank.

In order to calculate your insurance need, we start by looking at your current resources, and your family’s future spending needs.

What are some situations that may warrant more life insurance than normal? If one spouse has a much higher income, or is set to receive a pension in retirement, or a large amount of stock options set to vest in the future, you may have a higher insurance need than most.

You might also have a large need If there is a lot of debt or future spending goals in your plan, maybe debt from student loans or a mortgage, or a goal to pay for future college expenses for a child.

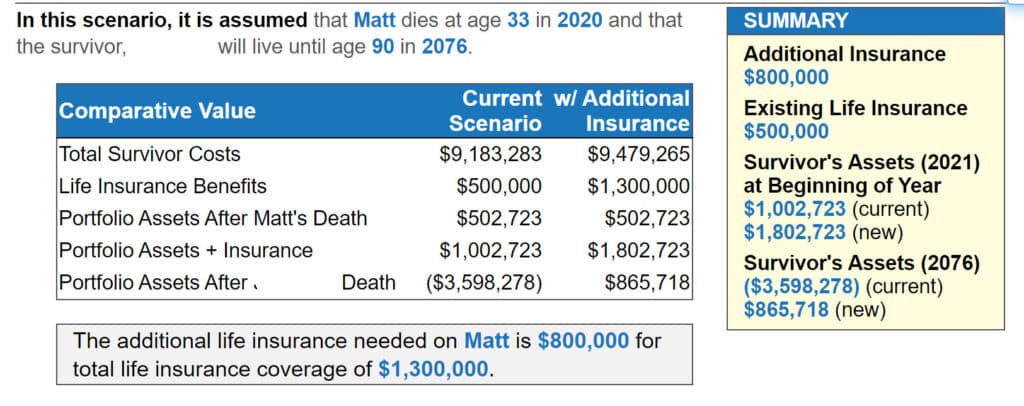

A typical insurance analysis summary that we do for clients looks like this:

But its also important to consider other resources such as employer benefits and social security survivor benefits that may be there for you. These may reduce your need for insurance, and reduce the need for you to purchase extra benefits.

Certain family members may be eligible to receive monthly benefits, including:

Lastly, we recommend for those who are looking for life insurance to work with a fee only and fiduciary advisor who is not paid commission on any products they recommend. This assures you receive advice that is in your best interest, and not the best interest of a salesman.

Many insurance agents are paid solely on commission from selling products, which we believe incentivizes them to sell you what is best for their pockets rather than your best interest.

Typically we recommend term life insurance for our clients, and help them determine the correct amount and the appropriate length of term insurance to purchase.

Let us help. Contact us today to get started.