Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Donor Advised Funds are a simple, tax advantaged way to give to charity and get a tax deduction for giving money to charity. Here are a few important features and advantages you should know about Donor Advised Funds, or DAFs:

A donor advised fund is an account that you deposit money or investments into, and then allow you to easily disperse the assets to charities over time. While the money is deposited into the DAF it can be invested and therefore grow in value, tax free, before being donated.

The accounts are administered by a custodian, such as Fidelity, Schwab, or Vanguard. The custodian will help you set up the account, make investments, and then send the proceeds to charity.

What is the tax benefit of using a Donor Advised Fund? You receive a tax deduction in the year that you make a contribution to a donor advised fund, not the year the money is dispersed to charity.

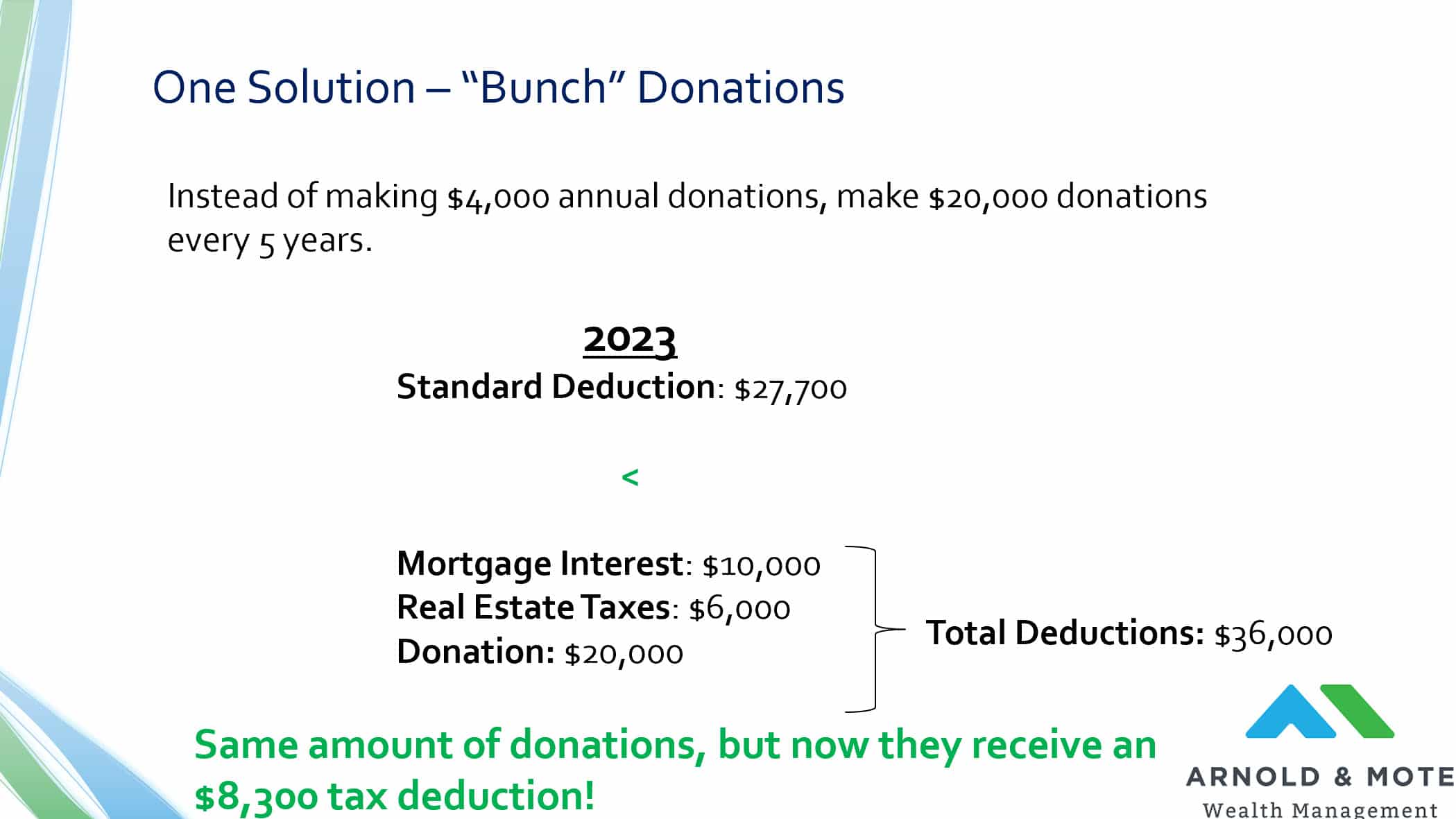

This allows you to deposit multiple years’ worth of charitable contributions into the DAF, receive a larger tax deduction, but then give those assets over time.

This is advantageous for most because of the recent significant increase in the standard deduction amount.

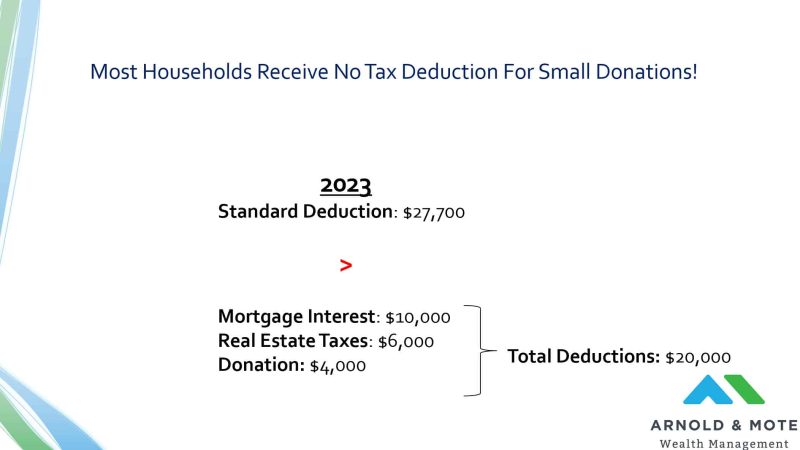

For example, in 2023 the standard deduction is $27,700 for a married couple.

If this household pays $10,000 in mortgage interest, and $6,000 in state and local taxes and has no other itemized deductions, they are still $11,700 below the standard deduction amount. So for example, if they donate $4,000 to charity they will receive no added tax deduction because the total amount of itemized deductions is still below the standard deduction amount:

However, if this household could contribute 5 years’ worth of donations to a Donor Advised Fund today, they could receive some tax deduction, and still be able to give $4,000 annually for the next 5 years.

This opens up some potentially beneficial tax strategies for those who are charitably inclined, and also have high level of tax due to Roth conversions, large expenses in retirement, or severance pay.

We have helped clients use a Donor Advised Fund in order to limit the large tax bill from an inheritance, large severance payment, or a large Roth conversion.

DAFs can also be funded with appreciated stock as well. Instead of selling any stock and recognizing capital gains, you could donate the stock into the Donor Advised Fund, sell the shares in the DAF, and then donate the proceeds and recognize no capital gain taxes. This helps you and the charity!

If you are interested in the details of how we create a tax-efficient charitable giving strategy, view our webinar here. We discuss details and examples of using a Donor Advised Fund, along with many other options to give to charity.

The rules around donor advised funds can be complex, though for very large donations relative to your income:

If you are looking to make cash donations into DAF that exceed 60% of your AGI, Adjusted Gross Income, you may not be able to take the full deduction amount in a single year.

If you are funding a donor advised fund with non-cash (such as appreciated shares of stock), you are not able to claim a deduction more than 30% of your AGI.

Contribution amounts in excess of these deduction limits can still provide tax deductions, but it may be carried over up to five subsequent tax years.

DAFs are a great tool in creating your charitable giving strategy and maximizing your tax deductions! If this is of interest to you, or you need help creating the best plan for you, please contact us to see how we can help you incorporate charitable giving into your retirement plan.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.