Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

There have been big changes to the Iowa tax brackets in the last few years. 2 major law changes since 2018 has drastically changed how Iowans are taxed on their income, and retirement withdrawals.

Below we list out the current income tax brackets for Iowans. More importantly, read on for planning opportunities that have arisen from these recent changes. Households with income in excess of $100,000, and retirees with IRA and 401(k) assets in excess of $500,000 have seen tremendous opportunities to reduce their Iowa state tax burden.

2025 brings us to the completion of Iowa’s transition to a flat tax. For 2025 Iowa will not have any income tax brackets. Instead, all taxable income will be taxed at a flat 3.8%.

This new flat tax will result in a tax reduction from prior year tax rates. For review, here were Iowa’s prior year tax brackets:

2024 saw the top tax rate drop to just 5.7%. But there were still a few tiers of income that resulted in differing tax rates on higher levels of income.

For married households in Iowa, the 2024 income tax brackets were:

| Iowa 2024 Income Tax Rates | |

| Taxable Income | Tax Rate |

| $0 – $12,420 | 4.40% |

| $12,420 – $62,100 | 4.82% |

| $62,100 and up | 5.70% |

Income tax rates for single filers were the same tax rates, but the income figures are halved. In other words, any income in excess of $31,050 for a single filer in Iowa was taxed at 5.70% in 2024.

Remember, not all income is considered taxable income in Iowa.

The more significant change in the 2022 tax reform comes from changes in how Iowa will tax “Retirement Income”, which is IRA and 401(k) withdrawals, pensions, deferred compensation plans, and other retirement accounts.

Beginning in 2023, Iowa will not tax any retirement income. Iowa’s tax brackets will not apply to Pensions or retirement account withdrawals.

This is a huge change for retirees in Iowa and result in thousands of dollars in savings annually. For example, a retiree who has an IPERS pension of $40,000 per year, and withdraws $50,000 per year from IRAs would have paid income tax (for 2022, at a rate as high as 8.53%!) on all this. In 2023 and beyond, this retiree would pay $0 to Iowa for that same retirement income.

This new bill has a couple of impacts for those Iowans saving for retirement:

This new tax bill has lead to some changes in current Roth conversion plans. Because Roth conversions done in 2023 or later will not be taxed at the state level, it has made it more attractive to do larger Roth conversions for some of our clients.

Before this new law, Iowa municipal bonds were potentially advantageous for high-income families in the state.

Let’s assume you are in the 22% federal tax bracket and have a taxable savings account invested in a corporate bond that yields 3%, producing $30,000 in gross income (before taxes).

in 2022, a retiree in Iowa would have paid Federal taxes, plus an additional 8.53% in state income taxes – $2,559!

Paying that extra 8.53% in taxes hurts!

But there was a way around that state tax bill involving an investment that is very beneficial for Iowans – municipal bonds. If an investor in Iowa purchases qualified municipal bonds, the income from the bonds will not be subject to state taxes.

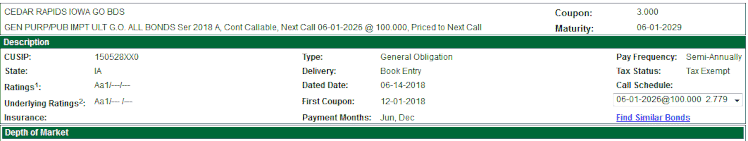

Let’s say our Iowa retiree purchased an Iowa municipal bond instead of a corporate bond. For example, this municipal bond for the City of Cedar Rapids:

Note: This bond is used as an example only. This is not a recommendation to buy or sell any security.

The bond has a yield of 2.84%, which is under the 3% that this investor could get on a corporate bond. However, that does not mean that it is a worse, or even lower returning, investment!

Now, because of the lower 2.84% yield (compared to the 3% yield on the corporate bond), our Iowa retiree earns just $28,400 in income instead of $30,000. But, the income is not subject to Iowa state tax of 8.53%!

That leaves our retiree with nearly $1,500 more than if they had chosen to invest in corporate bonds!

Municipal bonds are not always the best fixed income investment option, but for those in a highly taxed state such as Iowa, they can be incredibly advantageous in certain circumstances.

The benefits from this example will be reduced as Iowa’s tax rate drops from 8.53% in 2022 to 3.8% in 2025. However, there is a still a benefit for some high income families in the state of Iowa.

For more on Municipal bonds as investments for Iowans – See out blog post here.

Because of Iowa’s added state income tax, any additional investment income is subject to higher taxes. This means that reducing portfolio turnover, reducing dividends, and investing in funds that are unlikely to kick off large distributions is very important.

Whether you use stocks, bonds, mutual funds, or ETFs, choosing an investment that reduces annual taxes is extra important for Iowans.

Investing with taxes in mind is important no matter where you are, for those in high tax states, it is vital.

For more, see our blog post – 4 Ways to Reduce High State Income Taxes

Below is a review of the changes to Iowa’s tax law over the last few years. Remember, these changes in 2022 also significantly changed what income counts as taxable income for Iowans. Retirees in particular should know how these new tax rules will impact them, and the potential strategies for reducing income tax in retirement:

The bigger news from 2022 is the significant tax reform that was signed into law on March 1st, 2022.

This new tax law does not change the 2022 Iowa tax brackets, but will cause significant changes for 2023 and beyond.

The complete text of the 2022 law can be found here: https://www.legis.iowa.gov/docs/publications/LGE/89/HF2317.pdf

Here’s the details of the changes:

For married filing jointly households:

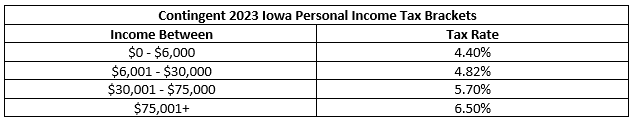

2023 will bring a significant tax cut to high income families in Iowa. Households that were previously subject to Iowa’s top tax rate of 8.53% in 2022 will now be taxed at either 5.7% or 6.0%.

For single filers in Iowa, the income amounts in the table above are cut in half. For example, the 4.4% rate applies to income from $0 to $6,000, the 4.82% rate applies to income from $6,001 – $30,000, etc.

Like the previous couple of years, there were no big changes to Iowa’s income tax brackets for 2022 from 2021. In general, there is a 4% inflation adjustment to all figures. Here’s the new 2022 personal income tax brackets for Iowans:

The state standard deductions in 2022 for Iowans are also set to rise slightly:

For now, it also appears that the standard pension and retirement account distribution deduction for those over 55 years of age will remain at $6,000 for single filers, and $12,000 for married filers.

Please note, the information below is now out of date as Iowa’s 2022 tax reform bill (detailed above) overwrote these changes. However, we are keeping details of Iowa’s previous tax laws and brackets below as they may be useful:

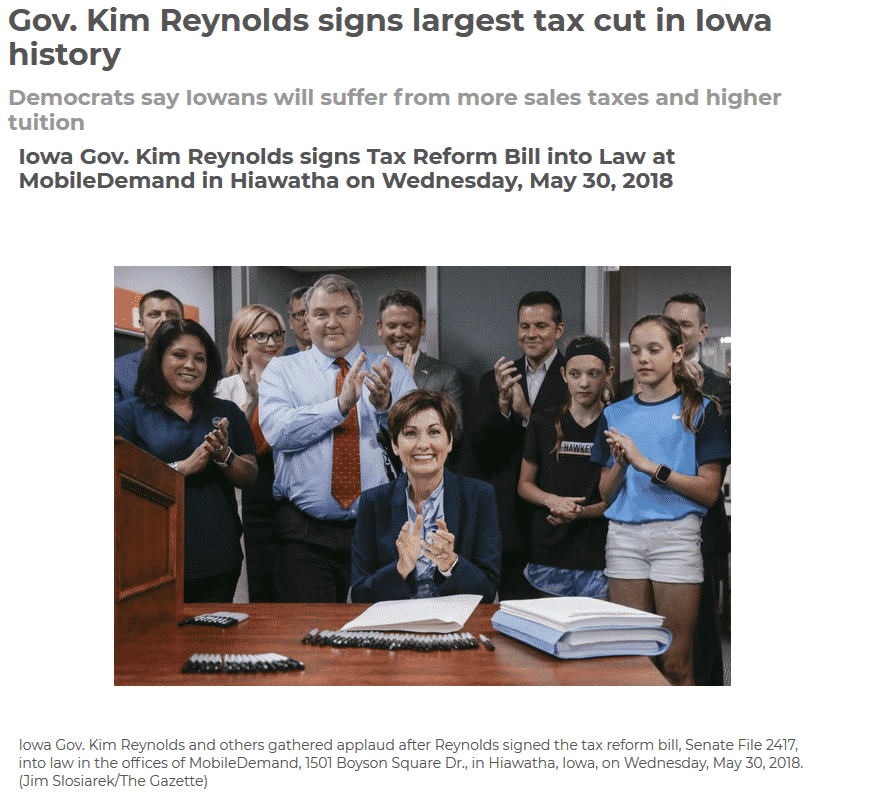

In 2018, Iowa’s Governor signed sweeping changes to the state’s tax code into law. In general, Iowa’s new 2018 law aims to lower personal income tax rates, while aligning the state law with the new federal law. Here are a few of the most important changes that will affect most Iowans:

Here is how the local news covered the landmark legislation:

So what changed in 2019?

One change to Iowa’s law that will affect every resident, a change in Iowa’s income tax brackets for 2019.

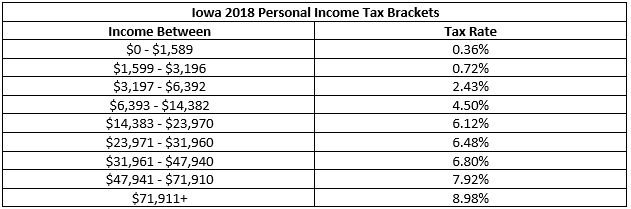

The new Iowa law did not affect personal income tax rates for 2018. Under the old law, Iowa’s 2018 income tax brackets will remain as follows:

However, things will be different for 2019, through at least 2022.

Under Iowa’s new law, beginning in 2019 these rates will be reduced slightly:

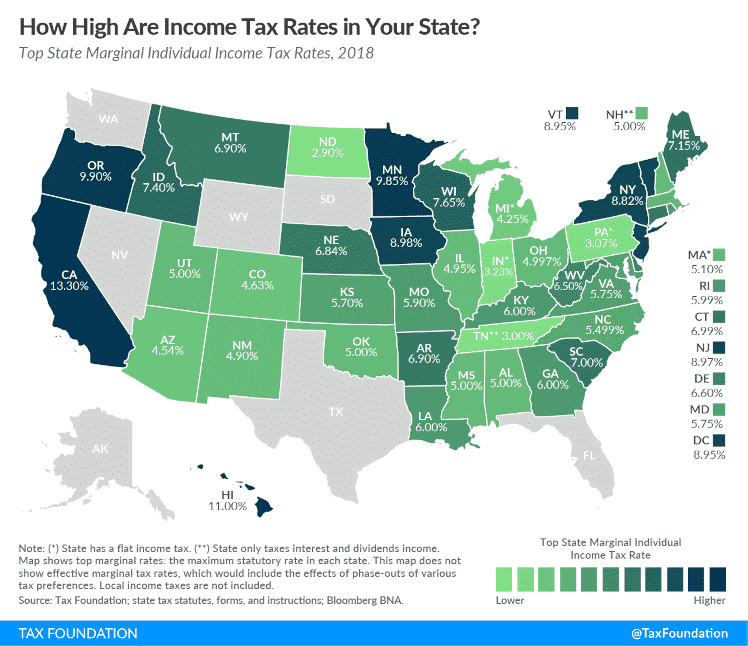

The rates in the chart above will be your Iowa income tax rates through 2022 (although the exact income amounts will change slightly each year due to inflation). As Iowans, we can be happy to see a slight reduction in rates, but we will still be one of the highest taxed states in the nation:

Image from the TaxFoundation article here

Like in 2020, there were not a lot of changes for Iowa tax brackets in 2021 except for a slight adjustment due to inflation:

The state standard deductions in 2021 for Iowans are also set to rise slightly:

For now, it also appears that the standard pension and retirement account distribution deduction for those over 55 years of age will remain at $6,000 for single filers, and $12,000 for married filers.

But the new law passed in 2018 adds a twist that may not make next year’s update so boring. IF the State of Iowa hits certain revenue goals during the period between 2019 and 2022, the State’s personal income tax rates will be reduced even further starting in 2023, and Iowa’s personal income tax brackets will be simplified to only 4 brackets:

A slight reduction in Iowa personal taxation rates was signed into law in 2018. However, the changes are relatively minor. Even after the small reduction in personal taxation rates, Iowans will still be one of the highest taxed in the nation.

The potential change in 2023 may make Iowa more competitive with a max taxation rate of just 6.5%. However, this is still above average for states.

There were not a lot of changes for Iowa’s 2020 rates except for a slight adjustment due to inflation:

The state standard deductions in 2020 for Iowans are also set to rise slightly:

For now, it also appears that the standard pension and retirement account distribution deduction for those over 55 years of age will remain at $6,000 for single filers, and $12,000 for married filers.

Those are the “Big Two” changes that affect a majority of people in the state of Iowa.

Additionally, there are a few small changes that will have a slight impact on your Iowa taxes in the future:

With the 2018 law, Iowa’s Section 179 deductions are changing, and will eventually conform to federal standards. For small business owners, this means a potential for huge savings.

Section 179 deductions allow for large, immediate deductions to account for the depreciation of assets. This depreciation can end up offsetting large amounts of income for those businesses or individuals that make large purchases of qualified equipment or property.

The IRS allows section 179 deductions up to $1 million dollars per year with a phaseout if the asset is greater than $2.5 million. However, Iowa offers a maximum deduction of just $70,000, with a $280,000 phaseout. And because of Iowa’s high rates, this means Iowans have lost a lot of potential deductions from their state taxes.

To see what this means for a typical Iowa small business, consider a farmer who just purchased a tractor for $400,000.

On their federal returns, the farmer may be able to take a section 179 deduction, and take a full $400,000 deduction on their federal income tax return this year.

But on their Iowa state return, things will look very different. Because the tractor was over the phaseout limit of $280,000 set by the state, the tractor was not eligible for a section 179 deduction, and instead would slowly be depreciated over a number of years on the farmer’s state return.

This leads our farmer to have significantly higher taxable income on his Iowa state tax return compared to his federal return. And when Iowa is taxing individuals at nearly 9% (and corporations as high as 12%), this means a lot of extra taxes.

Thankfully, over the next couple of years, this is changing.

Beginning in 2019, Iowans can deduct up to $100,000 (up from $70,000 today) in a single year, and the asset value phaseout rises to $400,000 (up from $280,000).

For our farmer, this means an immediate $100,000 tax deduction for 2019 if he holds off purchasing his tractor until 2019.

Then, beginning in 2020, Iowa’s state rules on section 179 deductions will couple with the federal tax law’s limits, which are currently a maximum $1 million deduction with a phaseout of $2.5 million.

This means a full $400,000 deduction for our farmer if he holds off purchasing his tractor until 2020.

This has broad implications for just about every small business owner in the state.

Consider our farmer used in the example above. If he can hold off on the purchase of his new tractor until 2019, he will be able to deduct up to $100,000 on his state tax returns, likely saving him up to $9,800 in Iowa state income taxes in 2019!

If that same farmer waits until 2020, when Iowa will allow up to $1 million in section 179 deductions, he can deduct $400,000 off of his Iowa state tax bill, saving up to $39,200!

Note: There is a lot of fine print when it comes to section 179 deductions. Only certain assets may apply, your business’ profit may limit your available deduction, assets must be primarily used for business purposes, etc.

At Arnold and Mote Wealth Management, we help clients navigate these changes and advise them on what purchases and capital allocations make sense today, and what is in their best interest to wait. Need help determining the best way to reinvest in your growing small business and take advantage of these new Iowa tax law changes? Or want to see how you can benefit from the tax law changes? We’re here to help.

If you wanted an excuse to cut your spending and save extra, this bill should provide you some incentive.

Under the new law, an additional 6% sales tax will now be levied on items such as your Netflix subscription, UBER and taxi rides, Amazon marketplace purchases, and more. Obviously, the more you spend, the more this change will affect you, but on average, it is expected to cost Iowa families an additional $50 per year.

With the new law, teachers are allowed a deduction of up to $250 for items purchased for their classrooms. This amount is coupled to the federal law teacher deduction limits, and will likely be slowly increased to offset inflation.

The reduction in the corporate tax rate for Iowa companies does not go into effect until 2021. For Iowa corporations, the top rate will be decreased from 12% to 9.8%, saving a company with $1 million in profit about $22,000 per year.

Even after the reduction, Iowa corporations will remain one of the highest taxed in the nation, with only Pennsylvania higher (at 9.99%).

How do these tax changes affect you or your business? Get in touch and let us help you find out!

The complete text of Iowa’s new tax bill is here: https://www.legis.iowa.gov/legislation/BillBook?ga=87&ba=sf2417

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.