Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

There are a number of valuable items you can review on your tax return to reduce how much tax you are paying when retired:

We find that retirees have much greater opportunity to reduce their tax burden in retirement than most. There are lot of strategies to reduce retirement taxes if you are proactive early in retirement. Here are two that we find most valuable:

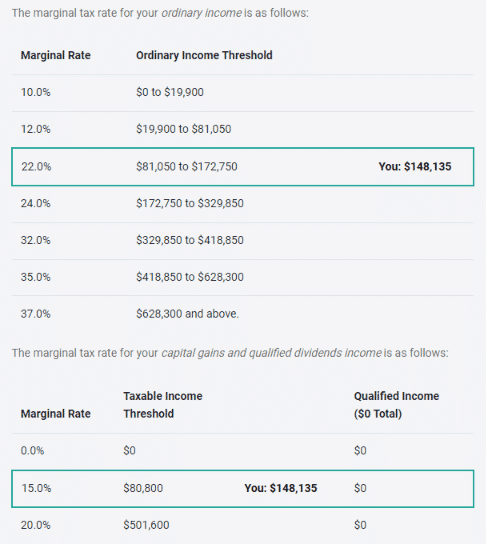

First, identify if you have room in low income tax brackets brackets — if you are in a lower tax bracket right now, consider getting MORE income by doing Roth conversions or recognizing capital gains. It’s important to look at your long-term expected tax rates and take advantage of lower tax years.

We produce annual tax reports that look like this to show room in lower income tax or capital gains tax brackets.

This helps identify opportunities for recognizing income at a low tax rate. Whether you are targeting a certain income tax bracket, the 0% tax bracket for long term capital gains, or keeping income low enough to qualify for Roth IRA contributions. Being knowledgeable of how income from various retirement accounts will impact your current tax rate, and also your future tax rate, is very important.

For many retirees, this is particularly important during early retirement, before Social Security benefits have begun, and before RMDs begin.

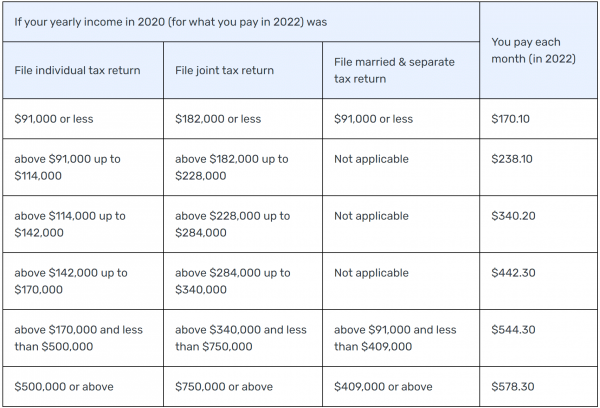

IRMAA, Medicare’s Income Related Monthly Adjustment Amount is a surcharge that Medicare charges if your income crosses certain thresholds.

The important thing to know is that going just one dollar over the threshold can lead to added charges in a future year. Depending on your income, this added fee can result in thousands of dollars more per year for your Medicare premiums.

Be very aware of the income thresholds and try to plan your income for each year to avoid those.

Looking for more? Watch our Tax Efficient Retirement Withdrawal Strategies Webinar here.