Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

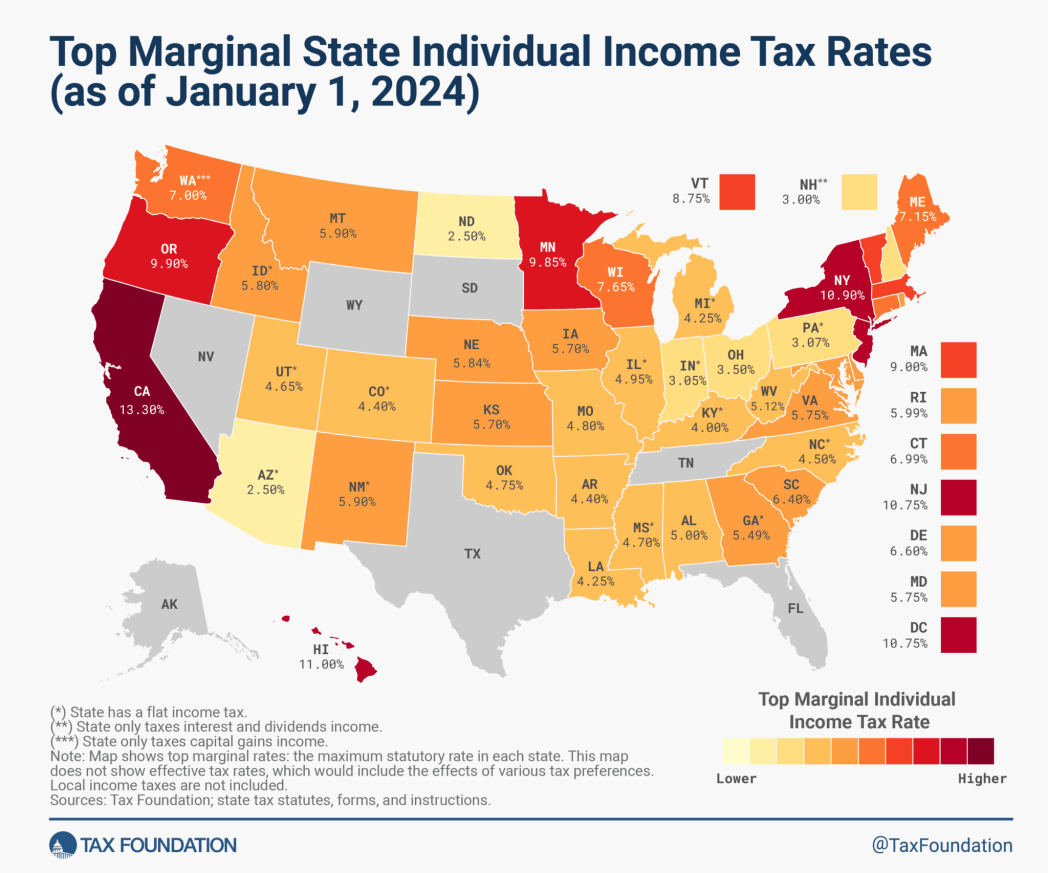

Although often overshadowed by the higher federal tax rates, state income taxes can take a large bite out of earnings. Thankfully, there are a few options to reduce your state tax bill from your investments and interest income.

For those in highly taxed states, simple changes like saving using treasury bills instead of bank CDs for your cash savings could knock off hundreds of dollars per year in your state tax bill. What else can you do? Here is a quick list:

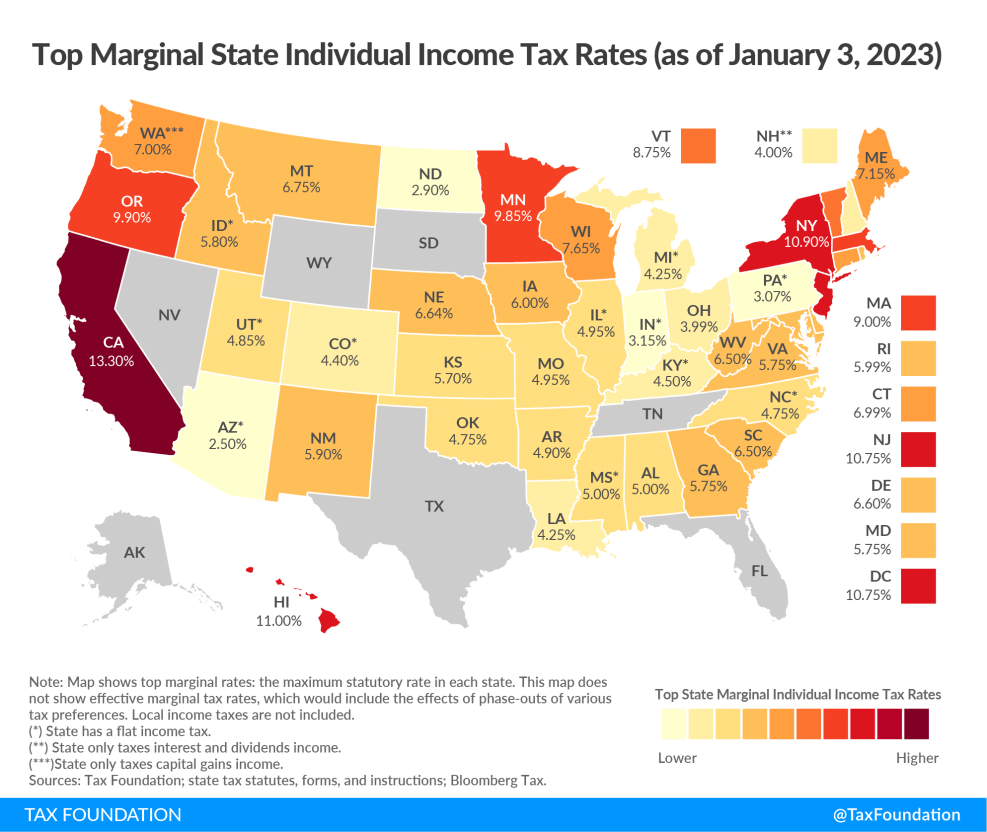

Which states have the honor of having the highest income tax rates?

These rates are based on the state’s highest marginal tax bracket, and is based on information from the Tax Foundation:

Source: TaxFoundation

Higher state taxes mean that how you should save and invest could be radically different than someone who lives in a low or no income tax state, such as Florida or Texas.

What can those in high tax states do to help reduce their state tax bill? Here’s a few quick tips:

When you earn interest on corporate bonds, a money market account, a bank CD, or even a basic bank savings account, any gains from interest are taxed as regular income. For a saver with an income of $200,000 in California for example, this means a 24% federal tax rate PLUS an 9.3% California state tax on all interest income.

For those in a high tax state, U.S. Treasury bills offer a great advantage; The interest from U.S. Treasuries bills, notes, and bonds are not subject to state taxes! Depending on what state you live in, that could mean up to an extra 13% for you.

This can benefit those with significant cash or bank CD savings, and long term investors who use corporate bonds or longer term bank CDs. We’ll look at both scenarios below:

For someone who has a significant amount in cash in a bank, CD, or a money market fund earning interest, being able to not pay state taxes on your interest could really save some money. Thankfully for you there is a way by using short term treasury bills instead.

For example, let’s take a look at a saver in California in the 24% federal tax bracket and 13.30% state tax bracket with $100,000 earning 4.75% in a bank CD.

Each year they receive $4,750 in interest, which is then taxed 24% federally ($1,140) and 13.3% ($631.75) by the State of California. After taxes, this saver is left with $2,987.25 for an effective after-tax yield of 2.98%

If that same saver used 4 week Treasury bills with the same yield, they would end up with $3,610, $631 more per year just by choosing a more tax efficient savings vehicle!

For those looking to boost their after tax savings with treasury bills you have a couple options:

Individual investors can use the U.S. Government’s Treasury Direct website to buy and sell treasury bills (along with savings bonds, treasury bonds, and other government securities). Treasury direct offers 4, 13, 26 and 52 week treasury bills.

You are also able to purchase treasuries in an online brokerage account. For clients of Arnold and Mote, we handle this for you. But if you are doing it on your own there are options available at numerous brokerages to buy individual Treasuries, or ETFs that hold only US Government Treasury bills. This can be an especially good option for those with savings in a bank account or CD over the FDIC insurance limit.

This benefit also works for longer term savings and investments as well. Let’s use our same California investor in the 24% federal tax bracket and 13.3% California tax bracket and assume they have $100,000 in a corporate bond yielding 2.85% in a taxable brokerage account.

They will receive $2,850 per year in interest, which will be taxed 24% by the federal government ($684) and then 13.3% by the State of California ($379). Our California saver would be left with $1,787, for an after tax yield of $1.787%.

An equivalent yielding Treasury bond would provide this California investor $2,166, for an after-tax yield of 2.166%.

Of course, treasury bonds don’t always have equivalent yields of corporate bonds. Early in 2018, short term treasuries had relatively high yields compared to short term corporate bonds. This gave treasuries a much higher tax-adjusted return for many investors in high tax states.

Less than 2 years later, and interest rates had fallen dramatically to where even with the tax savings, even AAA rate corporate bonds had a significantly higher after tax yield than treasuries.

So before acting, make sure you know what today’s interest rates are to determine the best investment for you. You can find today’s rates for treasury bonds, CDs, and money markets on a site such as the Wall Street Journal’s Market Center

Like treasuries, municipal bonds are often exempt from state and local taxes (and also federal taxes!). The federal tax break provides a benefit regardless on which state you live in, but for those in states or locales with high income tax, the additional tax break can make them extra useful.

But, many states and local governments have special rules and restrictions on which municipal bonds qualify for tax-exempt status. (For example, here is a list of Iowa’s restrictions for municipal bonds to qualify for a tax-exempt status) So check with your state and local laws, or a local CPA or financial advisor, to make sure you will qualify for the tax break.

How much can this tax break benefit an investor in a high tax state? Let’s look at an Iowa investor in 2022 tax year that was in the 24% federal tax bracket and 8.98% State of Iowa tax bracket.

Based on today’s interest rates let’s consider two options for this investor; a bond issued by Apple paying 2.85%, or a municipal bond issued by the city of Des Moines for 2.15%:

For those curious, this is based on real interest rates today. Here are the current going rates for various bonds today as I write this:

Which bond is best for our Iowa investor?

If this investor has $100,000 to invest, the Apple corporate bond would return $2,850 per year and be subject to a 24% federal tax ($684) and 8.53% from state taxes ($243), for an after-tax return of $1,923 or 1.923%.

A qualifying municipal bond from Des Moines that yields 2.15% would return $2,150 per year and is subject to no taxes, netting our Iowa investor an extra $1,175 over the life of the bond after taxes.

Even though at first glance it appears that Apple’s bond will have a higher return, that is not necessarily the case for an investor in a high tax state such as Iowa!

Investors can find municipal bonds with very short term or long term maturities depending on their saving or investing time horizon. However it is important to note that many bank accounts are insured by the FDIC, where municipal bonds have default risk. Make sure the higher risk of municipal bonds is within your comfort level and stick to higher rated issues with less credit risk.

If you want to learn more about Iowa municipal bonds, we have a detailed guide here: Here’s How and Why We Invest in Iowa Municipal Bonds

We also have a much more detailed video on how to determine in municipal bonds are a good investment for you here.

529 education savings accounts being used for tax free savings for college is nothing new.

But the new tax law has expanded the use of 529s to those who are paying not only college tuition and eligible expenses, but also private K-12 school tuition.

That means even if you don’t intend to use a 529 to save for the long term, or your child is not going to college, simply contributing to a 529 and them immediately using the 529 to pay tuition (for college or private K-12 school) can save you hundreds in state taxes. (Check with your state laws on this, as some states may have a 1 year holding period of funds in a 529 account!)

Tax benefits for 529s vary state by state and may adjust due to inflation each year, but of the top 10 highest tax states we listed above, here is the maximum state tax deduction and total state tax reduction you could qualify for as of 2024:

This information should be useful for those in every state, but the benefits will be greatest for those in the states with the highest income taxes.

Wondering how your saving and investing can be made more tax efficient? Let’s get started

Historic State Tax Rates from older versions of this post:

These rates are based on the state’s highest marginal tax bracket, and is based on information from the Tax Foundation:

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.