Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

In March of 2022, new Iowa tax reform was signed into law that will do away with Iowa’s complex income tax brackets and apply a flat tax. In addition to that change, there is also drastic reduction in tax rates on retirees with the exclusion of IRAs, pensions, and annuities from taxable income in the state of Iowa.

Below is a recording and transcript for a webinar we held in May of 2022 covering the details of this new law:

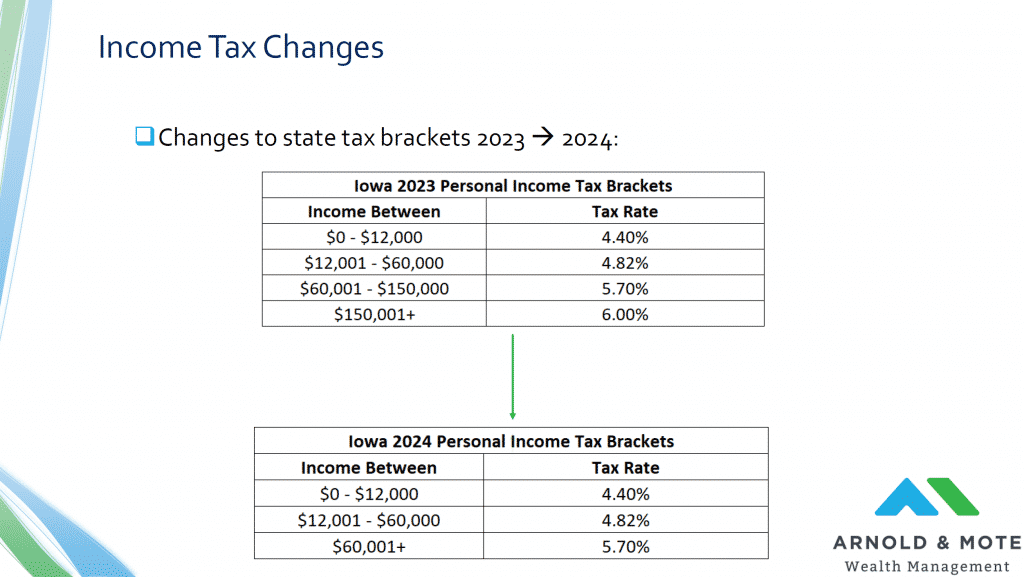

What received the most headlines is the changes to the state’s income tax rates.

Eventually, the state will move to a flat tax and do away with the current tax brackets. But, it’s a multi-year process to get there. Under this law Iowa’s tax brackets are going to be changing in 2023, 2024, 2025 and then finally one more time in 2026.

So what do these upcoming changes look like?

To start, here are the 2022 income tax brackets for Iowa:

And worth noting that these brackets applied to married or single filers. It’s a little busy with 9 total brackets, with rates ranging from .3% all the way to 8.53%.

And it was really that top tax bracket that got a lot of attention. The 8.53% rate left Iowa with the 9th highest state tax rate in the country. But maybe worse, this high tax rate applied to a much lower income than most states. You can see that even a married couple with income of $78,000 was taxed at 8.53%.

This made a married household with $78,500 income in Iowa actually have a higher top tax rate than a household with similar income in California or New York. Those states have higher top maximum tax rates, but you need income of hundreds of thousands of dollars to reach it.

So that was one item this tax bill was made to address.

And the first round of changes are set to go into effect next year in 2023.

Iowa will get different tax brackets for married and single filers, which is a big change.

And in addition to that, you can see that the tax brackets are going to become much more simplified – down to just 4 brackets.

And Iowan’s will be subject to a lower top tax rate of just 6% instead of 8 and a half percent.

For married households, you need a lot more income to get to that top rate – $150,000 now, double what was required before.

All of these brackets that we’ll be looking at are tied to inflation. So in 2023 this top bracket will not be exactly $150,000 when 2023 gets here, but something higher after this year’s inflation adjustment gets made, which might be a significant jump.

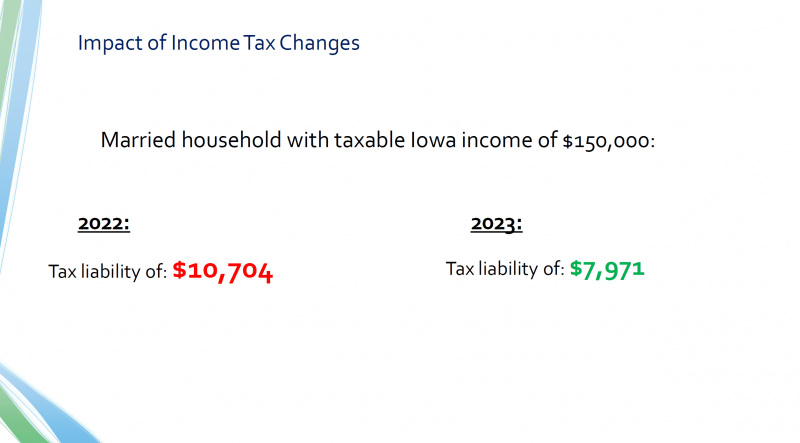

What does this mean exactly? Well the numbers will depend of course on your specific income. But just for an example, a married household with $150,000 in taxable income in the state will save just under $3,000 in state taxes in 2023 compared to 2022.

And that reduction in tax is just going to increase each year going forward.

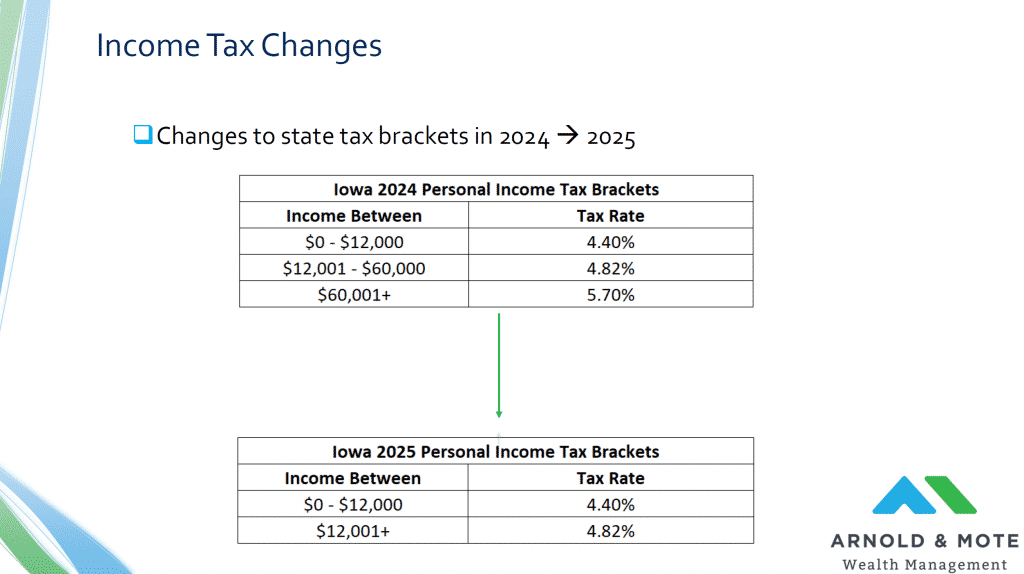

Looking another year ahead now.

Looking at the 2024 tax brackets and you’ll see that the top bracket from the prior year is just cut off. So no more 6% bracket, now all that income fits into the next bracket down, or the 5.7% bracket in this case.

And I should say, these brackets and any in the next couple slides are for the married filing joint tax brackets. Single brackets are just half these income amounts. So the 4.4% tax bracket for single filers is from $0 in income to $6,000, for example.

Go ahead one more year to 2025, you see once again the top tax bracket from the prior year gets cut, and now we will be left with just 2 tax brackets.

Since the 2 remaining tax rates are pretty close, and the income level pretty low. Pretty much a 4.8% flat tax in 2025 for Iowans.

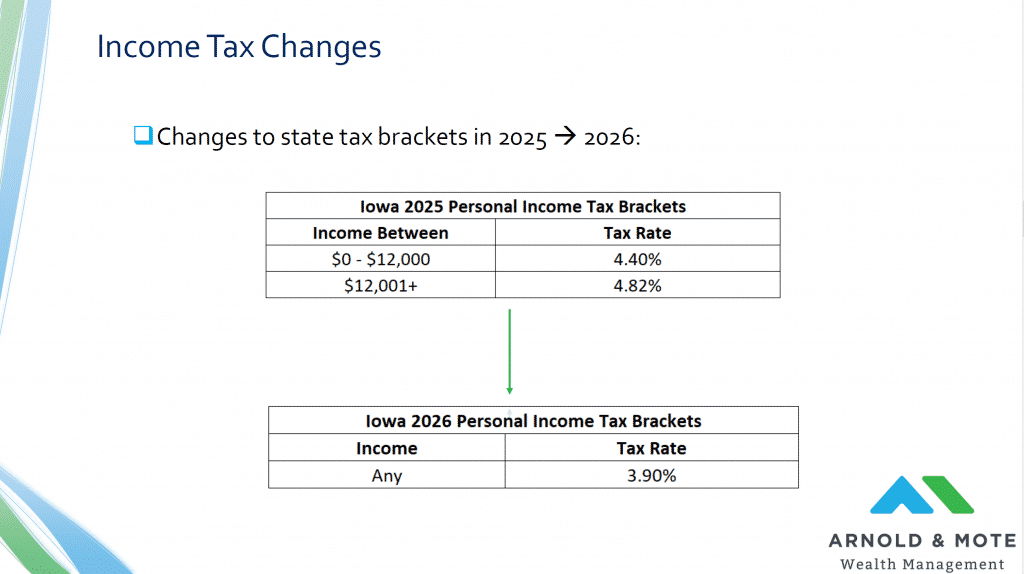

And then it gets us to 2026, when all that is left is a single tax bracket and the tax rate is cut further to 3.9%.

From 2026 on, whether you made $1 or a million dollars, it will have the same tax rate in Iowa.

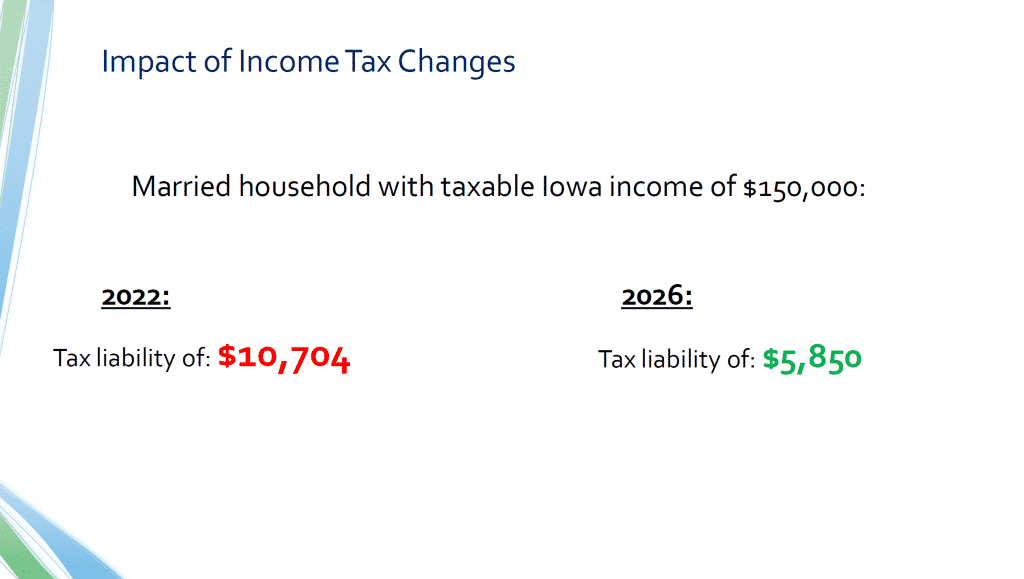

So what do these years of changes look like for our example household?

Remember that in 2022 this household would have had a $10,700 state tax bill on their $150,000 in taxable income.

Now in 2026, that same income will see a $5,850 tax bill, close to cut in half.

So this seems like a pretty big change by itself. And for young working couples, it certainly is.

These tax brackets use to be just as big of a deal for retirees too, since retirement account and IRA distributions, pension, and annuity payments all used to be taxed at these same rates…

But there’s even bigger changes for retirees with this tax bill.

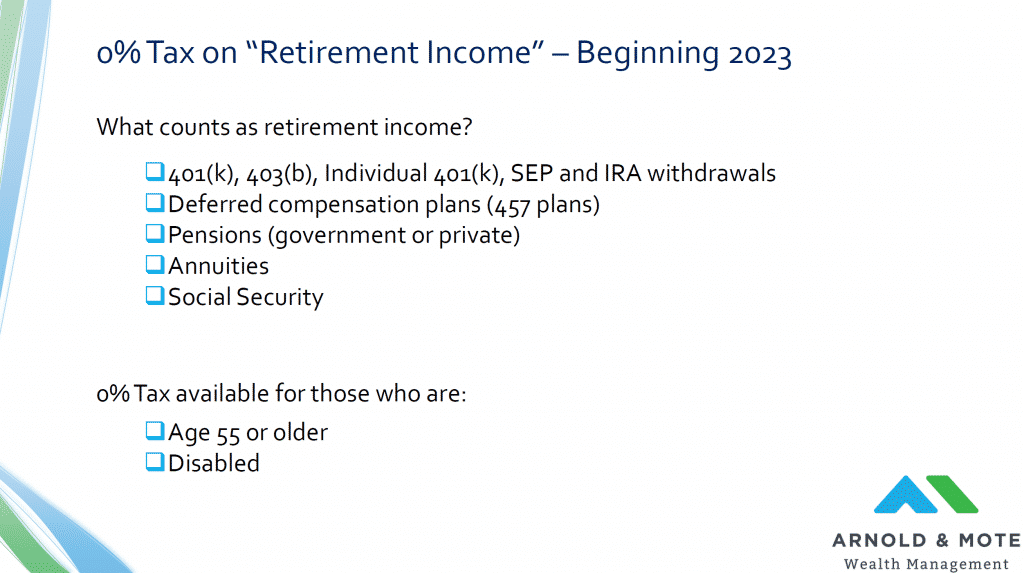

And that bigger change is that beginning in 2023 there will no taxes levied on what the bill calls “retirement income”.

What exactly is retirement income?

Then the fine print for this new law. In order to qualify for this 0% tax rate, you need to be 55 or older, or be disabled.

Note that the retirement income exclusion only applies to qualified annuities. Nonqualified annuities, along with nonqualified deferred compensation plans, are not eligible for Iowa’s retirement income exclusion and will be taxed as ordinary income. This has been made clear with some notes on the instructions for Line 7 of Schedule 1 by Iowa Department of Revenue, here.

So for most retirees that we see in Iowa, this is going to drastically reduce you state tax liability. And for a lot of people they will have no state tax due.

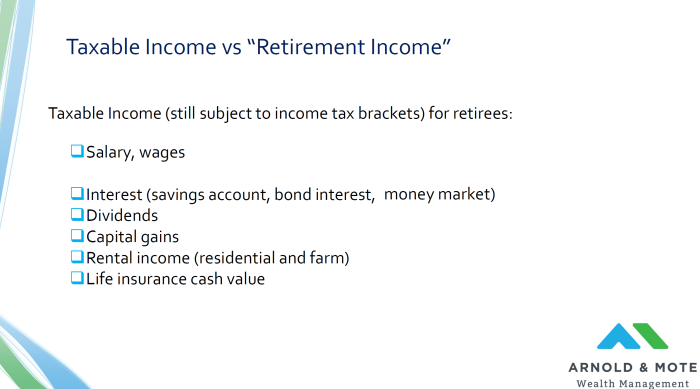

Even with this new tax bill, what will still count as taxable income? And by that I just mean, what does get taxed at the rate in the tax brackets we just looked through?

Of course wage income. W-2, 1099 contractor works etc. This could include severance pay if you’ve accepted a voluntary severance offer.

What is applicable for when you actually retire and stop working:

So, still a few things that may contribute to some amount of taxable income. But the big change here is excluding 401(k) and IRAs along with pensions from state taxes. That’s a big one for most Iowans.

We went through the significant changes to the tax law. Now what are the planning opportunities with this new law?

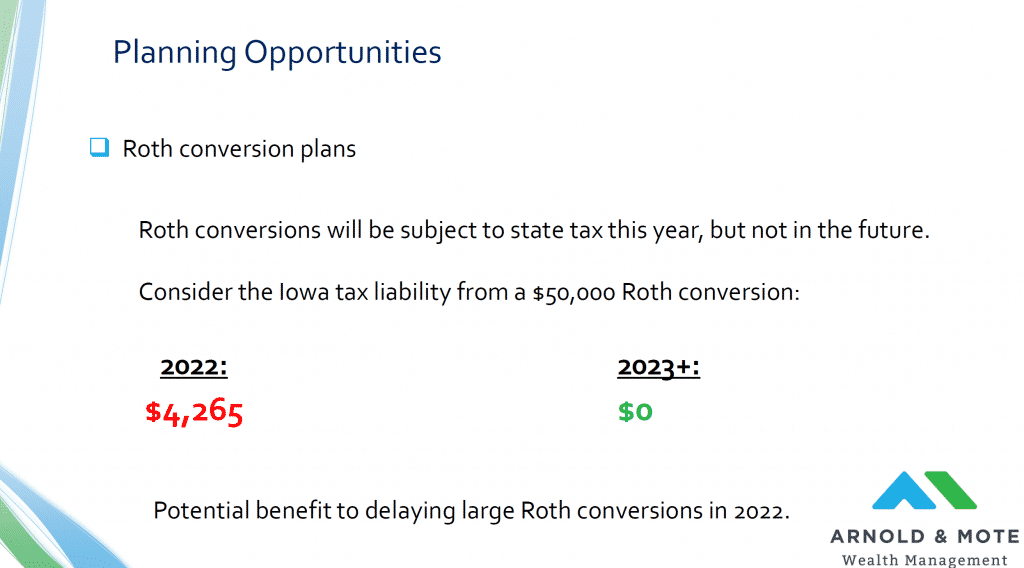

One item we’ve been working on with a lot of clients recently is Roth conversion plans. The whole idea with Roth conversions is finding the trade off of paying taxes now, to avoid higher taxes in the future.

And with this new tax law, we’re in an interesting situation where we know future tax rates are reduced, and actually completely eliminated on the state level. So, its changed up the math a bit.

Just for example, say you are looking at doing a $50,000 Roth conversion in 2022, right now that would result in an additional $4,200 in state taxes due for a household already in the state’s top income bracket.

By delaying just a year, you can take advantage of the 0% tax rate on IRA distributions, and pay no state tax at all.

It is more common that we are seeing a benefit to delay Roth conversions until future years to qualify for that 0% tax rate. At the very least we think it makes sense to hold off on really large Roth conversions this year.

But that’s not universal and really just requires looking at your specific situation. The older you are and the larger your IRA or 401(K) balances are, the more it tips the scales in still favoring some amount of Roth conversion in 2022.

A couple other planning items we have noticed that are impacted from this law.

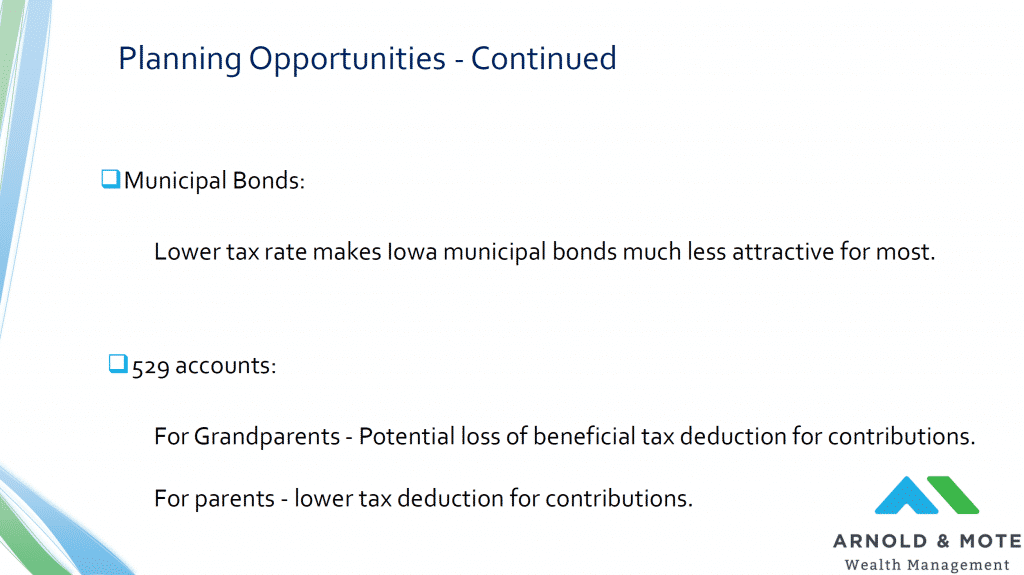

First, municipal bond income. Because Iowa was a high taxed state, very high income folks with large taxable accounts, not IRAs or Roth IRAs, may have had some benefit from using Iowa municipal bonds for income. This was a little rare from our experience, but it did apply to some people.

The benefit of Iowa municipal bonds is going to be reduced pretty significantly from this bill, just since the state’s tax rate is dropping so much. So at a time like today where we have seen bond prices decline, its could be a good opportunity to tax loss harvest out of those municipal bonds if you can.

Then, for grandparents that are saving in 529s for their grandchildren, you’re going to potentially lose out on that tax deduction if you have no taxable income now. Again, just because most retirees will have little to no taxable income to deduct from.

And even for younger families this is also a smaller issue. For example in 2022, a married household in Iowa’s top tax bracket gets a tax deduction that is worth $600 per child if they maximize Iowa 529 savings.

By the time Iowa’s flat tax rate goes into effect that tax deduction will be worth $275. So, a slightly smaller benefit there.

This is not to say that 529s are a bad idea now. You still get tax free growth on the money you deposit. But there might be a little less of an immediate tax benefit.

We have 2 finals slides here to just quickly highlight provisions of this new Iowa tax law that are really important, but just for a pretty select group of people. We really just wanted to highlight these new rules, so that if you know it applies to you, you know to reach out to us for more detailed help.

As a general disclaimer for the next 2 slides – these sections of the law are about 10 pages of dense legal speak. There’s a lot of fine print to these rules that would take another 20 minutes to go through here. So again, don’t take the text on these slides as the end all be all.

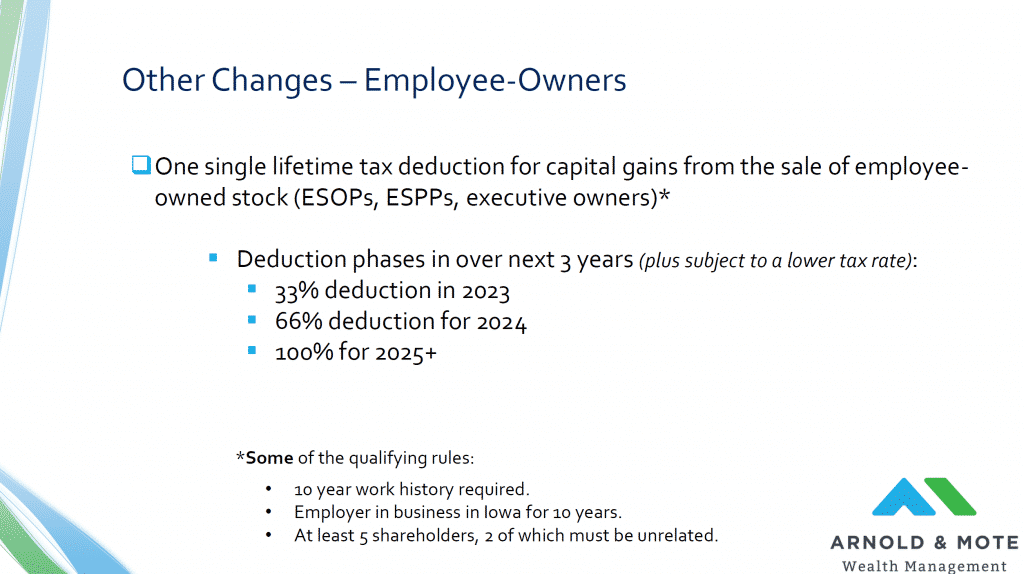

The first new benefit from this tax law is for those who own stock in their employer. So if you participate in an ESOP plan, this is for you. Or just for those of you who own shares in your company, maybe a director, or other executive.

There is a new rule that allows the capital gains on those shares of your company to be taxed at a reduced rate, and eventually not at all.

This benefit is being phased in over the next few years.

So for example let’s say you have $100,000 in capital gains from employer stock that you have held.

If you sell in 2022 – all of that $100,000 is taxable.

If you wait until 2023 – Just $67,000 of those gains are taxable, and worth noting, 2023 will also have a lower tax rate, so you get that benefit too. Or said another way, 33% of the gains are deductible.

In 2024, only $34,000 of those gains would be taxable, or 66% of the gains would be deducted.

And then in 2025 and beyond, the sale of that stock would be completely tax free.

Some of the basic requirements to qualify for this:

You need to have worked at the company for 10 years.

And, that company must have a 10 year history of having an office in Iowa.

And the company has to have at least 5 shareholders, 2 of which are unrelated. So no really small family owned business count here.

But, you can see that if you own a very significant amount of stock in your employer, this is potentially a really valuable benefit to know about.

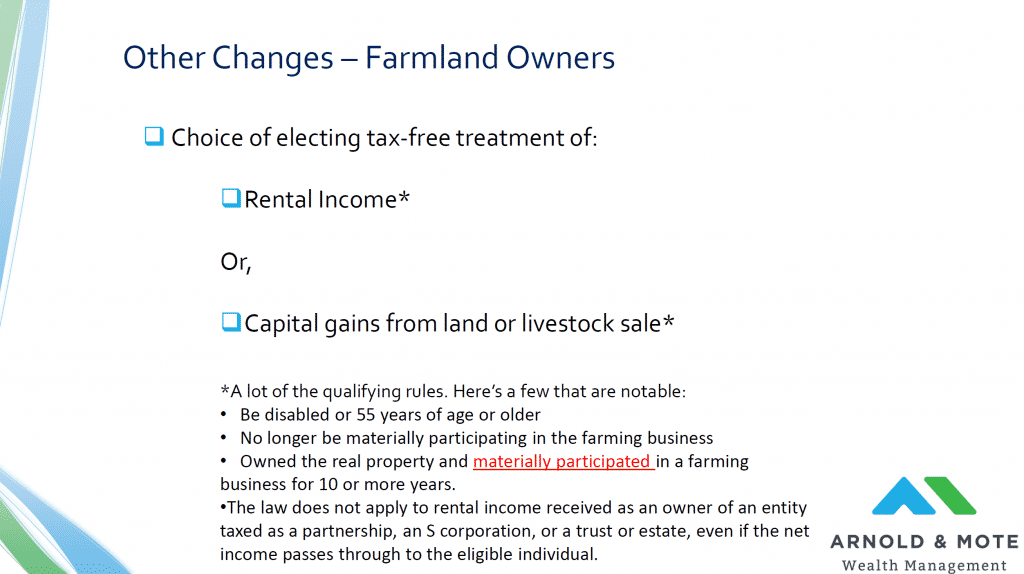

And lastly, there a special section in this new law to give farmers a potential tax break as well. What they are trying to do here is recognize that for some who were long time farmers, farm rental income essentially is their retirement plan and acts like a pension. Or, they are going to sell the farmland at retirement, so those proceeds should be treated like an IRA.

Now, a farmer who owns the land and has materially participated in the farming of that land will have a choice. They can either:

One, elect that rental income from the farmland will be tax free in the future.

Or two, elect that the capital gains from the sale of the farm when they sell will be tax free.

A farmer gets one of these options, not both. So, you would have some decisions to make on what option is best for you. If you know you want to pass the farmland down to your family, taking the rental income deduction is probably better. If you know that you will sell the farmland after a few years, then waiting and getting the exclusion on capital gains is probably the better route.

Like all the other new rules we have talked about today. This does not go into effect until 2023. So even if this applies to you, there is nothing that changes this year. I would think the only urgent item here would be if you would qualify for the tax break and are considering selling farmland right now. There could be a pretty big advantage of waiting 6 months in order to qualify for the state tax break.

Again, there would be a lot of consider here in determine the best of option for you, and to make sure you qualify.

Just a few of the qualifying rules:

Like with the IRA benefit, you need to be 55 years old or older, or disabled.

You had to have materially participated in the farming business for at least 10 years, and then now no longer be materially participating. So, if you inherited farmland from your parents for example and get rental income from that, it is my understanding that you would not qualify for tax free rental income.

And going along with that. This just applies to the actual individual owner of the farmland. So if you receive farm rental income from a partnership, corporation, trust or an estate, you do not qualify for this deduction.

We won’t go through all the fine print and details here since this is a bit of a niche topic and again would add a lot to this. But, for those that know this may apply to them, this is potentially a really important point of this new law.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.