Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Investing in municipal bonds is a topic we get asked about frequently. It is a topic that seems straightforward, but actually has some complicated features and calculations that we find leave a lot of investors with a misunderstanding of whether municipal bonds are right for them.

The primary feature of municipal bonds that causes them to be very popular with investors is the potential for all the interest of the bond to be tax free.

This can mean free of federal taxes, along with state taxes and even local taxes is that applies to you.

Municipal bonds may be exempt from federal income tax. I put maybe here just as a disclaimer really, because there are some bonds that are still taxed federally. However, your custodian should make it very obvious to you. For all examples in this post, we’re going to assume that the bonds are exempt from federal taxes just for simplicity.

And then also the interest on these bonds might be exempt from state taxes as well. To qualify for this benefit, you usually have to purchase a municipal bond within your state. That means if you live in Iowa and want a bond that will not be taxed in Iowa, you need to buy a bond that was issued somewhere in Iowa.

And again as a disclaimer, there is some fine print here. Not every single bond issued within a state is exempt from the state’s income taxes. So be sure your custodian is verifying that any bonds you purchase qualify for state tax exemption. From our experience working with Schwab, this is made very clear. But be sure to check before purchasing.

But what should you know before making an investment into municipal bonds? Because at first glance, everyone always seems to think that just because an investment is completely tax free, it must be a great investment.

That’s what we want to cover in this webinar today because as we’ll find out it’s usually not so simple as “these are tax free so they’re a great investment for you”.

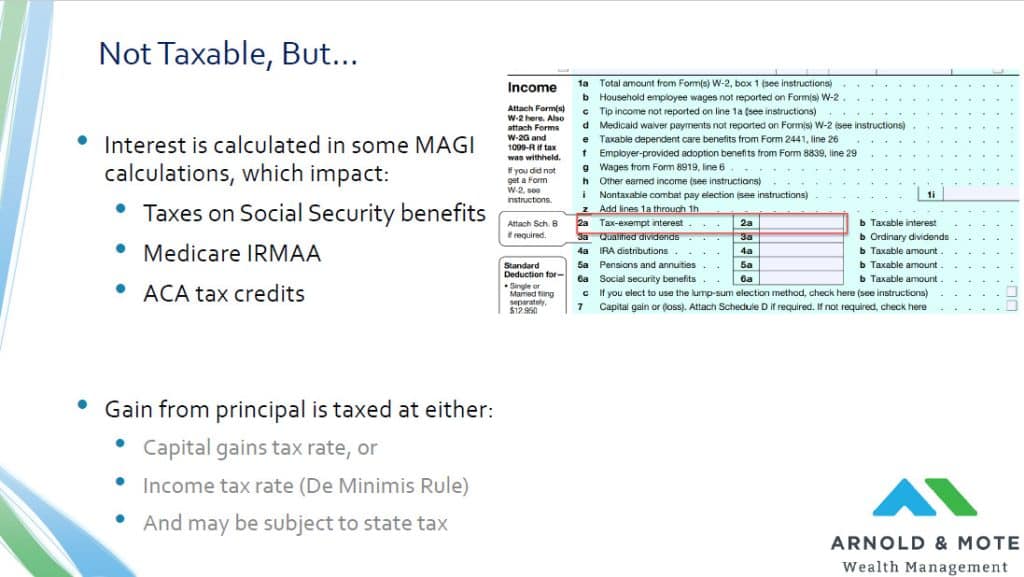

Just for an example on how municipal bond interest can trip people up on their tax planning:

While the income from municipal bonds is potentially not taxed by federal or state level it does still impact some parts of your tax return.

We are showing here on the right a form 1040 for your annual tax return. Notice that the interest from municipal bonds is still reported to the IRS.

Why is that? Well income from municipal bonds is factored into several different calculations for your modified adjusted gross income that do impact:

So, while these are not taxed at a federal income tax level these examples show you how the interest from these bonds can still significantly impact the net tax amount that you pay in any given year.

And then besides the interest, any gain in principle on investments in municipal bonds is also taxed.

This occurs when you purchase a bond at a price below what’s called its par value, or the value that it will be redeemed at. For example, if a bond would pay you $100 when it matures, but you buy it at 95, that $5 difference will be taxed.

This is very relevant right now because a lot of these municipal bonds have had significant declines in their value as interest rates have risen. If you buy these now and hold until maturity, or just sell once they increase in value, that gain in your principle is taxed.

And how that increase in value is taxed can depend on the certain formula called the de minimis rule, that we’re going to look at later, but just know it can either be a capital gains tax rate or an income tax rate. This is another example of what can be a big surprise for people that are thinking they have this tax free investment, and then the bond matures and they get hit with a big capital gains or income tax bill from the proceeds of their investment.

To start, let’s just say knowing all this, you still think muni bonds are a great investment for you.

How do you go about actually investing in municipal bonds?

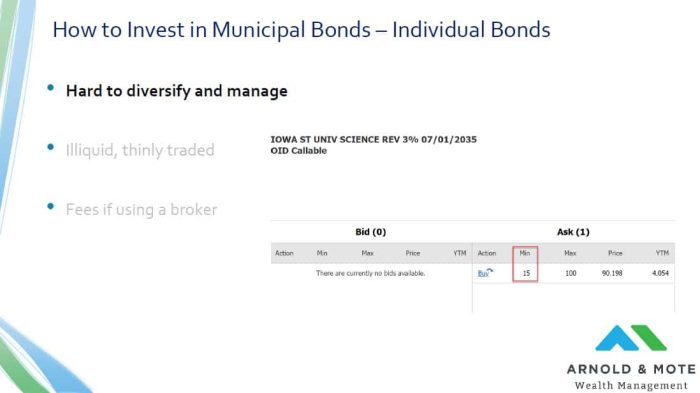

There’s a lot of different ways, generally the method most thought of as the most simple is just buying individual bonds. This means going to your brokerage account or going to a broker and saying I want to buy a University of Iowa municipal bond that will be tax free federally and on the state level, too.

There are big firms that invest this way for their clients, and a lot of individual investors as well that invest this way, so we frequently see portfolios full of individual municipal bonds like this.

But we think investing this way has a few potential drawbacks.

First of all, like with any type of bond, It can be difficult to diversify unless you’re investing with a really large amount of money. For example this image on the right is some details we see in Schwab if we go in and try to buy an individual bond.

This is a bond from Iowa State University and you can see right now the only offer to purchase this bond is from a seller that has a minimum of 15 bonds available for sale. This would be a minimum purchase of $15,000.

So, if all you have is $50,000 to invest, this could be too big of a portion of your investment to be comfortable with.

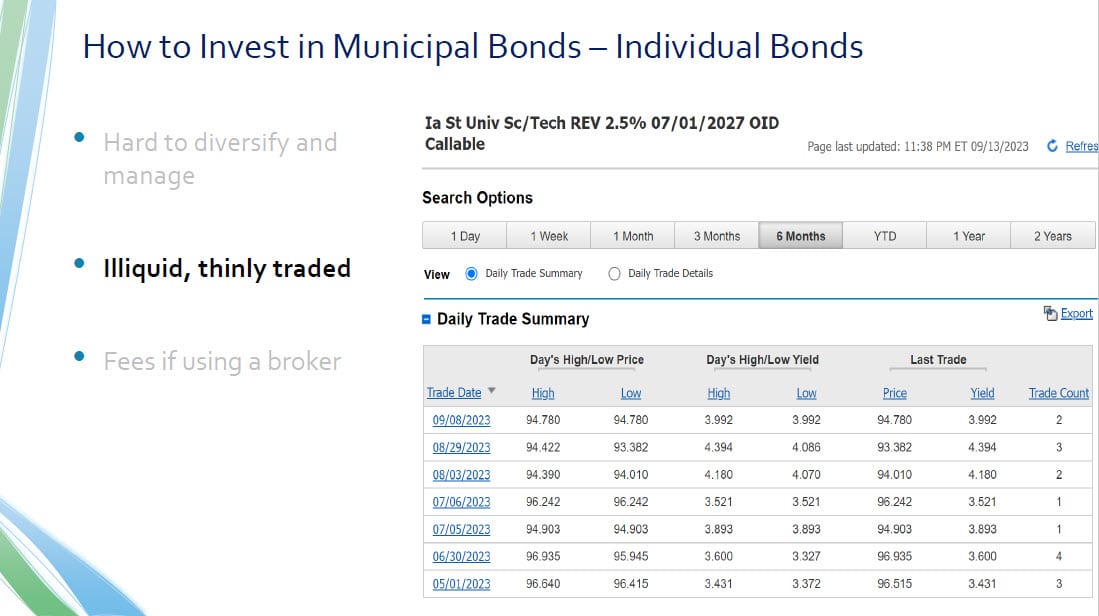

Another risk is that these bonds can be very illiquid and thinly traded on the secondary market.

Here we’re looking at a different Iowa State University bond, and you can see here over the last six months there’s only been seven days where this bond actually was traded.

If you own this bond and are looking to sell this bond before it matures, it could take quite a while to be able to sell and not only that, but you may have to take a lower price than what you want just because there’s not a lot of people looking to buy these at any given time.

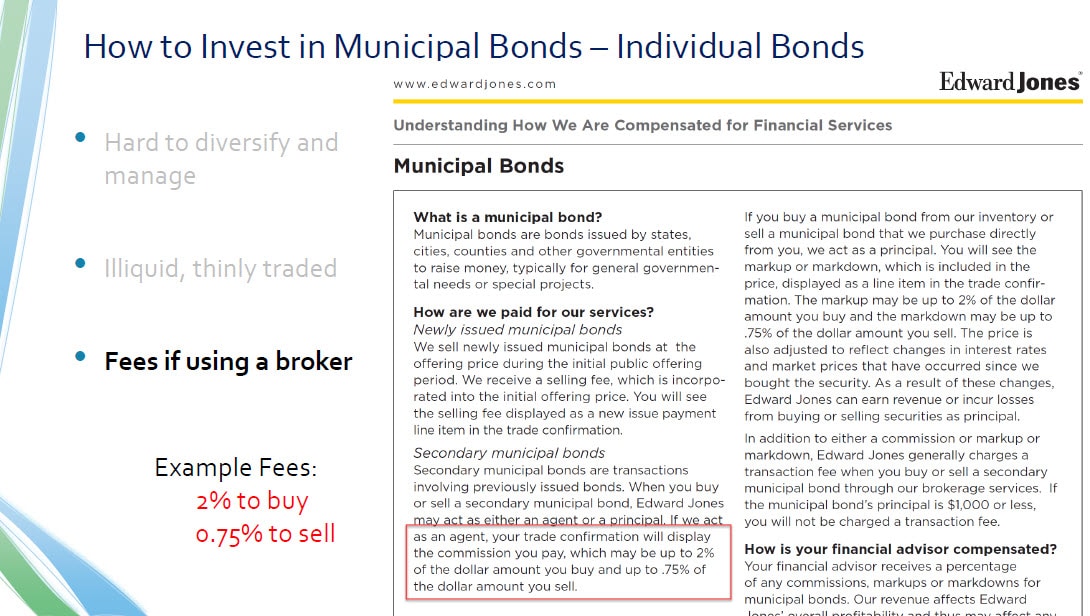

And lastly, if you are not comfortable looking through the thousands of bonds available in the municipal bond market and selecting your own bonds, you would go through a broker to help.

And they charge pretty significant commissions on any individual transaction.

You can find these fee disclosures for any broker out there, I’m showing here one from Edward Jones, and there’s a caveat that this could change at any time. But this exists for every other broker out there. And, from the many brokers I looked at as I was tracking this down, the fees seemed to be pretty much in line. There weren’t a lot of people that were much lower or much higher.

What is the fee in this example? Edward Jones is disclosing that they charge a 2% commission to purchase these municipal bonds for you and then they’ll also charge a .75% commission to sell and so just under 3% round trip fee.

That’s a pretty significant fee when we’re talking about investments that have generally pretty low yields.

For example, for that Iowa State University bond we looked at in a previous slide, this fee is more than one year of interest on this bond that you’re going to pay in commissions just to have this broker make this purchase and future sale for you.

And this is unfortunately one reason why these are so popular in people’s portfolios – brokers really like to sell them they’re very well compensated to sell these to you.

For these reasons a lot of people prefer to use mutual funds or ETFs instead of buying individual municipal bonds. And we think this is a very good choice for most investors, but it does have some pros and cons as well.

Using exchange traded funds or mutual funds in general make it very easy to diversify and manage your investments. You can buy one fund that’s going to hold hundreds or thousands of different individual bonds, giving you that a well diversified portfolio very easily.

They are also very easy to buy and sell, unlike individual bonds. These are generally very liquid, and you can purchase in a matter of seconds at a known price from any broker out there.

But, there are still a few things to consider when using mutual funds or ETFs for municipal bonds.

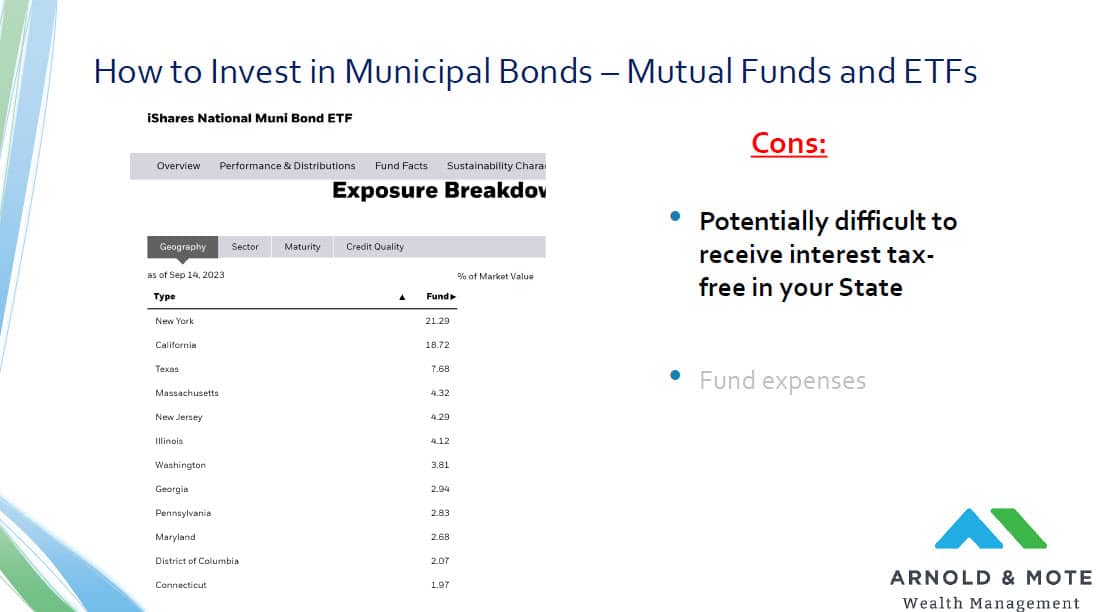

First, it can be difficult to receive interest tax free for your state.

Remember, you have to purchase a bond issued by your state to be exempt from state income tax. So, if a municipal bond fund buys a New York bond, I will still be taxed by Iowa for that interest. When you use a fund you don’t have as much control of which bonds they’re purchasing and you’ll likely end up owning a lot of out of state bonds.

And lastly, you pay for this convenience. Every ETF or mutual fund is going to have some kind of expense. This can vary widely as we’ll see in a minute, but is an added cost.

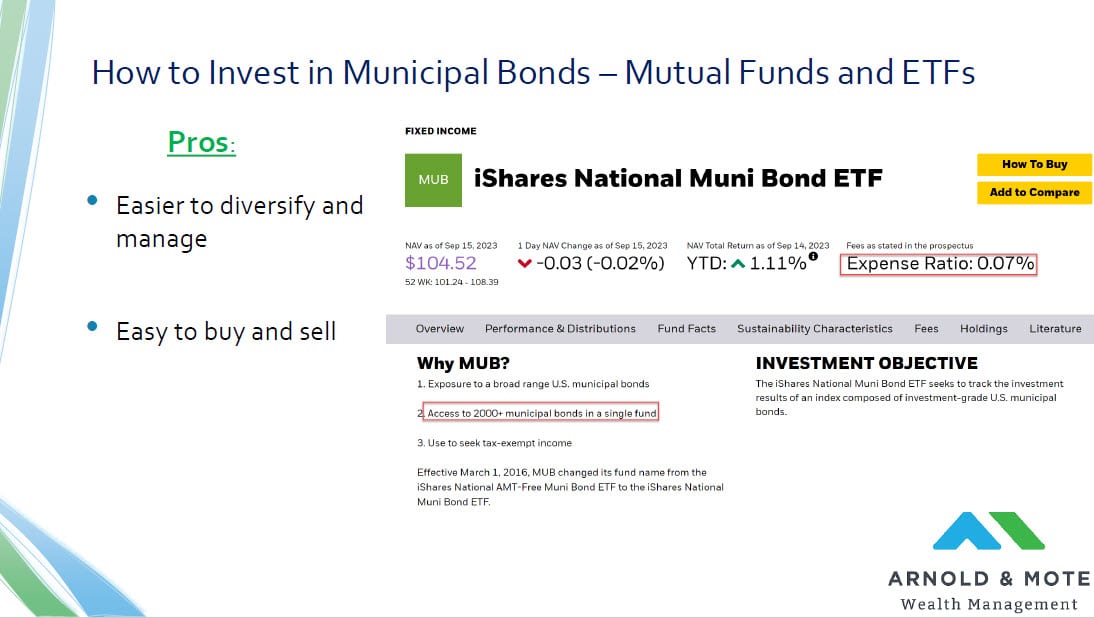

Just to look at an example, here we’re looking at a fund from I shares. This is the largest municipal bond fund out there today with about $35 billion dollars in assets.

You’ll see I highlighted in red here, the fund has a very low expense ratio of 0.07%, and this one fund has more than 2000 individual bonds as holdings.

An investment in this fund is diversifying you very well for a very low cost.

But even with this very good fund, there are still some downsides. For example, me as an Iowa resident will not receive much of a state tax exemption at all.

The image here is showing the breakdown of the investments that this fund makes, based on different states. You can see New York municipal bonds make up about 21% of the holdings, California municipal bonds are just under 19%, and you can go down this list here and would eventually see that Iowa bonds make up just 0.13% of the investments of this fund.

So, as an Iowa resident, only about a tenth of a percent of the income I get from this will be exempt from state taxes. Most of the income I will still pay state of Iowa taxes on, which could be a significant reduction in the benefit that this fund offers me as an investor.

Funds do exist that solely invest in one single states debt securities, so that investors get the entire income tax exempt for their state. These are easier to find for bigger states like New York, or California, but they do not exist for many states.

For example, there is no Iowa state municipal bond fund.

And as soon as you get outside of large bond funds run for the really big states, expenses start to creep up.

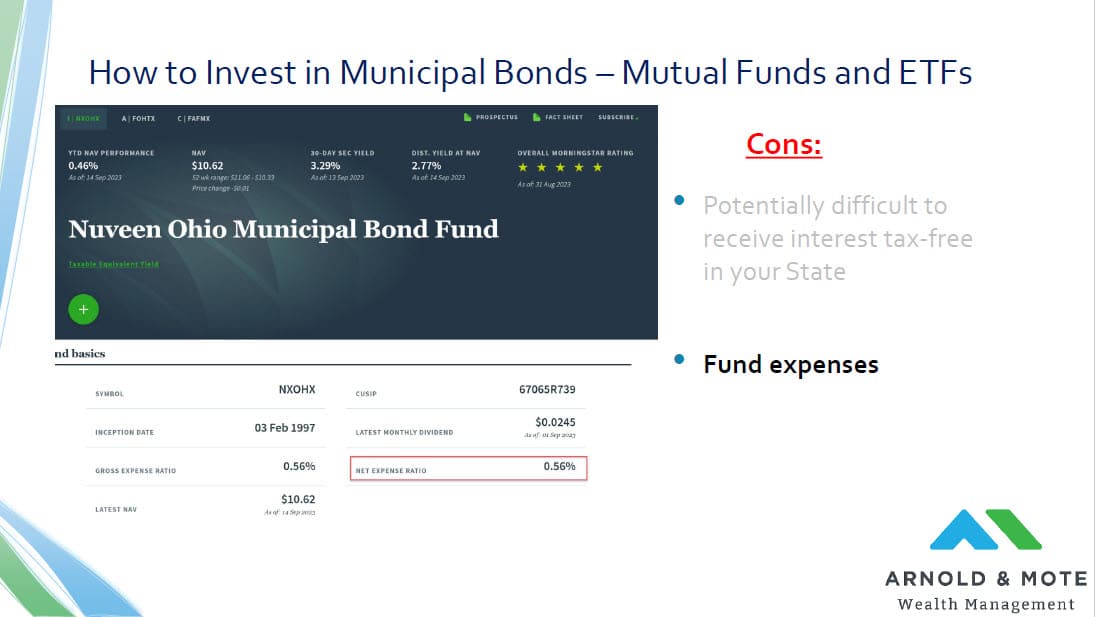

Shown here is an example of an Ohio municipal bond fund run by Nuveen, who is owned by TIAA. It invests exclusively in Ohio bonds. So, if you are an Ohio resident you might see this as a very attractive option because now these bonds are getting you both federal and state tax exempt interest.

But the problem is as these funds get more specified, their fees also increase. Shown here you can see that this fund has an expense ratio, or an annual fee, of 0.56%, so about eight times higher than that I shares fund that we had looked at in the past.

And what’s interesting is that although at the surface this bond fund should be very beneficial to Ohio residents the fees that are charged make it potentially not as good of an option.

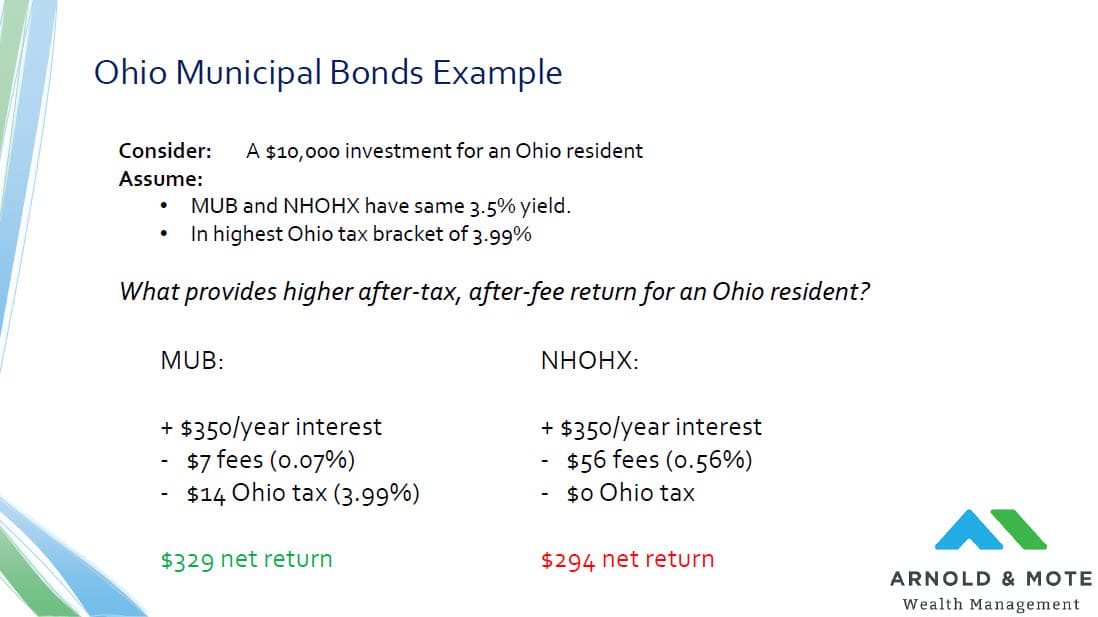

For an example of the impact that this added fee has, we’ll look at an example of a $10,000 investment from an Ohio resident and compare the net return for both that iShares fund we looked at above – that’s MUB, or the Nuveen Ohio municipal bond – that’s NHOHX.

As an assumption let’s just say they have the same yield of 3.5% that’s very close to what they are today but obviously this can change just depending on the holdings of the fund.

And let’s say this investor is in Ohio’s highest tax bracket which is just about 4%.

When we look at that $10,000 investment, each fund would pay you $350 per year in gross interest.

With the iShares fund you pay significantly lower fees $7.00 in this case compared to $56.

However you do pay Ohio State tax on most of that interest that would amount to about $14.00 in taxes. This this tax combined with the $7 fee means from that $350.00 per year in interest this hypothetical Ohio investor is getting about a $329 net return.

That $10,000 invested in the Nuveen Ohio municipal bond fund has $0.00 in tax for this Ohio resident but the increase in fees is so significant that it leads to a lower net return for this investor just because the fees are so much larger than the potential tax savings.

This is just an example, but is something that a lot of people do not look through. They get attracted to the idea of tax free municipal bond interest and they stop there and just figure that regardless of the fund fees, using a fund that is all tax exempt is always better, and that is really not the case.

Now knowing this information and details to consider, we wanted to run through an example or two to show you some real numbers about how to evaluate when a municipal bond actually makes sense for you.

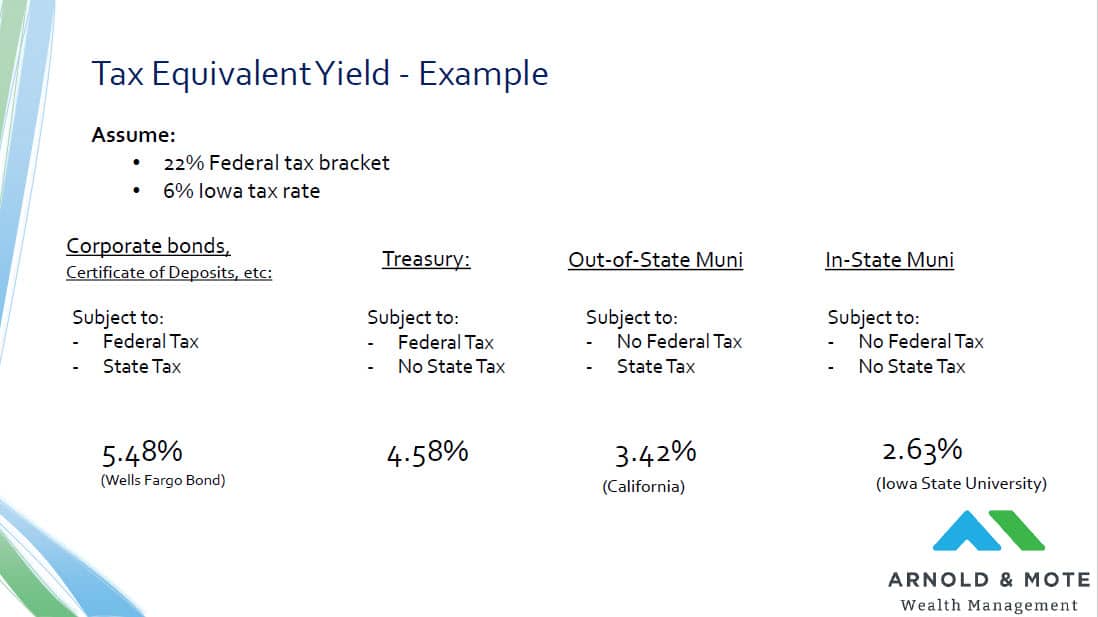

The biggest consideration besides fees is determining what’s called a taxable equivalent yield. This has to be a calculation because there are four different types of bond investments that each have a little bit different tax treatment.

You have corporate bonds, these are taxable bonds from big companies that you’ve heard Apple, Amazon, Microsoft and so on. Or also lumped in here is bank CD’s and brokered CDs since they are taxed the same way. The interest from these investments is subject to State and Federal income taxes.

Then, you also have treasury bonds, these are bonds issued by the US government, they are exempt from state tax. But you do still pay federal tax on the interest.

Next, you could buy an out of state municipal bond. This would be, if I’m an Iowa resident, I buy a California muni bond. This would not be subject to federal tax, so you get a nice tax exemption there, but it would still be subject to your state tax rate.

Then lastly you have the in-state municipal bond and so again as an Iowa resident this is me buying a just for example Iowa State University bond. We’re going to assume here I’m getting the full federal and state tax exemptions.

And what we see when we look at the interest rates for all of these types of bonds is that muni bonds have much lower coupon rates than some of these other options. What this means is that there’s a tax rate where municipal securities make sense, and there’s a tax rate where they don’t make sense based on these lower yields.

I’ve included here the interest rates of examples of these bonds as they were last week.

There’s a general disclaimer here that these numbers change every day and are just an example of 1 bond in each of these categories. It is not a recommendation to invest in any of these specifically and are used just as examples.

These rates are based on real data though, and I did try to match these up as well as I could to be a fair comparison. Each bond matures in about 5 years, and they all had the same credit rating of A2 from Moodys. These bonds all carry the same default risk according to the rating agencies.

With the exception of the treasury bond of course which is guaranteed by the government and is generally considered much safer, with lower credit risk, than the other three options here.

And so if you were considering an investment in any of these bonds, this is what you’d want to look at. What are the municipal bond yields, and how to the compare to yields on the other types of bonds? And, what are my tax rates that this interest is going to be subject to?

Once you have those answers, then you can figure out which makes the most sense.

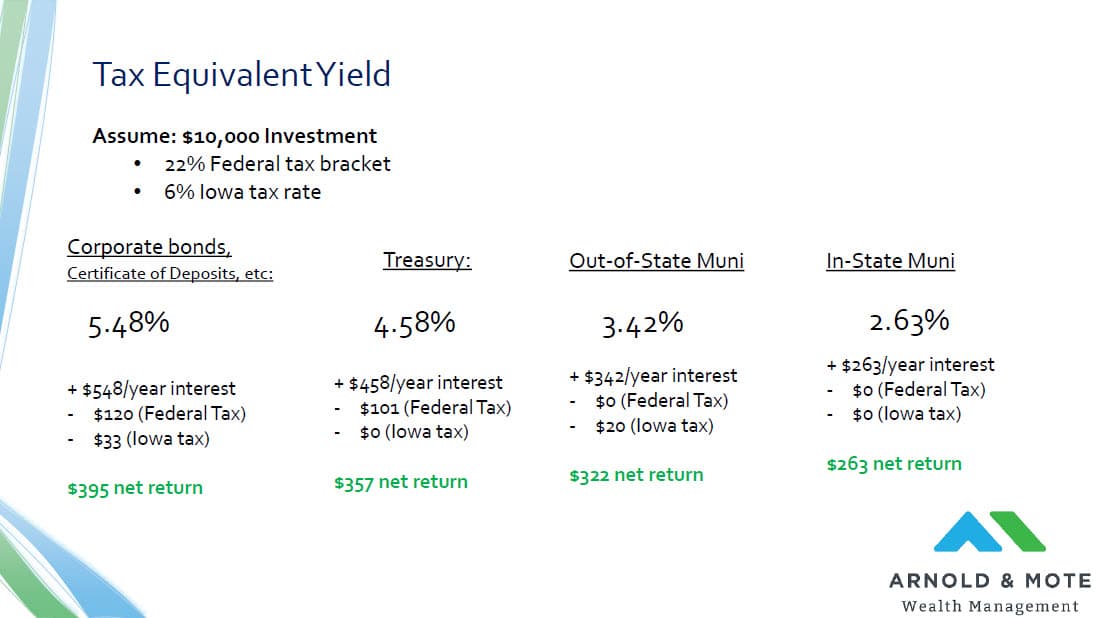

Assume a $10,000 investment for a resident of Iowa that is in Iowa 6% tax bracket and also in the 22% marginal tax rate for the federal income tax brackets.

Here’s how this interest ends up getting taxed and what your net return ends up being:

For the corporate taxable bond, or bank CD, that $548 an interest gets federal tax applied which would be about $120 dollars, and Iowa State tax would be about $33. You are left with $395 after tax.

For the treasury bond it’s a bit lower, about $357 net after tax.

The out of state municipal security would leave you with $322.

And with the Iowa tax-exempt bond you’re left with that full amount $263, since all payments will be tax exempt income.

So this is a perfect example of – just because a bond has more favorable tax treatment does not mean that it is the best investment for you.

And the most important thing to realize is that these numbers all look a little but different to everyone.

If we assume that this person is in the 35% federal tax bracket and lives in California and subject to their highest tax rate which is about 13%, these numbers would very quickly start to favor municipal bonds!

That is pretty common, that very high income households in high tax states do find that these are very good investments for their investment portfolios. But, it is hardly universal.

There’s much more to this analysis than just the interest rates. I had mentioned in an earlier slide that gains in principle on municipal bonds are taxed as well. That gain can be taxed at either capital gains tax rate, which is 15% for many people, or 20% for very high income households. Or, this gain can be taxed as income tax rates, which are higher, up to 37%.

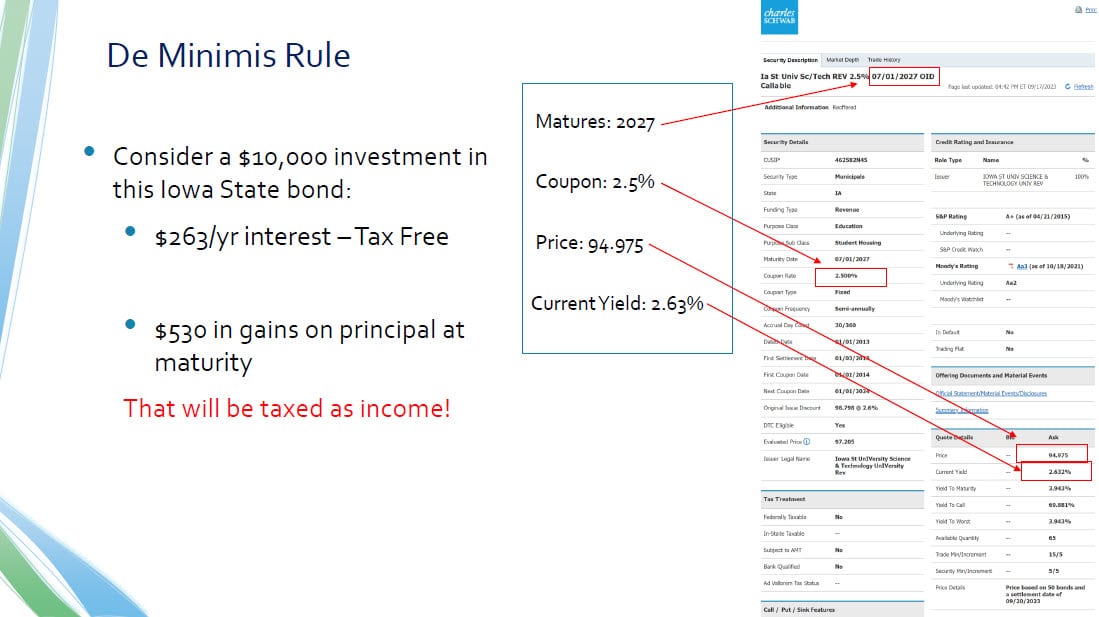

Whether your bond is taxed at capital gains rates or income tax rates is dependent on something called the de minimis rule. I’m not covering this in a lot of detail, but just raising awareness to show you another important factor in the decision to invest in municipal bonds.

There’s a pretty simple formula you plug in based on some metrics of the bond and it will tell you whether or not the principal gain from a municipal bond investment is taxed at either capital gains or income.

Shown on the right here is the detail of that tax free muni bond from Iowa State I used in a previous example. You can see here it has a current yield that 2.63%, what’s important for the de minimis rule is the price of the bond. This bond has a par value of 100 and a current bond price of just under $95. This means an investor purchases this bond for about $95 today, and receives $100 in principal payment at maturity, plus all the coupon payments over the years as well of course.

That $5 in difference, or about $500 per $10,000 investment will be taxed at Federal and potentially state income tax rates.

We said in the past slide that municipal bonds tend to just make sense for those at very high incomes and therefore tax rates, and so if we assume that the owner of this bond is at a tax rate of 32% or 35% Federal tax rate, plus 6% state tax rate, you’ll see they’re paying close to 40% of this gain back in taxes.

And this comes as a big surprise for a lot of municipal bond investors because they just heard “municipal bonds are tax free”, and think that kind of everything they’re getting from this investment is going to be tax free.

Like so many aspects of personal finance, the answer is – It Depends.

It depends on your investment objectives, your risk tolerance, your tax situation, your state of residence, and much more.

Hopefully this served as just a good look at some of the details you need to consider before investing in municipal bonds

I hope the key takeaways are pretty clear. While these investments do make sense for some, it is not a universal good fit for all investors.

Before you invest, make sure that that tax benefit is worth it for you. Do not get a lower return just because it’s tax free.

A financial advisor or tax advisor should be able to help you determine if these are appropriate investments for you.

Finally, a really important point is that this tax benefit of municipal bonds does not exist within qualified retirement accounts, so that’s 401K’s or IRAs or Roth IRAs.

Interest earned on investments within these accounts is not taxed anyway, so most tax free muni bonds have no added benefit being within an IRA. And that alone makes these not great investments for a lot of people since a lot of people have most of their wealth tied up in these retirement accounts they just quite honestly do not have a need for these.

If you have questions about on this, or any other topics related to your financial plan, please don’t hesitate to ask. We are a flat fee, fiduciary, fee-only financial advisor located in Cedar Rapids Iowa, and serving clients across the country.

Click below to set up a free 30-minute meeting with us to see how we help clients manage investments in retirement, and create tax efficient retirement plans.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.