Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Starting early with college savings gives compounding the most time to work, making even modest contributions grow significantly over time.

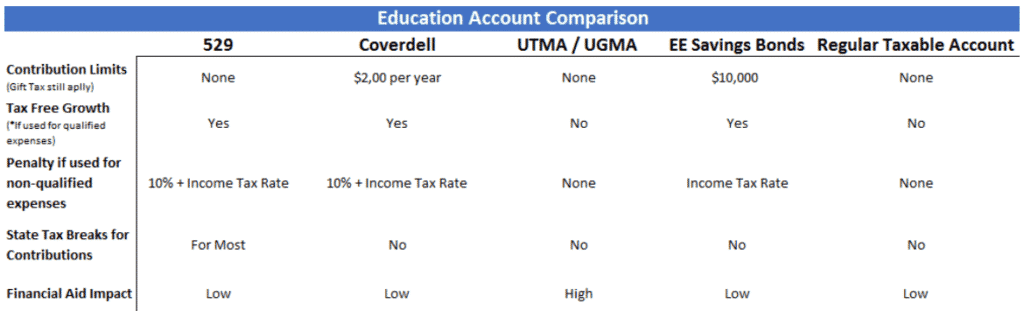

529 plans are the most popular option for tax-advantaged growth, but Coverdell accounts, UGMA/UTMA accounts, and savings bonds each offer unique benefits.

Every account type has trade-offs—including tax treatment, financial aid impact, and withdrawal rules—so choosing the right mix depends on your family’s situation.

Part 1 of our college planning series covers the “early years” of college planning, roughly anytime before sophomore year of high school for the beneficiary.

Part 2 of our series covers late stage college planning, what you can do when you or your child is sophomore year in high school through college.

Part 3 covers what you can do after graduation to help qualify for tax breaks on your student loans, debt forgiveness options and student loan repayment plans.

Regardless of your household income, planning for higher education can be burdensome.

For those who may not be able to (or desire to) fund a complete college education, the goal is to find the best “bang for your buck”. What can you do today to make your savings as valuable as possible for when it is needed later?

For those fortunate enough to be able to fully fund a college education, there are still several considerations, from asset allocation of savings to tax considerations. Wrong moves could trigger gift taxes, “kiddie taxes”, or surplus amounts in 529 savings accounts that will result in a 10% penalty to withdrawal.

College planning touches every generation. It’s common to have grandparents looking to help fund a grandchild’s college fund, parents doing the same, all while students apply for financial aid and work part-time jobs. Balancing everything can be tricky. Although we can’t answer every situation, this guide is made to help you understand the basics so you can make an informed decision (or realize that you’re lost and need to get help!)

Before going into specifics, here are some basic questions to consider that are relevant regardless of how you save for future education expenses:

Your specific numbers will vary based on the beneficiary’s age and which school you choose. But for a rough estimate, a family saving today for a child who will be enrolled in college in the years 2030 – 2033 should expect to need about $180,000 in total, based on today’s national average of an in-state, 4-year program and a 5% per year rise in education expenses.

Your greatest opportunity to save up money to help pay for college is to get started as soon as possible. Because of compounding interest, money that you save early on will grow to larger amounts later on. Unlike money saved in a bank account, money saved in Qualified Tuition Programs (QTPs), such as 529s, can be invested in stocks and bonds, giving you the chance for a higher return on your savings.

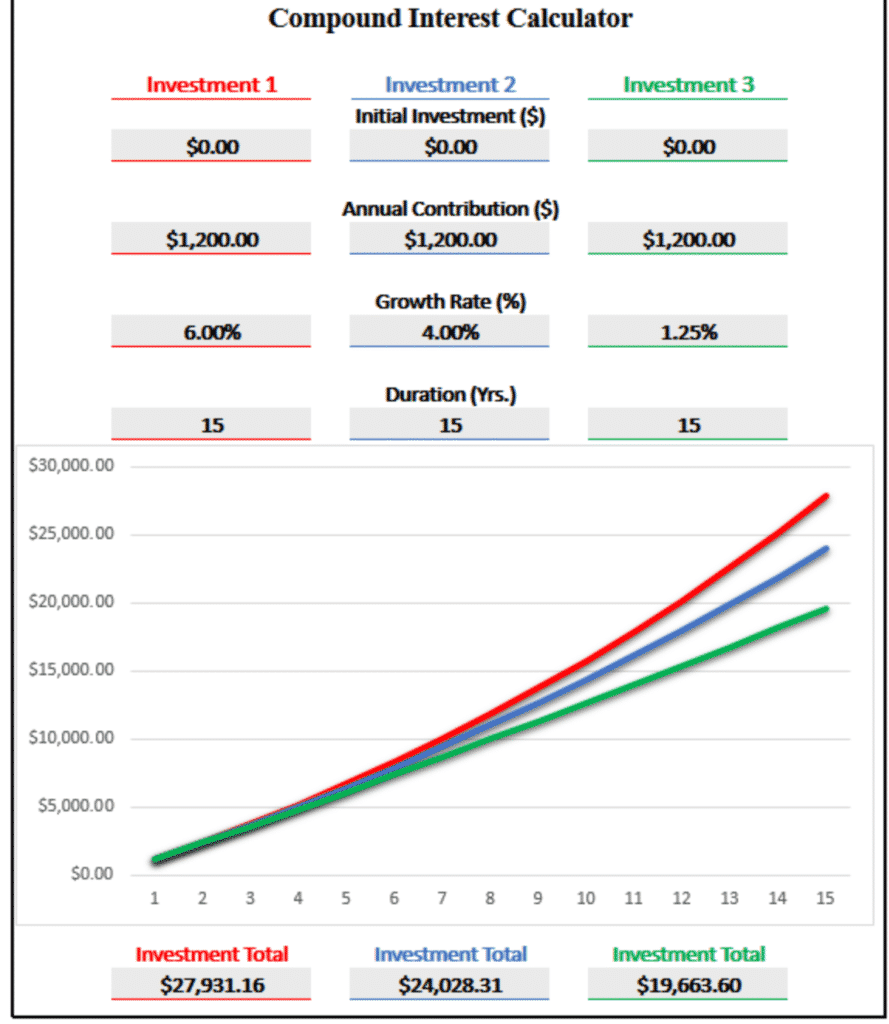

First, as a baseline, consider saving $100 per month ($1,200 per year) for 15 years, solely in cash, earning 0% interest. You would save $18,000 in total. Not a small amount of savings, but once we consider rising education costs and inflation, that $18,000 will likely not go nearly as far 15 years from now.

What if we could instead save that money in an investment that has the possibility of growing over the years, keeping up with inflation and rising education costs?

Above are 3 examples of varying returns you could expect to achieve with various asset allocations. The red line represents savings at 6%, slightly under the long-term historical return of the U.S. stock market. The blue line represents 4% growth, representing the returns of a “safer” mix of stocks and bonds. The green line represents 1.25% growth, which you could expect with ultra-safe investments like treasury bonds. We will cover asset allocation in more detail later.

Besides simply saving cash in the bank account, we are going to cover 4 ways you can start saving for future education expenses. Remember, this article just covers the “early years” of saving, and will not touch on scholarships, grants, tax credits etc. that help during the time you or a family member is in school. It will also not cover student loans, refinancing, payback plans, or debt forgiveness. For more on that, check back for parts 2 and 3 in our series.

The ways we are going to cover in the article:

529 accounts are the most popular form of education savings accounts. Nationally, there is a quarter of a trillion dollars ($250 billion) in 529 accounts!

Money within 529 accounts can be used for any “qualified higher education expense”, which can include; tuition and fees, room and board, books, and even money for a computer, computer software or internet access for the student.

In general, the primary benefits of 529 accounts:

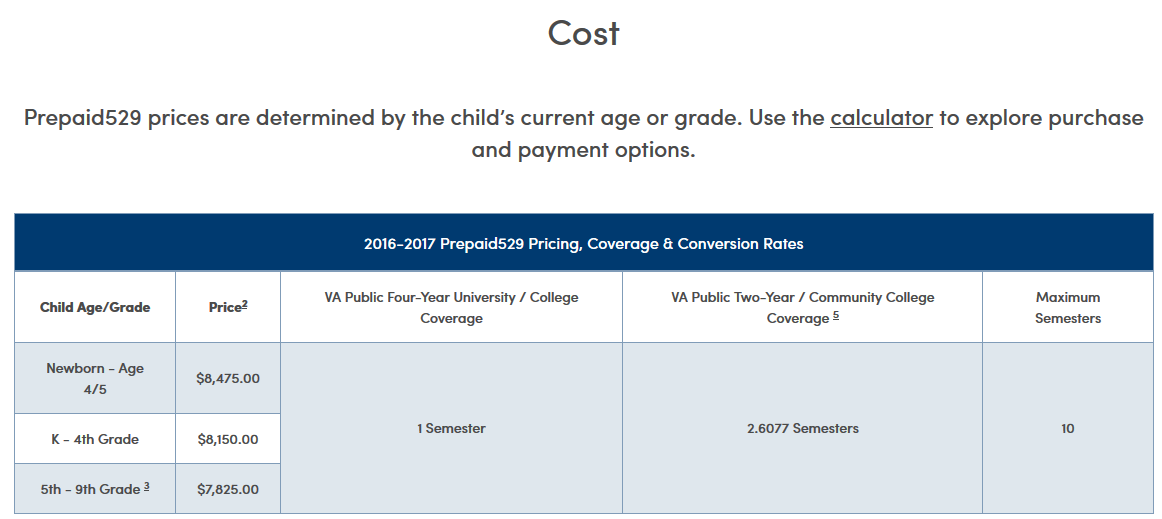

There are 2 types of Qualified Tuition Programs: Savings accounts and prepaid tuition plans. A 529 savings account allows you to contribute money, invest it and let it grow tax-free. A prepaid plan allows you to “pay tuition today” for credit to be used in the future. For example, Virginia offers a prepaid tuition program:

In Virginia, if you have a 4 year old you can pay $8,475 today in exchange for a semester at a 4 year public school in the future, regardless of inflation in college education costs. Most of the discussion below will pertain to 529 savings accounts.

Each state sponsors at least one 529 plan. You do not need to be a resident of the state’s 529 plan you choose to invest in (for example, a family that lives in Iowa could open an account in Nevada’s 529 program). However, if your state offers tax breaks for 529 contributions, like Iowa does, you may lose those tax breaks by using another state’s 529 plan.

Most states offer some kind of tax incentive for 529 savers, but tax deduction amounts and limits vary state by state. At time of writing, the following states offer no tax benefits for 529 contributions; California, Delaware, Kentucky, Hawaii, Massachusetts, New Hampshire, New Jersey and Tennessee.

In general, if your state offers a tax deduction for 529 contributions, you should likely strongly consider your home state’s 529 plan.

If your state does not offer any tax incentives for their 529 program, you want to look at each state’s plan and compare fees and investment options.

Once you have decided what 529 program to use, opening an account will require an account manager (the person who controls the account) and the beneficiary (which can be yourself, your spouse, siblings, your child, stepchildren, stepbrothers, niece, nephew or first cousin).

The beneficiary can be changed to another qualifying family member if needed. So if you have 2 children and the first does not go to college or use the entire 529 plan, it can be transferred to the other child. There may be tax consequences for changing beneficiaries that “skip a generation”, such as if the beneficiary transfer their account to their grandchild.

You can effectively begin saving for a child’s college education before he/she is born with a 529 account. You can list yourself as the beneficiary and change the beneficiary once your child is born.

There is no annual contribution limit to a 529 plan, or an income threshold required to be eligible for a 529 plan.

Again, because each state is different, it is impossible to provide specific advice on investments in a general guide. For clients, we will sit down and compare options available based on their needs. But in general, the same rules for asset allocation in your retirement portfolio apply to 529s.

It is frequently cited that stocks have the best long-term returns. Although true over the past 100+ years, when investing for college, you are likely working with a shorter time frame than your retirement account. Stocks are also volatile. Historically, investors can expect at least a few 5% corrections each year, a 10% correction once per year, and a 20% correction once every 3 and a half years. If your entire college savings account is allocated to stocks and that 20% correction occurs just when you need to make a large withdrawal, you will be hurting.

A common investment option in 529 accounts is a target date fund, whose investment allocation changes as the date you or your child goes to college comes closer. A decade out, your savings will be allocated more heavily towards stocks, but when you are just a year away from beginning withdrawals, your allocation will shift to more cash and bonds, which are much less volatile. For many, this is an easy, stress-free option.

Besides a target date fund, most investment options to choose from will be labeled “Growth/Aggressive”, “Moderate” or “Conservative”, and you are in charge of allocating appropriately.

For most who are looking to start setting money aside to pay for college expenses more than a few years in the future, a 529 plan is the best option.

But there are a few considerations:

529 accounts owned by a student that is a dependent or the student’s parents count as a parental assets for FAFSA purposes. 5.46% of parental assets count towards the EFC (Expected Family Contribution).

If the student is independent, that rises to 20%.

If the student’s grandparents, or parents if the student is independent, own the 529 account, none of the assets count towards the EFC, but 50% of distributions above $6,420 will.

If you save too much in your 529 account, or the beneficiary of the account does not go to college, you will be left with a balance in your 529 account and have a few choices.

Accounts can be transferred to another beneficiary (see above for gift tax and generation-skipping implications), or can be simply withdrawn and assessed income taxes and a 10% penalty.

Because of the penalty, if you are unsure if your child will attend college, it may be worthwhile to evaluate other options before loading up a 529. Investing outside a 529 and gifting appreciated shares to the student when needed can help cover expenses without producing taxes, since your student will likely have a 0% or 15% tax on long-term capital gains (as long as you can avoid the “kiddie tax”).

Another option is Coverdell Education Savings Accounts, which we discuss below:

Like 529s, Coverdell savings accounts allow for savings to grow and compound tax free, and distributions are tax free if used for qualified education expenses.

However unlike 529s, Coverdells can also cover additional qualified expenses such as tutoring, uniforms, transportation and certain after-school programs and activities.

These features may make Coverdells appealing for families looking for a way to start saving early for private or religious schools the child will attend before college.

Primary Benefits of Coverdell Accounts:

Unlike 529 accounts, Coverdells do have contribution limits and income limits in order to qualify.

A beneficiary can have unlimited number of Coverdell accounts, but is limited to $2,000 per year in total Coverdell contributions. So if a beneficiary’s parents, grandparents and Uncle each open a Coverdell account for the beneficiary, total contributions between all 3 accounts must be less than $2,000 each year. If the parents contribute $1,000 in their account, and the grandparents contribute another $1,000 in their account, the Uncle will not be able to contribute to his account any that year. Contributions can only be made if the beneficiary is under 18 years of age.

There is also an income limit for those who can contribute to Coverdells. For 2019, modified adjusted gross income (MAGI) for contributors must be less than $110,000 for single filers or $220,000 for joint filers. Although corporations and trusts can contribute to Coverdell accounts, regardless of their income, which may benefit high-income business owners.

Having a 529 account does not impact your eligibility to contribute to a Coverdell account, and vice versa. You can contribute $5,000 toward your child’s 529 account and $2,000 to your child’s Coverdell account.

Coverdell investments should be managed similarly to 529 accounts (discussed above). Keep in mind that if the savings are intended to be used for elementary or secondary schools, your time horizon will be much shorter, and investments should likely be more conservative.

Money in Coverdell accounts must be distributed by the time the beneficiary is 30 years old.

If distributions are made in excess of qualified education expenses, and don’t fall under a few notable exceptions, income tax and a 10% penalty will apply.

Like 529 accounts, beneficiaries can be changed to avoid tax and penalty. The same rules apply to changing beneficiaries on Coverdells as 529s. The new beneficiary can be a spouse, child, niece, nephew, sibling or first cousin.

In most states, minors cannot own stocks and bonds, and parents cannot simply transfer these assets to minor children. UGMA or UTMA accounts are a trust that allows minors to effectively own securities such as stocks and bonds, but also other assets like real estate and art.

However, unlike Coverdell and 529 plans, investment growth is not tax-free, and earnings from the account are subject to federal income and capital gains taxes.

These accounts are set up with a designated beneficiary, who is a minor, but also a custodian or trustee that will manage the account until the beneficiary reaches a certain age, where they will become the sole owners.

UGMA and UTMA accounts allow for the creation of a trust without an attorney needed to prepare trust documents, or court needed to appoint a trustee. These accounts are most often set up at banks and brokerages and controlled by a custodian until the minor reaches of age.

The gifts into the account are irrevocable, meaning that once transferred into the account they cannot be taken back. Also, the beneficiary of a UGMA / UTMA account cannot be changed.

UTMA and UGMA accounts allow for much more flexibility in investments compared to 529 accounts. Holdings can include individual stocks and bonds, ETFs and Mutual Funds along with alternative assets like real estate, art, patents, and more.

Any earnings on assets within the account are subject to the child’s tax rate, so “Kiddie Tax” rules will apply to incomes over a certain threshold.

At the time of trust termination (when the owner of the account changes to the child), the money becomes solely that of the child. The child has no obligation to use the money for education expenses.

Because the gifts into these accounts are irrevocable, once transferred you will have no say into how the assets are used, with the beneficiary becomes an adult. Unlike 529 or Coverdell accounts, there is no penalty for assets used for other than education expenses.

Also, because the assets are property of the child, account balances will weigh heavily on financial aid eligibility. A child with a large UGMA/UTMA account balance would be unlikely to be eligible for needs-based financial aid.

Also, investments in UGMA / UTMA accounts should be carefully managed to avoid high amounts of income and capitals gains for the child in order to avoid triggering Kiddie Tax rules, where income will be taxed at the parent’s tax rate.

The accounts listed above are the most common forms of ways to save for education expenses in the early years. But for some, U.S. Government Savings Bonds may also be a good option.

U.S. Government savings bonds come in 2 forms. EE series and I Series. The interest on both bond types can be tax free if used for qualified education expenses as long as you fall within the income limitations (For 2019, that is $92,550 for single filers or $146,300 or joint filers).

In addition to covering qualified education expenses, savings bonds can also be redeemed tax free if the proceeds are used to fund a 529 or Coverdell program.

If purchased very early, EE series savings bonds have a unique benefit that makes them exceptional ways to save for education expenses. After 20 years, EE series savings bonds are guaranteed to double. Despite the fact that EE series savings bonds pay very small interest today, after 20 years the bond’s value will be adjusted.

Taking into account doubling after 20 years and tax free when used for qualified education expenses, EE series savings bonds after an effective 3.98% interest rate. This is a nearly 4% risk free investment that you can not get anywhere else.

For those afraid to “lock in” money into a 529 or Coverdell account, savings bonds may provide a better option. Bonds can be cashed out without 10% penalty if needed for emergencies, and if bought early, can provide a return similar to conservative investment allocations within a 529 account.

This provides a great option for those hesitant to put a lot of money into a college savings plan very early on. Instead of loading up a 529 and risk paying a penalty if the money is not used for education expenses, you could instead buy savings bonds, have them on hand incase of emergencies, and then decades down the line cash them out and fund a 529.

If you are in a state that gives tax breaks for contributions, you can take the tax deduction too! making the after tax return on savings bonds when used as a savings vechile even higher!

Here is a chart for those looking for a quick take away.

Note: The chart above has a lot of fine print. For example; financial aid impact can vary based on account owner, whether the owner is a dependent or independent, etc. This chart may not apply to your financial condition.

For those looking for a hand with higher education planning, our comprehensive financial plans include college planning, funding analysis and management of accounts. Contact us today for a free, no obligation meeting.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network. Arnold & Mote Wealth Management is a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas.