Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Planning for the costs of long term care can be one of the most difficult tasks for retirees who are in need of long term care, or supporting a loved one who is in need of care.

We have a few suggestions for how you approach this topic:

A wide range of care is available, depending on your need.

There is in-home care, which is the least expensive, but it might not work for everyone.

There are other options like independent living, assisted living, and nursing care that are also available. Costs for these levels of care can be as high as $80,000 per year here in Iowa, and even more expensive elsewhere in the country.

Genworth Insurance has a calculator here that can help estimate the cost of certain levels of long term care where you are.

After knowing what to expect with the potential costs of long term care, now is the time to start planning how to pay those expenses.

Long term care insurance can play an important role here if you have it. It will be important to know the aspects of your policy like the elimination period, monthly benefit, and maximum lifetime payout of the policy for your planning.

The next step is to consider how your investments can help pay these expenses. If you have IRAs, Roth IRAs, and taxable brokerage accounts, these can be tremendously valuable assets to use to pay for your long term care expenses.

You may also want to develop a withdrawal strategy to make sure you are using those investments in the most tax efficient way possible to help ensure they last for as long as possible.

Consider your other assets such as your house, car, and other items. If you do not need them any longer, they may be able to pay for some of your increased expenses.

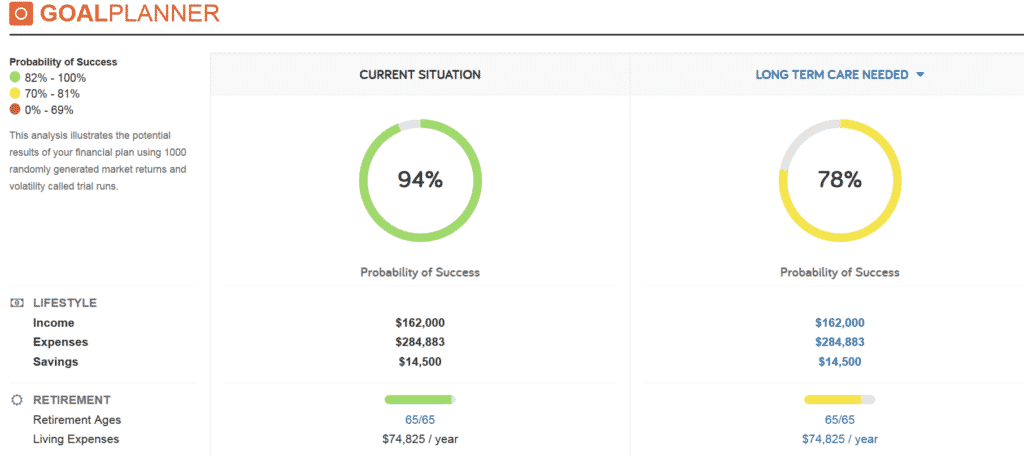

We can help with planning how to use your assets as efficiently as possible, and also estimating how prepared you are for a long term care scenario.

Lastly, make sure you find the right long term care community for you.

For those in Eastern Iowa, we have a collection of interviews and information from several of the long term care communities in the area.

Here are some samples, if you are interested in the complete PDF please contact us:

Redefine Retirement – An Interview with Meth-Wick

Retirement Reimagined – An Interview with Indian Creek

Retirement Your Way – An Interview with Cottage Grove

Bringing Fulfillment to Retirement – An Interview with The Keysteones