Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

This is part 2 of our college planning series. You can find part 1, which discussed early college planning here. Part 3, which will discuss what you can do after graduation, is here.

College planning is much more than just funding a 529 plan and saving money for 15 years. Although that will lead to great long term results, there is a significant amount of savings you can find by properly planning all through the college experience, including the time the student is already enrolled! This section of our college planning guide covers strategies available to help you save money in the late stages or “last minutes” of planning, roughly from the time the child is a sophomore in high school through college graduation.

Main topics discussed:

Bonus: We recently hosted a webinar on this topic! Specifically, our webinar detailed how to use your 529 savings in conjunction with the various tax deductions and credits available to those with higher education expenses. You can view a recording of the webinar here: How to Use a 529 and Available Tax Benefits to Maximize College Funding

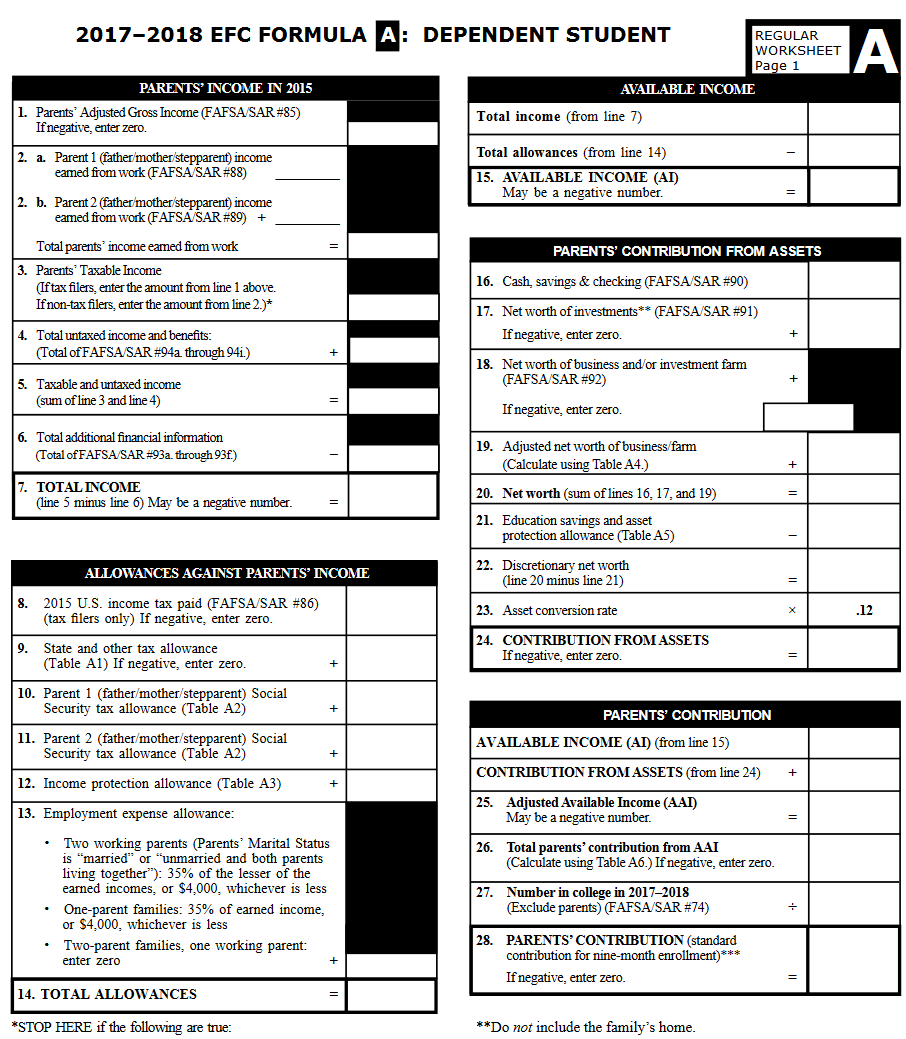

In order to qualify for any Federal financial aid programs, you must fill out a FAFSA form. The application process takes into account parental assets and income along with the student’s assets and income and then determines an “Expected Family Contribution” number (EFC). The amount of aid you will qualify for depends on your college costs compared to your EFC number. We will not cover much about how to fill out FAFSA, but we will look into how your EFC is calculated and what it means for parents and students as far as options to make their chances for financial aid higher.

Students and parents complete the FAFSA each year, so even if you do not qualify in year 1, remember to submit each year because you may qualify later!

New for the 2017-2018 school year, FAFSA considers your “Prior-Prior year” income, or income from 2 years ago. This is a change from how it had been, when FAFSA considered “prior-year” income. This makes the filing easier, since previously families had to estimate taxable income as FAFSA applications were due before income taxes had to be filed, and then applicants would have to amend their FAFSA for any changes. Now the process is much easier as far are retrieving old tax records and filling out in the form correctly the first time around. This also means the important years of household income relative to FAFSA eligibility are shifted.

Now under the new rules, household income in the student’s sophomore year of high school will be the first year where your income will affect financial aid eligibility. The simplest thing you can do to help yourself be eligible for federal financial aid is to do what you can (legitimately!) to keep your household income low from the student’s sophomore year in high school through sophomore year in college.

Avoid selling large amounts of stocks, see if you can delay bonuses, etc. These are not the years to sell the vacation home (if its going to produce a large profit), the family farm or business. Heck, use it as an excuse to take a vacation and work a little less if you want!

You can also increase 401k or IRA contributions, which are made pre-tax and therefore reduce your taxable income.

It also means that household income during the student’s last 2 years in college will have no effect for financial aid eligibility. So if you do have a chunk of stock or real estate, or anything to sell that would generate taxable income, do it during the last 2 years the student is in college!

The first factor that goes into the calculation that determines if you are eligible for financial aid is your EFC, or your Expected Family Contribution number. This is what the government thinks you should be able to afford to pay while you or your child is in college.

The calculation of your EFC is made up of parental assets and student assets if the student is still a dependent.

There is a long list of what makes you “independent” in the eyes of student aid. The most common reasons (but not all) include; the student is 24 years old or older, married, enrolled in master’s or PhD program, a veteran or has children.

Once you figure that out, its time to plug in some numbers. A lot of numbers:

And that is just page 1 of 4!

Thankfully this has become a little easier with the IRS’s online data retrieval tool, which can pull the relevant information from your previous tax returns.

But it is important to know what goes into the calculation, so you know the best way to allocate your assets. Should you keep the assets in a 529? In the child’s name? in the parents’ name?

First, the largest factor to your financial aid eligibility is your income. For a dependent student that means the parent’s income AND the student’s. For the independent student that means the student and their spouse.

The EFC calculation starts with your adjusted gross income and adds back all those deductions you took to lower your taxable income. 401(k) contributions get added back, IRA contributions, Health Savings Account contributions, child support, moving expenses, and just about everything else. (So, increasing your 401(k) contribution will save your money from being taxed by Uncle Sam and your state, but it will not help you have a “lower income” in the eyes of FAFSA.)

Then, subtract federal and state taxes that you paid, social security taxes, and your “Income Protection Allowance” which is based on the size of your household and the number in college.

This will give you an “Adjusted Income”. This will be added to a certain percentage of your assets (more on assets below) and converted into an amount that the government says you can afford to pay. There is no set percentage of your income, EFC is based on parents’ age, income, state of residence, family size and more. There is an example further below that may give you a rough idea on what your EFC number will be.

Next up, assets.

For the next step in the process you add up the parent’s assets and investments. What is considered an asset or investment for FAFSA?

Assets and Investments DO include:

Assets and Investments DO NOT include:

The key takeaways here? Parents are not penalized for having significant savings in retirement plans or big houses.

Then, the full value of these assets is given a weighting factor. This is important:

Meaning that parental assets have a lower impact on financial aid compared to student’s assets. So if you are asking the question on whether it is better to have assets in parental accounts or the student’s account – in most cases it is better to have assets in parental accounts.

(Actually the effect is bigger than just .12 to .20 because in the calculation for EFC parental assets get 2 additional adjustments and exemptions that reduce their effect even further. These adjustments will depend on your age, family size and income, so it is hard to give a specific number. But it will reduce parental asset and income impacts even further)

A couple of examples calculating EFC:

Example 1: Married couple with $200,000 in income in the state of Iowa, age 45, with 1 child and $120,000 in assets that count towards the EFC calculation (assume 529 plans, emergency fund, taxable brokerage account, etc). No assets or income for the child.

This family would have an EFC of about $73,000. (Again, this is a very rough estimate and not made to represent any family in particular)

This is saying that the government thinks this family can afford to pay $73,000 this year toward their child’s education. This family would likely have a difficult time qualifying for needs based federal financial aid.

Example 2: Single parent with $65,000 in income in the state of Iowa, age 43 with 2 children, 1 of which is in college and $40,000 in assets that count towards the EFC calculation. No income or assets for the child.

This family would have an EFC of about $9,235, making it much more likely to qualify for federal student aid for most univiersities today.

Example 3: Same stats as example 2, but the $40,000 in assets all belong to the child applying for the financial aid. How much of an impact will having assets in the child’s name have on their EFC?

With that “minor” change, this family’s EFC went from $9,235 to $15,730. A HUGE gain considering the only difference is who owns the assets. That change could result in $6,000 less in financial aid this family will qualify for.

Bottom line – Parent’s assets count much less, so if you will qualify for financial aid don’t gift your child $40,000 their sophomore year in high school to pay for college.

As a side note, for high income families, it may make MORE sense to gift assets to their children…. (no one ever said this was easy to understand!) more on that in the “Gifting Assets” section below.

There are numerous tax credits and deductions available, here’s a few of the most common:

The American Opportunity Credit is a tax credit up to $2,500 available to assist those who are paying for higher education. The credit is available for each person who you are paying qualified education expenses for. So if you are paying college tuition for 2 kids, you can claim 2 $2,500 credits.

In order to qualify to claim the credit you must be paying the qualified education expenses for yourself, your spouse or a dependent and your modified gross income must be under $90,000 if single or $180,000 if filing jointly. These numbers are for 2019 and may be adjusted higher in future years.

And you, or whoever you are paying for, must be a qualified student, which is defined as one who:

The amount of tax credit you receive is based on your qualified education expenses. 100% of your first $2,000 of expenses will go towards your credit. After that, 25% of each additional dollar spent will be given as a credit until you reach the max credit of $2,5000. So in order to qualify for the whole $2,500 credit you must have $4,000 in qualified expenses ($2,000 + (25% * $2,000).

The American Opportunity Tax Credit can only be used for those in undergrad, it will not help you with a masters, Ph.D. or second major if you go back to school later in life.

The American Opportunity Tax Credit is usually the best option available for those who qualify. But the IRS does not allow you to “double dip” this tax credit with any other tax advantaged option available. So if you are claiming the lifetime learning credit (below), deducting higher education expenses on your tax return (also discussed below), fully funding the education expenses with a 529 or Coverdell account, or have tax-free grants and scholarships, you will not be able to claim the American Opportunity Credit. So take the time to figure out which one is best for you before you file your taxes.

The lifetime learning credit is a tax credit up to $2,000 available for eligible students who paid qualified education expenses. Unlike the American Opportunity Tax Credit above, you may only claim 1 lifetime learning tax credit on your tax return. So even if you have 2 kids in graduate school, you will only get 1 $2,000 credit.

Also, you need to have much higher qualified expenses to get the full $2,000 in credit. The amount of tax credit you receive is based on 20% of the qualified expenses you paid during the tax year. So, if you had $8,000 in qualified expenses, you can claim a credit of $1,600 ($8,000 * 20%). You need expenses of $10,000 to qualify for the whole lifetime learning credit.

Like the American Opportunity Credit, in order to qualify to claim the credit you must be paying the qualified education expenses for yourself, your spouse or a dependent. However, the lifetime learning credit has a lower income limit. In order to claim the lifetime learning credit, your modified adjusted gross income must be under $65,000 if single or $131,000 if married.

The lifetime learning credit is also available beyond your first 4 years of postsecondary education. You can claim the credit an unlimited amount of times as long as you qualify, making this the preferred tax credit for many graduate students, their parents and professional students.

The IRS also allows a simple deduction for qualified education expenses you paid for yourself, your spouse or a dependent, up to $4,000.

Like the tax credits above, there is an income limit in order to qualify. For 2019, if your modified adjusted gross income (MAGI) is $65,000 or less (if you are single, less than $130,000 if married) you can claim a deduction up to $4,000.

If your MAGI is more than $65,000 but less than $80,000 (if you are single, more than $130,000 but less than $160,000 if you are married) then you can claim up to a $2,000 deduction.

If your MAGI is over $80,000 if single, or $160,000 if married, you are ineligible to claim a deduction on your taxes from tuition and other education expenses.

Keep in mind that this is just a tax deduction, not a tax credit like the American Opportunity Credit and Lifetime Learning Credit. If you qualify for any of the credits discussed above, they will likely be more beneficial than this deduction. However, if you do not qualify for any of the credits above, the tuition and fees deduction is certainly better than nothing.

Normally, it is a bad idea to take from your retirement savings to pay for a child’s college expenses. But there may be some scenarios where it makes sense, so let’s cover the rules quick.

Normally, any distribution from IRA accounts (that can mean ROTH IRA, traditional IRAs, SEP-IRAs or SIMPLE IRAs) before age 59.5 will result in you paying income tax on the amount withdrawn in addition to a 10% penalty.

However, early distributions used for qualified education expenses are not subject to a 10% penalty (you will have to pay income taxes on the amount withdrawn if using a traditional IRA though, sorry!)

Normally, 529 accounts are best for early stage planning because the investments within the 529 need to time to grow and compound.

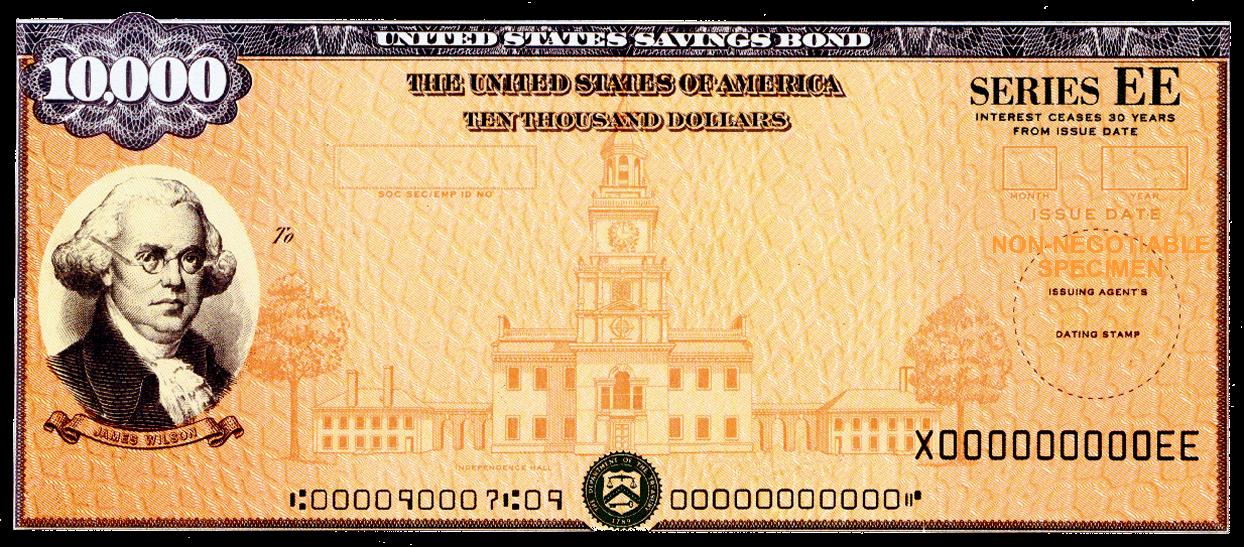

We covered the basics of 529 accounts in part 1, but there is one additional tax break that will help some of those who have used U.S. Government Savings Bonds to help save for college get an extra break in their state taxes in the late stages of college planning.

As discussed in part 1, the interest from U.S. government savings bonds is tax free if used for qualified education expenses.

But the section of U.S. tax code that covers savings bonds has a very different definition for qualified education expenses when it comes to savings bonds. Room and board, computers, software, books, supplies or other equipment is NOT qualified expenses for U.S. savings bonds.

But, contributions to 529 and Coverdell accounts IS considered a qualified expense for savings bonds. That means, you can cash out your savings bonds (tax free) and use the proceeds to fund a 529 and get a tax deduction (if you are in one of the 44 states that give tax deductions for 529 contributions).

This is a strategy for those who are afraid to lock up money into a 529 account early, for fear of paying a 10% penalty if not used for college expenses, but still looking for a tax advantaged way to save.

Although today’s interest rates on savings bonds are very low, this has the potential to be a powerful strategy when combined with EE series savings bonds purchased in early state college planning.

Recall from part 1 that EE series savings bonds are guaranteed to double every 20 years. That nice feature combined with a tax free gains if used for qualified education expenses means they have an effective interest rate near 4%. Couple that with a state tax deduction if you are eligible and EE series savings bonds offer a risk free rate that matches that of a conservatively managed asset allocation in a 529, without the risk of a 10% penalty.

If you have been setting money aside for college expenses in a traditional taxable investment account there may be some last minute moves you can do with those assets to save on taxes. In general this strategy below is best applied for those who have significant savings and income high enough to disqualify them from any financial aid, and with parent’s whose income is high enough to disqualify them from the American Opportunity Credit (that is, household income over $180,000).

If you are paying for your child’s college, your child is very likely in a lower tax bracket than you. And for those with income under $37,950 (which applies to most college students), the tax rates on long term capital gains is 0%!

Whereas parents are likely in a high tax bracket, and will pay 15% or higher in taxes for selling appreciated assets such as stocks or bonds. Instead of selling those assets yourself, they may be gifted to their children instead, sold by the child (who has a lower tax rate) and used for education expenses that way.

There are a few obstacles to navigate around with this strategy however. If your child is still claimed as a dependent, you will very likely run into issues with the “kiddie tax” (where if a child has a certain amount of unearned income, it is taxed at the parent’s rate instead of their own) if giving more than a couple thousand dollars’ worth of assets.

So, if you are looking at giving more than just a couple thousand dollars in assets, this strategy alone won’t save you much (though, a couple hundred dollars is not necessarily anything to balk at!).

But, if your child is supporting themselves, the child can claim the standard deduction for themselves, which is a deduction up to $6,300. Couple this with the personal exemption of $4,050, and American Opportunity Credit of $2,500 and you can achieve some significant tax savings even after running into the kiddie tax.

Taxes get complicated quick, so lets put this into an example to see the savings:

Parental modified adjusted gross income (filing jointly) is $200,000. (High enough so that the parents would not qualify for the American Opportunity Tax Credit and they can not deduct tuition on their tax returns and as we saw above, would likely not qualify for much need-based financial aid)

They want to cash out stocks to help pay for their child’s college. Selling that stock would trigger a long term capital gain of $25,000 for the parents. If the parents sell, they would have a tax bill of $3,750 (assuming long term cap gains tax of 15% – 15% * 25,000 = $3,750). If the parents sold this amount each year for 4 years, their total tax bill would be $15,000 (just from the stock, not including income).

If the parents instead gift the stock to a student that is supporting themselves and therefore not a dependent on the parent’s tax return (IRS’s definition of being able to support yourself is covering half your expenses) with a student job that pays $10,000, how will that change the total amount of taxes paid?

The child has capital gain income of $25,000 from the gift and sale. The child can take the standard deduction (which is a deduction of $4,050) and the personal exemption (which is a deduction of $6,350) resulting in taxable income of $14,600. Taxed at the parent’s tax rate of 15% means a tax bill of $2,190.

However, unlike the parents, the child is eligible to claim the American Opportunity Credit of up to $2,500, enough to remove any tax burden from the stock sale!

This in effect gives the parents an extra $15,000 that can be saved in retirement accounts, spent on a vacation, a new car for your soon to be college graduation or anywhere else.

This move is sometimes referred to as a “tax scholarship” for the parents. Which is fitting because many families with higher incomes wrongfully assume there is nothing they can do to help lower the cost of college expenses. However, this is very wrong. Just because there is not financial aid or traditional scholarships available, there are still moves you can do that will lower your taxes.

The tax savings is even higher for parents with high incomes, who fall under the 20% long term capital gains tax rate and 3.8% net investment surtax.

We touched on a lot of different topics that are applicable to households of very different incomes. The important point is to understand that it is never too late to have a financial plan for college. Even if your student is already enrolled. Whether your income is $40,000 or $200,000+, examples in this article alone show the potential to save thousands in taxes or expenses.

Maybe surprisingly for some, the largest savings in our examples is the family with an income over $200,000 that likely assumes there is nothing they can do to lower their costs!

Wondering how you can reduce your college expenses? Let us help! College planning is just one of the services we offer.

Contact us and let’s get started!

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.