Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

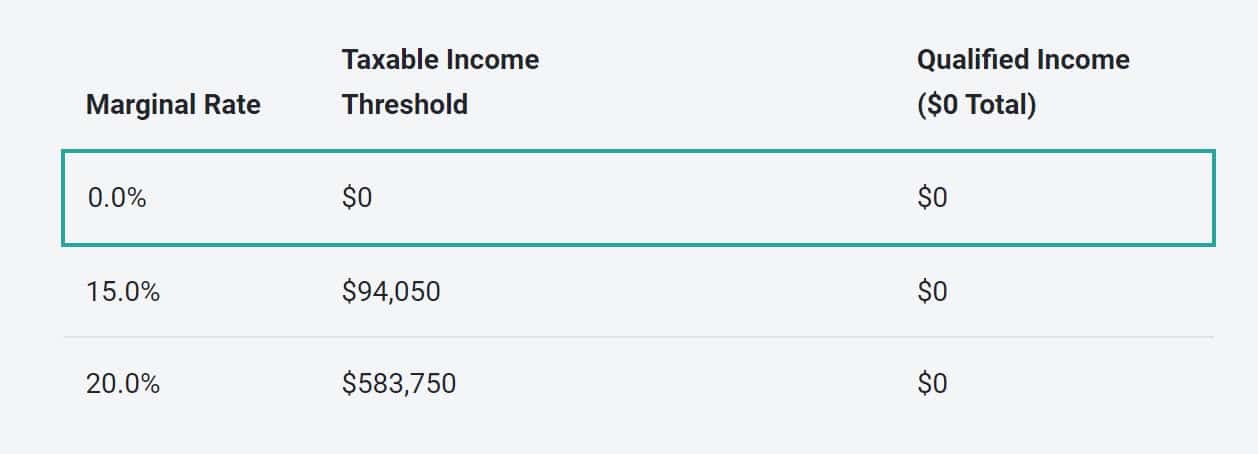

If you have appreciated investments in a brokerage account, whether it be mutual funds, ETFs, or a concentrated individual stock position, you should know about an opportunity that exists within our tax brackets today to potentially recognize long term capital gains on your investments at a 0% tax rate.

Purposely recognizing long term capital gains in the 0% tax bracket is commonly called tax gain harvesting, and it can be an incredibly valuable planning strategy to reduce your taxes in retirement.

In 2024, a married household with taxable income below about $94,000 has the opportunity to take advantage of this.

Though note that this exact amount will change each year with inflation.

Who can take advantage of this? Just about anyone who finds themselves in a low income year. Commonly, we see this with those early in their retirement, before RMDs have begun on their retirement accounts and before Social Security has begun.

But this opportunity comes up in many other situations as well. Perhaps younger workers who are experiencing a gap in employment could qualify, or families that want to gift appreciated stock to their lower earning family members should also consider this strategy as well.

While there are many households who fall within the income range for the 0% long term capital gains tax bracket. However, this does not mean this is something that should be done automatically if you are able.

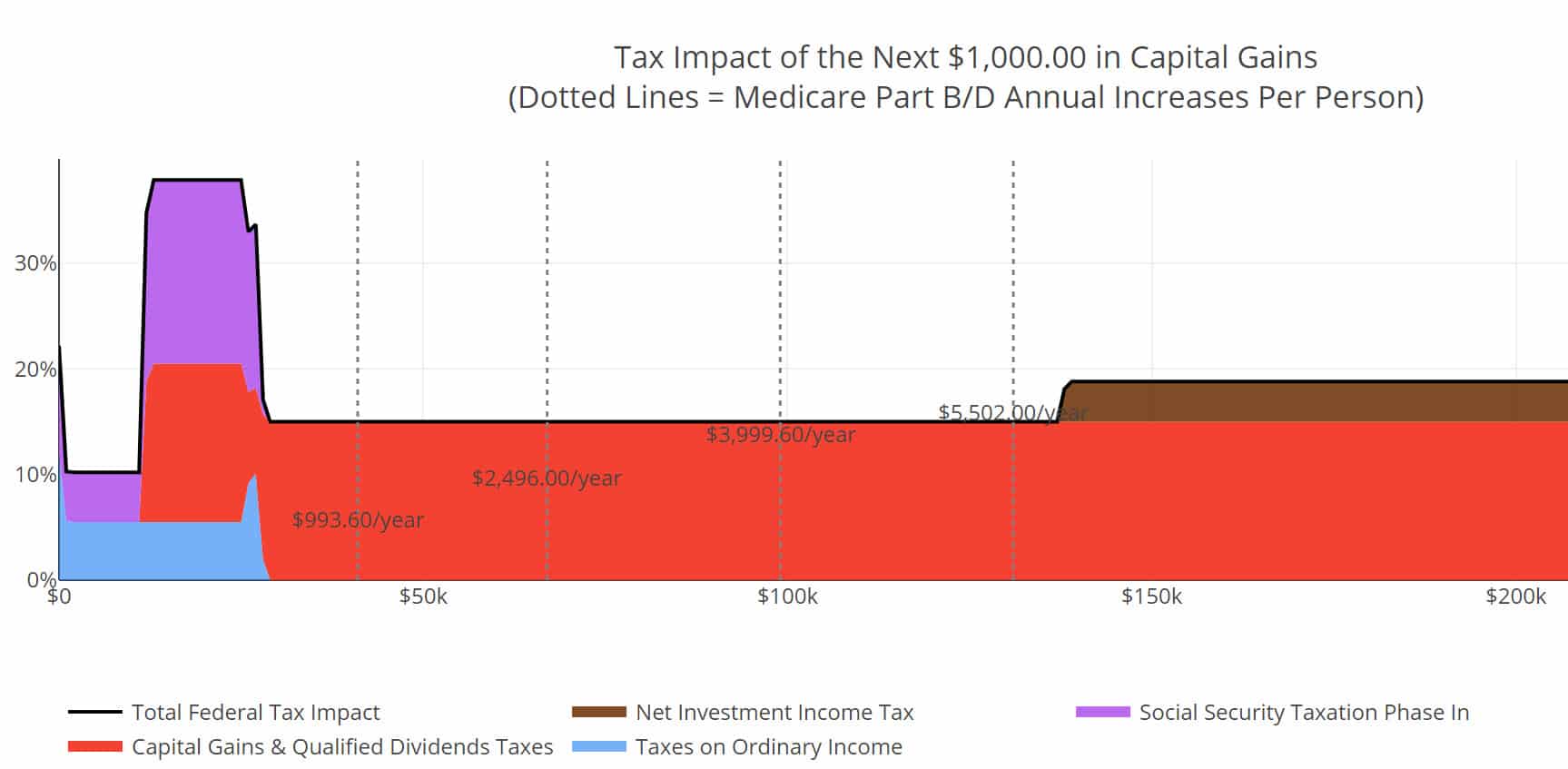

And that is because recognizing capital gains, even if you are within the 0% capital gains tax rate, causes taxes to be realized from other sources of income.

Where we find this causes the biggest unexpected tax impact is for those who have a large portion of their Social Security benefit untaxed. As you recognize capital gains, it may push more of your Social Security benefit to be taxable. This can push more income into higher tax brackets, and cause effective tax rates to skyrocket higher.

For example, for a single filer who has very little of their Social Security benefit taxed, recognizing capital gains can quickly create effective tax rates of nearly 40%! This retiree may think they are being smart recognizing capital gains at a 0% tax rate, but they are causing an even higher tax burden on their income that completely negates the benefit of 0% capital gains tax!

Below is a sample of a chart we create with clients as we develop tax plans and tax efficient withdrawal plans to visualize the tax impact of recognizing additional capital gains or income. This can help us identify any unexpected consequences of recognizing capital gains.

Finally, executing this strategy is very easy. You may be familiar with the idea of tax loss harvesting, which has more complicated rules like the wash sale rule, and may require reporting over multiple tax years of tax returns.

This isn’t the case with gain harvesting. You can simply sell these investments, recognize the gain, and immediately repurchase the same security. Analyzing this is just one part of our work in creating tax efficient withdrawal strategies for our clients.

If you are wondering about how to get money you’re your investments in the most tax efficient way, please reach out. We offer free 30-minute consultations to talk with us:

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.