Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

This is the third and final part of our 3 part series on saving for college. Part 1 discussed the early years of college planning (sophomore year in high school and earlier), part 2 discussed late stage college planning (sophomore year in high school through senior year in college) and now we discuss what you can do to save money in the late stages of college and after graduation.

With outstanding student loans well over $1.4 trillion and affecting more than 90 million Americans, student loans have quickly become American’s largest debt problem. Over 11% of student loan borrowers are in default, and many more struggle to make payments every month. Thankfully, congress and the IRS have written special rules and exemptions to help student loan borrowers repay their debts.

What options are available to you to help lower your payments, lower your taxes, refinance or get your debt forgiven?

– Student Loan Interest Deduction

– Modified Repayment Plans, such as income based repayment

– Student Loan Consolidation

– Student Loan Deferment or Forbearance

– Student Loan Refinancing

– Student Loan Forgiveness

One way to “save” on your student loan payments is to deduct the interest you paid on your student loans on your taxes each year. This doesn’t reduce your student loan payments, but it will help to increase your tax refund (or lower your taxes due) at the end of the year.

The IRS allows you to deduct up to $2,500 in student loan interest that you pay each year. Remember, this is not a tax credit, but a tax deduction. Effectively, you pay no income tax on the money you spent paying the interest on your student loans, up to $2,500 each year.

If you are in the 24% tax bracket this deduction can be worth up to $600 each year for you, so it is worth understanding and taking advantage of.

It is also important to note that this deduction is only for the INTEREST you paid on your student loans, not the total payment. You can determine the amount of interest charged on your 1098-E tax form that will be mailed to you, or your loan statement.

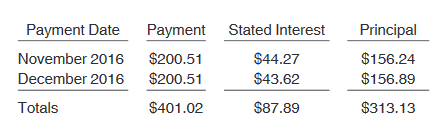

You will see your payments broken down like this:

For this graduate, they are only able to deduct $87.89 even though they paid $401.02 in payments for the year.

You can also factor in the cost of the loan origination fee and any capitalized interest (interest that accrues while the student is still in school and before payments begin).

You can also deduct interest on your credit card if it was used to pay for qualified education expenses.

In order to be eligible, in 2019 you must have a Modified Adjusted Gross Income (MAGI) of $80,000 if single, or $160,000 if married. However, benefits begin to phase out with incomes over $65,000 if single or $130,00 if married.

These numbers will likely increase over time with inflation.

In general, private student loans are much less forgiving than federal loans. Whereas many federal loans have income based repayment plans available, private loans have less. Because every private loan can be different, it is nearly impossible to provide assistance here for everyone. For starters, look in your student loan contract for any wording on repayment plans.

If your student loans are Federal Loans, there are many options available to you to modify your monthly payment.

This is going to be stated several times in this post, but it is that important. If you refinance your federal loan with a private lender, all/most of these options will go away. So think long and hard before doing so.

The U.S. Government offers several repayment plan options:

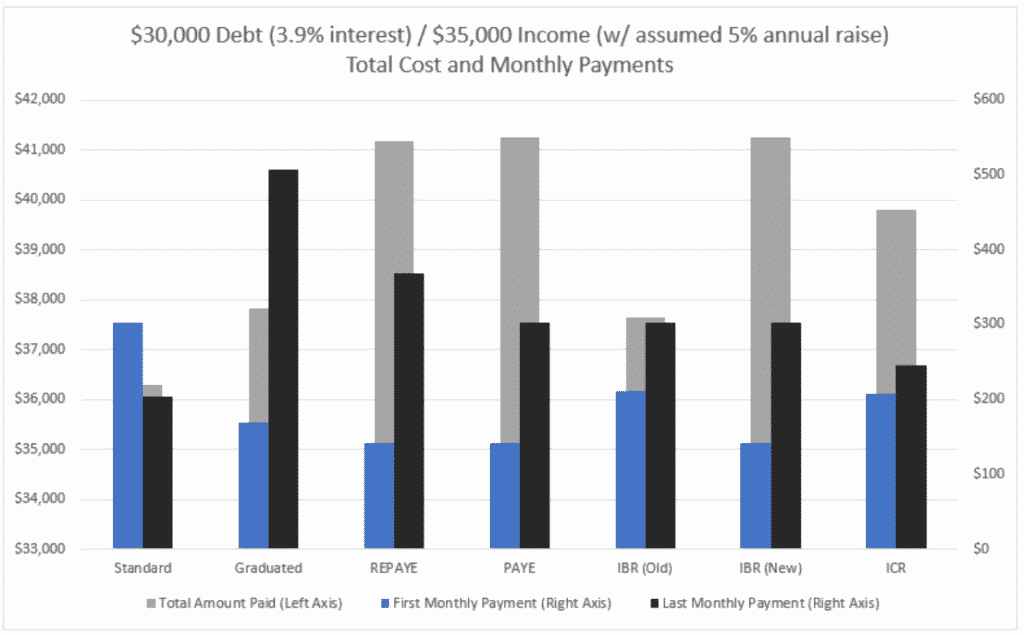

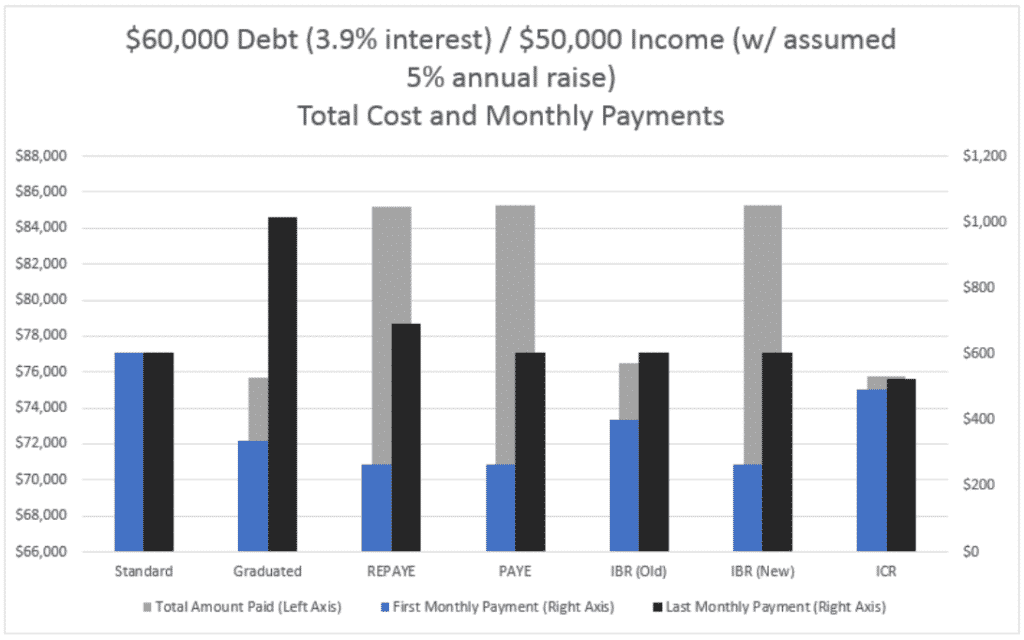

This is the standard repayment plan for most federal loans. Repayment periods are between 10 and 30 years depending on the amount of student debt you have. Under this program, your monthly payment will remain fixed throughout the life of the loan.

This repayment plan can result in the cheapest total cost for your loan, since payments are higher and you pay your loan of quicker, so you are charged less interest.

If the payment is affordable, this option is best for many in the long run because of the reduced interest paid. Remember, while on this payment plan you still qualify for student loan interest deduction and loan forgiveness options.

What will repayment options look like with the Standard Repayment Plan?

For a single graduate with $20,000 in a Federal Direct Consolidated Student Loan with an interest rate of 6.8% and an income of $40,000 you could expect your monthly payment to be around $153 per month, with a 20 year repayment plan, for a total cost of $36,640. (This does not assume any loan forgiveness)

With the Gradual Repayment Plan, student loan payments start small and increase every 2 years. All borrowers with Federal loans are eligible to choose the graduated repayment plan.

On the plus side, payments start out low, which is convenient for your first couple years in the workforce where you are not making a lot of money. But, because your first payments are smaller, your loan generates more interest. For example:

For a single graduate with $20,000 in a Federal Direct Consolidated Student Loan with an interest rate of 6.8% and an income of $40,000 you could expect your monthly payments to start around $113 per month initially, but slowly increasing to $233 a month towards the end of your loan, for a total cost of $40,020 over the life of the loan.

The lower initial payment is nice, but the loan comes with a total cost $3,400 higher.

You can apply for a Revised Pay as You Earn Repayment Plan to have your loan payments capped at 10% of your household discretional income, which is the difference between your income and 150% of the poverty line for your household size. For a family of 3 in 2017, that is $20,420.

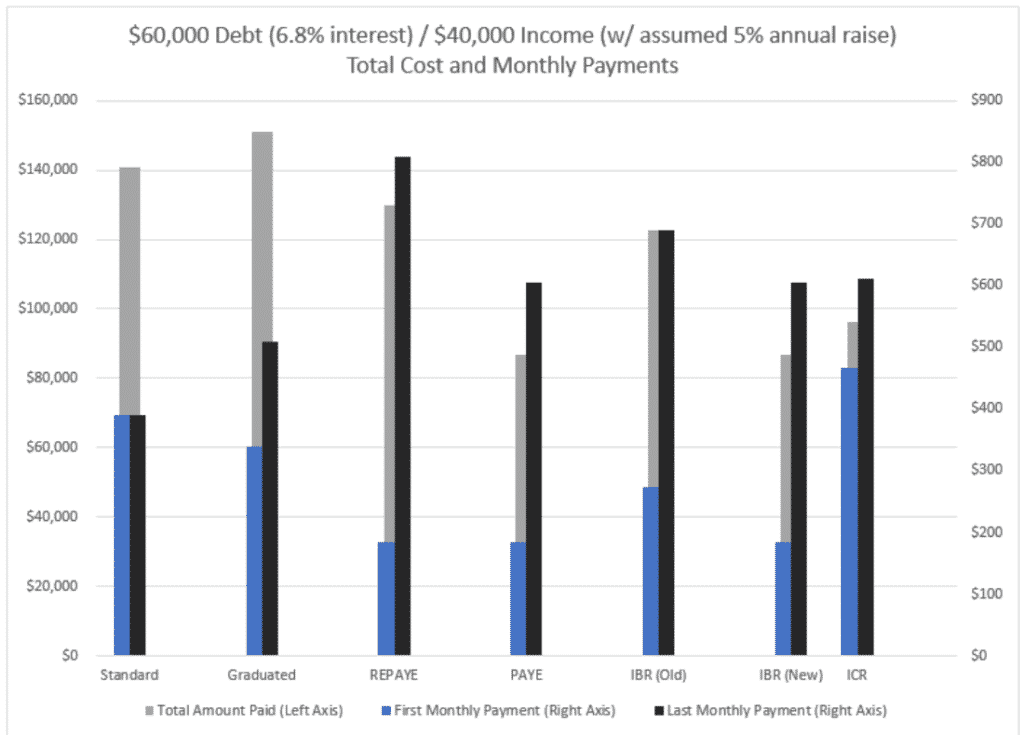

For our example of a single graduate with $20,000 in a Federal Direct Consolidated Student Loan with an interest rate of 6.8% and an income of $40,000 you could expect your monthly payments to start at $183. Payments will adjust annually as your income changes. Assuming income rises at 5% annually, this student would have monthly payments at the end of their loan of $331 per month, and the loan would be paid off in 114 months at a total cost of $28,115.

This option is cheaper in our example because the loan is paid off sooner than in the standard repayment plan above. However that is not always the case. For student loans with 10 year payback terms, the REPAYE plan may result in a higher total cost. Individual results will be dependent on your debt level and income.

Another significant feature of this repayment plan is that balances are forgiven after 20 or 25 years (20 years for undergraduate study, 25 years if loans were for graduate study) of payment. But this may have serious tax implications as well. See below in the Student Loan Forgiveness section. For students with higher debt levels this payment plan may be a very attractive benefit.

If our example graduate above has $60,000 in student debt instead, with the same $40,000 in income, their monthly payments will still start at $183 a month and rise as their income rises. But the loan will not get paid off in 25 years. After the 300th payment, the remaining balance of the loan will get forgiven, saving the borrower $11,700. The total cost of this student loan would be $130,020 for this borrower, which is $10,000 less than if the borrower remained on the standard repayment plan.

The PAYE repayment plan is very similar as the REPAYE plan, but is specific for newer student loans.

All terms of the repayment plan are the same (monthly payments of 10% of your discretionary income). The only difference is that forgiveness is given at 20 years for every loan on the PAYE repayment schedule.

For our higher debt graduate example used above ($60,000 in debt, $40,000 income), monthly payments will be the exact same as those of the REPAYE plan, but the loan balance is forgiven after 20 years. For this borrower, $54,700 in debt would be forgiven and the total cost of the loan would be $86,596. That is $55,000 less than if that graduate would have used the standard repayment plan. Knowing your student loan repayment options can make a HUGE difference!

The IBR repayment plan is very similar to the REPAYE and PAYE plans above. The only difference is for those who borrowed before July 1st 2014.

For those who borrowed before July 1st 2014, your monthly payment is capped at 15% of your discretionary income and the debt balance is forgiven after 25 years.

For our example graduate with $60,000 in debt and $40,000 in income, monthly payments under the plan would start at $274 per month and increase as income rises. The loan would be paid off in 20 years, for a total cost of $122,655.

With an income-contingent repayment plan, the monthly payment on your student loans is capped at the lessor of:

– 20% of your discretionary income

– Or, the monthly payments of a fixed-rate plan with a 12 year repayment schedule.

This plan still offers some protection to borrowers from a low income, but will result in a higher minimum payment.

For our example graduate with $60,000 in debt and $40,000 in income, monthly payments under the plan would start at $466 per month and eventually rise to $611 where they would be capped. Under this plan, this graduate would repay their loans in 174 months for a total cost of $96,258.

All examples assume graduate is single with no children or dependents.

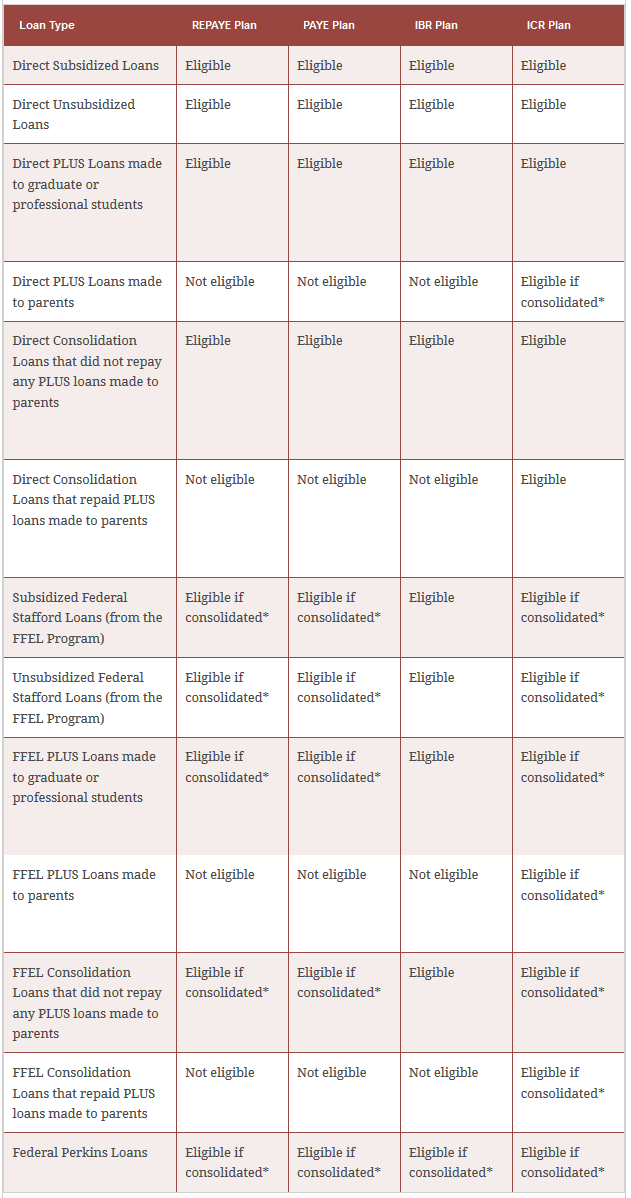

Not every Federal Loan is eligible for these repayment plans. Each of the repayment plans listed above are available only to qualified borrowers depending on which type of Federal Loan they have:

Consolidating your student loans is a way to lump multiple smaller loans into one large loan. Consolidation can make your repayment process simpler, leaving you with just a single monthly student loan bill. Consolidation can also be beneficial for those looking for lower total monthly payments, as consolidated loans can be given a longer repayment schedule.

Consolidation of federal loans can also get rid of some poor qualities of student loans. If you have a variable rate on some of your loans, you may be able to consolidate into a fixed rate loan to eliminate the chance of rising monthly payments. You may also be able to consolidate different loans into one large loan that offers income based repayment plans or even forgiveness options (as seen in the image above).

But consolidation is not a cure-all. A longer repayment schedule will result in a larger total cost for a loan since you pay more interest. Consolidation may also remove certain benefits from your student loans, such as income-based repayment options, forgiveness options and more.

Before consolidating, be sure you understand both the positive benefits your current loans have, along with what you stand to gain or lose in the process.

The decision to consolidate your students loans will be dependent on your specific loan terms, income, personal finances and more. Some big picture items to consider:

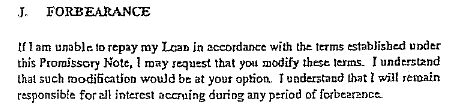

In certain circumstances, you may be unable to make your loan payments. You could lose your job, have a financial emergency, or decide to go back to school.

For private loans, look in the terms and conditions of your paperwork to see if there are any options for pausing or reducing your payment.

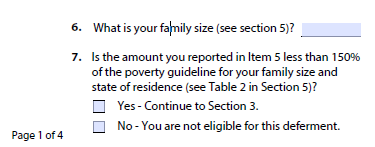

For Federal loans, you are eligible for a deferment if (the list below is not exhaustive, but represents the most common reasons):

– You are enrolled at least half-time at a qualifying college or school.

– While you are unemployed (up to 3 years)

– You are experiencing “economic hardship” where your household income has dropped below 150% of the poverty line for the size of your household.

– You are in the military

You will generally have the option of paying interest only payments on your loans while in deferment, or allow the interest to be capitalized to the loan (effectively raising the principal due on the loan).

If your loans are in deferment you have the option to pay the interest on the loan. If your loans are in forbearance, you are required to pay the interest on your loans.

You are eligible for a forbearance of your student loans if:

– You are serving in a medical or dental internship or residency program

– Your monthly payment on your student loans is greater than 20% of your total monthly gross income.

– You are in the National Guard, AmeriCorps, or a teacher.

Loan forbearances are granted for no more than 12 months, but can be extended.

As interest rates as fallen, student loan refinancing has become a huge business. Many of the warnings given in the Loan Consolidation section apply to refinances as well.

You can not refinance your federal student loan into another federal loan.

You can not refinance a private student loan into a federal loan.

You may refinance a federal loan into a private loan, but you will lose any benefits such as all of the repayment and forgiveness options discussed above.

You can refinance your private loan into a private loan, but the terms on your loan may change.

If done at the right time, refinance your student loan may be able to give you a lower interest rate, a more optimal repayment plan, or better terms depending on your original and new lender. However it is important to weight the benefits your current loan has as well. It may not be worth refinancing just to get a lower interest rate.

Under the PSLF, those who work in full-time “public service jobs” may be eligible to have the remaining balance of their student loans forgiven if they make 120 qualifying payments to their loan while employed at a public service organization.

Not every student loan qualifies. Only the following loans are eligible:

· Direct Subsidized Loans

· Direct Unsubsidized Loans

· DirectPLUS loans

· Direct Consolidation Loans

However, borrows may be able to consolidate several other loan types (such as Stafford Loans) into a Direct Consolidated Loan and then be eligible.

And the loans must be under one of the following repayment plans:

– REPAYE

– PAYE

– IBR

– ICR

– 10 Year standard Repayment Plan

– Any other Direct Loan program if monthly payments made were equal or greater than the payments required if you were on the 10 year standard repayment plan.

In order to qualify for loan forgiveness under this program, you must:

– Be in good standing on your loans (not in default)

– By employed by a public service organization while making all 120 qualified payments, at the time you apply for the loan forgiveness and at the time you receive your loan forgiveness.

And you must be employed full-time (30+ hours per week) in one of the following organizations:

– A government organization (can be federal, state, or local)

– A non-profit, tax-exempt organization

– A private, non-profit organization that is not union or political in nature that provides any of the following public services; emergency management, military service, public safety, law enforcement, early childhood education, public health, public service for the disabled, public education or public library services.

Loan forgiveness sounds great, but there may be a consequence for getting the slate wiped clean. If your forgiveness does not meet specific criteria, the amount of debt that is forgiven will be considered income and you will face a massive tax bill.

Imagine finding out that you have to pay the income taxes as if you made $50,000 during the year when you had no idea it was coming. It has happened!

If you qualify for loan forgiveness, it is likely the best long term option, but you need to be prepared if you are going to have a massive tax bill.

Loans forgiven under the Public Service Loan Forgiveness Program are NOT taxable, along with forgiveness programs for federal student loans for teachers, law school repayment assistance program and the National Health Service Corps Loan Repayment Program.

If you do not qualify for forgiveness due to public service, your student loan balance may still be forgiven after 20 or 25 years if you are on an income-based repayment plan. This forgiveness is very likely taxable.

If your student loans are on an income-based repayment plan and will be forgiven, start planning now for a large tax bill. The specific amount you are taxed will depend on many factors, but expect to pay 15-20% of the forgiven balance to be safe. Start saving now, as it is not unusual for large student loan debt.

Any forgiveness of private student loans, though very rare, will likely be a taxable event.

You have a lot of options when it comes to repaying your student loans. To determine which option is best for you, you need to determine what monthly payment you can afford, what repayment plans you qualify for and the benefits of your current loans compared to options through consolidation or refinancing. The right decision could save you tens of thousands of dollars.

Still confused about your options? Our comprehensive financial planning will help you determine your best course. Let us help you today.