Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

The addition of the new Mutual Fund Window in the TSP is the biggest change in the thrift savings plan programs history.

In June of 2022 The Thrift Savings Plan, which is the retirement plan available for all military and federal workers, is being updated with many big changes.

There will be a lot of cosmetic changes, a new website design, a new mobile app, and improved online process for completing paperwork for rollovers and withdrawals.

But perhaps the change with the biggest impact on your retirement is the addition to what they are calling the mutual fund window. What is this new mutual fund window and should you use it?

This new feature adds thousands of more investment options onto the TSP platform. Now you will have many more options than just the G, F, C, S, and I funds you have been used to in the past.

And while it may seem that adding more investment options would be a good thing, there are a few things you’ll want to understand before making the change.

First, there are several added new fees if you elect to use these new investments.

There will be a $150 per year administrative fee that you will have to pay just to use the new Mutual Fund Window. If you are just getting started saving and investing in your Thrift Savings Plan, this may represent a significant fee based on your account balance.

In addition to that new administrative fee, there is a $28 fee for each trade in the mutual fund window. That means that if you plan on investing a 3 different mutual funds each month, you would be paying over $1,000 in trade fees each year, plus the $150 administrative fee!

Then, in addition to those fees there is potential for much higher fees by way of the expense ratios on each of the new investment options. Depending on your account balance and the new funds you choose, this may result in thousands of dollars in extra fees per year.

How much can added expense ratios impact your retirement plan?

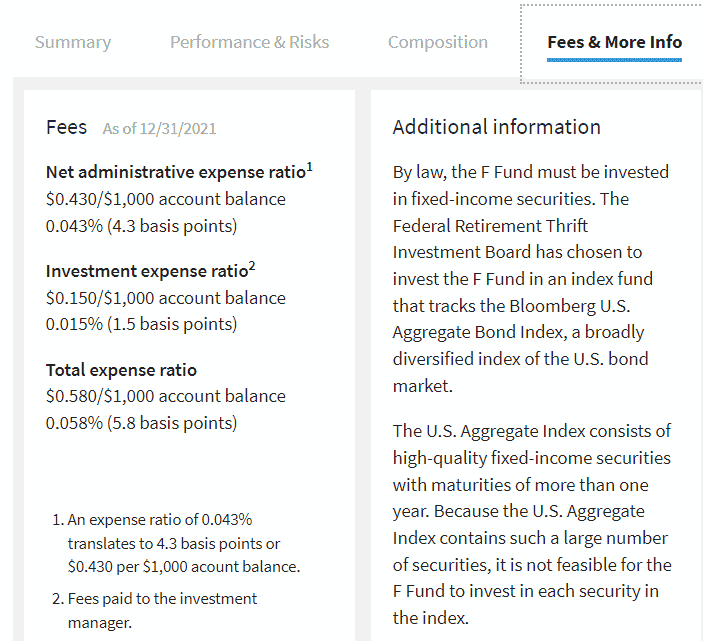

Consider a TSP investor who wants to explore alternatives to the TSP’s bond fund (The F Fund). This fund currently has an expense ratio of 0.058%. That means if you have $250,000 invested in the F fund, you will pay $145 in fees.

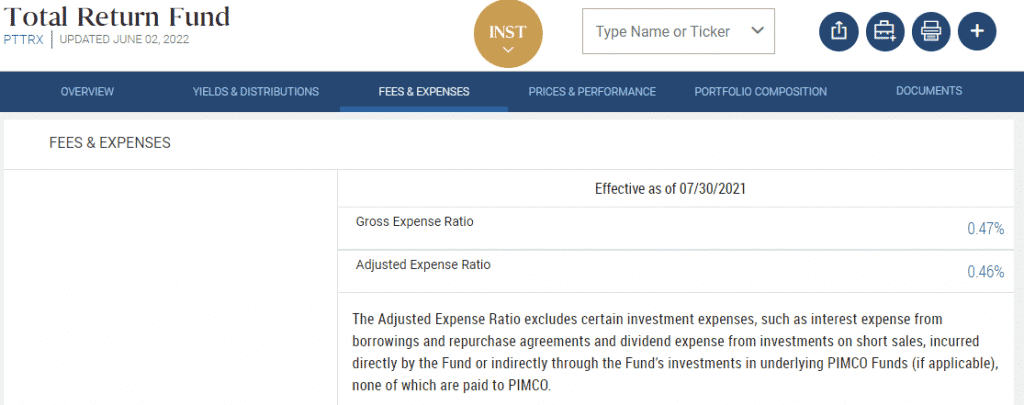

Consider now instead you choose to use the TSP’s new mutual fund window and invest in a different bond fund – A total bond fund like PIMCO’s Total Return Bond Fund that has an expense of 0.46%. That increased fee will cost you $1,150 in fees, plus the $150 annual administrative fee, plus the $28 trade fee.

Before you jump into any new investments outside of the traditional TSP funds, make sure that any perceived benefits are worth the added price. For most, they won’t be.

Because ultimately, what made the TSP such a great plan is that it offered very low cost investment options really some of the lowest fees anywhere in the industry, and made it simple to create a diversified portfolio.

While the options may have seemed limited, it also kept a lot of investors out of trouble by avoiding higher risk, and higher fee options that exist for others using IRAs or other 401(k) plans.

Now, TSP users will need to be extra careful that the investments they choose are truly the best option for them and they aren’t being taken advantage of.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.