Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

One thing we love about being an independent, fee-only, fiduciary financial advisor is spending time focusing on the “other” elements of a client’s financial plan. Yes, your retirement investments are important, deciding when to take social security is a pivotal decision, and knowing when to do Roth conversions can have a huge impact on your net worth.

But, there are many other big decisions around money that you make, especially if you are a homeowner.

One question that was coming up more and more was:

“Is it a good investment to put solar panels on my house?”

This year, we have run the numbers for a couple of clients and found the potential returns to be very favorable for those with cash available and adequate retirement savings already.

So good, in fact, that it convinced one of our advisors to reach out and get a quote and ultimately install panels on his home. Here are the numbers and projected return of his solar install:

When we started our research for solar, it was hard to find specific numbers and real-life examples available, especially for Iowans. So below, I want to run through the exact numbers for the installation of our solar system, the projected “return”, and why we decided to use money from a taxable brokerage account to pay for the solar system.

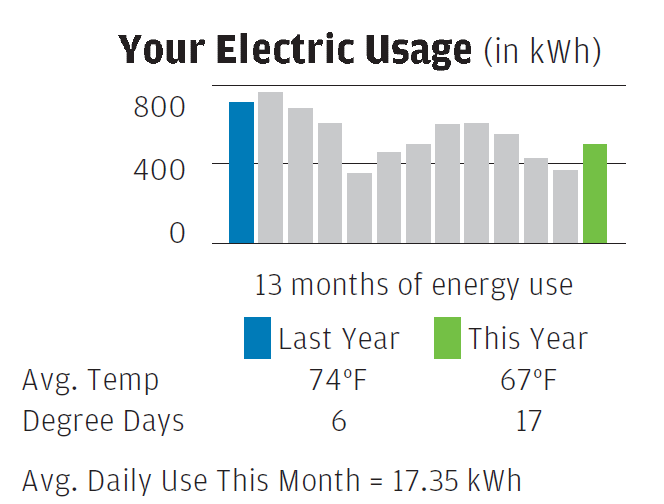

The first step when determining whether solar is a smart investment is to know how much you spend on electricity each year. Add up your last 12 electric bills – How much do you spend?

Our numbers: Over the last 12 months, we used 6,444 kWh of electricity, which averages out to 537 kWh per month. This currently costs us $109 per month, of which $13 is fixed costs we will always pay. So our actual electricity costs $96 per month on average, or –

$1,152 per year.

This $1,152 is what we would have an opportunity to reduce, or eliminate each year with the installation of a residential solar system.

With this information, the solar installers will give you a quote for a residential solar system.

Your specific optimal build will depend on who provides your electricity. We are with Alliant Energy, which installs “rollback” meters, which simply means any electricity we generate from our new solar system will directly offset, or rollback, our electric meter. If we have surplus credits at the end of the year (meaning, we generated more than we used), we get a payout, but it is very small – much lower than the price we pay for the electricity.

At the time we had our system installed, we paid about 18.8 cents per kWh, so offsetting that with solar could have huge paybacks, but excess production pays just a fraction of the 18.8 cents to us.

In our case, it was not worth it to install a system designed to significantly overproduce any more than we use.

Long story short, we decided on a 4.32 kW system. The system is projected to produce enough electricity to make up for ~95% of our usage. It should produce a little over 100% early on, but as the panels degrade slowly (we were told to expect 0.5% decrease in efficiency of the panels each year), by the end of their lives they will produce enough electricity to offset 95% of our electric bill.

For the calculations below, I’m going to assume only 95% of our electric use is offset every year. Hopefully this is very conservative as the panels should produce more early on.

So, remember from before that we pay $1,152 each year in electricity. If we can offset 95% of that, that means we would save $1,095 per year with a solar system.

The cost of the system we chose to “save” us $1,095 per year came out to $15,768. But, there is a huge caveat to that – Tax Credits!

Although “investing” $15,768 in order to give us an annual return of $1,095 is not exactly a terrible return, it gets much better once you consider the impact of the state and federal tax credits available for residential solar installation.

For 2019, Iowans are eligible for two separate rebates on the cost of their solar installation.

First, the federal solar credits. Currently, you get a tax credit equal to 30% of the total cost of your solar installation. Buy $15,768 of solar panels for your house, get $4,730 back next time you file your federal taxes.

Next, state solar credits. Iowan’s get a tax credit equal to half of the federal tax credit, with a maximum credit of $5,000 (This will drop in the future as more people claim the credit).

For our $15,768 solar installation:

– $4,730 federal tax credit

– $2,365 state tax credit

= $7,095 total tax credit

After all the tax credits, our $15,768 solar system will end up costing us ~$8,673.

To pay for our system, we found out through our installer that EnerBank was offering 0% 24 month loan for the amount of our tax credit. So, we took out a 0% loan for the amount of the tax credits, that will be due in June of 2021. (If we don’t pay the loan off by June 2021, the interest rate is 18%! So if you go this route, be sure on planning to pay the loan off completely before the interest free period closes!)

This will allow us to not have to cough up the $7,095 right off the bat. And actually, will give us time to invest the tax credits for about a year and a half before needing to pay off the loan! We plan on investing the credits in very safe, tax efficient investments like treasury bills, which should produce about $200 in interest over the course of the year.

In summary, our out of pocket expenses for this solar system will be about $8,673.

That $8,673 spent today should save us $1,095 per year, and hopefully more, going forward.

More than likely, we should save more than that since the cost of electricity will rise in the future.

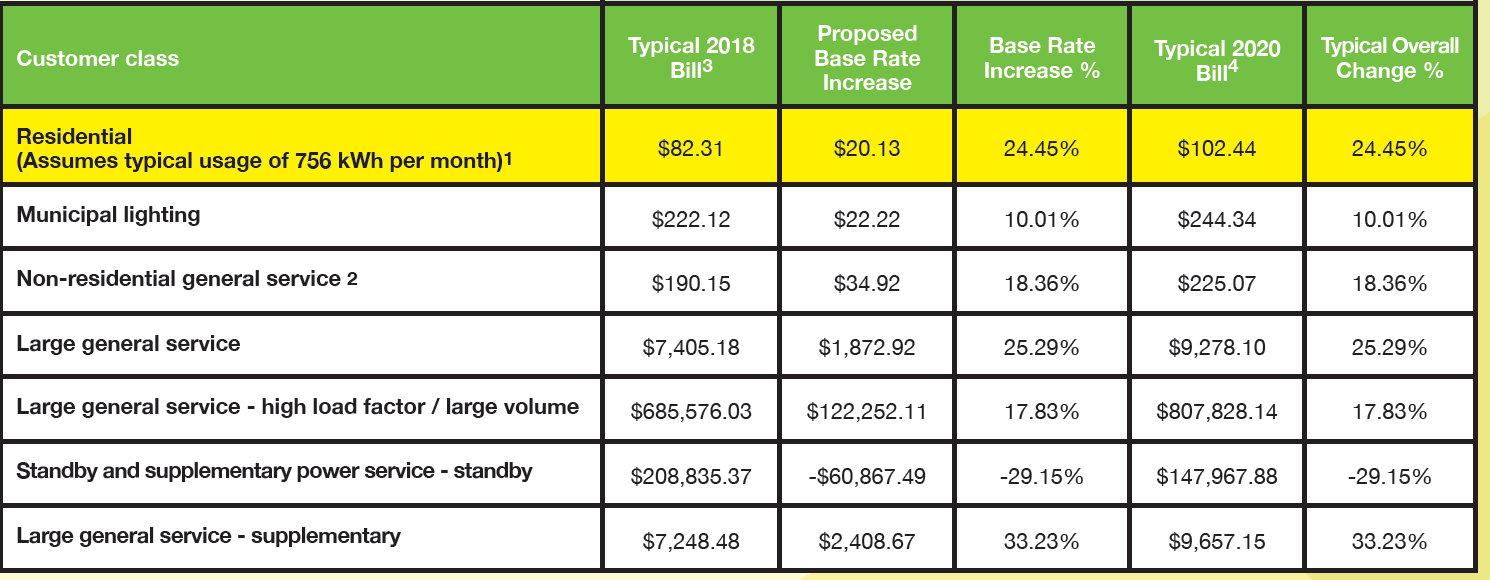

Maybe now is a good time to mention that Alliant just proposed a whopping 24.45% rate increase!

The panels are projected to last for up to 40 years, but full warranty is only 25 years.

So lets say the panels last just 25 years. In total, if electricity costs don’t rise at all – This $8,673 system should save us at least $27,375 over its life.

That is a pretty darn good return. There are no investments that we recommend to clients that could produce $1,095 in annual income for 25 years from a one-time $8,673 investment today.

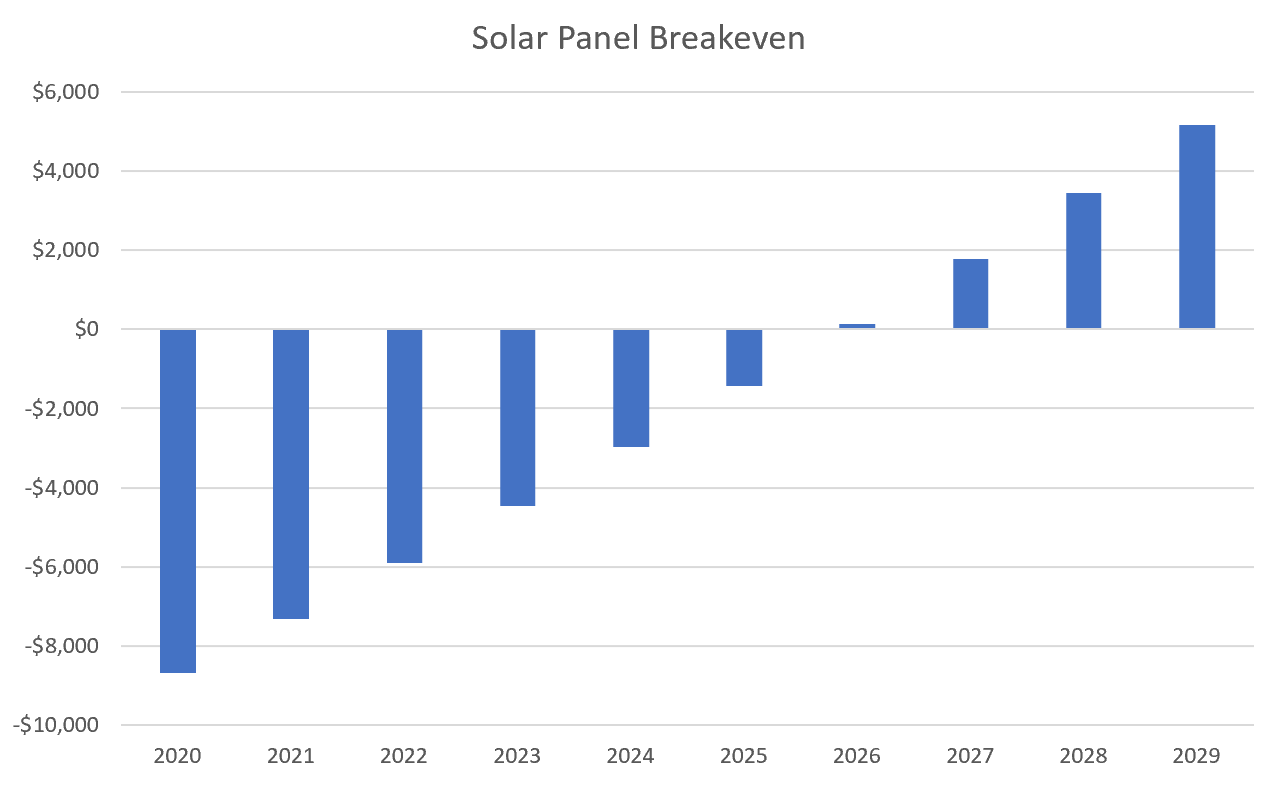

We calculated our solar system to have an Internal Rate of Return (IRR) equal to about 12% if our electric costs don’t increase over time.

If electricity rates rise 3% per year, its higher – about 15%!

If rates rise 24.45% by 2020 as proposed and then 3% per year thereafter, our IRR goes up to 18%, with about a 6 year breakeven:

1. The Money Put to Solar Becomes Very Illiquid

In essence, we are putting a $8,673 investment into our house that will become very tough to access should we need cash for an emergency in the future. We would need to take out a home equity line of credit (HELOC) in order to get access to that money again.

Writing a check for $9,000 is no small decision. Make sure you are not exhausting your emergency fund and will still have plenty of cash available if needed.

Think of any money put towards solar as a very long term investment.

On the plus side, there is some good evidence that the installation of solar can increase the value of your home: Here’s one study that shows solar raises the value of your home.

So, even if you decide to sell your home before the solar panels completely pay off, you may still come out ahead.

2. Insurance Costs Could Go Up.

For us, the added solar panels will raise our annual home insurance by $129 per year. This may not be the case for everyone, but for us this was a small additional cost.

3. Solar Laws Could Change

A bill circulated the Iowa house and senate last year that would have led to a $300 annual charge for those with solar panels on their homes.

The bill did not become law, and those with solar already installed would have been grandfathered in, but that doesn’t mean it can’t happen in the future. If a new law would be created that would cost us $300 per year to have solar panels, it would significantly impact our projected return on the solar panels.

4. Financing Solar Panels Will Reduce Their Return

We decided to pay for the panels upfront in full. However, financing options are available. We were given an option to finance the panels with a 7 year loan with a 3% interest rate, or a 20 year loan at a 5% interest rate.

The 7 year loan was temping, but we ultimately decided to forgo financing options and just pay up front.

Although the panels may still provide a decent return with financing, it will reduce your effective return by a few percent. But, this may still be a good option for those who don’t want to, or simply can’t fork over thousands of dollars right away.

5. Should You Pay Up for Quality?

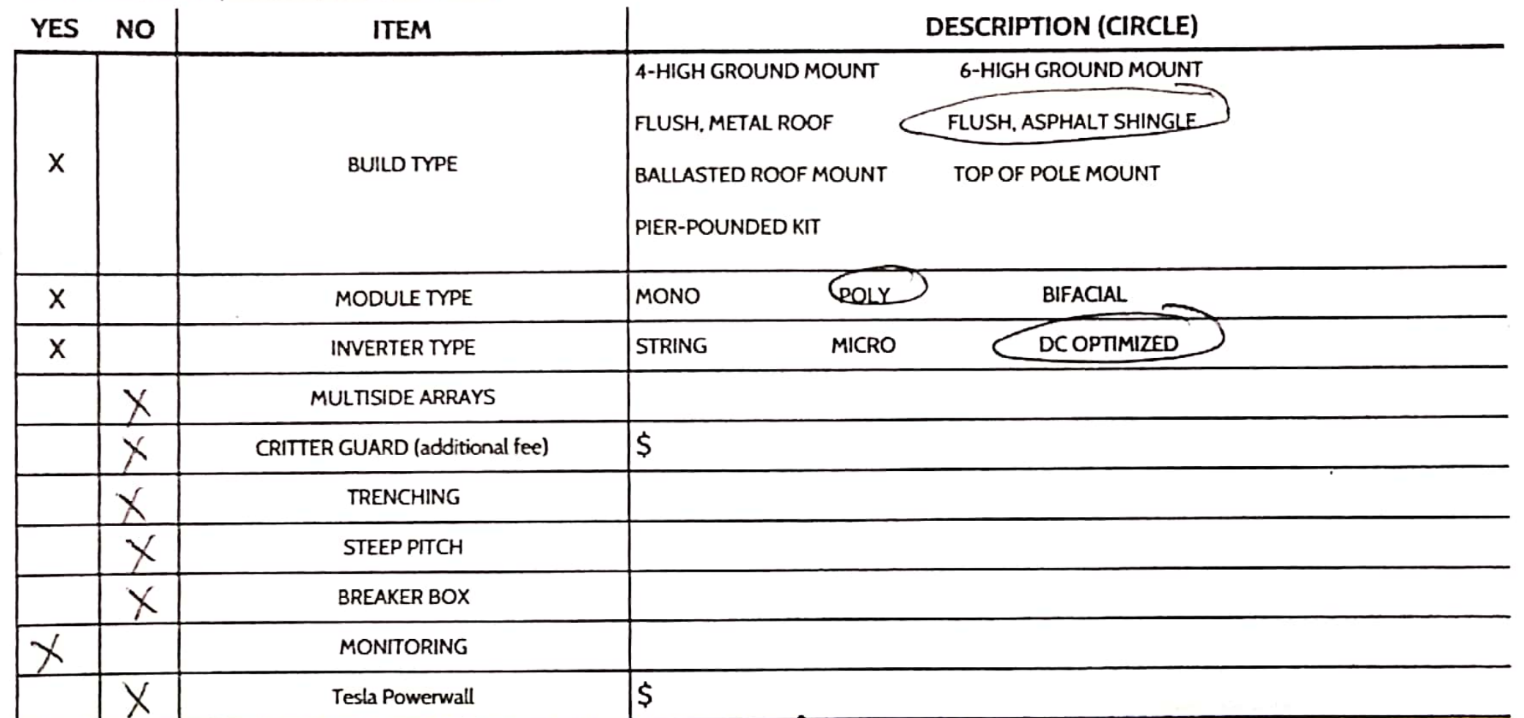

The solar system and installers we decided to go with were not the cheapest options available. There are a lot of different options with what type of panels to use, and who you want to install them.

We “paid up” to have a local, more reputable company install the panels rather than a much smaller installer who was going to use lower quality panels. We could have reduced our costs by as much as 30% going with the cheapest options available. Ultimately the returns were high enough for us regardless, and we felt more comfortable going with who we did.

There are many options on type of panels, inverters, type of install, and add-ons that could impact your final cost – And return. Here’s our final order sheet:

Clients always ask us questions such as; “Should I pay extra towards my mortgage, or save?”, or, “Should I pay extra towards my student loans, or save?”

Ultimately, this was a similar question. What is the projected return of solar panels, compared to what we could expect to get in the stock market?

Even on the low end of our projections, a 12% annual return, I believe solar panels will have a higher return than our taxable investment portfolio.

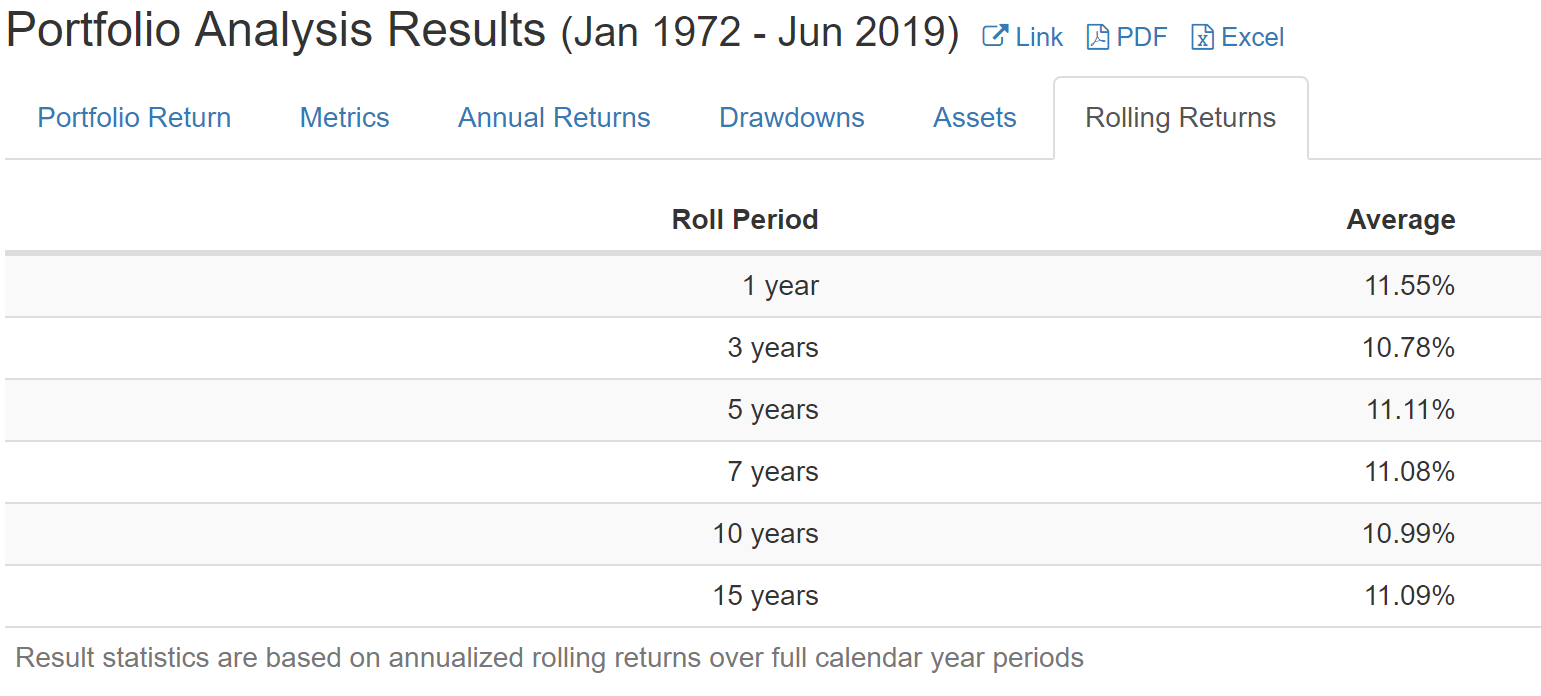

Since 1972, the average annual U.S. stock market return over 15 year rolling periods is just about 11%:

Since we had this money in a taxable account, there would have been some tax drag also, meaning our after tax returns would be a bit lower.

Also, I liked the idea of diversifying our investments. Between 401ks, IRAs, Roth IRAs, our taxable brokerage account, and income the Arnold and Mote business being largely dependent with the stock market – Almost all of my family and I’s net worth is strongly correlated the stock market. I viewed this as an investment with long term returns similar to the stock market, but completely uncorrelated to the stock market. As long as the sun keeps shining, we should have decent returns.

However it is important to note that this money was coming from a taxable brokerage account, not a 401k, IRA, or Roth IRA. We would not advise taking money out of tax-advantaged retirement accounts to pay for solar. 11% long term compounding returns in a tax advantaged retirement savings account such as a 401k, IRA, or Roth IRA is probably going to be better than our returns on solar panels over the long term.

So far, with the numbers presented to us and a few clients, we have found solar panels to be a very attractive “investment” for those with the financial means to buy them.

However, like many financial decisions, it is not easy to produce an answer in a blog post that will be the correct answer for everyone.

If you have no emergency fund, or paying for solar would deplete your emergency fund – Solar is probably not a good idea.

If you are behind on retirement savings, and not taking advantage of your 401k, IRA, or Roth IRA – Solar is probably not a good idea.

If you are going to sell your house very soon – Solar is probably not a good idea.

All that said, there are a lot of families that would benefit. Is solar a smart investment for you? Let us help you decide:

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.