Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

You spent your whole life planning for retirement by saving in your 401(k) and IRAs. Now that you are retired, there is a different type of planning to do – How to use your investments in the most tax-efficient way.

In this webinar that we did for clients in 2020, we look at the benefits of financial planning around large purchases such as cars or retirement homes.

Did you see? We were interviewed in the Wall Street Journal on this topic! See all of our media appearances and mentions on our press page, here.

There can be significant tax benefits for coming up with an optimal plan for selling assets in retirement. Depending on how you withdraw from your retirement accounts, your tax burden may be very different.

Below you can watch a recording of our webinar, and a transcript is also available below:

I thought maybe the best place to start would be a relatively simple example. For our example, we are looking at a recently retired married couple in Iowa, with a decent Social Security income, and living expenses of $80,000.

On top of those normal living expenses, they want to purchase a new car, which will be an increase of $35,000 in expenses for the year.

And this couple’s largest form of savings is in their IRA. And because it is this couple’s largest retirement account, they use the IRA to fund all of their spending needs that are in excess of their Social Security received.

So, what happens to this couple? Well, they withdraw an extra $35,000 out of their IRA. This creates more taxable income for them. That income bumps them up into a higher tax bracket for the year.

And you can see here their 2020 tax bill based on these assumptions.

In total, because these IRA withdrawals are taxed like normal income, they would pay just over $15,000 in total taxes

Then, the following year, they would pay much less in taxes because they have less in withdrawals without the car purchase.

And in total over these 2 years, they are paying about $18,712 in taxes.

Now we will get into a little bit more of the details in how these numbers are calculated later, and why just a $35,000 purchase can have such a large increase in total tax bill. But for now, just remember this $18,700 number

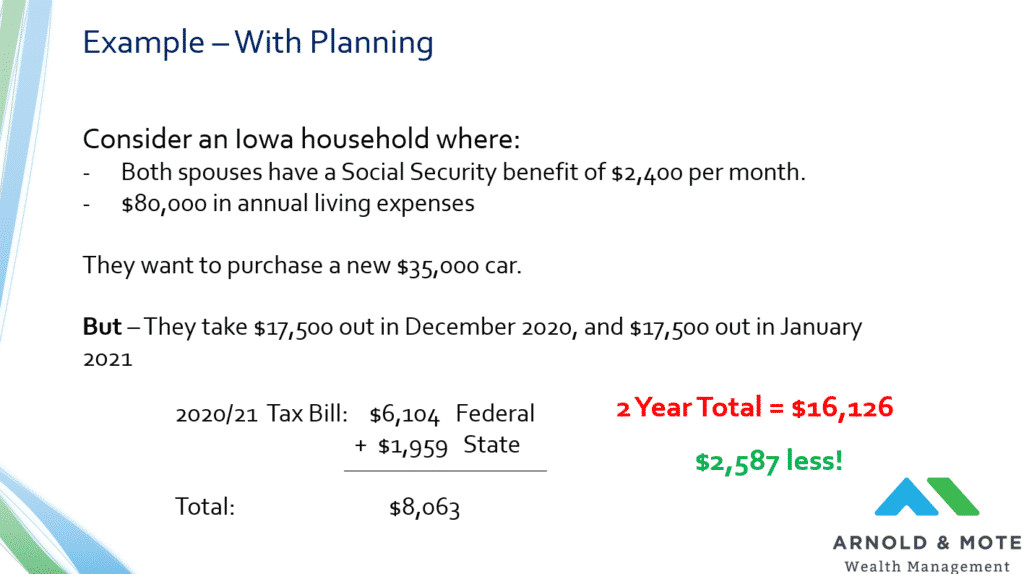

Now, let’s look at if this same couple did things just a little differently.

Instead of pulling all $35,000 out in one year, this couple pulls half of that $35,000 out in 2020 and the remaining half in 2021.

All that matters here is the tax year that the withdrawal takes place. It can be December 31st 2020, and January 1st, 2021. What matters is that the $35,000 in income from the IRA withdrawal gets spread over 2 tax years.

And just this one move, relatively simple right? Ends up lowering their 2020 tax bill.

And of course they have this slightly elevated tax bill in 2021 also because there is an increase in withdrawals that year as well. But, in total their total tax bill over the next 2 years is just over $16,000. That is a $2,500 reduction in taxes just from spreading this expense out over 2 years.

Not a bad return from just a little bit of planning!

And so, I wanted to start with this example just to give you an idea on why planning around big expected expenses like a car can be so beneficial.

Now $35,000 cars might not be your thing, but I don’t think it is unusual for a newly retired couple to have some periodic jumps in spending, especially early in retirement. It might be a home renovation, it might be a year with a lot of travel, like we will all be due for after the coronavirus passes.

Or, it might be due to a year with increased medical costs. It might be the purchase of a new home or a second home, which as you can maybe imagine after the numbers from just a car purchase, a home purchase can really create some big tax bills. We have an example later with this presentation with this same couple purchasing a vacation home.

And so that was an example I was hoping would catch your attention on just how one time expenses, even somewhat modest expenses, can impact you.

So why do these big increases in taxes happen?

Need help creating a tax-efficient withdrawal plan? Schedule a free, no obligation meeting to talk with us and see how we can help you!

The code laws have several cliffs, or areas where if you hit certain levels of income, you tax rate can increase rapidly.

The first example, a big reason why this example household’s tax bill went up quick is how our tax brackets operate.

A lot of times people describe the way our ordinary income tax brackets work is by thinking of each bracket as a bucket. As you earn income throughout the year, whether you are earning a salary at a job, or withdrawing from your IRA, these buckets begin to fill up.

For 2020, The first $19,750 in taxable income is taxed at 10%. This is the same whether you are Warren Buffett or an 18 year old flipping burgers.

As you earn more, that 10% bucket fills up, and after you earn $19,750, the next bucket begins to fill. Right now that next bucket is the 12% tax bucket. In this bracket you can earn an additional $60,500 and have it taxed at just 12%

And it goes on, the taxes increase as your income increases. As you earn more you will be subject to 22% tax, 24% tax, and so on. There are more brackets than I am showing here, but just to keep it simple I stopped at the 32% bracket.

Now one thing to notice is that some of these tax buckets have tax rates that are very close. Moving from the 10% bucket to the 12% bucket results in just a 2% increase in your tax rate. That’s not bad.

But there are certain tax brackets that have relatively steep jumps. This is one of the cliffs I referenced earlier. After the 12% bucket, the next step is to start filling up the 22% bucket. That is 10% higher than the previous bucket – almost doubling your tax rate.

And what was happening with our example client was that their normal expenses and social security lead them to be entirely in the 10% and 12% buckets. But when they took out the $35,000 for the car, that $35,000 was almost entirely in the 22% bucket. That $35,000 taxed at 22% almost created the same amount of taxes as $80,000 in Social Security and living expenses that filled up the 2 previous brackets.

We then showed that the couple spreading the car expense over 2 years dramatically reduced their tax bill. That was because much less of those withdrawals ended up spilling over into the 22% bracket. So, the couple saved that 10% difference between the 12% bucket and the 22% bucket for most of their withdrawal.

The tax buckets were a big source of the increase in taxes for our example household, but it doesn’t quite explain everything.

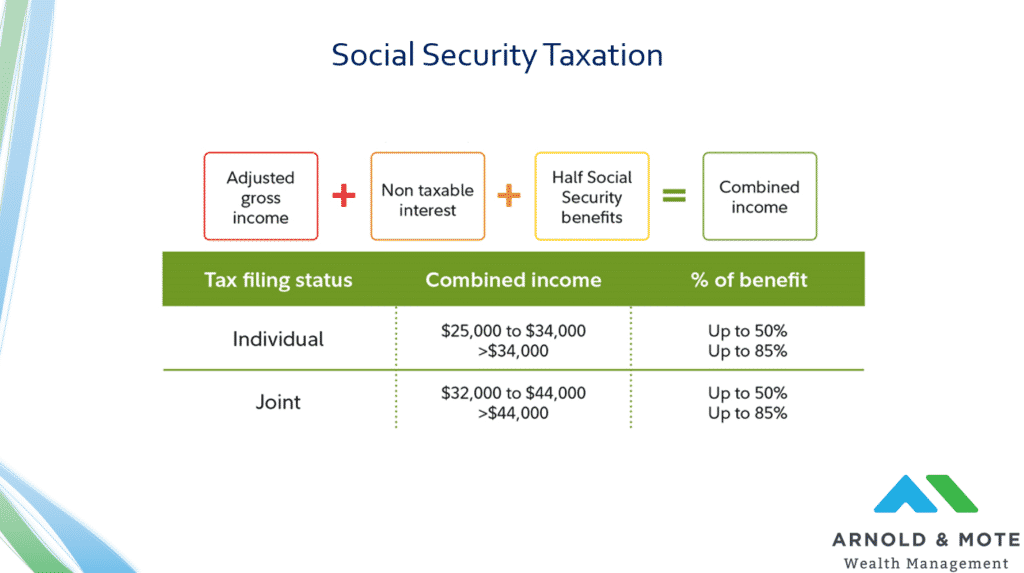

The other cause for our example couple’s sharp increase in taxes was because of how Social Security is taxed. And Social Security has its own “cliffs”, or levels of income that cause sudden increase in your taxes.

At low levels of income, Social Security is not taxed. And you earn more income from other sources, and IRA withdrawals count as income here, more and more of your Social Security gets taxed.

At a maximum, 85% of your benefit becomes taxable. These levels change every year based on inflation, but in 2020 if you have combined income of over $44,000 – 85% of your benefit is taxable if you are filing your taxes as a married couple.

But in years with low income, the percent of your social security that is taxed can be low. For our example client, if all they did was collect their $2,400 per month each in Social Security, they would have no taxes due at all.

But, the IRA withdrawals bumped them over these cliffs, and after the living expenses and the $35,000 car withdrawal, which was treated as $35,000 in ordinary income because it came from the IRA, all of a sudden they not only paid taxes on that $35,000, but that income also caused a portion of their social security to be taxed as well.

This caused a bit of a feedback loop for our example couple. Since more of their Social Security was taxed, it fed more money into those buckets that we looked at earlier, which filled up those lower tax brackets faster, and led to more money from IRA withdrawals being taxed at 22% rather than the lower 10% and 12% rates.

There are more of these cliffs that I won’t go into detail on. But just to give you an idea on other items that trip up retirees with large one-time expenses.

If you are over age 65, large one-time increases in income will raise your medicare costs. This is called IRMAA, Income Related Monthly Adjustment Amount. This is a very sharp breakpoint, where even $1 more in income will cause you to pay tens or hundreds of dollars more per month for your Part B and Part D plans.

The exact amounts your Medicare premiums will increases depends on your earnings, and the year. The most recent numbers are available on Medicare’s website.

State tax brackets, for those in states that have income tax of course, have these same buckets like the Federal tax code. For Iowa for example, the top tax bracket rate is 8.53%. So it doesn’t do as much damage as the federal tax rate, but it certainly adds to your tax bill.

Long term capital gains, this is taxes from your investments outside of your tax deferred account, usually a taxable brokerage account. Under a certain amount of income, these are subject to 0% tax rate. Once you get over $80,000 in taxable income, they are taxed at a 15% tax rate. Again, a big jump once you cross over a certain amount of income. By the way, these same tax rates apply to qualified dividends as well.

And then there are a lot of different tax credits or deductions that you qualify for based on your income. Just as one example, we talked in our CARES Act webinar about the stimulus checks that were sent out based on income. If you had a high income from a large traditional IRA withdrawal the year prior, you may be disqualified from receiving the tax credit.

Here’s What Tax Efficient Withdrawal Planning Looks Like

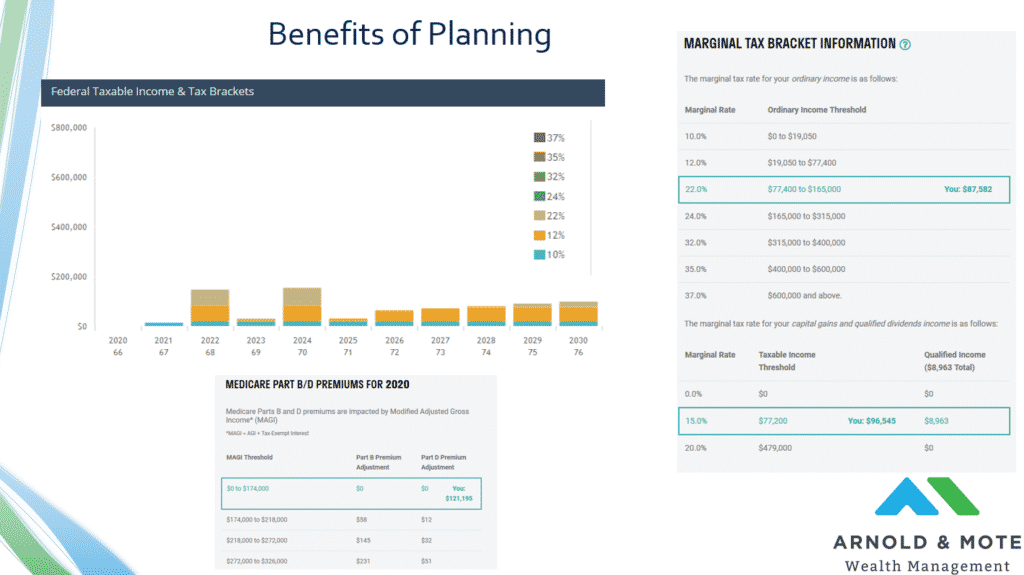

And so, all of this has been a long way to say that we see tremendous benefits in being able to plan around these big one-time or periodic expenses.

Maybe you have seen in our plan that we are accounting for car replacements every 5 or 7 years in your plan. Having that on the radar helps us identify high and low tax years and some opportunities for you.

Technology has made this much easier too, just from the technology released over the last couple of years we are able to do much better tax planning.

For clients, we like to do this heavy lifting for you. But, we like you to know the whys behind some of our questions, and some of the planning that goes on behind the scenes. Then, if we recommend taking some withdrawals from your IRA, while also using some from a taxable account or a Roth IRA for example, you know why. Because sometimes it can sound a little bit crazy to be using one account one year, and another account or combination of accounts to pay for expenses the next year.

But there can be good reason to do so.

Switching gears a little bit, but building on some of the information we covered on how the tax brackets work.

Another really valuable analysis we have found for clients recently is the potentially positive impact that loans can have on your financial plan.

Now that sounds a bit crazy maybe. You have probably saved your whole life with the idea that you would save enough to not need loans in the future. And that is understandable.

But as you have probably seen from the yields on your bank savings accounts, or yield on your bond holdings at Schwab, interest rates have come down dramatically.

And while it is not fun that the lower interest rates have led to a lower yield in some savings and investments. It also means that rates have come down dramatically for loans that typical retirees can take for normal large one-time expenses in retirement. I’m thinking specifically car loans and mortgages.

A lot of new cars can be financed at 0%, 1%, or 2% today. 30-year mortgages are close to getting below 2.50%, and 15 year mortgages are closer to 2%.

And if you are thinking about our previous example and those tax cliffs that were triggered that resulted in 10% higher tax rates. You might see where we are going with this…because if borrowing at 3% can save you 10% in taxes, there is a nice opportunity to take advantage of that difference.

But let’s run the numbers quick.

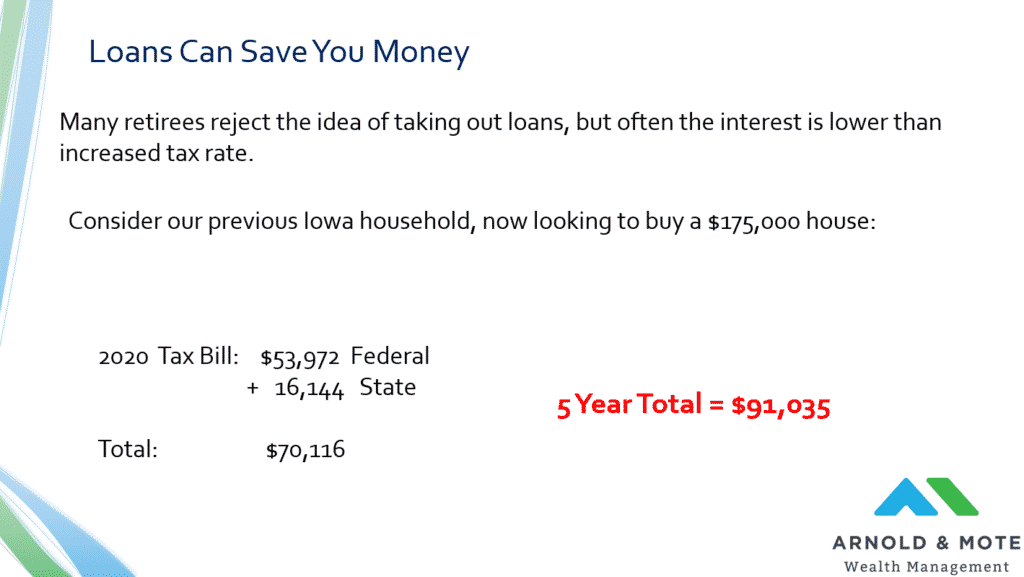

Our same example couple from before is now looking to buy a house. They are looking at a $175,000 condo for a second home somewhere maybe.

And again, they, like many retirees we see, have a lot of money saved in their IRAs. So, they don’t initially think about taking a loan – because why would they if they had enough money in an IRA to fund this and still meet their other goals? And so, they want to use that IRA savings to pay for a house.

That means a big withdrawal from their IRA this year.

If this couple uses their IRA to fund this home purchase, they have a $70,000 tax bill for the year. A really high jump.

Then, over the next few years their taxes drop back down to a more normal level. Over the next 4 years, they will pay a total of about $91,000 in state and federal income taxes.

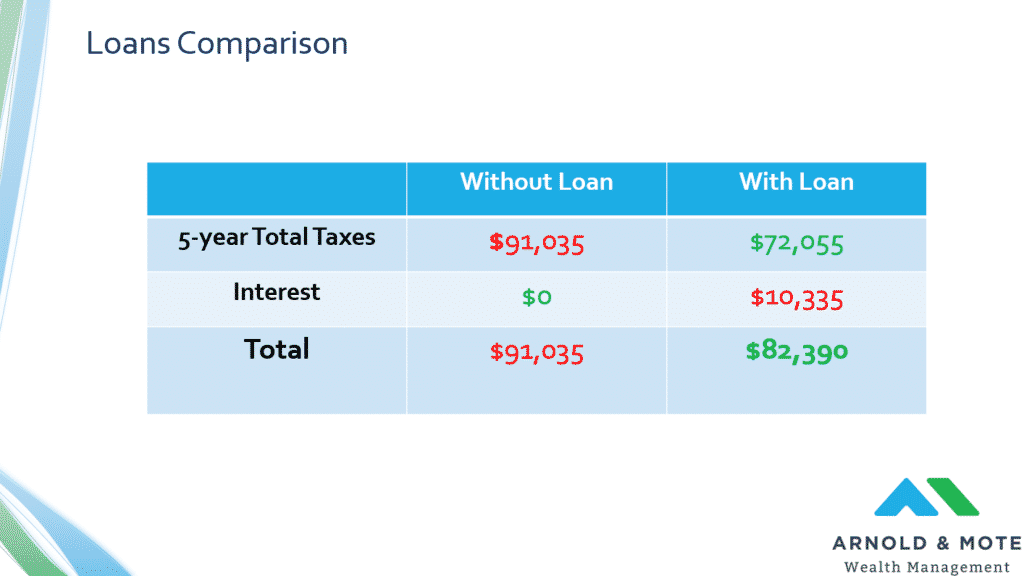

Now what happens if this couple takes out a mortgage and they don’t necessarily have to take 15 or 30 years to pay it off, but just help spread out some of the expenses over a 5 year period.

They have a much lower tax bill in 2020, or whatever year they buy the house, but slightly elevated for the remaining 4.

But in total, it results in a total tax bill of $72,000.

Right away you can see a big difference in the total tax bill between these two scenarios.

We need to add one expense to the loan scenario, the interest the Mortgage.

For this example, it would be about $10,000 in interest.

But still, even when we factor that in, we are close to a $10,000 net benefit for this sample household by taking a loan to buy this house.

This can be a surprise for many retirees, and again, a very significant potential savings that was the result of just a little bit of planning.

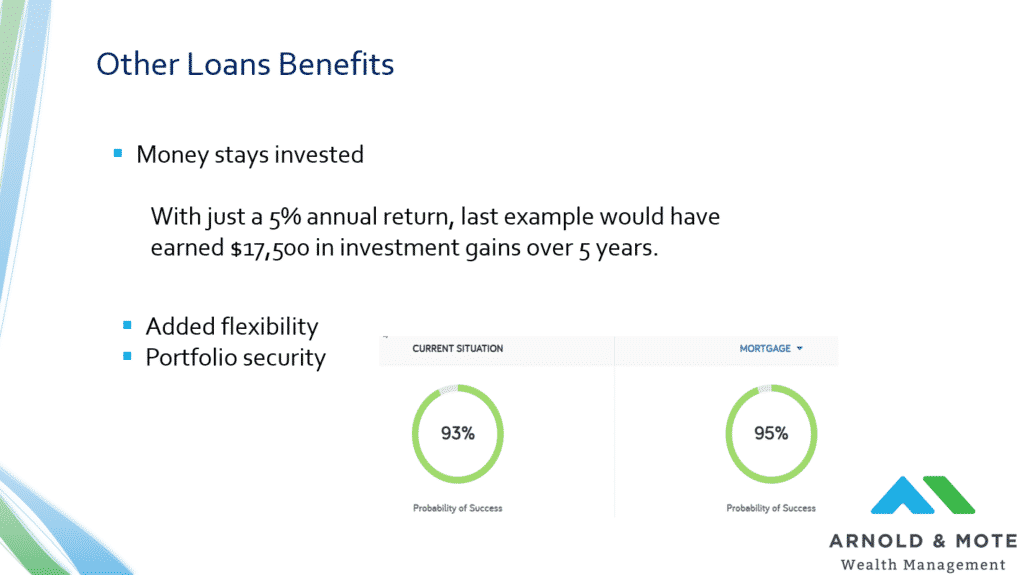

And when we look at the impact of loans not only on taxes and interest, but with the financial plan as a whole, there can be other benefits too.

First of all, by taking a loan out, more money can remain invested. Now of course the market can be volatile, so this is no guarantee. But on average the market goes up. Even if we apply a relatively conservative annual growth rate over those 5 years, the money that stays invested instead of paying off the house in full earns $17,500 for this example household.

So, if you consider the $10,000 in tax savings, net of the interest cost, and then add this $17,000 – We are getting close to a $30,000 difference in the 2 strategies of paying for the house. Of course there is no guarantee on this part of the equation though.

And perhaps more important that we find is that a mortgage in particular gives a retiree a lot of flexibility in retirement.

In our example we had the household pay back the mortgage very fast, over 5 years. But, they would most likely have taken out a 15 or 30 year mortgage, not a 5 year mortgage. So, if they had emergency expenses somewhere else, or the stock market really dropped and they wanted to leave money in their accounts for longer to give it a chance to recover, they could reduce their monthly mortgage payment back to the minimum that would be required for the 15 or 30 year mortgage, and take reduced draws from their portfolio for a long period of time.

And this is related, but when we look at monte carlo simulations, which is where we run a client’s portfolio through a randomized set of stock market returns over time. We find that loans reduce the risks that are associated with sharp declines early in retirement, and can increase portfolio longevity.

Really a retiree is most vulnerable to big dips in the stock market early in retirement. But early in retirement is also when retirees tend to have higher one time expenses.

When a new retiree takes a big chunk out of their portfolio really early in retirement, it technically creates just a little bit more risk from a stock market drop early in retirement.

A loan, even a shorter term loan, helps reduce that risk because less money needs to come out of the retirement nest egg in periods of potentially really poor returns.

It is a small factor, but certainly an additional small benefit for the flexibility that a loan provides.

And so, we are wrapping up now. We blew through a lot of numbers, but I wanted to show you some real world examples of how these seemingly small decisions can make thousand dollar differences.

And all of this adds up. You will likely buy a few cars in retirement, and likely have several other large one-time expenses. Each one of these is a chance to do some planning and potentially save a bit of money in taxes.

In general, we find that a few ways we can create savings for clients is to:

Spread payments out over several years, like our car example or even a 5 year mortgage. This can help reduce hitting those tax cliffs and filling up higher tax brackets.

Taking advantage of lower income years means recognizing when you are not spending as much as you might in future years. It might mean making sure you fill that 12% bracket if you know there will be years ahead where you will enter the 22% bracket, for example.

Using different account types can also help. If you have accounts other than just a qualified retirement account, say a taxable account or Roth IRA. Those can help supplement withdrawals to create much less of a tax burden. We didn’t cover this in much detail today as this was getting long, but we will have a future webinar that touches on this topic.

And, don’t completely write off loans for large purchases. You should never buy something just because you can afford the loan payments of course, but if done correctly and at low interest rates, it can be beneficial.

As Fiduciary, Fee-Only financial advisors, this is just one example of the value we provide to our clients. For a look at the other services we offer, reach out and schedule an introductory meeting with us!

Looking for More?

For some retirees, we find that a Roth conversion strategy provides great long term tax benefits. While Roth conversions do increase taxes temporarily, they can greatly reduce taxes over the course of your retirement plan.

To see how a conversion strategy works, see our Roth conversion blog post.