Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

For people approaching retirement who have an IPERS retirement benefit, you may be wondering if delaying your pension benefit is a good idea. IPERS is just one piece of a successful retirement plan, but for many it may be the most important to get right. Here’s what to know about beginning your IPERS benefit at retirement:

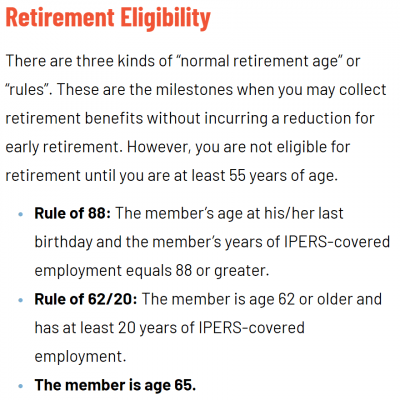

First off, we should note what counts as retirement age for regular members:

Delaying past these timeframes, if you are intending to retire, doesn’t get you much– there is no additional benefit that’s earned by delaying. This is in contrast to some other corporate pensions or Social Security, which has a well-known increase in benefits if you wait past your Full Retirement Age.

Figuring out your fixed income is a good first step as you begin to create your retirement plan. Some other important questions to ask:

When should you start Social Security?

What are your needs for cash flow early in retirement?

How should you use your investments early in retirement?

We have helped many of our IPERS clients create plans around their benefit and other investments.

We offer complimentary, no obligation meetings to answer your questions and discuss how we work with clients. You can set up your free meeting here: Schedule a Meeting

We have also done numerous webinars on IPERS and other financial planning topics for our clients and prospects. You can watch a recording of our most recent IPERS webinar here.

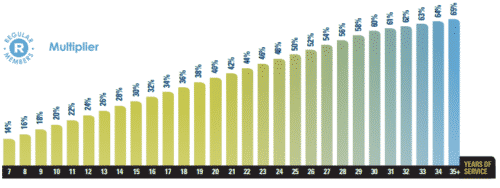

In that webinar we cover a few basics of the plan, such as calculating your benefit, and how to avoid costly mistakes with your benefit.

If you are looking for further information, the Member Handbook is also a great resource for answering your questions about your retirement benefit.