Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Converting your whole IRA to a Roth can mean paying more taxes now than you’d pay later.

Extra taxes and surcharges can make conversions more expensive than they seem.

Some assets, like those for charity or low-tax withdrawals, are better left in a traditional IRA.

Does it make sense to fully convert your traditional IRA to a Roth? The root of this question is about future taxes you expect to pay.

Fundamentally, it’s a bad idea to fully convert if you pay more in total taxes on the large Roth conversions now than you would pay in future years for the regular, expected use of those pre-tax assets. In order to determine how much of your IRA to convert, you’ll want to calculate your long term tax liability year-by-year. Then, compare how accelerating some income through Roth conversions will change that long term tax liability.

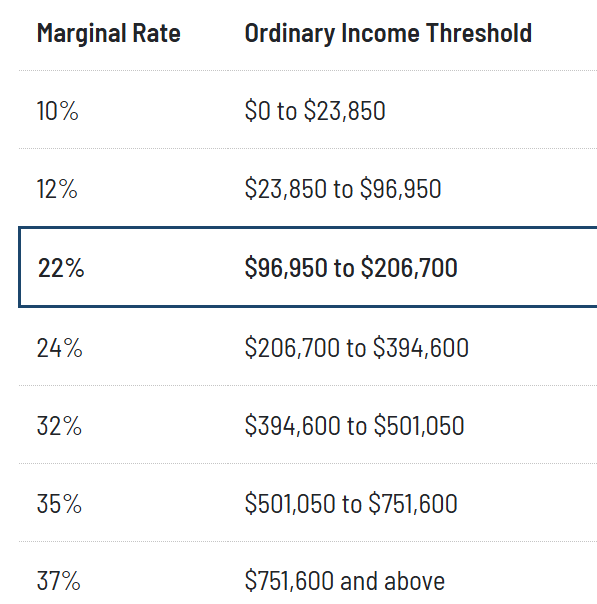

When you do the calculation, it’s important to look at all the components of income tax that you could pay by fully converting and total those up. That is, it’s not just your ordinary income tax rate, but also extra taxes you may be subject to like the tax on your Social Security payments, IRMAA or the Medicare surcharge, and Net Investment Income tax.

Here is a chart we look at behind the scenes when developing a Roth conversion plan for a client. We look at not only the federal income tax brackets the client is in, but the many other taxes and surcharges that apply to find the effective tax rate of additional income. There are many instances where clients think they are in the 12% tax bracket, but their effective tax rate on $20,000 of additional income is over 30%!

You’ll want to compare this to what might be a regular use in your retirement of pre-tax assets.

First, if you are charitably inclined, you will most likely not want to convert your entire traditional IRA to Roth. Giving to charity from your IRA as either QCDs (Qualified Charitable Distributions) or in your estate is one of the best ways to donate money. There is no sense in doing a Roth conversion, paying federal and state taxes, just to leave the charity with less money.

Second, if you only need a small regular ongoing amount from your IRA to cover you living expenses, you may be able to do that from a pre-tax IRA with a minimum of extra tax. If you can have your IRA withdrawals taxed at the 10% or 12% tax rates for most of your retirement, it may not be worth paying 22% or 24% in federal taxes to convert the balance to a Roth IRA.

What you need is a tool to add up all those future years of expected income taxes and compare the total to what you would pay to convert everything to Roth.

At Arnold & Mote, we have those tools and the necessary experience working with many clients who have tackled this exact question. Reach out today for a free consultation.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network. Arnold & Mote Wealth Management is a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas.