Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Roth conversions can be a huge benefit for many investors and retirees. In fact, we help many of our clients with them every year.

But, it takes proper planning to find the right amount to convert and when to perform those conversions. We have seen a lot of mistakes in Roth conversion plans that have resulted in thousands of dollars in additional taxes or lost benefits.

Here’s a few of the most common:

The first common mistake we see is developing a Roth conversion strategy without thinking about your charitable giving wishes.

If you are charitably inclined, QCDs or qualified charitable contributions can be the most tax efficient way to donate to charity and negate any tax impact from required minimum distributions. Too much in Roth conversions early in retirement can reduce the amount you have available for QCDs over time. This may result in you paying more in taxes, or charities receiving less money at the end of your plan.

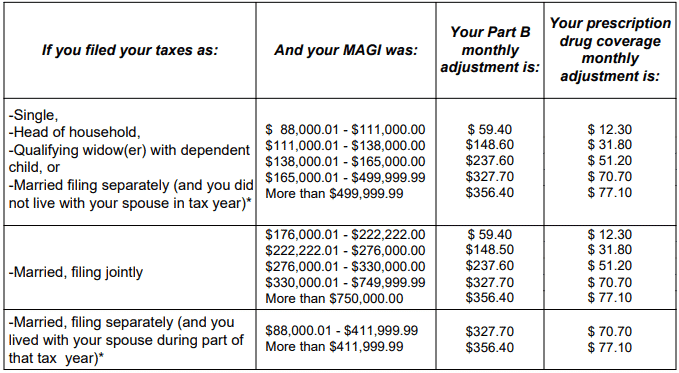

The next common mistake we see is triggering IRMAA or the income related monthly adjustment amount to your Medicare Premium.

This is an added surcharge to your monthly medicare costs and can result in several thousand of dollars in added annual medicare costs for a retired couple. IRMAA can be triggered with just $1 in income above certain thresholds.

So, calculating your Roth conversion to not unnecessarily cause you to jump up to a higher income bracket and pay IRMAA is really important.

Lastly, performing Roth conversions creates income that can negate a lot of other tax benefits available for with low taxable income.

For example, retirees may find themselves in the 0% long term capital gains tax bracket or in a position where only a small portion of their Social Security is taxed. Depending on your IRA balances, it may not be worth sacrificing those benefits to get money in a Roth account.

Roth conversions are a tremendously valuable tool for many, but the calculations are complex. Being sure you understand all the consequences of doing Roth conversions is really important. And if you don’t, find a financial advisor who will help you.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.