Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

The Net Investment Income Tax is an added tax that is charged on dividends, interest, and capital gains from your investments. It can also apply to many other forms of income, such as rental property income, passive business income, and even certain annuity payments.

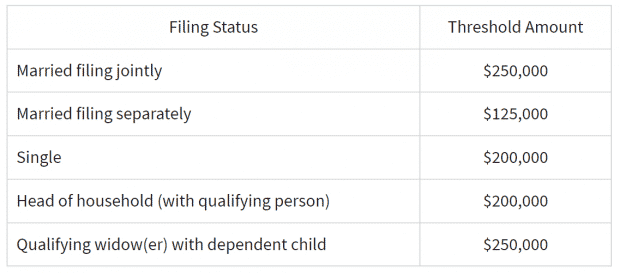

The tax applies only to individuals and trusts with a MAGI, or Modified Adjusted Gross income, over a certain threshold. This income limit threshold is set by the Internal Revenue Service and changes based on your tax filing status (Married filing jointly, married filing separate, or single filing), but will begin to trigger for most households at either $200,000 or $250,000 in MAGI.

If your income is high enough to cause you to be subject to the tax, you will face an extra 3.8% tax on your investment earnings or a 3.8% tax on the amount that your annual income in excess of the income threshold noted above.

Here are a few examples of types of income that count towards the net investment income tax (these are common items, but the list is not all-inclusive):

– interest (from bonds, bond ETFs or mutual funds, bank CDs, money market funds, series I savings bonds, etc)

– dividends (from stocks, stock etfs and mutual funds, REIT dividends, etc)

– capital gains (long-term and short-term)

– rental income

– royalty income

– withdrawals or payments from non-qualified annuities

– income from businesses that are passive activities to the taxpayer (“Passive income”)

Here are examples of income that does not count towards the net investment income tax (these are the most common items, but is not all-inclusive):

– Wages

– unemployment compensation

– operating income from a nonpassive business

– Social Security Benefits

– alimony

– tax-exempt interest (such as from municipal bonds)

– self-employment income

– distributions from certain qualified retirement plans such as 401(k)s, 403(b)s, and traditional IRAs

For someone who relies on dividends and interest to fund their retirement, or those who use their investments for large purchases such as a house or car in retirement, this tax can easily amount to many thousands of dollars.

Consider a couple who file their taxes jointly and are near retirement, but currently with high income. They have a combined $200,000 in W-2 wage income, and receive $20,000 in dividends and interest from their investments.

They want to purchase a retirement home now, which requires a $150,000 down payment that they plan to take from their taxable brokerage account. Assume the $150,000 in investments they sell have a cost basis of $50,000, so $100,000 in gains are taxed at long term capital gains rates on their tax return.

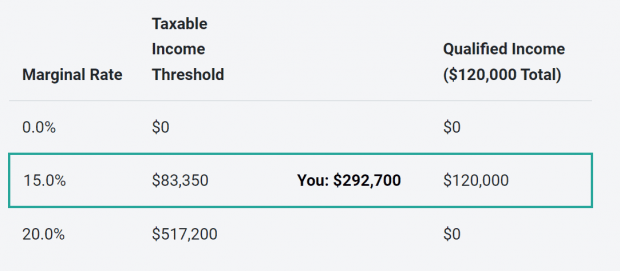

This couple has an MAGI of $320,000, and taxable income of $292,700.

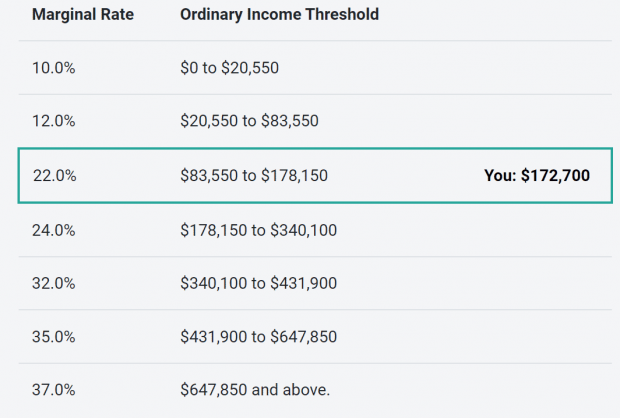

They would find themselves in the 22% Federal income tax bracket:

And their capital gains tax bracket is 15%:

But in addition to these regular income taxes and capital gains taxes, they would also pay an additional $2,660 in taxes due to the Net Investment Income Tax, which would be calculated and reported on their tax returns on IRS form 8960.

For this example, their NIIT liability is calculated by taking 3.8% of $70,000. ($70,000 is the amount their MAGI is in excess of the income threshold noted in the table above).

What can you do to avoid this tax?

A little bit of planning can go a long way. If you can split large investment sales over two tax years, you could dramatically reduce the amount of income or capital gains subject to the tax.

Proper investment account maintenance can also help prevent the net investment income tax as well. Things like tax loss harvesting, or purposely recognizing small gains to raise your cost basis over time can help reduce the impact of this tax later on.

If you are retired and find yourself frequently hit by the net investment income tax, consider QCDs (Qualified charitable contributions) or creating a Roth Conversion plan to reduce future required withdrawals and income.

If you are trying to do this yourself, you’ve likely found that tax planning, particularly planning around creating tax-efficient retirement plans is complex.

We help our clients create financial plans that help you meet your goals and reduce your tax liability. We offer free 30-minute consultations here so that you can find out if we are the right fit for you and your retirement plan.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.