Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Charitable giving has always been important, and charities are seeing need right now more than ever.

While a charitable giving strategy should never be done solely for tax deduction purposes, there are ways you can donate to help charities that are in need today, while also claiming the largest benefit for you that is possible.

In this post, we want to walk you through a few key steps that we think about with clients as we develop their charitable giving plan.

Bonus: We recently did a webinar on this topic as well. You can watch a replay of the webinar here:

Since the Tax Cut and Jobs Act (TCJA) tax reform was passed in 2018, a little more planning is now required for small to medium-sized donors to receive a tax deduction for their donations.

Most of that additional planning is because of the tax reform bill’s change to the standard deduction.

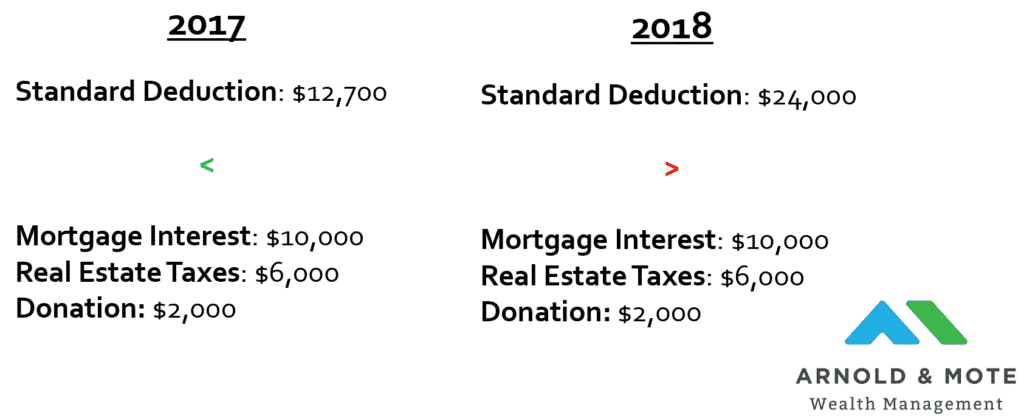

For a married couple, the standard deduction nearly doubled, from $12,700 to $24,000.

Why did this make such a large impact on a charitable giving plan?

The standard deduction is an amount you can claim on your taxes no questions asked. No matter what you did during the year, in 2017 if you were married you could get a $12,700 deduction.

If you had more deductions, say from mortgage interest, property taxes, or charitable contributions, you could itemize your taxes and get a higher tax deduction.

In 2017, and before the tax law change, for a lot of Americans it was relatively easy to get above that standard deduction amount.

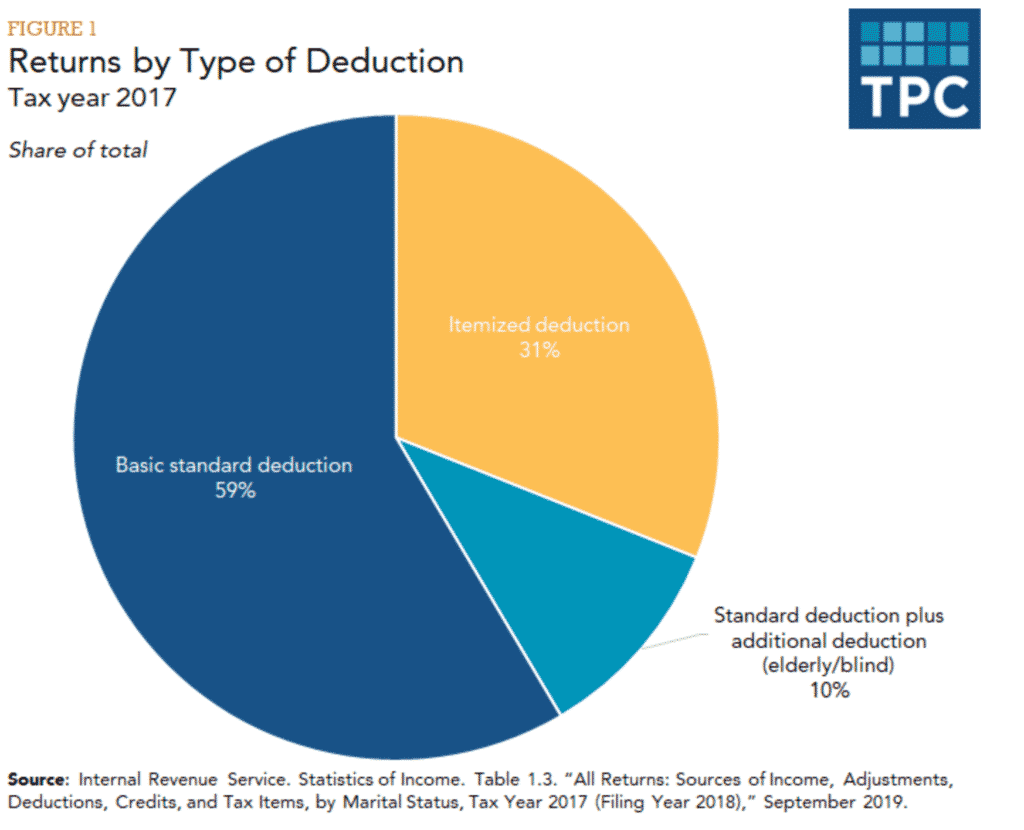

In total, about 31 percent of households had deductions in excess of the standard deduction in 2017:

Prior to 2018, if you had an average sized mortgage and paid property taxes, that alone probably got you close to deductions that exceeded the standard deduction.

And that means that these households were very likely to be able to fully recognize deductions for their charitable contributions.

But then in 2018, the standard deduction almost doubled overnight. That meant a married household now needed $24,000 or more in deductions in order to receive any extra deduction on their taxes for charitable contributions.

The numbers below are representative of the mortgage interest and taxes for a $250,000 in Johnson County, Iowa just for example, and show the significant impact that tax reform had on their charitable giving deductions.

And what you can see is that if this person in 2017 wanted to make a donation, even a very small donation, that entire donation would be tax deductible because their other deductions like mortgage interest and real estate taxes have already gotten them up and over the standard deduction. This could have donated even a small amount, say $100, and received a full $100 deduction on their taxes.

But that changed in 2018. Now the standard deduction is much higher. This makes filing your taxes easier, but makes it less likely you will receive extra deductions for your charitable contributions.

Today, less than 10% of households itemize their deductions, nearly 70% less than 2017!

This change had a negative impact for those who were donating for the tax deduction. As shown in the image above, now this exact same household will receive no added tax deduction for their $2,000 donation, because they fall under the standard deduction.

So, this change in 2018 added another wrinkle to a charitable giving strategy. Especially for those who want to contribute smaller amounts during the year.

But there are ways to still donate and receive a benefit even if you fall under the standard deduction.

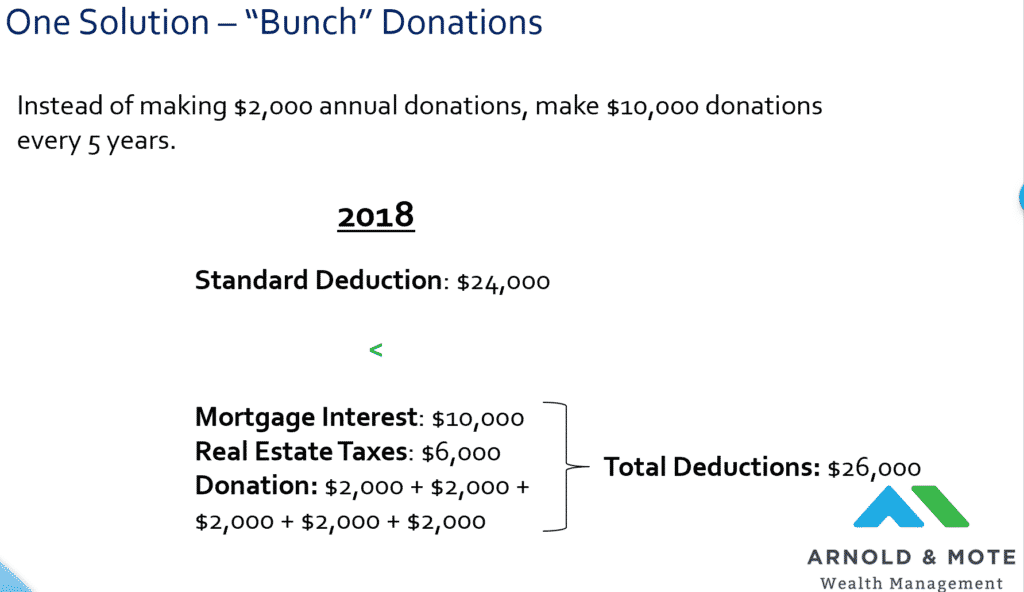

The first and easiest change was to simply group, or bunch, your donations to get you up above that standard deduction. So, instead of giving $2,000 per year, maybe you give $10,000 every 5 years.

This would give this example couple over $24,000 in deductions for the year, so now they can itemize and receive extra tax deductions for their increased charitable giving.

However, it is still not a perfect solution. Even with $10,000 in donations, notice this couple is only getting a $2,000 added deduction over the standard deduction for their $10,000 donation.

It is an added benefit, but unless you are donating large amounts, multiples of the standard deduction, it is hard to realize the same benefit as before the tax law change.

Another recent law has made one improvement to this situation.

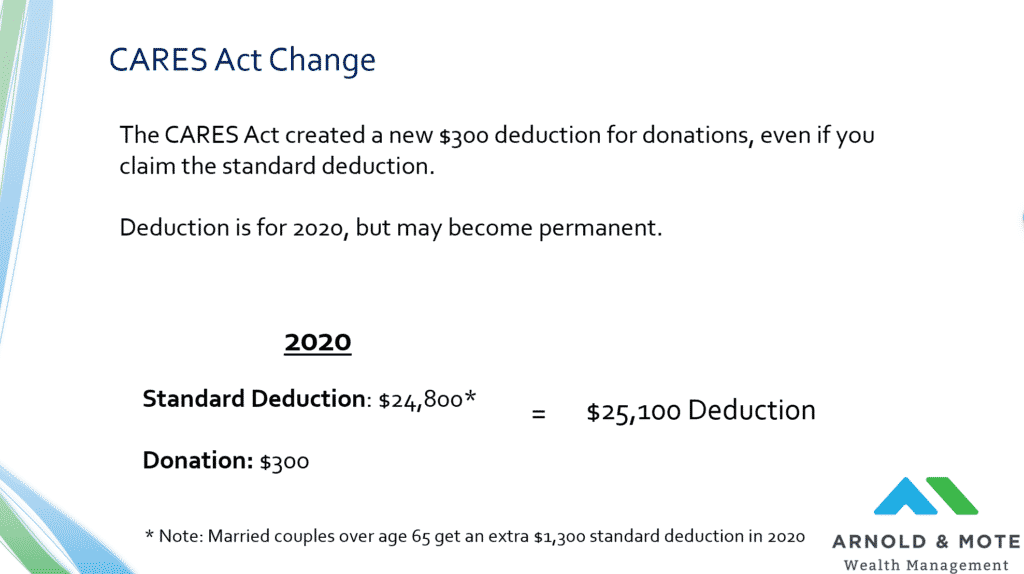

The CARES Act, which was recently passed in response to the coronavirus epidemic, added one small benefit for those who want to donate to charity – A $300 above the line deduction for charitable contributions.

Even if you claim the standard deduction this year, if you give $300 to a qualified charity, you can get a $300 tax deduction in 2020.

This $300 deduction is for cash donations only. So contributions of stock, clothes, or vehicles do not count towards this benefit.

Make a cash donation, and keep a receipt from the charity that you made the donation to.

Also, contributions to donor advised funds, which we’ll talk about later, do not count towards this $300 deduction. It must be a cash or check given directly to a charity.

But bottom line, for 2020, this $300 cash donation should be one of your highest priorities for giving. Everyone can take the deduction for it, and its cash that goes directly to charities, which is important today as well.

As the law stands now, this $300 deduction is only available for 2020, but there is pressure to make it, or some increased deduction, permanent – We’ll see!

Once you get above that $300 donation, there are other strategies to help save you on taxes and provide the most bang for the buck for charities, even if you are not donating really large amounts of money.

One simple way is to donate investments to a charity rather than selling the investment and giving the charity the proceeds.

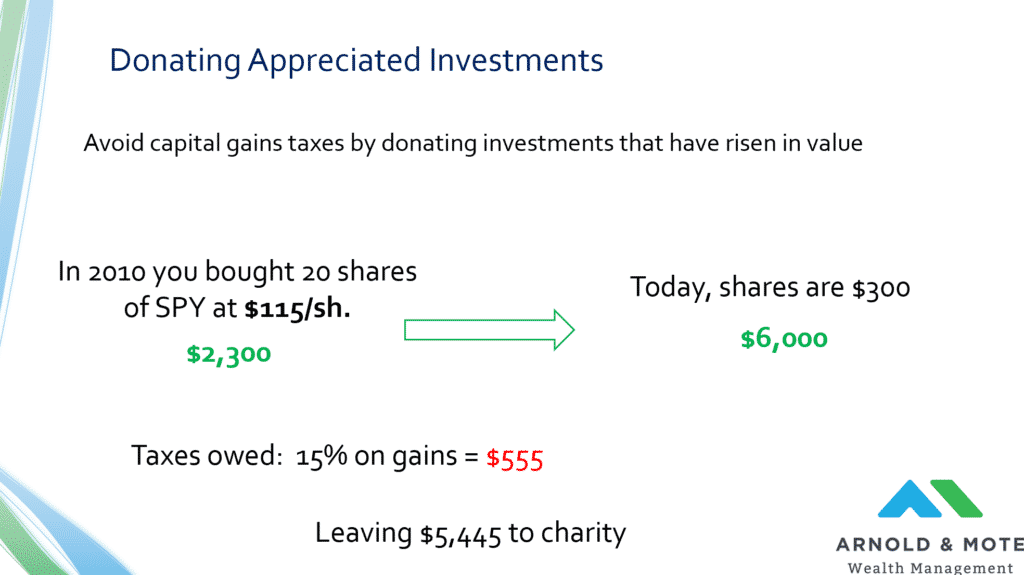

Just as an example on the benefits of this strategy, consider that 10 years ago you purchased an S&P 500 index fund. Just for example here I used 20 shares of the most popular ETF today, SPY, which 10 years ago was at $115 per share.

Today, that investment in SPY that was worth $2,300 10 years ago has almost tripled and is worth $6,000 now.

So let’s say you want to donate this to a charity. Your first inclination may be to just sell this security and give the cash to the charity, right?

But looks what happens. You will need to pay capital gains taxes on the difference from the $2,300 original investment and the $6,000 it is worth today. For most, that is taxed at a 15% long term capital gains tax rate, so you are going to end up with a $555 tax bill, which leaves $5,445 to the charity.

The charity will obviously be grateful for the donation. And you may be able to take a deduction for $5,445 if you itemize your taxes.

But still, there is a better way.

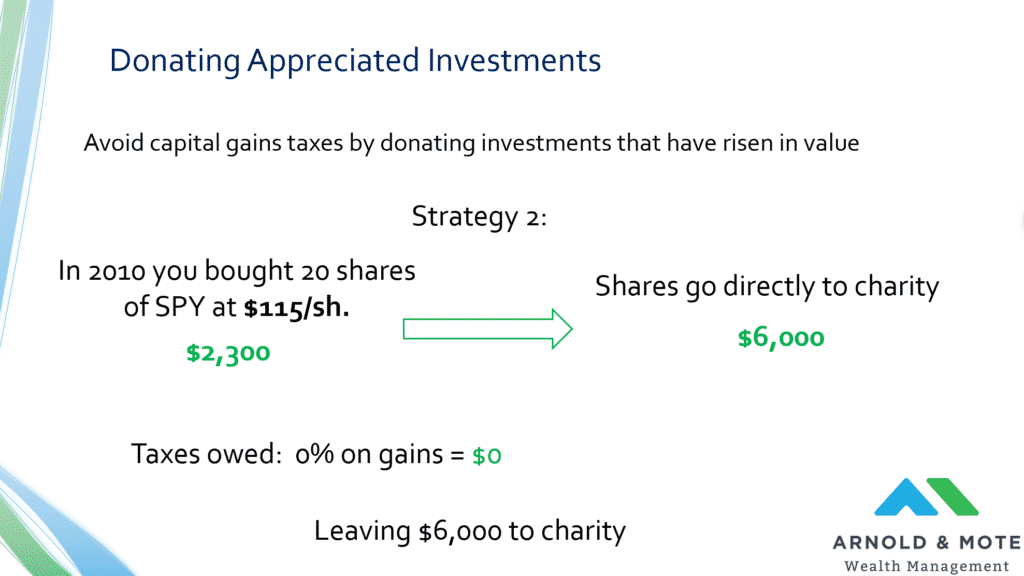

Instead of cashing out the security, you could donate the 20 shares directly. This can be done a few different ways, one of which is a donor advised fund which we’ll talk about in just a few slides. If you have a charity in mind to donate to, contact them and they will be happy to help you donate your appreciated stock.

But, you can transfer those 20 shares worth $6,000 directly to a charitable account. You receive a $6,000 deduction if you itemize, and the charity now gets $6,000 instead of $5,455. Because remember, the charity will not pay any taxes on the gains like you would. So, you get a $555 larger deduction, and the charity get $555 more. It’s a win-win scenario.

Another very popular way to make donations, even small donations, and receive tax benefits is available for those age 70 ½ or older. This is special distributions from your IRA called a Qualified Charitable Distribution, or QCD.

A QCD allows you to give money directly from your IRA to a charity. For our clients that have this set up, we get a special checkbook that is used for QCDs. Or, if you don’t want another checkbook lying around we can get your signature on a form through Schwab, where we custody client investments.

But either way, it is very easy to do. If a client wants to donate $100 from their IRA, they can let us know, we’ll make sure cash is available in the account, and then they can give the charity a check or sign a form to send the money.

There are a few primary benefits to this. First, it avoids you making the withdrawal and facing income taxes on the withdrawal from your IRA.

And second, any QCD counts against your RMD, or required minimum distribution for the year.

So, if your RMD is $10,000, you can just for example, write a $1,000 QCD check to a charity, and then you will only have to withdrawal $9,000 to satisfy your RMD. This saves you income taxes on $1,000 – Which for most can be a couple hundred dollars.

Let’s look at the benefit of the tax savings, and increased charitable donations, that a QCD provides.

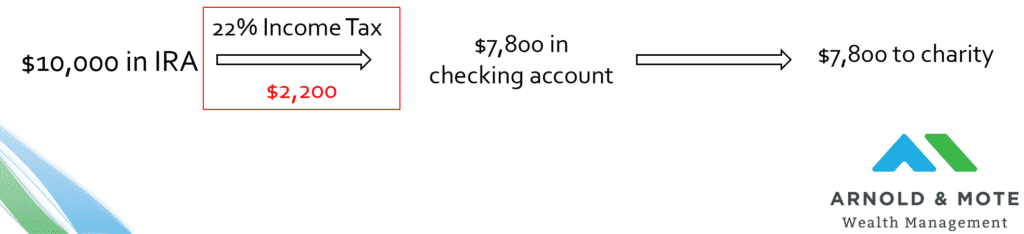

Let’s say you have $10,000 you want to donate from your IRA. Like in the previous example, your first inclination may be to just withdrawal the money from your IRA into your checking account, and then give the charity cash. With this scenario, you will pay taxes on the IRA withdrawal. If you are in the 22% tax bracket, that amounts to $2,200 in taxes. Then, you give the charity $7,800.

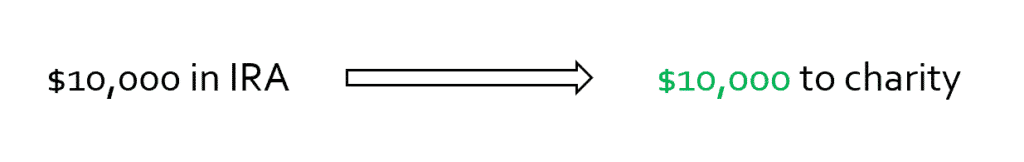

Again, the charity will be very grateful, but you can do better.

By doing a QCD, you simply give the charity a check from your IRA for $10,000. The charity gets all $10,000 and you avoid the $2,200 in taxes that you would have paid for that $10,000 withdrawal. That is a huge difference for both you and the charity!

Its hard to talk in absolutes, but if you are over age 70 ½, or especially age 72 and taking RMDs and you are charitably inclined, QCDs should likely be the first priority for your charitable contributions.

It is the best way to give you a direct deduction in taxes, regardless of whether or not you take the standard deduction, and gives a charity the largest amount possible.

There are some limits, such as $100,000 per year. So if you want to make really large donations, there may be other options you need to consider in addition to doing QCDs. But, for a vast majority of our clients, QCDs are the best, most tax efficient, and simplest way to give to charity.

The strategies we have talked about so far cover the needs of a lot of people for normal, or regular annual charitable contribution amounts. Now we want to move to options that exist for larger donations, maybe one-time donations or end of plan donations, and how to maximize the tax benefit for you, and the charity.

The first example is one to show you how a charitable giving plan is connected to the rest of your comprehensive financial plan. For those of you who are charitably inclined and want to leave assets to 1 or more charities at the end of your plan, your estate plan is very important.

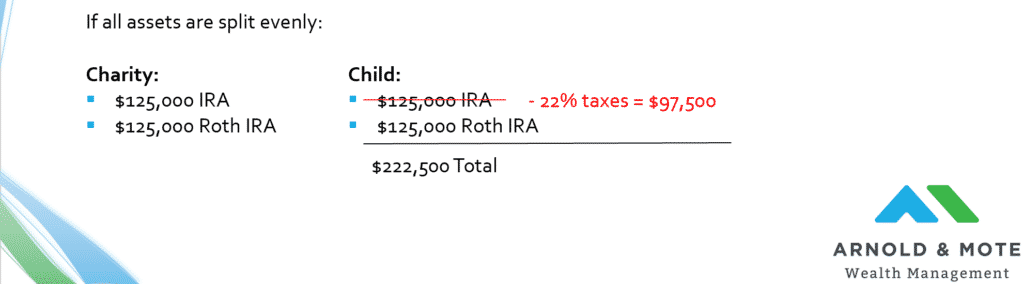

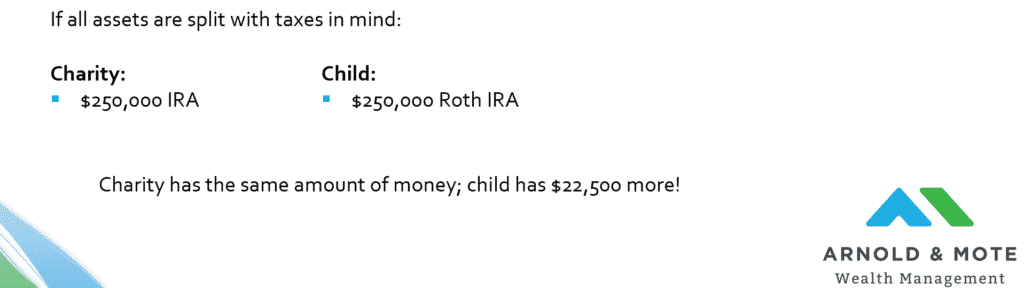

Let’s say you want to leave half of your assets to charity at the end of your plan, and half to children or family.

For simplicity let’s say you have $250,000 in an IRA and $250,000 in a Roth IRA.

If those assets get split evenly the charity will be given $125,000 in IRA and Roth IRA money, while your family will get the same.

The problem is that your family will be stuck with paying income taxes on the IRA money. If they are in the 22% tax bracket, that’s $27,500 in taxes.

So, adjusted for taxes, your family now receives $222,500.

But there is a better way to do this that leaves the charity with the same amount of money, and leaves your heirs with more money too.

If instead your estate plan calls for the accounts to be split up by account type, you could direct the charity to receive the $250,000 in IRA assets, and your family to receive the Roth IRA assets.

With this scenario, the charity still gets $250,000, and your heirs get $250,000 in tax free assets, since inherited Roth IRAs are not taxable like an inherited traditional IRA.

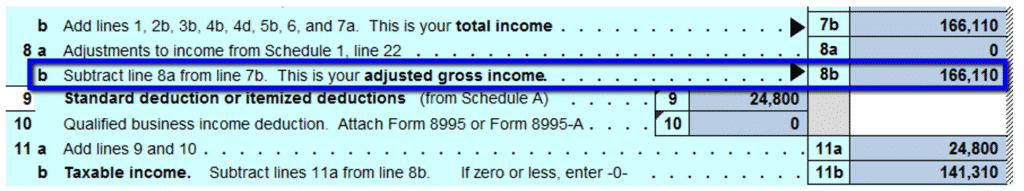

One quick note as we get further into the topics of larger donations. In the past, deductions for charitable contributions were limited to 60% of your AGI, or adjusted gross income. This is calculated on line 8b of your tax return.

So, if you had an AGI of $100,000, you could only get a tax deduction this year for the first $60,000 in donations. You can still carry over that excess donation deduction, but it might not have the same impact.

For 2020, there is a special exception for that 60% limit. Instead of 60%, it is now 100% for cash donations. Important to note, this 100% limit only applies to cash, so the donor advised fund deduction limit, which we’ll talk about in more detail later, remains at 60%.

Now, this can obviously be very good for someone with a large income and who wants to make a large donation. If you sold a business, or held stock in a company that was sold, or had some other large taxable windfall and wanted to make a very large charitable contribution to offset those taxes, there are big benefits for doing that charitable donation this year.

But this also applies to many others in more typical situations as well. Many retired couples who live off of Social Security and small IRA withdrawals have very low AGIs, and in prior years may have hit that 60% deduction limit fairly easily. 2020 gives them, and everyone really, the opportunity to make a donation and effectively pay no income taxes this year.

Another very popular way to make large donations is through a donor advised fund.

A donor advised fund lets you make a contribution today, realize a tax deduction for the full amount this year, but distribute that money over time.

The money is irrevocable, meaning once you donate money to the donor advised fund, it can not be undone. So if you donate your life savings to a donor advised fund, but then need long term care later in life, you can’t pull the money out to use for yourself. Once the money’s in there, its in there for good.

It is a way to perform the “bunching” of donations that we talked about early on. So, if you want to donate $2,000 every year. You could donate $20,000 into a donor advised fund today, realize a full $20,000 deduction today, but still just distribute $2,000 per year for the next 10 years.

There is also an added benefit that the assets in a donor advised fund can be invested, so that they can grow over time. You can put that $20,000 in a donor advised fund today, and hopefully over the next 10 years that money can grow with the stock market and result in you donating much more than $20,000 in the end.

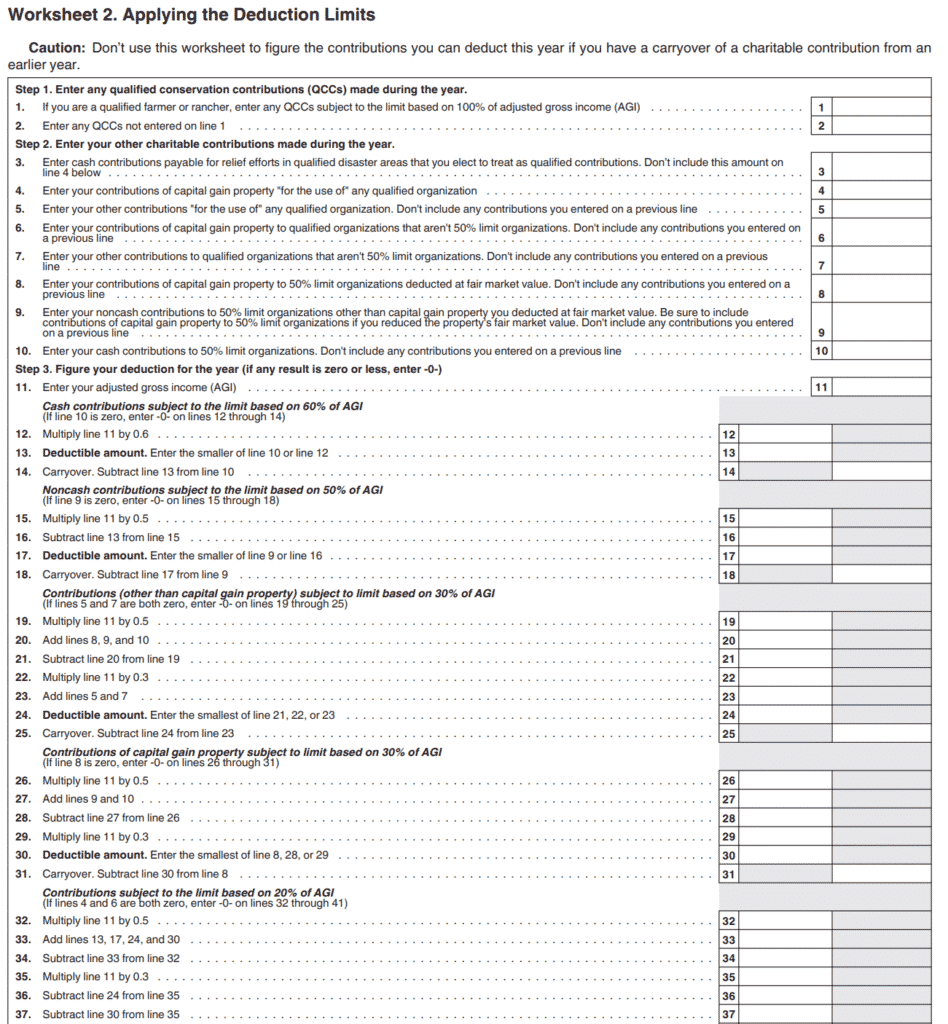

One quick note. Donor advised funds are one of the simpler ways to realize a large tax deduction, but there is still some fine print. Or actually there is a lot of fine print.

The IRS has a publication, Publication 526, is just about how to calculate charitable tax deductions. It is about 30 pages long, and has a 2 page worksheet, one page of which is shown below, to help you calculate how much of your donation is tax deductible if you use donor advised funds.

In this post, we want to give you an introduction to donor advised funds, but we also want you to know that it can be a little more complex than just getting a deduction for every dollar you put in a donor advised fund.

Where you run into limits and complexity is in very large donations into a donor advised fund that amount to 60% or more of your AGI, or 30% if you are using only appreciated securities to fund the donor advised fund.

Again, if you do contribute more you can carry over those extra deduction to future years, but it may not have the benefit you were hoping for.

We say all this here in hopes that you will include us in if this is something you are considering, because there is a lot we can do to make all these details work in your favor.

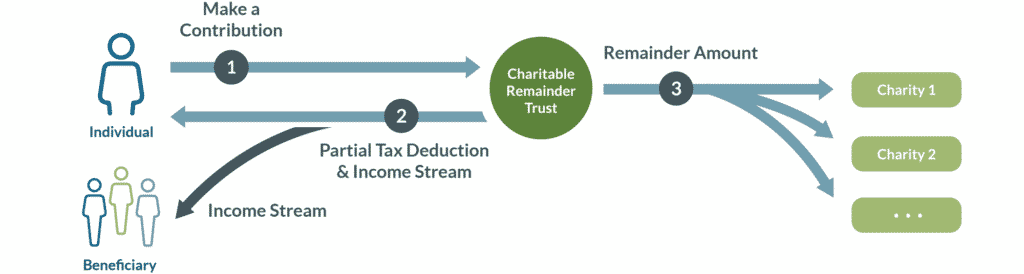

The last strategy we are going to introduce to you is called a Charitable Remainder Trust, or sometimes called a CRAT for short.

There are several variations of these, but in general they are trusts that accept your donations, but pay you a certain amount of money per year until you pass. Once you pass, the remaining money goes directly to the charity outlined in the trust document.

This has some advantages over a donor advised fund for example, because it allows you to earn some amount of income from your investments, which gives a lot of people a sense of security in retirement.

A lot of people find it hard to part with a large portion of their wealth in retirement, because of the uncertainty we all have. You might live to be 110 years old, you might need extra money for health reasons, etc.

Remember, if you make a very large donation to a donor advised fund, say $250,000, you are never getting any of that money back.

If that makes you concerned, you could donate $250,000 to a charitable remainder trust, and agree to receive an amount of money, say $12,500 per year for as long as you live. That gives you some amount of income, but still accomplishes a goal of setting aside a large amount of money to a charity while you are still alive.

A charitable remainder trust can be a simpler way to make sure money gets to where you want to go, if you don’t have other reasons to have a complex trust. If you don’t have a complicated situation, property in multiple states, farmland, etc. you may not have a reason to get a full trust made up, and a will may work just fine for the rest of your assets.

For those in that situation, a charitable remainder trust is easier and cheaper than having a general trust. And the assets in a charitable remainder trust are not contestable in the will. The money is out of your estate – It’s in a real trust, and the money is certain to go where you intended it to go.

You do receive a tax deduction at the time you fund a charitable remainder trust, but it may be lower than if you used a donor advised fund. The formula is complex and has a lot of variables. The amount you can deduct is based on your age, how much money you contribute, and general interest rates, which is all defined by the IRS.

So, these certainly provide tax savings, but you need to run the numbers with us and a tax professional to determine if its right for you.

There are ways that donations you make can benefit both a charity and you. So it is wise to think about how to best pair the deductions you can get from making donations, with other items in your financial plan.

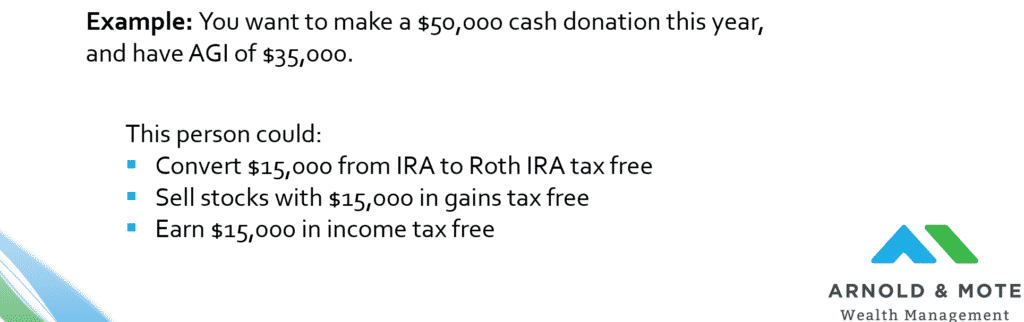

Just as a final example, here are some numbers representative of a retired couple, just living off of Social Security and some small distributions from an IRA. Assume this married couple has an AGI of $35,000 per year.

Because only some of Social Security is taxable, their AGI is low. Now, if this couple wants to make a large donation this year in excess of their AGI, it opens up a lot of planning opportunities. They could do Roth conversions for effectively no tax, or take capital gains from some investments that have appreciated in value and offset those gains with their charitable deduction. Or you could offset taxes from a larger IRA withdrawal, maybe to take out money you know you will use for a family vacation in the next year or two.

We use this example here to make sure you know that we can help you not only with your charitable giving strategy, but also see what other secondary benefits those donations can provide you.

So please reach out to us if this is something we can talk to you in more detail about, or if you have a strategy in mind that you want us to second check or optimize.

Do you have a charitable giving plan created yet?

Schedule a meeting with us and we’ll help you get started!

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.