Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

529 education savings accounts are one of the best ways to save for future college expenses. While you likely have a basic understand of how 529 accounts work, we find that there are lots of questions in the actual utilization of these accounts, and a lot of other features of these accounts that are generally unknown.

Below is a replay of a webinar we did to walk through some FAQs around 529 accounts that we have heard. We cover questions like:

If you find the video and post below helpful, but sure to subscribe to our YouTube page where we have new content like this a few times every month! Subscribe Here.

One disclaimer before we get into the details: Some of the benefits of 529s are guaranteed at a Federal level, so those will be available to everyone regardless of what state you are in or what 529 plan you are saving in.

However, every state has small differences in benefits. I’m going to try and be really clear for what benefits apply only to Iowa. But as a general disclaimer here, if you are using a 529 from a different state other than Iowa, reach out to us and let us double check your state’s tax rules.

First, just a clarification on a couple terms that we will use throughout the webinar.

Each 529 account is associated with 2 people, and sometimes these terms get mixed up or are confusing if you have not opened a 529 account before.

529 accounts have an owner. This is the person who legally owns the assets in the account. They are the sole decider of investment decisions, or choosing when to take withdrawals. The assets in the account legally belong to the owner and there is no obligation that the assets be used for the beneficiary’s future expenses.

This is one of the big differences between 529s and other popular accounts for minors such as UGMAs or UTMAs.

For most, the owner is usually a parent or grandparent. And an important note – 529s are not joint accounts like you may be used to with bank accounts or taxable brokerage accounts. Iowa law allows just one owner. This is going to be important as we get into the next couple slides.

Then there is the beneficiary. This is usually the child or grandchild. And this is the person whose higher education expenses can paid for with assets in the account. For most, this will be a child or grandchild. But it can also be the adult if they are going back to school later in life, for example.

And again, each account has just one beneficiary. You can change the beneficiary of the account, we will get into that later. But this one listed beneficiary is the only person whose qualified education expenses can be paid for from the account in order to get the tax breaks allowed for 529s.

One of the major benefits for 529s is a state tax deduction for contributions.

Each spouse can deduct up to $3,474 this year (2021). Based on Iowa’s top tax rate of 8.53% that makes this deduction worth a maximum of about $296 for single filers, or $592 for married couples.

This amount adjusts upwards a little bit each year to keep up with inflation. You can contribute more than $3,474, and there certainly may be benefits of doing so, but you will only get a tax deduction on your first $3,474 of contributions.

And also worth noting. Each spouse is entitled to a maximum $3,474 deduction per year. A married couple can deduct more, but those contributions over $3,474 must be made to the other spouses separate 529 account.

So for example, let’s say John and Jane are married and saving in a 529 for their child. If the only 529 account they have is an account owned by John, and they contribute $5,000 to that account, they can only claim a $3,474 deduction because that is the max deduction from any single account.

What this couple really should do is create 2 separate 529 accounts. 1 owned by John, and the other by Jane. Once one account receives $3,474 in contributions, then future contributions switch over to the other account.

Just continuing our last example, now that $5,000 in total contributions is split between John and Janes account, and they can take the full $5,000 deduction.

So, where this come into play is if a married couple is going to contribute more than the annual deduction limit to a 529. If all you plan to contribute is $1,000 a year, there might not be a need for both spouses to open up 529s. But, if you are planning to contribute more than the $3,474, or whatever the amount is for future years, both spouses should have a 529 account.

There are a couple others types of contributions we wanted to discuss to. Of course you can just make regular contributions from your bank account, but there are several other ways to get money into the account as well.

First are gifts. Most states 529s make gifting really easy. For Iowa you can send someone a link over email that allows them to very quickly and easily contribute to your 529.

But, a couple notes on gifts. First of all in Iowa, account owners can not claim a deduction for gift contributions from others. So, if whoever is gifting you money contributes directly to the 529, technically you are not supposed to claim a deduction for that. If that person were instead to give you a check first that you deposit into your personal bank account, then use to fund the 529, you can technically claim the deduction since you funded the account. Perhaps a little goofy, but that’s how the law is written.

Also of note, those making the gift to an Iowa 529 can not claim a deduction for their gift to another person’s 529. We see this applies most frequently for grandparents, who are gifting money to their child’s 529, that is for their grandchildren.

If that grandparent wants to take a tax deduction, they need to open up their own 529 with themselves as the owner and make the grandchild the beneficiary.

So, if you plan on giving smaller amounts to someone’s 529, it might not be worth setting up your own separate account for a small tax deduction. But, if you plan to be giving a lot, it may be worth setting up your own account to take advantage of the tax deductions.

Another interesting feature of 529s involves savings bonds. You might know that savings bonds have a feature where if the proceeds are used for qualified education expenses, the interest that has accrued may be tax deductible.

But, something that a lot of people don’t know is that contributing to a 529 is technically a qualified education expense for these savings bonds.

So, if you have savings bonds that you don’t really want to keep anymore, but are hesitant to sell because you don’t want to recognize the interest from them, you can roll them into Iowa’s 529 program, get a deduction for the contribution, and avoid taxes on the interest of the bonds. This might not apply to everyone out there, but for those with savings bonds holdings who are looking to also help save into a 529, this feature can be really valuable and save on taxes.

One other tax deductible contribution type is rollovers.

I think those of you on this call might be more familiar with the term rollover when it applies to your IRA or 401(k). This is the same type of process, but just with 529s. The IRS does not consider the money moving from one 529 to another to be a distribution, so like IRAs there are no tax penalties for rolling over 529s into other 529s.

And for Iowa, any rollovers are deductible contributions. So, if you have $2,000 in a Florida 529 from when you used to live down there, you can roll that Florida 529 into a new Iowa 529 and get a $2,000 state tax deduction.

This might also apply if you have been investing in a 529 offered by another financial advisor. These advisor led 529s are not necessarily a bad thing, but some have you save in other state’s 529 plans. Since you are using out of state plans you get no tax deduction. This rule allows you to roll that account into Iowa’s 529 plan and finally get your deduction.

One note on this before we go on – Depending on the state you are moving your 529 from, you may have to pay back any state tax deductions you received.

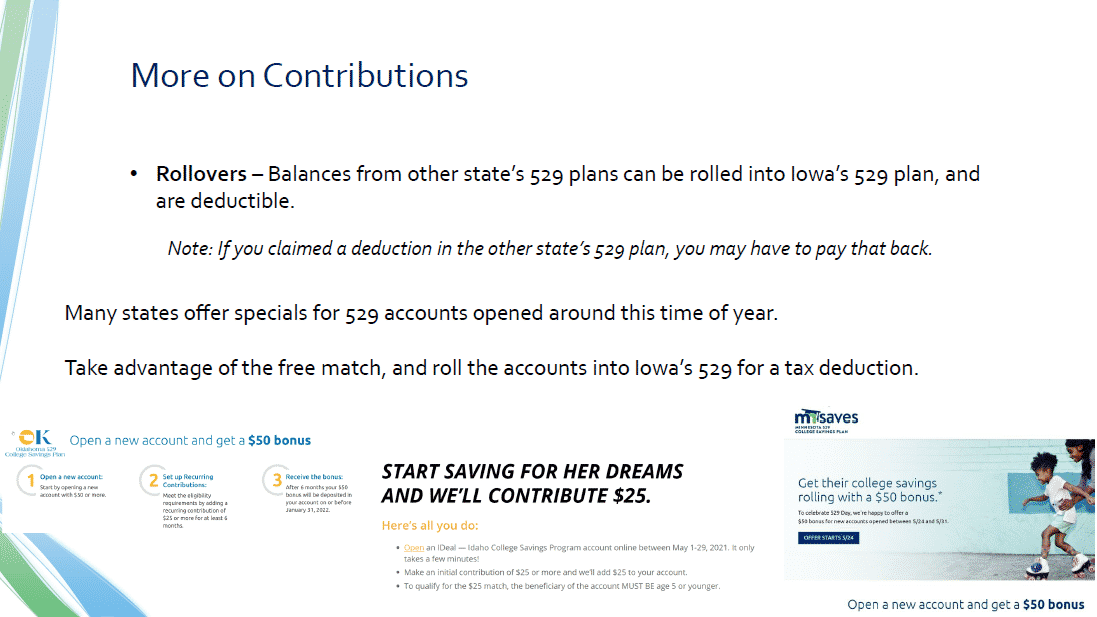

One last interesting feature with rollovers. Around this time of year (note: this was recorded at the end of May) there is a lot of press to try and raise awareness on 529 accounts. 5/29 day is coming up next week and you might see more of this then.

And a lot of states offer matches for contributions made to 529 accounts during this time. For example, MN, OK, and ID all give $25-$50 bonuses for new accounts created and funded this week. Last year there were about 10 states that offered these types of deals.

So, if you think it is worth your time, you can look for these matches, open accounts, fund them to get the match and then roll them into an Iowa 529 to get a state tax deduction. Its not exactly like winning the lottery, but a married couple get probably get $300-$400 by taking advantage of these deals if they really want to.

And one last note as we talk about 529 account contributions. You might read a lot online about 529s and gift taxes. Or if you are saving for a grandchild you might hear about something called the generation skipping tax.

While these are technically a thing, they do not apply to very many people. These gift taxes and generation skipping taxes apply only if you give about the lifetime exclusion amount, which right now is about $11 million per person.

So, if you think you will be gifting more than $11 million in your life, talk to us before making any really large gifts to 529s. But if you can safely assume you are not going to be near that limit, don’t worry about any gift taxes.

It might be worth noting that the $11 million figure could always come down in the future to something more reasonable. But you will have plenty of warning and time to act.

Now going from contributions to withdrawals.

The other big benefit of 529s of course is that in gains in the account are tax free if used for what is called qualified expenses. But what does that mean exactly?

There is a little fine print with a few of these, but in general there are a lot of expenses that qualify. Tuition is the big one of course, but Room and Board is also a very large expenses. Textbooks can be very expensive too.

One item that I’d like to highlight on this list is student loans. Up to $10,000 in a 529 can be used to pay towards the student’s loans if desired.

We sometimes recommend families take advantage of federal student loans for a small portion of their education expenses for some potential benefits or to help with cash flow even if 529 balances are fairly large. This gives families some extra options to either let the 529 grow, or contribute to help your child or grandchild pay for their loans if you’d like.

And I’d also note that there is no time requirement for assets to remain in a 529. You can contribute $3,474 to the account to get the full tax deduction, and the next day send the money to the school to pay a tuition bill. This comes in handy especially for those with kids in college currently, and they forget that they can still funnel money through these accounts to get the tax breaks.

Also, relatively new in 2018, is a rule that allows 529 accounts to be used to pay private tuition. Up to $10,000 per year can be used for K – 12 tuition for qualified schools. Sometimes this is a tricky balance for families, since college is so expensive you want to keep money in those accounts to grow and be of use later. But for some this is a great benefit.

And now for a couple scenarios that we hear from people that causes them some concern about using 529 accounts.

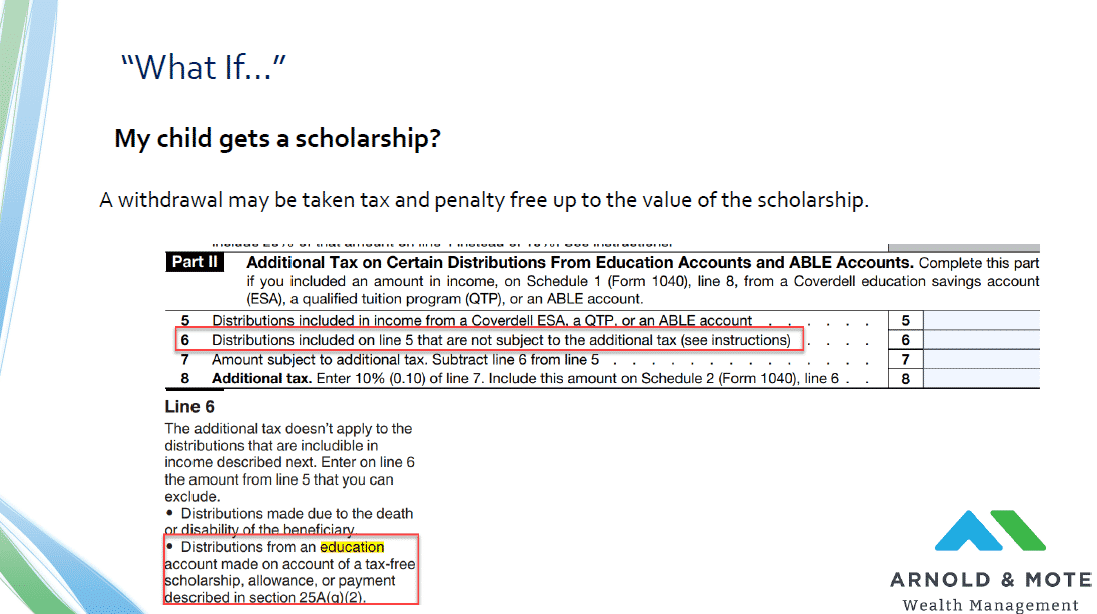

One thing we hear regularly is “what happens if my child, or grandchild, get scholarship?

There are 2 points we like to make.

First, a scholarship may very well cover tuition, but you may still have a lot of other expenses like room and board and books. I know for the University of Iowa, room and board alone will cost $10,000 or so. And, the 529 can be used for those expenses. So, you may still have a need for that 529 money, even if your child receives a full tuition scholarship.

Second, there is a special provision that allows you to withdrawal penalty and tax free an amount up to the value of your scholarship. So, if your child or grandchild receives $20,000 in scholarships, $20,000 can come out of your 529 with no added tax or expense.

This is another concern. That you will spend decades saving up in these accounts only to have your child not attend college.

First, remember from that list that there are a few other expenses that may qualify for use of the 529 still. Perhaps your child doesn’t go to college but goes to an apprenticeship. Any related expenses for that may be able to be paid with the 529.

And also, these accounts can be easily transferred to another beneficiary with no tax consequence.

So, if you have another child, or other grandchildren that might still attend college, you can change the beneficiary and then use the money for their qualified expenses.

And family member is pretty broad here, it covers much of your immediate family, and even cousins.

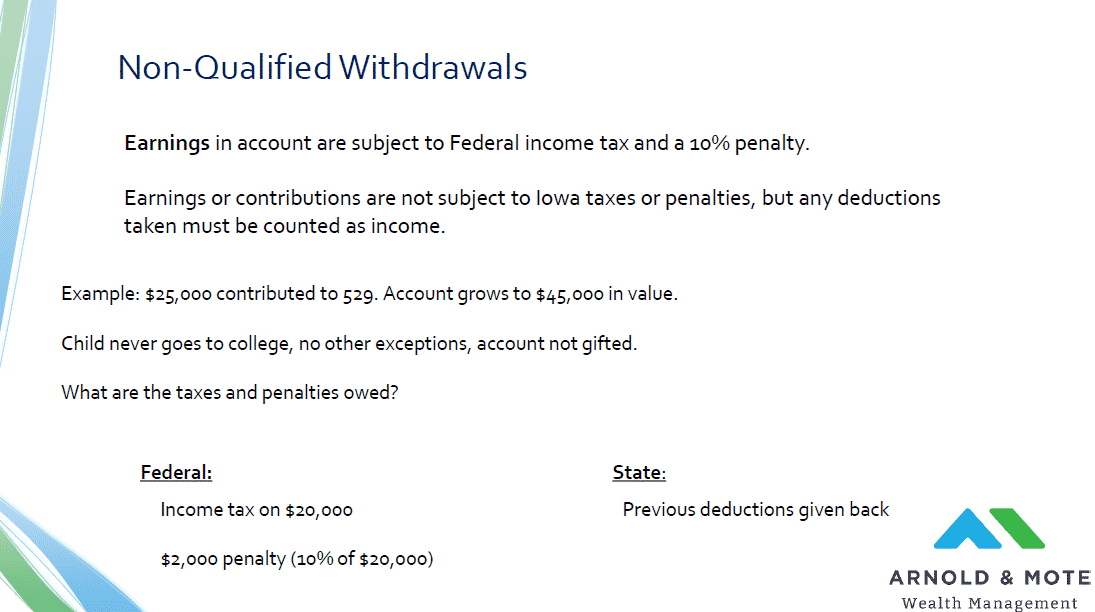

But, worst case scenario, what kind of penalties and fees would you be looking at if your child doesn’t attend college, does not qualify for any exceptions to get money out, and you do not want to gift the account.

First of all, only the earnings in the account are subject to any taxes and fees on the Federal level.

The state of Iowa does not penalize you at all. However, they may claw back any previous tax deductions that you took for your contributions. But they do not add any income tax for earnings on the account.

And while these are not insignificant, we find that this is less than a lot of people were thinking for a worst case scenario.

Even if you have a good sized 529 account, and have contributed $25,000 to the account over the years. And lets say that account grows to $45,000. What are the taxes owned?

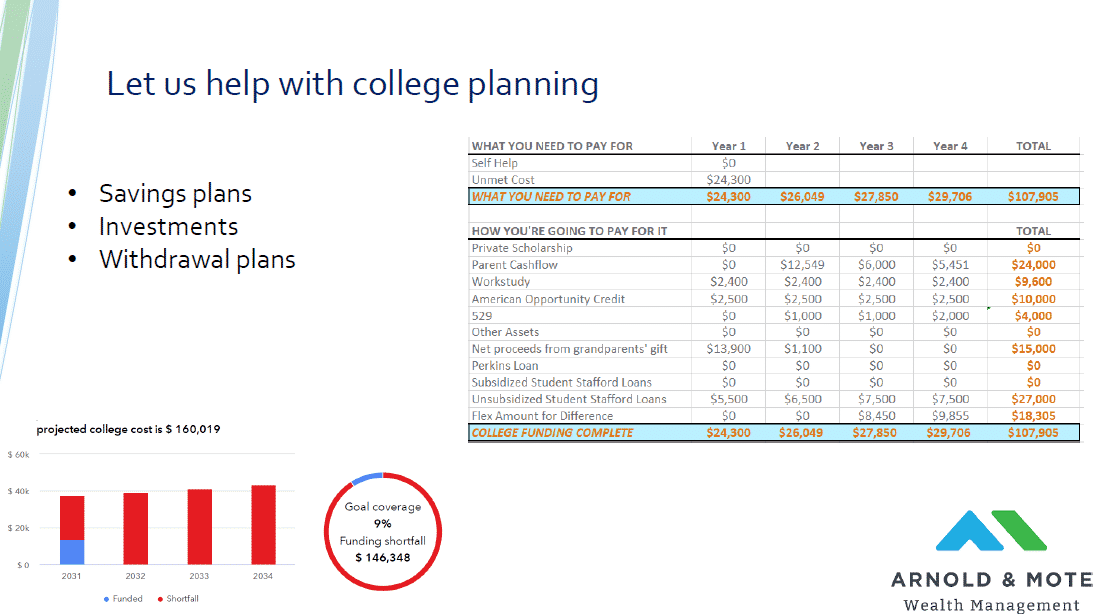

As you may start to see, all the ins and outs of college savings can get more complex. Let us help you with your college planning to ensure you are on track, and saving in the most tax-efficient way possible.