Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

When should you cash out a whole life or universal life insurance policy? Life insurance is a vital part of any financial plan, but that plan can change over time. An insurance policy that was right for you at one time may not be right for you today. Because of that, we get a lot of questions about what to do with old insurance policies.

In this post we’ll briefly discuss how to decide when to surrender or cash out a life insurance policy and what potential tax consequences to be aware of.

This question is usually asked about permanent life insurance policies that build up cash value over time, like Universal Life, Variable Universal Life and Whole Life insurance products.

First and foremost, these policies should only be kept based on your insurance need.

Insurance salesmen like to highlight many of the policy’s other features such as the policy’s investment potential, ability to take our loans on the policy, or its cash value that could grow over time. But don’t get caught up in all that, these are not good accounts if your primary concern is long term retirement savings.

For most, these should be used only for those that have a need for permanent life insurance, not for a savings or retirement account. If you have no need for life insurance, it may be worth cashing out the policy.

Let’s say you have run the analysis (or had us help you do it – this is just one of the many financial planning services we offer to our clients!) and determine you do have a need for life insurance. Does that then mean these cash value life insurance policies are right for you?

Even if you do have insurance need, you should first compare your current policy to lower price alternatives such as term insurance. We find a lot of our clients are much better suited with term insurance and investing in Roth IRAs, or even taxable brokerage accounts, compared to some of these insurance policies.

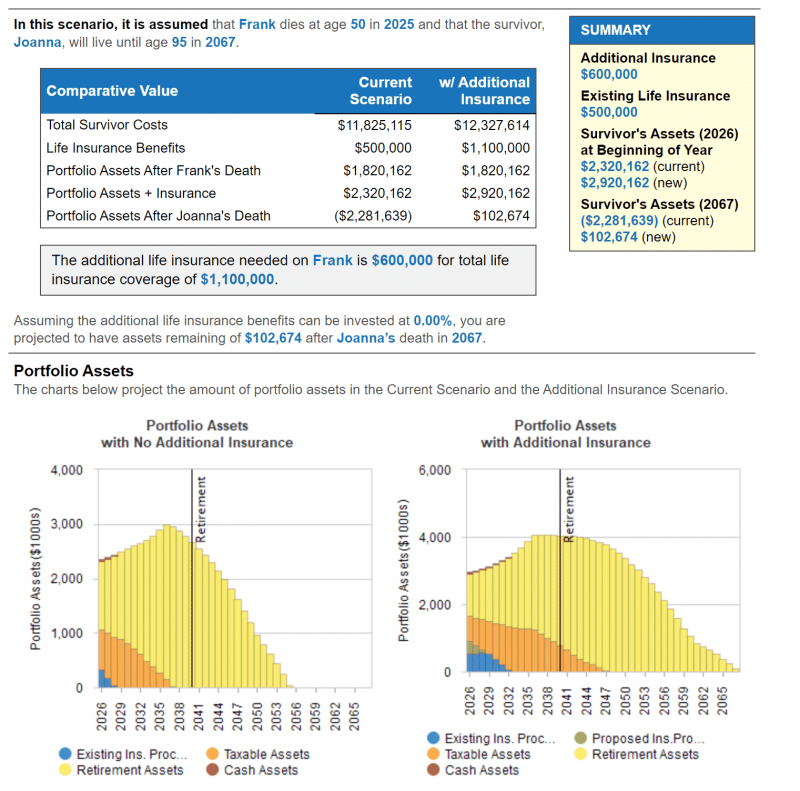

Here’s an example of our life insurance “Gap Analysis” we do to consider if you need insurance, and the appropriate type of life insurance for you:

A couple things to be aware of before you cash out your life insurance policy:

First, cashing out your insurance may have tax impacts. Make sure you understand your tax liability before cashing in the policy.

Not every insurance policy is the same, but your insurance agent, or a fee-only fiduciary financial advisor like Arnold and Mote Wealth Management, can help you determine any taxes or penalties you will face from surrendering your policy.

In general, there are 2 different fees or taxes that you may be subject to when cashing out a whole life, or universal life insurance policy:

Surrender Fees – These are fees charged by the insurance company. These fees differ depending on the insurance company you are dealing with and the type of insurance you purchased. This fee will be a percent of the cash value of the policy, and will decline every year you own the policy.

For example, your policy may have a 12% surrender fee if you cash out of the policy after year 1, a 10% fee if you surrender after 2 or 3 years, a 7% fee if you cash out in years 4 or 5, and so on.

Federal Income Taxes – Any earnings on the cash value of the insurance policy may be taxable as income. So, if you have had $10,000 in earnings in your policy and you are in the 22% tax bracket, cashing out the policy may result in $2,200 in income taxes.

Depending on your insurance policy, there may also be a separate 10% federal tax penalty on any earnings in your policy.

You may also have the ability to exchange your current policy for another insurance policy. This is known as a 1035 exchange, which can be done tax free and get you in a better policy more suited to your needs.

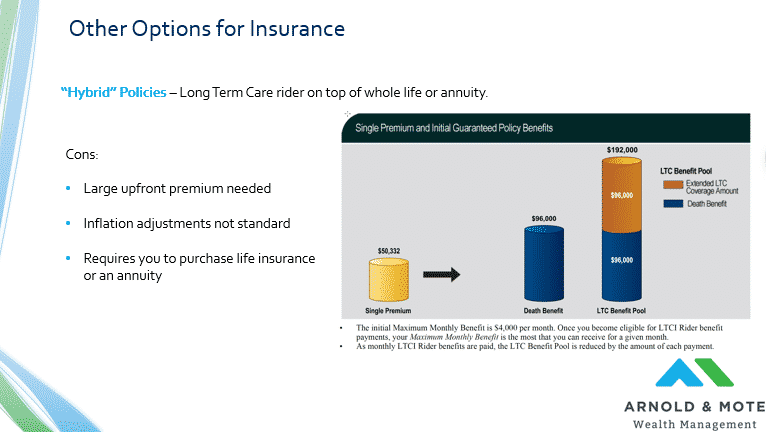

This exchange may allow you to use the cash value to buy different type of insurance, or buy a policy that has additional features (or riders) that are more appropriate for you. For example, if cashing out the policy is not feasible, you may want to consider a life insurance policy with a long term care rider that could allow you to use that cash value in the future to pay for long term care costs.

The image above is a slide from a webinar we did for clients about long term care. If saving or paying for future long term care is a priority for you, watch our long term care webinar here.

Ultimately, determining the best course of actions with these policies is difficult because they have not only become part of your estate and insurance plans, but also your retirement and savings plan as well. Determining the best course of action requires a look at nearly every single aspect of your financial plan.

As Fee only and fiduciary financial advisors, we help our clients analyze their need for insurance and determine their options with these policies. We strongly recommend getting advice on these policies from someone who will look at your financial plan holistically, and who will not receive a commission based on your decision.

Have an insurance policy you are considering surrendering? Let us help you decide if it is the best option. Schedule a free, no-obligation meeting today.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.