Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

The FBI estimates that more than $10 billion dollars were lost in 2022 due to cyber related crimes.

It has never been more important to keep yourself safe online, but it is becoming harder and harder to prevent your personal information from falling into the wrong hands. Here’s 4 tips to help keep your online investment and banking accounts secure:

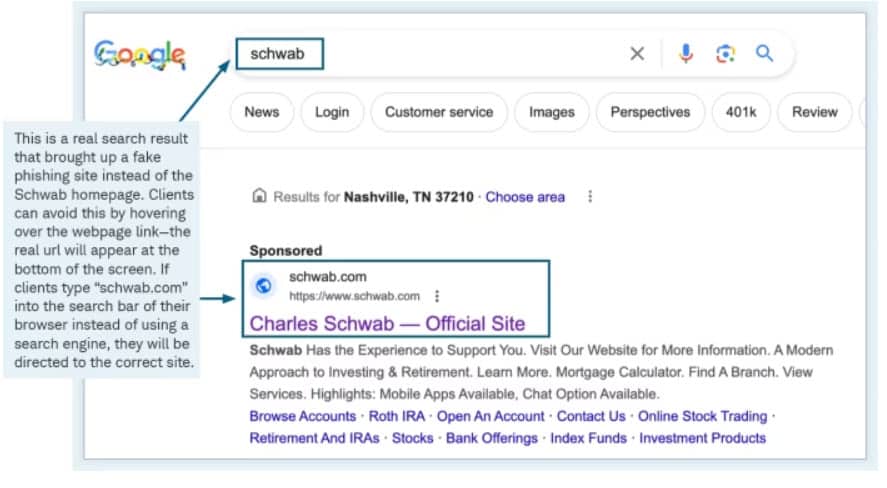

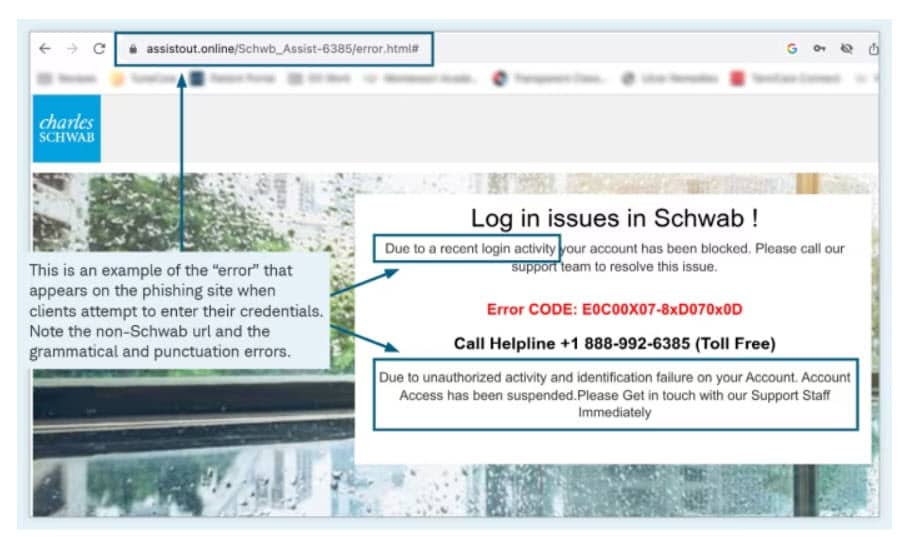

Scammers are using search engine optimization (SEO) to create fake websites that appear in search results for trusted institutions like Schwab. When you visit these sites, you are exposed to phishing attacks aimed at stealing your information and assets.

To help fight these schemes, you should avoid using Google, Safari, and Firefox to search for Schwab or other important websites. Instead, type the known website in your browser—for example, www.schwaballiance.com—or use the Schwab Mobile app. You can also save all of their favorite websites’ correct addresses to their browser’s bookmarks.

Be sure to promptly report any issues like this to us, or Schwab Alliance at 800-515-2157.

These tools help you generate secure, complex passwords, and help make it easy for you to remember them.

Popular examples are LastPass, Dashlane, 1Password, Keeper, and there are many more. These have the same general function in creating secure passwords for you, and then automatically filling in the login information for you.

This makes sure you are using secure passwords, but makes it much easier for you to log into accounts without having to remember complex passwords.

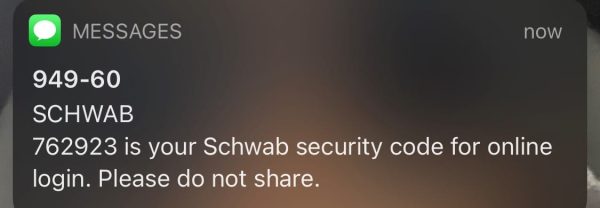

This adds an additional layer of security to your accounts, and is critical to have on your more sensitive accounts such as bank accounts, and investment accounts. With MFA set up, even if someone has your password, they won’t be able to get into your account.

MFAs work by requiring you to enter a code that is texted to your phone when you try and log in. For example, with MFA set up on your Charles Schwab investment account, you will receive a text message like this when you log in.

You will be prompted to enter that code on your computer.

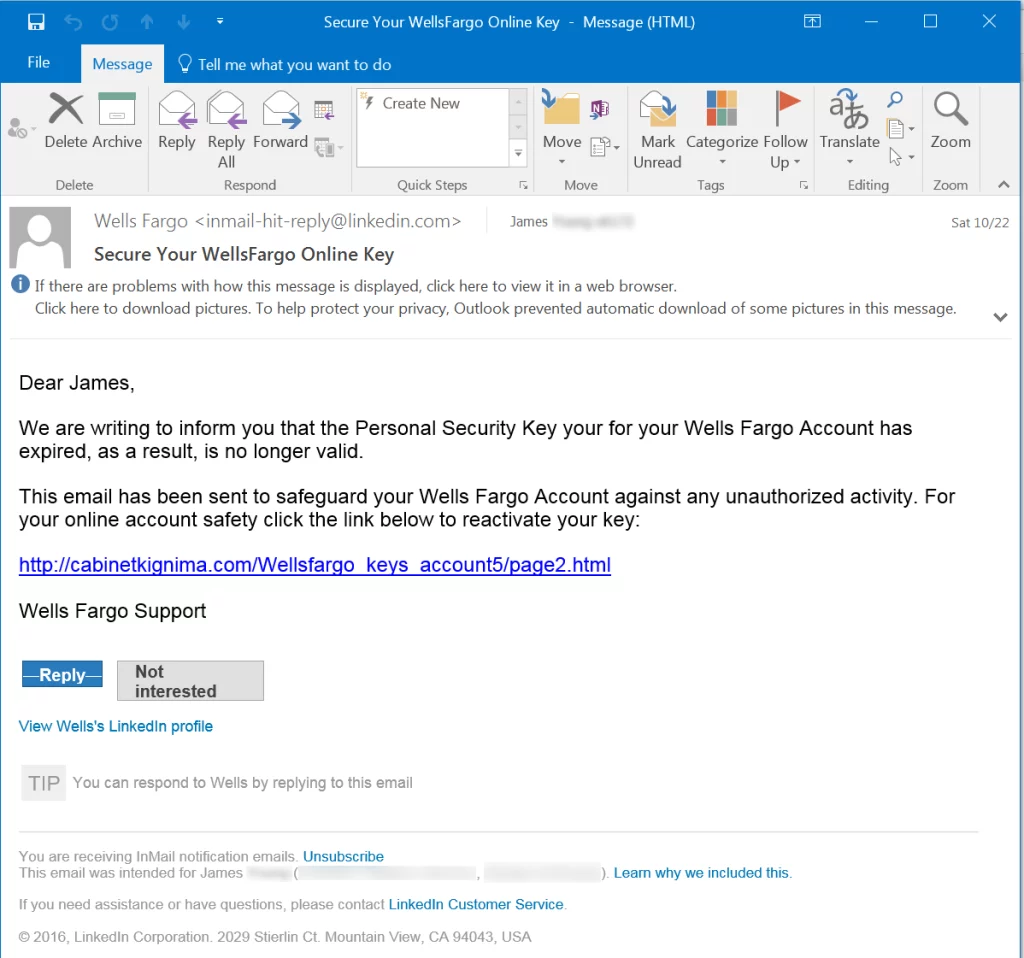

Make sure you know who is sending the email before you click any links. It is very easy to disguise an email to appear to be from a large company. Most common are messages pretending to be from a bank, Amazon, Apple, or Norton Security. Never click links in emails that are suspicious and never call the number listed in the email. Always use an independent source to verify the phone number.

Always call to verify the email is real if you are in doubt.

We have previously done a longer webinar on cybersecurity and feature specific examples of some of the most common scams, here: