Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Successfully appealing Medicare’s IRMAA surcharge can save a retired couple thousands of dollars in annual Medicare costs.

However, there are strict requirements for when you can and cannot appeal the Income Related Monthly Adjustment Amount. This post will discuss how to appeal Medicare’s added surcharge. If you are not sure why you are being charged an extra tax on your Medicare Part B and Part D premiums – See our blog post here for the basics on Medicare’s IRMAA income related surcharge.

If you have experienced a significant drop in income, or expect to in the next year – did you know that this can impact how much you pay for Medicare? It can, Medicare looks 2 year back at your income to determine what you should be paying for your premiums.

For a lot of our clients, we find that when they go through a life event such as retiring, a change in job, or a death of a spouse, your income will drop. And that should change the amount that you pay for Medicare.

Because of the 2 year lookback on Medicare’s calculation of your part B and Part D premium, under certain situations, this income may be much higher than what you are currently making now.

If you meet the criteria (more on that below), you can file an appeal with Medicare to get your premiums lowered. This is a SSA-44 form.

The form has several steps:

First, you must select your qualifying “life changing event”. The reason for your appeal must be one of the following:

Then, you will need to provide your past AGI (Adjusted Gross Income) and tax-free interest (generally, municipal bond interest). Then finally, provide what you expect your new lower income will be.

Lastly, you will be required to provide proof of your life changing event. This may be a marriage certificate, a death certificate, separation from work letter, or severance offer letter for example.

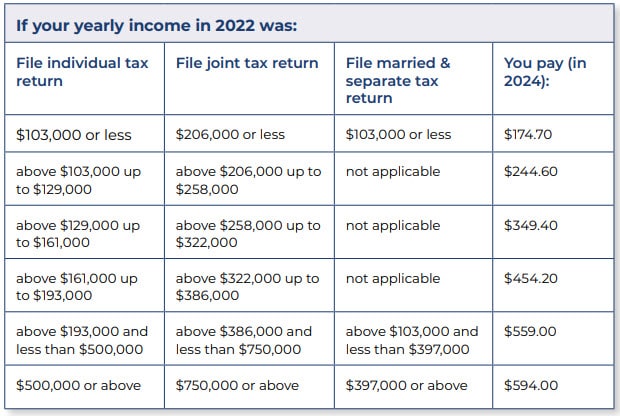

Your potential savings will depend on your income reduction and marital status. Also note that the Medicare IRMAA brackets and surcharge amounts change every year.

For example, lets say in 2022 you were married and you earned $259,000. Now, as 2024 comes around, you have retired and expect your 2024 will be less than $206,000.

The Social Security Administration will likely send you a notice in early 2024 that your 2022 incomes triggers an Income Related Monthly Adjustment Amount for each spouse. In this example, that surcharge would be an additional $174.70 per month, per spouse. In total, this couple will be asked to pay an additional $4,192.80 for Medicare Part B. (There will also be a small surcharge to Part D prescription Drug plans as well).

Because a stoppage of work is a qualifying event, you are eligible to appeal this. If your appeal is successful, Medicare will reduce your future Part B and D premiums, and retroactively pay back previous Medicare surcharges you paid in the year.

Are you impacted by Medicare IRMAA surcharge? While appealing can fix this year’s impact, if you are impacted once it may be likely you are impacted again.

At Arnold and Mote Wealth Management we help our clients through the Medicare IRMAA appeal process, and also create long term retirement withdrawal plans to avoid this in the future. For more, see our blog post here: Calculating and Avoiding Medicare’s IRMAA

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.