Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Gold and silver are among the most storied investments throughout history. Perhaps no other investment brings as strong of opinions and emotions that investing in gold and silver.

And especially with headlines recently on rising inflation, gold investing has been on people’s minds.

But, for those of you where we manage your investments, you know that Gold, silver, or any other commodity really, is not part of our normal recommended portfolios.

In this webinar, we talked about how gold and silver have performed historically compared to other investments, why we don’t use gold as a default investment for clients, But we also looked at the different options you have to buy gold and silver if you want to do it. Because in our opinion, there are certainly good ways to buy and invest in gold, and bad ways.

Without a doubt, the most common reason for investing in gold or silver is that these commodities supposedly represent a safe store of value. There’s no real definition for what that means, but you see it repeated over and over again.

Gold and silver are always commended for being a store of value. These are just a few headlines that have been up recently.

And I think this is a pretty common viewpoint if you asked anyone on the street – that gold and silver would be considered a safe store of value.

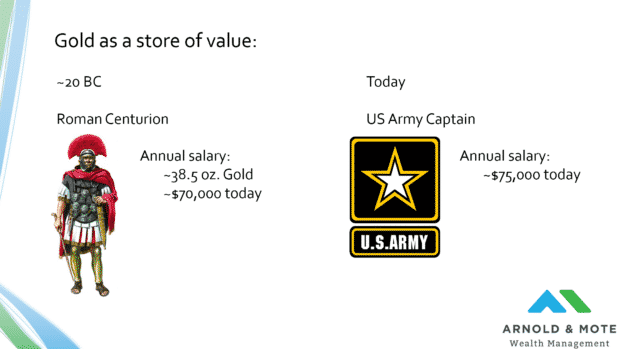

And over really long periods of time – this has certainly been the case.

We know this because gold has been a form of currency for at least a few thousand years and there is a lot of documentation about costs of items, or salaries for certain jobs.

And just for example, it is pretty well documented that during the reign of the Roman emperor Augustus around 20 BC, a Centurion, which was one of the highest ranking members of the Roman army on the actual battlefield, had a salary in coins that totaled about 38 and a half ounces of gold. Today, with the price of gold at just over $1,800 per ounce, 38 and a half ounces of gold is equal to about $70,000.

And if we look today, a Captain in the US Army has pretty similar responsibilities, and depending on their rank has a salary between $72,000 and $79,000. So, pretty darn consistent after a little more than 2000 years.

And there’s a few more examples similar to this one. The price of a loaf of bread in 500 BC, or the price of a toga for Roman politicians. Gold has purchased about the same amount of bread and clothing over the last 2500 years.

So, it is certainly true that gold has done a good job of maintaining purchasing power over the last 2500 years or so.

The problem with all these examples, is that a lot of people think that since gold has maintained purchasing over the last 2500 years, that it does over shorter term periods too.

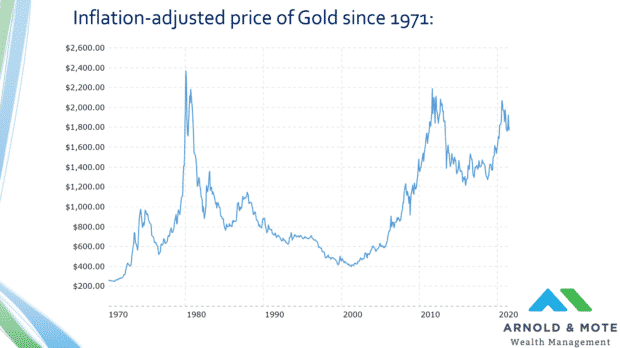

And that is the first problem that I see when I hear gold described as a store of value. Because the last 50 years, the time period since the price of gold was free from its fixed price in dollars, gold has been anything but a safe, stable asset.

This is a chart of the price of gold over the last 50 years that has been adjusted for inflation. In other words, the price is all in today’s dollars.

And the first thing to notice is that there are some pretty big swings. Increases in value are good of course if you own gold. But 60% declines in the early 80s, or 50% declines in the 20-teens is hardly the performance of something that you would consider a safe store of value over the short term.

Also worth noting, Gold has yet to get back to its inflation adjusted peak in 1980. Looking at a 41 year history of being underwater, and if you compare that to the stock market. Even an investor who bought in September of 1929, right before the great depression did not fare nearly this bad as an investor who bought gold’s peak 50 years later.

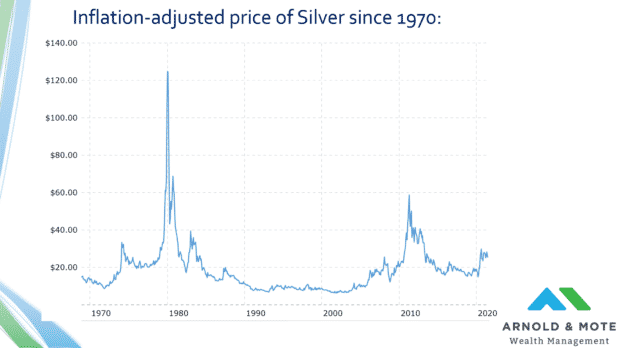

And if you are curious, Silver’s chart doesn’t look much better.

This is a chart of Silver’s price per ounce adjusted for inflation. It is a little hard to tell with this chart since the y-axis gets a little stretched out because Silver’s peak in 1980 was so much higher from the Hunt brothers corner or attempted corner of the Silver market.

But in general Silver has been almost exactly twice as volatile as gold based on standard deviation.

My only point with those last couple charts was just to show that over short periods of time, gold and silver are very volatile. In fact, more volatile than the general stock market.

And so, if you want an investment to keep your money safe over a short period of time, say a couple years, gold may actually be a poor choice.

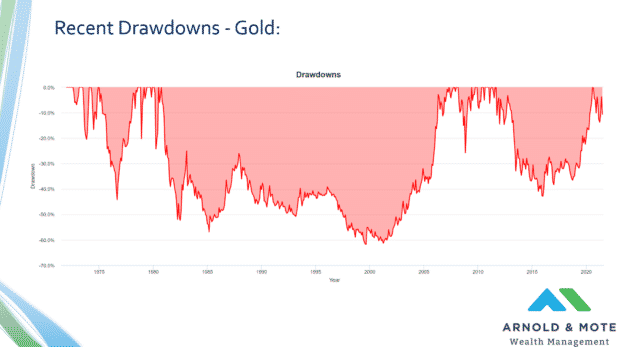

This chart just highlights the drawdowns in the price of gold from the previous chart. These drawdowns are not adjusted for inflation, but you will still see a few separate decade long periods where gold was underwater in the last 50 years, and some pretty steep declines during those times. 50% drop in the mid 70s, 60 percent drop in the 2000s, and a 40% drop around 2015 just to highlight the worst ones.

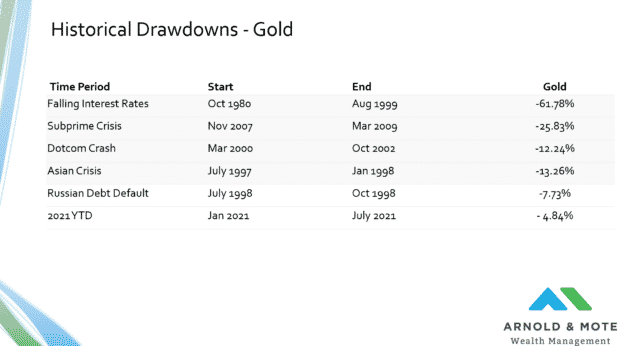

And what I think I find most interesting is when some of these drawdowns occurred. This is a table of how gold performed during some notable times of stress in our economy.

Most interesting I think is the second row here, the subprime crisis. During a time when our country was literally seeing bank runs and the failure of some really large banks and financial institutions like Wachovia, Lehman Brothers, Bear Sterns, for example. Gold fell more than 25%.

Maybe its just me, but I would think gold would be a pretty good investment if you are worried about the US financial system falling apart. But it turns out cash would have been much better.

A few of these other events were periods that saw stress on other major world economies, not necessarily the US.

The Russia debt crisis saw Russia literally default on its debt, and saw triple digit inflation for the country, the Asian crisis saw a lot of Southeast Asian countries come close to going bankrupt and was actually responsible for the US stock market circuit breakers triggering for the first time in history. So, there was a lot of panic here around that too. And you can see from the table, gold was still hardly a great store of value over these periods.

Then the last line I threw in there only because of the recent inflation headlines. And while a 5% drop in gold is not necessarily significant, the fact that its coming at a time when inflation is rising a little over 5%, is interesting I think.

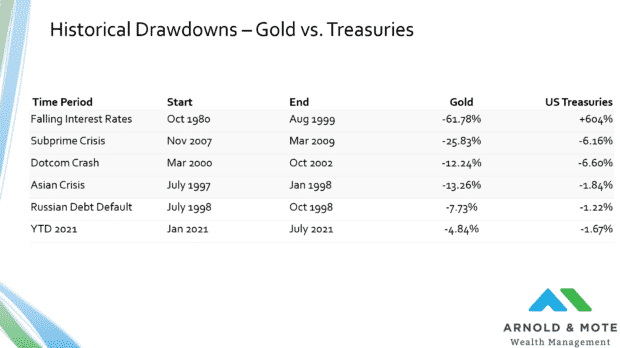

Now, I added a column to represent US Treasuries, an asset that we use in client portfolios for safety and to diversify from stocks.

And I won’t go through line by line here, but although treasuries have hardly been immune from any decline, they have had much less volatility than gold.

And so I think this is pretty significant. Everyone talks about gold or silver as stores of value. And here are at least 4 of the worst economic stresses across the globe in the last couple decades, and not only has gold not been that stable during these periods, it has seen some pretty steep declines.

If you want an asset that has historically maintained your purchasing power over short periods of stress. US Treasuries have done a much better job.

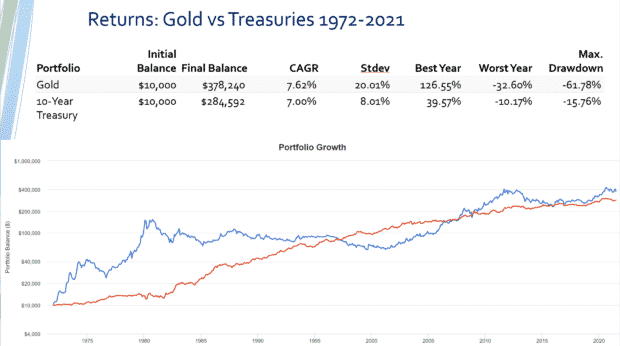

We are going to get into long term discussion in the next couple slides. But I just wanted to put this in here to show the long term impact if you used treasuries as your safe investment, instead of gold.

While gold has outperformed by about half a percent per year, you had to weather some pretty big moves up and down.

Specifically, look at the differences in max drawdowns over this period. If gold is going to make up a significant part of your portfolio – you know its not unusual for a retiree to have 30 or 40% treasuries – if gold was 30 – 40% of your portfolio and it fell 60%. That’s pretty scary.

So when I look at this, if I have to pick one of these assets to be the safe part of my portfolio, it’s a pretty easy choice. A little less return, but way more protection of the value of your investment.

Today, gold is being discussed because of the rise in inflation.

And, as we already showed, over 2000 year periods gold has kept up with inflation. But, that hardly means that it does over shorter periods of time.

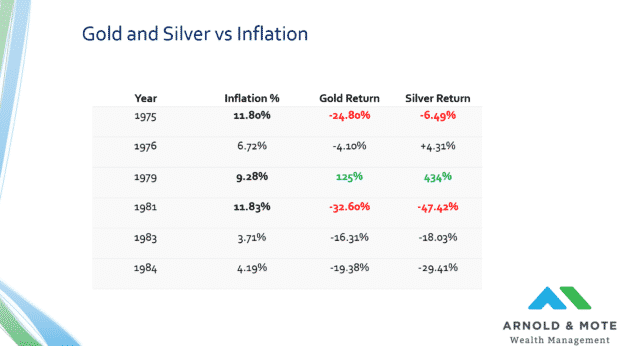

This table here shows how gold and silver performed during many of the high inflation years of the 70s and early 80s.

Don’t get me wrong, there were years in the 70s where gold did very, very well.

But, it is hardly a given that if there is inflation, gold and silver perform well. 1979 in particular is just about solely responsible for being the reason that we think gold and silver always do well during inflationary times. These 100 or 400% gains really mess with the averages. But If you take any single year in isolation, there’s no correlation between the return of gold and the rate of inflation.

We showed that over short periods of time, gold is very volatile that makes it tough to be considered a safe store of value in the short term.

But what about the long term? If you are fine with the volatility of gold, and don’t need it to protect the value of your investment over short term periods – does it still have a place in your portfolio for its long term returns?

To start to think about that, I thought about what you could do if you were holding a lot of gold over a long term period, and how it would compare to other potential assets you could buy instead.

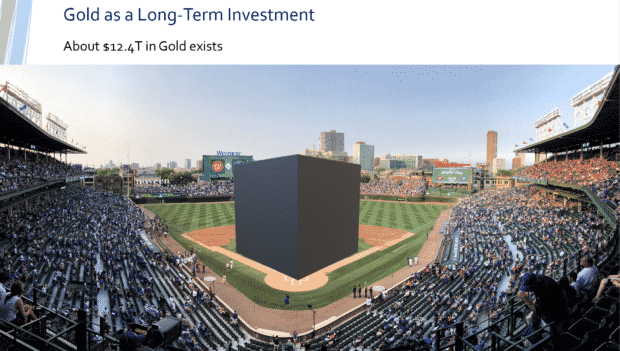

This is Wrigley field, home of the Chicago cubs. And even if you haven’t been here specifically, most people are pretty familiar with the relative size of a baseball field.

And if you bought every ounce of gold in existence today and melted it down and put it in a giant cube, you’d have a cube of gold that measures about 70 feet on each edge. To put that in perspective, here is what it would look like on the pitchers mound at Wrigley field.

This gold would be worth about $12.4 trillion dollars. A lot of money, and no doubt it would be great to have that amount of gold.

But if you were concerned about the long term growth of your investments. Think for a second about what this cube of gold would do.

It is what we would call a “non-productive asset”.

And that’s a big difference from the types of assets that are in our client portfolios for long term savings.

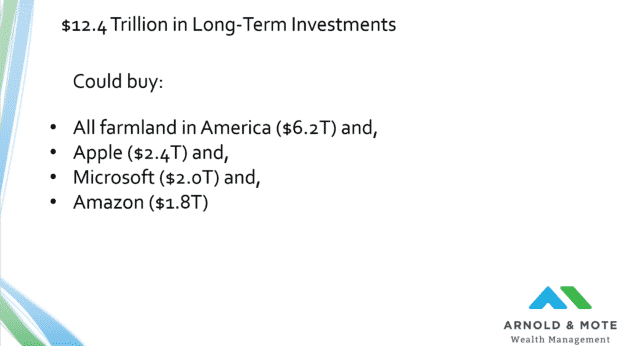

If instead you wanted to put that $12.4 trillion into other assets, here’s what you could buy:

I think this is interesting in its own respect. But what is really interesting is what an investment in these assets would produce compared to our golden cube.

When you are investing for the long term, you want an asset than can compound your growth to get really great long term results. And these productive assets would give you the opportunity to do just that.

Remember our gold cube would just sit there. It doesn’t pay dividends, it doesn’t reinvest in itself, it doesn’t produce anything.

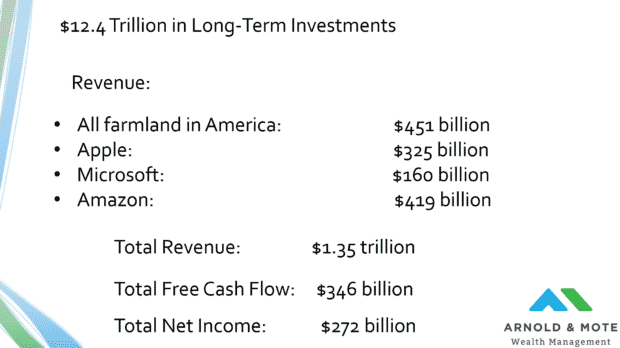

Compare that to these assets here. If you instead spent your money on these assets, the farmland would sell about $450 billion in product during a year, Apple sells about $325 billion in phones, airpods, and other products, Microsoft gets about $160 billion, and Amazon gets about $419 billion.

That is $1.35 trillion dollars that would get sent to you if you owned these assets compared to the gold cube. And there’s lots of ways to value assets, some people look at cash that is produced, or maybe net income – what is left after every employee is paid, tractor is purchased, etc.

And that would result in over 1 quarter of a trillion dollars in your pocket in just one year. You still have all the assets, plus now you have a quarter trillion to reinvest in something else, to buy another business, or whatever you want to do.

And this difference in owning productive assets doesn’t really show up in any single year. But over long periods of time, these productive assets do something that Gold or other commodities really just can’t do – compound your savings.

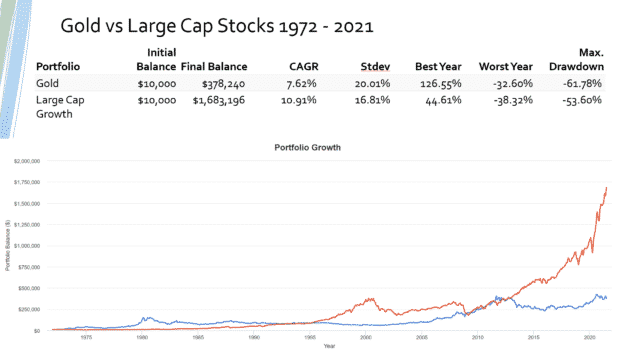

This chart here shows the long term growth of an equal investment in gold compared to a diversified basked of large cap growth stocks, like Apple, Amazon, and Microsoft.

And what you see is that over time, gold has no way to compete with an asset that gives you this reinvestment potential. This exponential rise at the end of this chart is compounding working its magic, and is why investments like stocks can make such great long term investments.

And so, just to summarize:

We believe gold is too volatile to be considered a safe store of value over shorter time periods. Things like cash, and US Treasuries have been much better at protecting the value of your investment over short periods of time, even during really high economic stress.

And then, if you want to invest in something with a multi-decade long time horizon, productive assets like stocks have performed much, much better.

And we have a lot of history on this by the way. Just looking at the US stock market alone gives us nearly 200 years of history. And if you look back further, Amsterdam had a stock market in the 1500s, and the returns that we have experienced in our lives is not out of the ordinary of the last 500 years.

So, if you really want to put your investments in something for the long term, its just really tough to beat the long term performance of the stock market.

Lastly, real quick on how to invest in gold and silver. Those last few slides we tried to show why we don’t believe gold, silver, and other commodities really deserve a big allocation to your portfolio.

That said, we completely understand the desire to have some amount in gold. And if it makes you feel better knowing you have something tucked away in gold, then its good to do.

(And, if you want to honestly know, Quinn and I both have a gold coin or two that we have purchased in the past that we continue to hold on to. Its not a significant holding by any means, but I can only speak for myself here, it is fun to have a few pieces or historical coins or the like.)

And I think that’s the big benefit of owning gold in physical form if you are going to own it. You have it, you can see it, you know its there.

But that can come with some headaches if you build up a good amount of gold. Storage is one thing to consider, maybe just a safe, you might want to insure it in case it is lost, or stolen.

And then liquidity can eventually be a problem when you want to sell. I can tell you that I probably would have sold my 2 gold coins by now, but its hard to sell a small amount of gold anywhere near the spot price that you see in the news.

If I send this to a big broker, I have to mail it, they have to examine it and verify its real, then send me a check. It takes about 2 weeks if you use a site like APMEX, and they have pretty high minimums.

If you have a small amount you want to sell, be prepared to take a low offer for that gold.

And the one warning we have here is about investing in physical gold in what is called a self-directed IRA. These are the ads you see on TV about owning gold with your IRA. If you want to own physical gold with money that is in an IRA, you need to open an IRA at one of these gold custodians, send your money there and they hold onto the gold. If you want it in your home, it counts as an IRA distribution.

And that also means that rules around IRAs like RMDs, or required minimum distributions, apply to gold holdings too. Every year you will still have to sell that physical gold, and of course pay their fees and accept their low asking price for your gold.

So, if you can avoid it, I don’t think owning physical gold with your IRA is the best idea. There’s lots of fees and just general inconveniences.

If you want to own gold in your investment accounts and don’t mind not being able to physically see and touch it, there are options.

Listed here are a couple of the most popular gold and silver ETFs that you can buy in any of your investment accounts.

The big pro here is that you have the liquidity of the stock market. You can sell just about any amount of gold or silver in a second at a price very close to the actual spot market price.

The downsides with this is that there are a bit higher expenses. The fees range all over the place, but expect to pay a little under half a percent per year for storage, security, and admin work to run the funds.

And of course, with this way of buying gold and silver, there’s no way to have possession. These funds do actually own gold and silver that is held away at a vault, but you can’t get your hands on it even if you want to. All you can do is sell the shares and get cash.

Although there are still a few cons on the list. If you are talking about a larger investment in gold or silver, or want to use IRA money to make the investments, to me this seems like an easy way to get exposure to the price of these commodities.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.