Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

College planning is much more than just saving in a 529 account. If you have a child nearing college age, saving in a 529 over the last decade or more was obviously very important

But we are not going to talk today about the benefit of saving in 529s today, instead we are going to talk about how you can now use those assets that you have saved in combination with the multiple tax credits and deductions that are available, to take full advantage of the tax free growth your 529 provided, along with other tax benefits.

Below is a replay of a webinar we did for clients in the fall of 2020 about how to use all the options available to help you pay for college and develop a plan to pay for college that uses a 529 account, and also takes advantage of the tax credits and deductions that are available.

Please note: This webinar and the following content was produced in 2020. As tax laws change, you should verify that any/all tax credits and deductions are still available.

As we were putting this together, we realized this is very much like retirement planning. For a long time you are concerned with saving and putting money away. Then, one day the switch flips and you are now taking money out.

This switch introduces you to a whole different set of things to consider, that you probably have not thought about before. There is income tax considerations, withdrawal strategies, tax planning around your different investment accounts, There’s really a lot more to consider, and the same things happens with college planning.

There is so much more to do than just pulling some amount of dollars out of your 529 this year. Here, we hope to show you the value in develping a plan to get this done in the best way, that results in the least amount of money out of your pocket.

Financial planning is very specific to the individual or household. What works and is best for you may very well not be best for someone else.

And college planning is no different. In fact I think it might be as complicated as any other tax planning strategy. The IRS has a publication, publication 970 that is only on the tax benefits of education expenses just that and nothing else, and it is 93 pages long.

On top of that every household has different amounts of savings, and types of savings like 529, taxable brokerage account, or savings bonds. And every household has different income and income sources.

So, it is impossible to make a webinar that will be exactly right for you. But what we hope is that this shows you some possibilities and options you have not considered, and that you come to us to help craft a specific plan for you.

We are starting with planning around your 529 account because these are far and away the most popular way to save for college. If you have a 529 Account that you have been saving in, now is the time to use it.

As you probably remember, you likely received a small state tax deduction for contributing to these accounts, and they have been growing tax free for as long as you have been saving in them. Now, you get the third benefit – Money comes out tax free as long as it is used for qualified education expenses.

What exactly is a qualified expense?

The IRS defines it as expenses that are required for enrollment or attendance. Tuition is the big one here, there are other odds and end books are another cost that counts. But for most, making that tuition payment is going to be the big check you write each year.

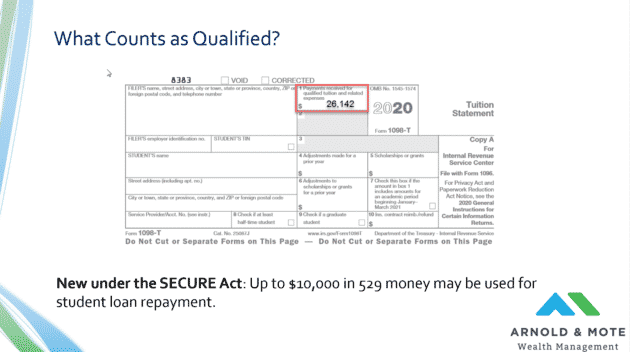

But, how do you know for sure what is considered qualified?

Most of the time, determining the majority of qualified expenses is easy. Come tax time you will be given a 1098-T, which outlines the amount of qualified expenses you paid. Although there could be exceptions or other items, this is a good place to start.

This is something that is important to go through with your advisor or college to make sure you know what is qualified and what is not.

And, like any other time you are trying to plan around the tax law, know that things can always change. New in the last year was a big change for those with 529 accounts – Now, up to $10,000 in 529 assets can be used after graduation to pay for student loans.

So, we will talk about this in a specific example later…but this opened up another strategy for college planning that did not exist previously. Now, you can use 529 assets well beyond just the 4 years you are in college. And, you now have extra time for assets to grow and compound tax free.

But, one important caveat before we go along. We will be using the term qualified education expense a few times in the next few slides.

But depending what tax benefit we are talking about, what counts as a qualified education expense is different.

Now, this is not us that are making this confusing. This Is a quote copied and pasted right from the IRS. And if you read it, notice it says that what counts as a qualified expense for some tax breaks, does not necessarily count as a qualified expense for others.

For example, room and board may count as qualified if you use a 529, but it is not qualified if you are trying to take advantage of tax free US savings bonds, or the American Opportunity Credit, or the Lifetime Learning Credit.

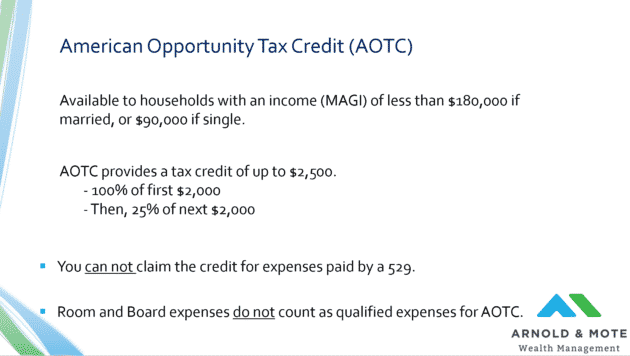

If you are paying for college, the primary benefit you want to look at is the American Opportunity Tax Credit. This is available for married households with a MAGI, or modified adjusted gross income under $180,000, or half that for single households.

The credit is available for only 4 years for each taxpayer. So if your son or daughter goes to school for 5 years, or does graduate school you can only claim this credit for 4 of those years.

The credit gives you a dollar for dollar tax credit for the first $2,000 in qualified education expenses that you pay. That means if you write the university of Iowa a check for $2,000 next year for tuition, the government will give you $2,000 back as a tax credit when you do your taxes the following year. So, this is very valuable.

It can provide up to $2,500 dollars, but you need to spend an additional $2,000 to get that last $500 in credit.

So in total, you can receive the full $2,500 credit if you have $4,000 in higher education expenses, which if you are paying tuition at most schools, you are going to have.

Now an important point. You can not claim this credit if you pay all of your qualified education expenses with a 529. And maybe now you can start to see a planning strategy open up here. Even if you have the assets in a 529 to fully pay for a year of school…you might not want to. Because if you pay $2,000 out of pocket, the government will give you $2,000 right back.

Let’s look at a specific example:

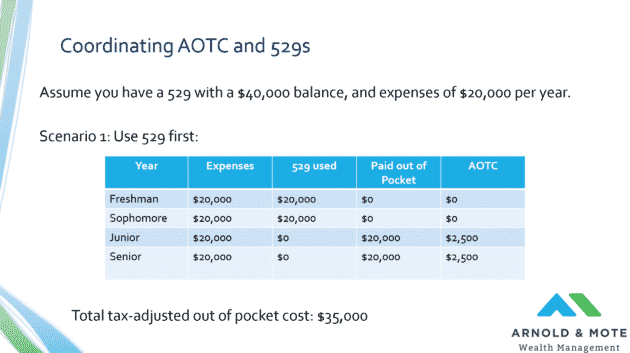

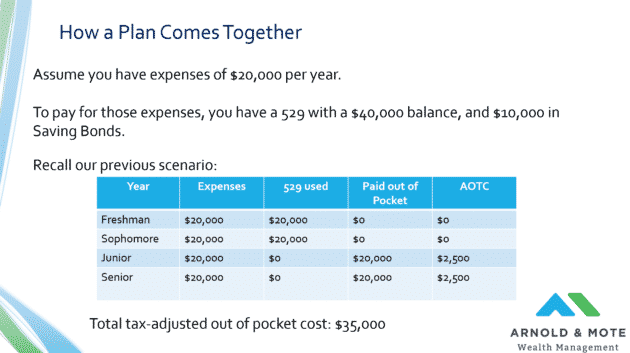

For an example, lets consider a family that has done very well saving for college. They have $40,000 in a 529 account. Now their child is in college, and they will have qualified education expenses of $20,000 per year.

How should they pay for school?

Well, its not hard to image a family eager to not have a tuition bill for a couple of years and relying solely on that 529 to pay for the first 2 years of expenses. That is what we are showing in the table here/ For years 1 and 2, the family pays nothing out of pocket, and uses the 529 for everything.

They think this is great because they don’t have any bills. But look at this far right column. Because they paid no out of pocket expenses, they can’t claim the American Opportunity Tax Credit.

Then, in the last 2 years, they are stuck paying everything out of pocket. Now they get the AOTC.

In total, this household pays $35,000 for school. They pay $40,000, but get a total of $5,000 back from in tax credits.

And it is important to note here, out-of-pocket here can of course mean just out of you’re your free cash flow, but it can also mean money from student loans, or penalty free retirement account distributions. So, if you are like most households who will rely at least partially on loans, this strategy is still available to you.

Let’s look instead at what would happen if this family spread out their 529s, and paid some amount out of pocket each year.

In this example, our household is now only using $10,000 of their 529 each year. That means they have to pay $10,000 out of pocket each year, but it also means that because they are paying out of pocket, they qualify for the American Opportunity Tax Credit, and get $2,500 of that back.

This strategy allows them to effectively save $5,000 on their total college tuition costs, since they qualify for $2,500 tax credit 2 more years.

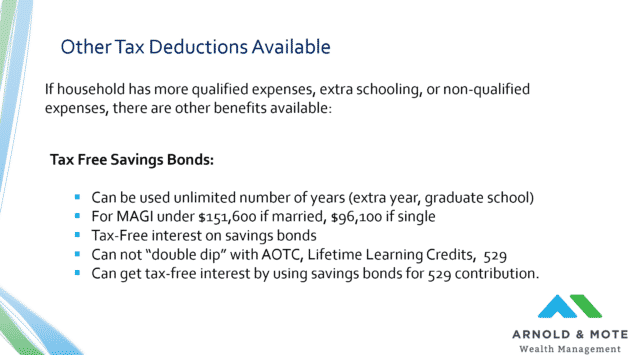

Besides AOTC, there are other benefits available that you want to know about in case you are not eligible for AOTC.

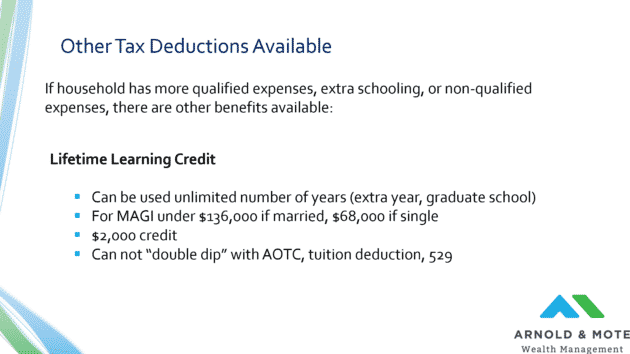

The first is Lifetime learning credit.

This can be used an unlimited number of times. So if you take an extra year to graduate, or go to graduate school, this is a tax credit you want to be aware of.

The income limits are lower, and the credit is a little less than the American Opportunity Credit, but it is still very useful for those that are eligible.

And, you will see this as a common theme as we go through a few other tax benefits, you can not double dip. That is, if you claim the AOTC, you can not also claim lifetime learning in the same year. If you claim lifetime learning credit, you can not deduct your tuition expenses, and if you pay for everything out of a 529, you can not claim the lifetime learning credit.

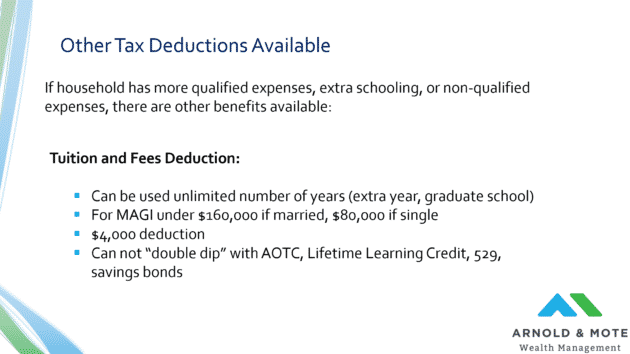

Another option is to simply deduct the tuition payments that you make.

This would be for those with too high of an income to qualify for lifetime learning credit most likely. Because this is available for households under $160,000 in AGI. And provides a $4,000 deduction.

With that income, you are up in the 22% tax bracket, so this deduction is worth about $880 for you.

And lastly Savings bonds have a few special rules. The popularity of savings bonds has gone away a bit, but if your kids are college age, you may have these lying around still, or maybe you planned ahead and bought them as a way to save for college.

If they are used for qualified education expenses, the interest that you earned on the bonds, which would normally be taxed at your federal tax rate, is eliminated. So, if you purchased $5,000 in savings bonds a while back that are worth $10,000 today, if you just cashed them out you would likely be subject to a little more than $1,000 in taxes depending on your other income. However, if you use them to pay for qualified education expenses – they are tax free. That saves you $1,000.

And, very interestingly, It is specifically written in the IRS publication that using the proceeds of a savings bond to contribute to a 529 is considered a qualified expense. So, you can get tax free growth and then a state income tax deduction on your 529 contribution.

And so, we’ve been over a few benefits, but how does all of this fit together for you to use to their maximum potential?

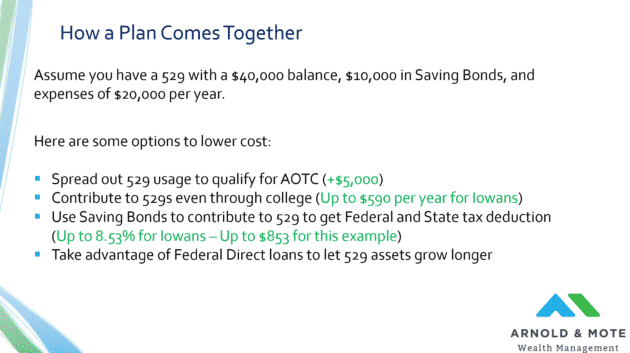

So remember our original example, where the family has expenses of $20,000 per year, and $40,000 in 529s. And now, we are adding some savings bonds to show how an additional layer of benefits fits in:

In our original example, this household ended up paying a tax-adjusted $35,000.

What can this household do to get the most bang out of their buck for savings?

Well we showed initially how simply spending the 529 out over 4 years instead of 2 years qualified them for an extra $5,000. What else can they do?

Another thing a lot of people don’t think about, you can continue to contribute to a 529 account even while your student is in college. There is no requirement for money to sit in a 529 for a set amount of time. You can deposit $5,000 on a Monday, take the state tax deduction, and pay tuition on Wednesday if you want. This opens up 4 more years of tax deductions for this household.

And, they can use the savings bonds. They can take advantage of the tax free interest to reduce their taxes by $1,000, and then contribute the proceeds to a 529 to get the state tax deduction.

And they can utilize Federal Direct student loans to help make the out of pocket payments as well. Remember, using loans still leave you eligible for American Opportunity Tax Credit. Remember that loans can be paid through a 529 account, so it could leave the assets in a 529 to grow and compound longer. And maybe most importantly, it can help you as a household be more comfortable paying. We have been assuming $10,000 per year out of pocket here, but that is not an easy thing to do. Loans could allow you to spread these payments out over several more years, take advantage of more benefits, like deducting student loan interest.

Student loans get a really bad name today because of how they can be irresponsibly used. But ultimately, a reasonable amount of loans combined with a college savings plan may not add significantly to your total cost and can certainly make your life less stressful.

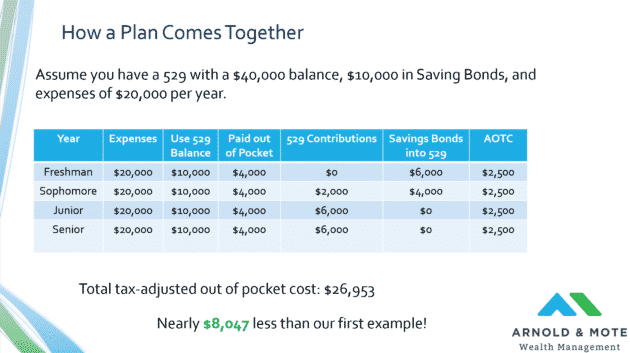

So what does this all look like?

I’ve added a few columns to the table below to show these added benefits and how they can be implemented. We’ve added 529 contributions, which are to show money paid into the 529 and then directly taken out to pay for tuition that year, and then we added savings bonds, which are cashed in and put directly into a 529 to get the state tax deduction.

So, notice that the 4 middle columns always total $20,000, just like our first example. But, by spreading out the money into different types of contributions and taking advantage of what is available for this sample client. Ultimately, their after-tax cost of college is under $27,000.

That is $8,000 less than our first example. Although we went through this fast, I hope this helps you realize the potential value in sitting down and thinking through a plan like this.

And that is why we are here.

This is what we help families do every year. There are a lot of things to juggle in a college plan, and we would love the opportunity to help you.

We at Arnold and Mote are a fee-only, fiduciary, independent financial advisor.

As Fee-Only, we don’t accept commissions on any product we recommend or suggest.

As Fiduciaries we are required to act in your best interests at all times.

We would love an opportunity to help you through this and create a college plan that is right for you.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.