Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

IRMAA is based on MAGI – calculated as your AGI plus tax-exempt interest, using only the taxable portion of Social Security.

Some income doesn’t count – Roth IRA withdrawals are excluded, making Roth conversions a powerful tool to reduce future surcharges.

Planning is essential – retirees with large pre-tax accounts can often save thousands by creating tax-efficient withdrawal and Roth conversion strategies.

Understanding the type of income that counts towards the IRMAA calculation is important because avoiding IRMAA can save you hundreds of dollars per month on each spouse’s monthly Medicare bill.

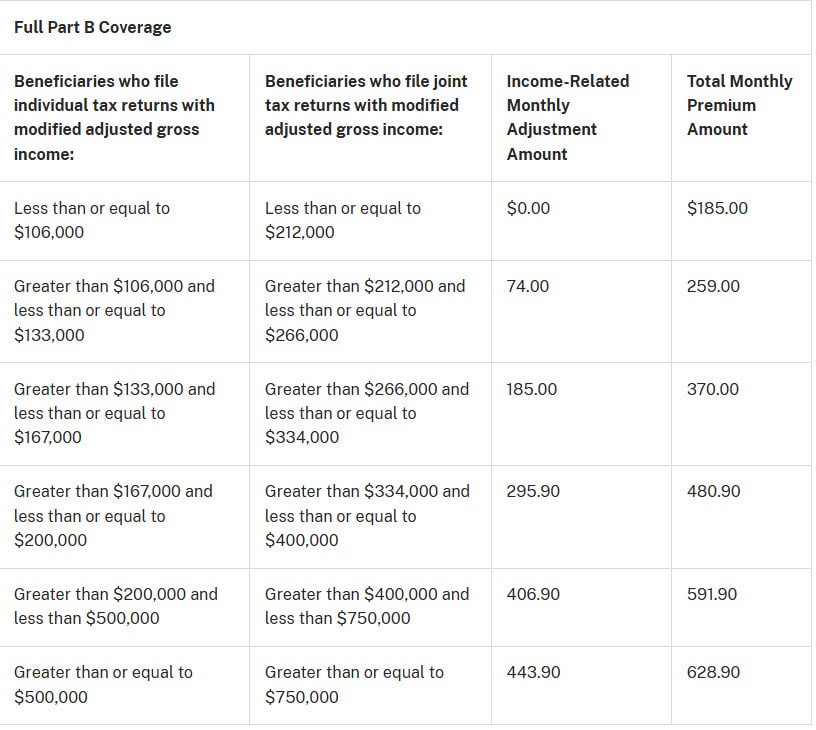

IRMAA, or the income-related monthly adjustment amount, is a surcharge to your monthly Medicare premium that is based on your income from two years prior. The impact of the surcharge varies and is dependent on your income.

The exact cost will vary each year, but for example in 2025 if you are single and your household income was between $167,000 and $200,000 in 2023 you would pay an additional $295.90 per month on top of the standard monthly rate for your Medicare part B, for a total of $480.90 per month!

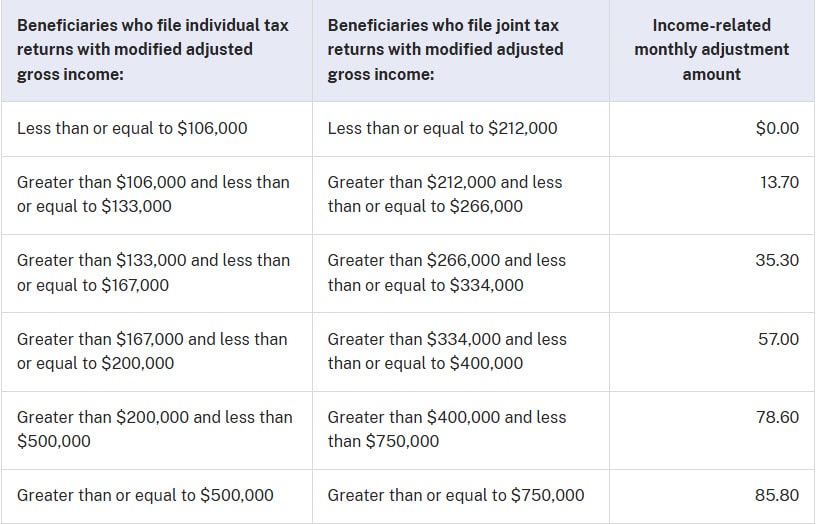

There is also an additional surcharge on the monthly premium for your Part D prescription drug coverage plan as well:

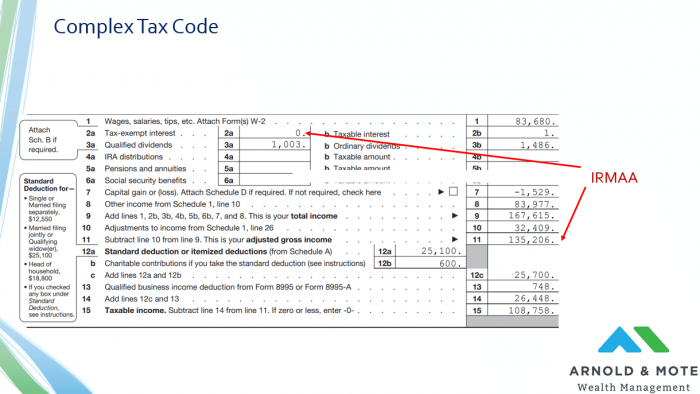

IRMAA is based on what is called your Modified Adjusted Gross Income, or MAGI.

This can be confusing to calculate or find because it is not a specific line item on your tax return.

To calculate MAGI for Medicare IRMAA, take your AGI and add tax-exempt interest.

AGI (Adjusted Gross Income) is the sum of all your income that is subject to tax – the most common sources for this for retirees is IRA withdrawals, capital gains, dividends, interest from CDs, and only the taxable portion of your social security. This total is a line item on your annual tax return.

Then add in the total of your non-taxable interest – This is usually any municipal bond income. The total of your AGI, plus non-taxable interest, is your MAGI for IRMAA purposes.

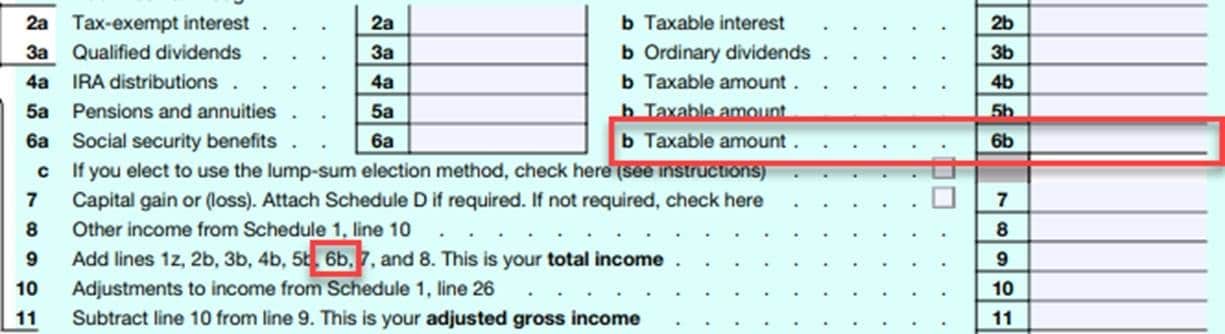

This is a common question, and one that is answered incorrectly on several prominent websites.

The calculation for IRMAA MAGI (Modified Adjusted Gross Income) includes just the taxable portion of Social Security. This comes from the Social Security Administration Handbook here, which states:

“Modified Adjusted Gross Income is the sum of:

AGI, and total income, is just based on the taxable portion of Social Security:

Just as important for retirees who are trying to avoid the IRMAA surcharge is understanding what types of income does not contribute to IRMAA.

The big one is withdrawals from Roth IRAs. Regardless of how much you take out from Roth IRAs, it is not taxable.

If you are like most Americans and a significant portion of your savings is in pre-tax retirement accounts like 401(k)s and traditional IRAs. Developing a plan to convert some of those assets to Roth accounts early in retirement can have huge benefits and help you avoid IRMAA in the future.

We help our clients develop Roth conversion plans, and tax efficient withdrawal plans in retirement to help insure their income in retirement does not unnecessarily trigger IRMAA, or any other added tax burdens in retirement.

While this applies to just about anyone. We find that those with $700,000 or more in pre-tax retirement accounts in particular can save a significant amount on taxes in their retirement with a proper plan.

We also have a post specifically on Appealing the Medicare Surcharge that may be of interest. This appeal process is only available to those who have certain life-changing events, such as retirement/work stoppage, loss of an income producing property, death of a spouse, and a few others.

We find that more often than not, those that are subject to this additional premium for Medicare will be impacted again.

We are a flat fee, fee-only, independent financial advisor. That means we do not charge a percentage based fee to our clients based on their assets to create a financial plan and manage investments. Just one flat rate, whether you have $2 million or $10 million in assets.

We are also Fee-Only advisors, which means we do not collect commissions for any product we recommend.

If you’d like to see more about our retirement planning process, and how we can help you create a plan to save on taxes in your retirement, please reach out. Click below for more:

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.