Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

A new bill has resulted in many changes to retirement planning. RMD ages are changing, 529 accounts may not be rolled into Roth IRAs, you may be required to save into a Roth IRA if you are highly compensated, and more.

What changes will impact you and what are the planning opportunities around this new bill?

The recording below is a webinar we recently did for clients about the changes from the SECURE ACT 2.0. A transcript of the webinar is also posted below.

Have questions about the bill’s impact on your financial plan? Please schedule a free introductory meeting with us.

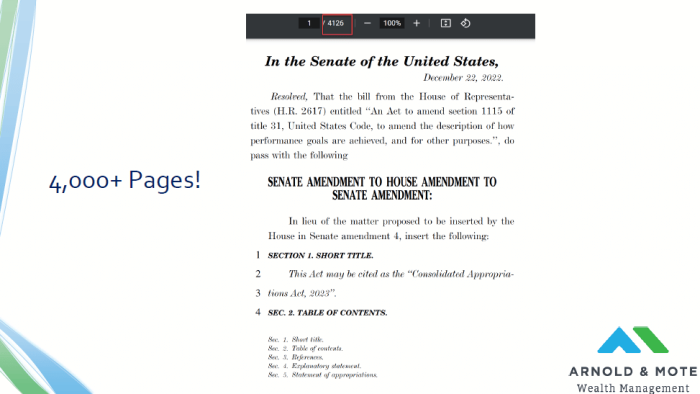

First of all, a disclaimer that has been at the start of many of our webinars covering new retirement related bills, and that is that these bills are massive. This one is more than 4,000 pages. Fun fact – I believe it is the second longest bill to ever be passed by Congress.

So, we can’t possibly cover everything here.

What we aim to do is highlight a few provisions that impact a majority of people. And then you’ll see we also have a couple slides at the end that quickly summarize big changes that only apply to perhaps fewer people but could be very significant for them, and we want to highlight these changes as a way to say – let’s talk about this in more detail in a future meeting.

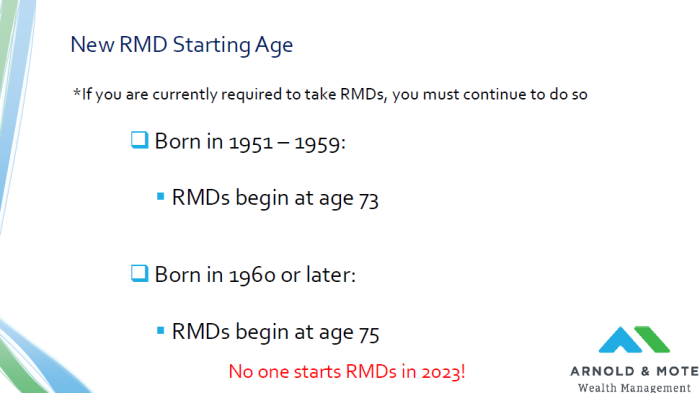

The part of this bill that has the biggest impact for our clients is a change in RMD or required minimum distribution ages.

Just as a reminder, this is the age when the government requires you to begin making withdrawals from your pre-tax retirement accounts. IRAs, 401(k)s, 403(b)s, etc.

First, know that if you are currently taking RMDs, there is no change. You will continue to be required to stay on the same schedule you are on. Secure Act 2.0’s rules on RMDs do not impact anyone already taking RMDs.

But, if you are not taking RMDs yet you are effected by this change.

If you were born in 1951 through 1959, you now begin RMDs at age 73.

And if you were born in 1960 or later, your RMD age is now 75.

So, either a bump back of 1 year or 3 years depending on when you were born. Remember that the RMD ages changed from 70.5 to 72 in 2019 from the SECURE Act.

This change also means no one starts RMDs in 2023.

What does the delaying of RMDs beginning mean for your financial plan?

It still means that Roth conversion will be incredibly valuable if you are in your 60s, and have a significant portion of your retirement in tax deferred accounts.

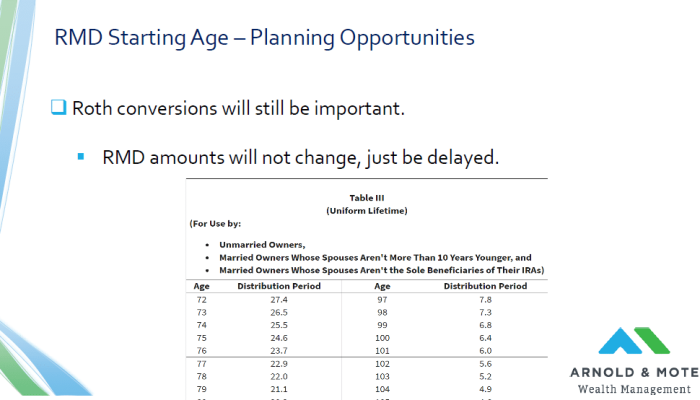

Although they bump back the starting age of RMDs, the percent of your account that you are required to take out at each age stays the same. That percent that your RMD is based off of comes from the IRS uniform lifetime table show here. This is not changed at all.

Maybe said another way, the amount that you previously had to take out at age 72 is not the amount that you now have to take out at 75. The amount you will need to take out at 75 is going to be higher. So, when RMDs start for you, it will be a bigger amount that you will have to take out now.

The beginning of RMDs is delayed, which a lot of people like, but it really does nothing to help retirees from eventually seeing really high tax rates that can be caused by RMDs later in retirement.

And in fact, this delay could make things worse if you do nothing because the assets can now continue to grow for a couple extra years and build up additional tax liability. So, if rising RMDs were going to be a problem for you, from a tax perspective, they still will be.

RMD Changes to Roth Conversion Plans

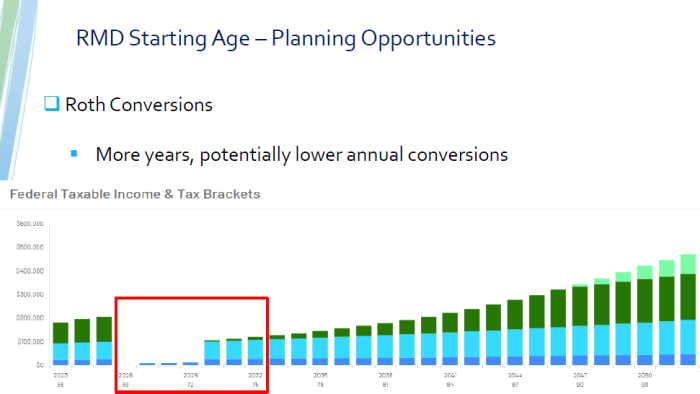

This new RMD age change buys you additional time to get money over into Roth accounts, though.

How this impacts you specifically is just going to depend on your situation of course. But, It may result in smaller annual Roth conversions amounts, but for a couple extra years just as an example.

But what we always try to take advantage of is the period of potentially lower income a retiree has between the time they retire, and then when Social Security and/or RMDs begin. That is shown in this chart here. Now, this period of potentially lower income is longer, giving those who are creating a plan additional years to get conversions done.

And it also gives additional retirees a few extra years to just use pre-tax money to pay for withdrawals for regular living expenses over this time too. For those that had smaller Roth conversions plans, it may mean that a modified withdrawal strategy is all that is needed now.

But, if you wait until into your mid 70s to do Roth conversions, this change may mean doing even more conversions since RMD have the potential to get bigger now if you don’t act early.

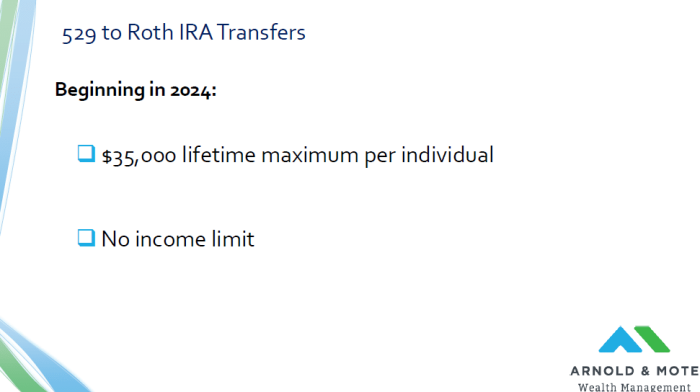

The other big change in this bill is the allowance to transfer money from a 529 college savings account into a Roth IRA beginning in 2024.

There’s a lot of fine print to this though, which we’ll cover in the next few slides. But, if you do everything right there is now the ability to transfer up to $35,000 in your lifetime from a 529 account to your Roth IRA.

That lifetime $35,000 limit is per person.

And, you can do this transfer regardless of your income. Recall that there is an income limit to be able to contribute to Roth IRAs. For 2023, single filers can not have income above $153,000. Married couples must be below $228,000 in order to be able to do a Roth IRA contribution.

This transfer can be done even if you make more than the IRS’s allowed limit.

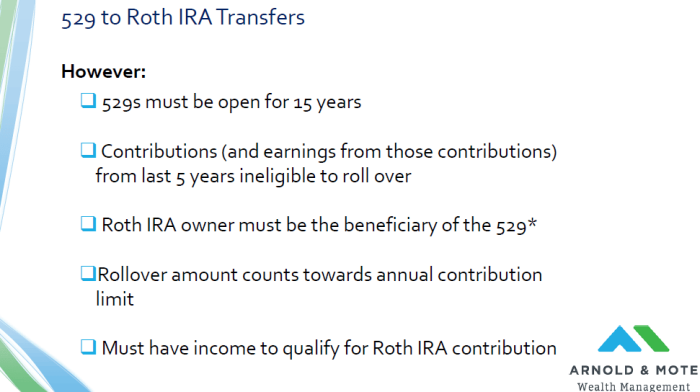

Here’s the fine print to be able to take advantage of this (I told you there was a lot of fine print, right?).

First, the 529 must have been opened for 15 years before you do the transfer to a Roth IRA. So for those of you that have old 529s open, this might be something you can take advantage of soon. But, if you don’t, then this is a very long term planning strategy.

Next, none of the amount you roll over from a 529 to a Roth IRA can be contributions, or earnings of those contributions, from the last 5 years. So again, even if you have an old 529 still open but there isn’t much for a balance, there is a 5 year hold of any contributions before they can come out and moved to a Roth.

Next, the owner of the Roth IRA must be the beneficiary of the 529. Most 529s are set up with a parent or grandparent as the owner and the child or grandchild as the beneficiary. That means the money can only go into the child or grandchild’s Roth IRA.

The asterisk is there because one of the benefits of 529 has always been that you can change the beneficiary of the account to certain family members without any tax impact. For example, if I have a 529 account with my son as a beneficiary but he doesn’t need the money, I can change the beneficiary to be my nephew, or even myself or my wife.

What’s not clear in this bill is if changing the beneficiary of a 529 impacts that 15 year clock. The IRS is going to have to offer guidance on that, and that could potentially have a big impact on how this works.

Then, any amount you roll over from a 529 counts towards your annual Roth IRA contribution limits. For 2024 if the annual Roth IRA contribution limit is $6,500, the most you can transfer from a 529 to a Roth IRA in that year would be $6,500. If the owner of the Roth IRA does a $1,000 contribution, then the most you can roll over from a 529 that year is then $5,500.

Lastly, the owner of the Roth IRA must have income to qualify them for Roth IRA contributions in the first place. So, you can’t use this technique to fund a Roth IRA for your 15 year old if they aren’t working and have income. You need to have income to make a Roth contribution, and therefore you need income to do a 529 to Roth IRA transfer.

This also impacts those within 15 years of their projected retirement date. For example, if you are 60 and want to use this to top of Roth retirement savings, and don’t have an existing 529, it will be 15 years before you can make the transfer. That means you’ll be 75, and if you don’t have any earned income at age 75, you won’t be able to do the transfer.

I think this last bullet point is the one that you really have to plan around.

So, lots of fine print there that we wanted to make sure we covered. But now, what opportunities does this open up for you exactly?

I see 3 main options:

First, with enough planning it will allow just about everyone to effectively be able to save more in your Roth IRA. Again, since there’s the long 15 year waiting period that has to be met, this might be a long term strategy. But, for those with extra cash flow in their 30s, 40s, or lower 50s for sure…and particularly if you have high income, you should consider taking advantage of this. This is $70,000 extra that a couple could get in their Roth IRAs – $35,000 for each spouse. That very advantageous for a younger household particularly.

What this was really meant to address was the concern that parents have about saving too much into 529s, or saving and then their kids end up not needing the money or not going to college. We don’t think this is nearly as big of an issue as many make it out to be, because there’s already a couple other options to help you in this situation. But, this is now another. So, hopefully you can more confidently save into a 529 now and if the money isn’t needed. Transfer back to your Roth IRA.

Or, this could just be a good way to help start kids or grandkids retirement savings. If you know your plan is in good shape, this is a way to effectively get a little more inheritance into a tax advantaged account for your heirs.

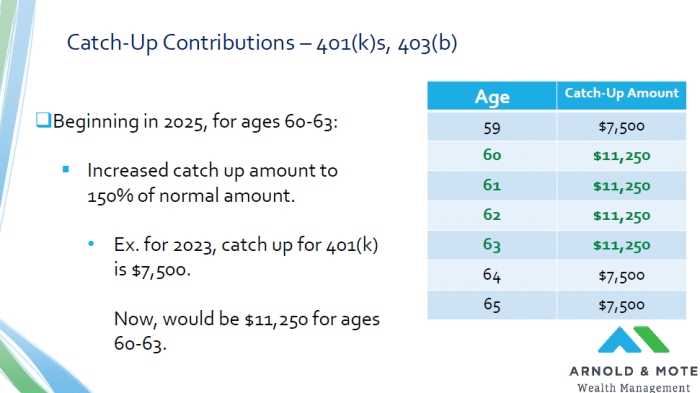

On to the next topic, there is a big increase in catch up contributions that you can make into employer retirement accounts. But it’s a bit strange and only available for a select few.

Just as a reminder, starting at age 50 you can contribute more to your 401(k) or 403(b) workplace retirement plan. For 2023 the amount anyone can do is $22,500. Then, if you are age 50 or older you are allowed to do an extra $7,500 for a total of $30,000.

Now, beginning in 2025 there will be an even higher catch up amount, that is only available if you are age 60, 61, 62, or 63.

If you are between age 60 and 63, your new catch up amount, again starting in 2025, will be 150% of the normal catch up amount.

So, If this was going into effect this year you’d get 150% of $7,500 or $11,250.

This seems a bit strange compared to what we are used to because your savings amount will drop back down at age 64 and beyond. But, I guess that’s the way its going to work from now on.

Your early 60s are now prime years to put more into a retirement plan now.

Being able to save more into a 401(k) is always a good thing, but there’s an even bigger change to catch up contributions.

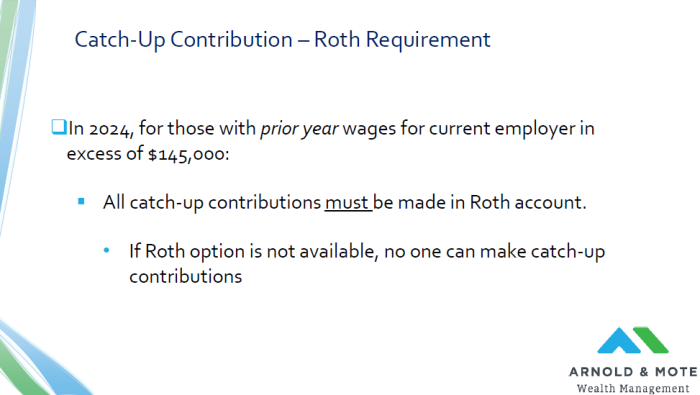

Starting next year, if your prior year taxable income with your current employer were in excess of $145,000 – All of your catchup contributions must be made into your Roth account. You will not be able to save your catch up contribution into a pre-tax account.

Your regular $22,500 amount can be pre-tax still, but the additional $7,500 or $11,250 will have to be Roth.

This won’t be a bad thing for a lot of people. Roth savings are very good to have. But for a few that are at very high levels of income late in their careers, or really want a lot of tax deductions or one reason or another, (for example, if a child is college age and you are keeping taxable income low to qualify for a tax credit like the American Opportunity Tax Credit), then you may not like this change since its going to force you to be taxed on that income when in the past you would have had the chance for up to a $30,000 deduction.

One aspect of it in case your current 401(k) doesn’t have a Roth option. If there is not a Roth option in the company’s 401k plan, then NO ONE in the company can make catch up contributions. So, I would think that this will be a change that pretty much ensures most companies add Roth 401(k) options, because a lot of highly compensated employees might be pretty upset if not.

And I should note, the income of your spouse doesn’t matter for this at all. It is solely based on individual income, which is a little unique as far as tax rules go. This could again create some interesting savings strategies for households where one spouse has high income in excess of $145,000, and the other spouse below that limit.

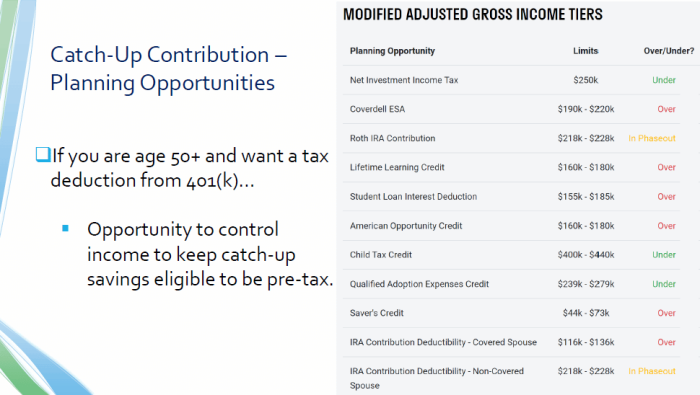

The specifics of this change add for some new tax planning opportunities for those who are age 49 and up. There could be some potential benefits to changing up savings strategies in order to get under that $145,000 limit.

That’s because that $145,000 limit is taxable income. So, just for example if you have $175,000 in gross wages, but max out a health savings account for your family, pay for health insurance, and max out your 401(k) with pre-tax contributions, you will be under that limit and now able to do a catch up contribution the following year with pre-tax income.

This won’t come into play for everyone. But for those who it does, it will be valuable to plan around.

Just for example, on the right of this slide is just a few of the common tax credits, deductions, or surcharges that exist that are income dependent. These income limits shown are for a married couple, but limits exist for single filers as well.

If you are age 49 or over with a salary between $145,000 and about $180,000 and take advantage of any of these credits or deductions shown here and you on the verge or any of these income limits, there likely a good opportunity to do some tax planning this year with your 401(k) contributions.

Moving on, one more Roth related change. Beginning now, or really once your employer updates their plan documents, you may elect your employer match be made into a Roth account. Previously this was always a pre-tax contribution. That’s not going to be the case anymore.

That does mean that the company contribution will be added to your taxable income though.

So, if you have a salary of $100,000 and your company does a 6% match, your new taxable income will be $106,000.

But, this isn’t mandatory, so it’s a great option for those who Roth savings really makes sense and the increase in taxable income is not a big deal.

Another employer match change – Beginning in 2024 you may elect your employer match be made towards your student loans.

For some this will be a good benefit, effectively letting you use pre-tax income to pay your student loans. This might be of particular value for high income households.

But, I think those considering this should be careful because its also a potentially big decrease in your retirement savings. And again, generalizing here but thinking this primarily impacts younger savers. And getting money in your 401(k) early is pivotal to start taking advantage of compounding interest down the road.

And especially for those with Federal student loans, there’s just a lot of great protections on those like income based repayment plans and loan forgiveness options that may make it a bad idea to sacrifice retirement savings in order to pay the student loans down quicker.

Its an option, and a good option for some. But I don’t think its an option that should universally be elected by default and deserves some discussion and planning first.

There are a number of new options for penalty free withdrawals from 401(k)s. So, this is for those under age 59.5.

I won’t go into the details here, but a few of these are targeted I think to very young workers, entry level, who may be afraid to save into a 401(k) because they want to build up their emergency fund. There are new options for either $1,000 or $2,500 penalty free withdrawals for cases of emergency, and the definition of emergency has been very relaxed so just about anything could qualify.

Another option is that 401(k)s can now be used to pay up to $2,500 per year in long term care insurance penalty free. As a reminder, the withdrawal is still taxed, but if you are 58 and paying for long term care insurance, you could not use your 401(k) to make the payment, up to $2,500, and not worry about early withdrawal penalties.

This is beneficial for the right person. We also just see a majority of people look for long term care insurance after age 59.5, when you are allowed to withdrawal from these accounts penalty free anyway. So this might not be a huge impact, but may be beneficial for those who purchased insurance early.

New Retirement Plan Options for Business Owners

And last topic here, and another one that we just wanted to mention here but not go into depth on. If you are the owner of a small business or in business by yourself, there are a lot of new options for retirement plans for your business.

In general, new Roth options are now available for other types of plans like SIMPLE’s and SEP’s.

And also an entirely new type of account called a Starter 401(k). This account has no company match and is essentially an IRA, but would allow higher compensated employees to save a little more into a tax deferred accounts, because they might not be able to save into a pre-tax IRA if their income is above a certain limit.

If you have a solo 401(k) you have more time to make your contributions now. It used to be by December 31st, now you have until the tax deadline. This gives those with solo 401(k)s a potentially huge advantage in tax planning. So again, for a select few a pretty big change.

And lastly, just know that if you are a small business and looking to start up a retirement plan for your business, there’s new tax credits available where the IRS will essentially pay you back for any start up costs.

I thought it might be good to just list a few items that did not change with respect to this bill.

Because this bill had been circulating for years, there were earlier versions of it that had some new proposals that got some press initially, but did not make it through to the final draft.

There are no changes to backdoor Roth contributions – this is a way that those with higher income can sometimes get money into a Roth IRA. There was a lot of talk about this going away, but its not now.

Same with Roth conversions. There were prior versions of this bill that were going to severely limit who can d a Roth conversion, based on income or account balance. Nothing along that line made it in, so anyone is still eligible to do Roth conversions.

And there was some text in prior versions as well that were going to create extra large RMDs for those with pre-tax retirement accounts over certain balances. This was going to be a potentially huge change for those with big 401(k)s or IRAs, but nothing made it through. So once again, no changes here.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.