Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

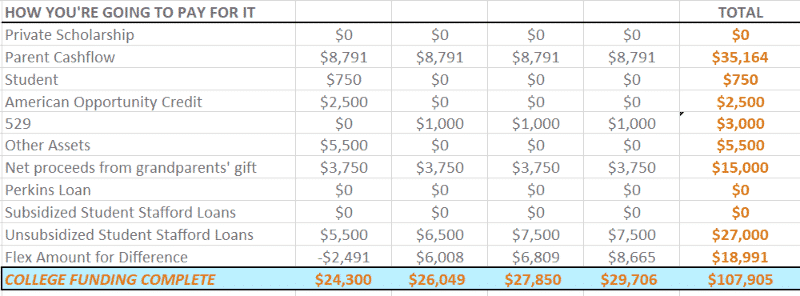

The fact you’ve arrived at this page is a good sign you’re resourceful and financially responsible. You likely live within your means, diligently contribute to your 401(k) and maybe a Roth IRA too. Perhaps through online research you stumbled upon College Savings Iowa 529 Plans a couple years ago and you now regularly contribute to both of your kids’ accounts.

You’re confident you’re on solid footing, but your finances are becoming more complex and require knowledge beyond what you’ve figured out on your own. In fact, you’re not sure what questions to ask or how to determine the best course of actions.

These are problems better left to financial experts for solving.

As fee-only fiduciary financial advisors, we are uniquely suited to identify and solve a wide range of financial problems for our clients.

Here are examples of three common problems we solve for our working professional clients:

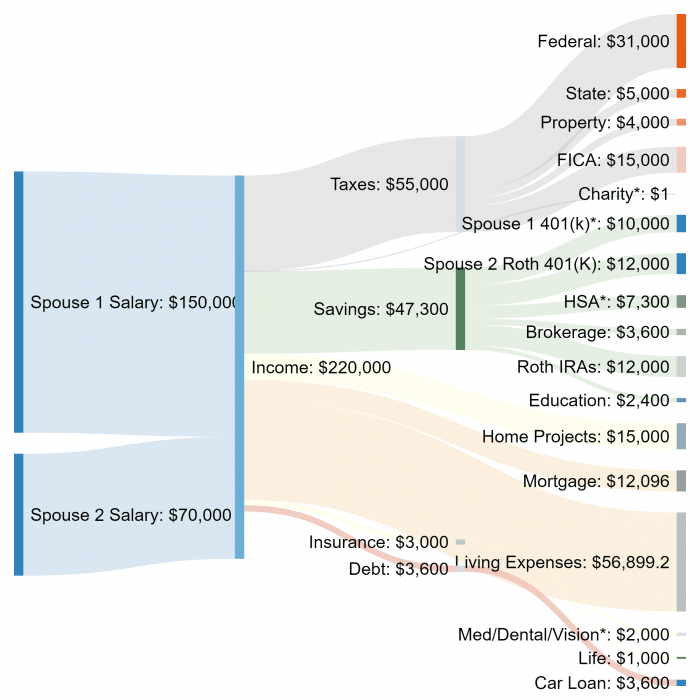

You’ve done the hard work of earning the money, but where’s the best place to save it and why?

This is typically the first problem we solve for clients.

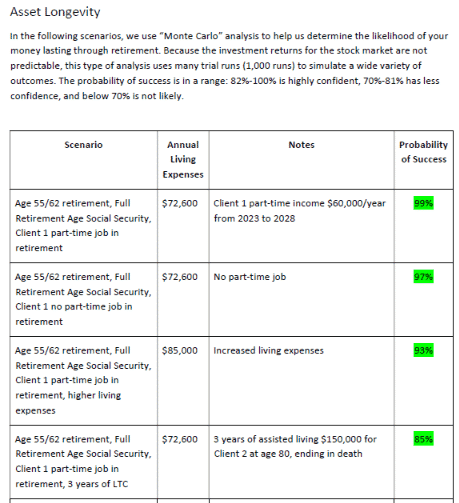

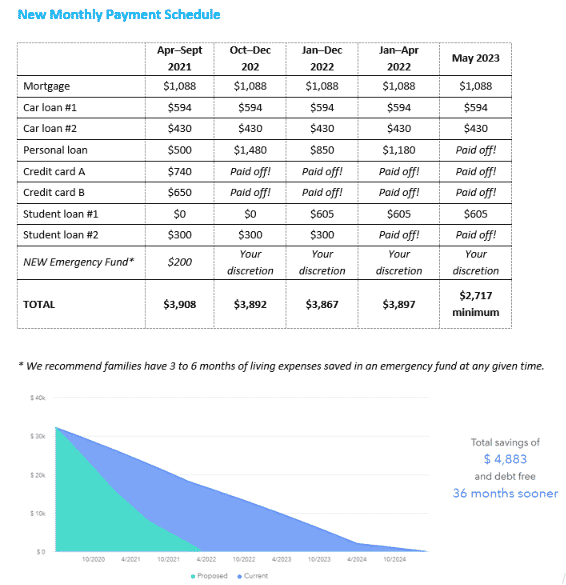

We start by creating a financial plan based on your unique financial goals. Whether big or small, long-term or near-term, we’ll show you how likely it is you can achieve your goals with your assets using monte carlo analysis. We’ll also test different scenarios to show you what else is possible.

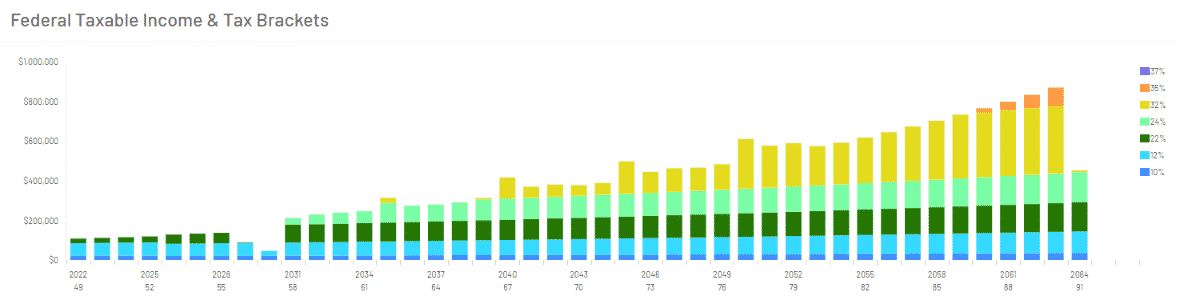

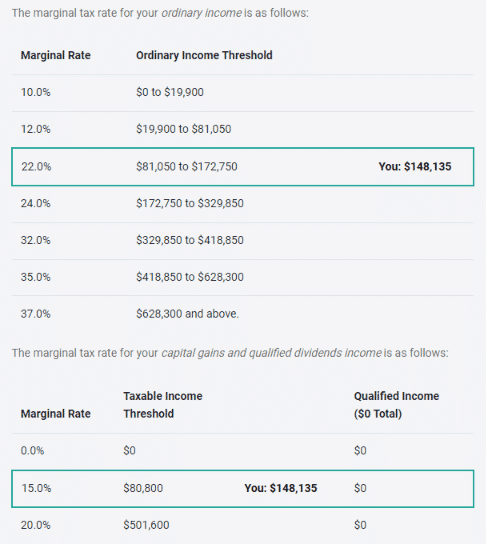

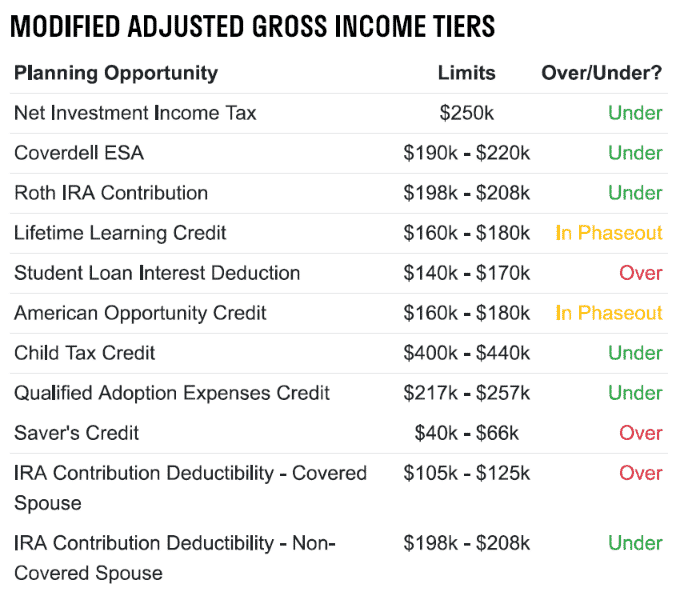

Then we’ll analyze your current and future tax situation to create a savings strategy for your goals. We use advanced tax and planning tools to find opportunities to lower your taxes and to determine how much you should save to different types of accounts. It’s ideal when clients save to a combination of accounts – tax-deferred, tax-exempt, and taxable.

Need help creating your retirement saving strategy? Schedule a introductory meeting with us to see how we help professionals like you create a financial plan.

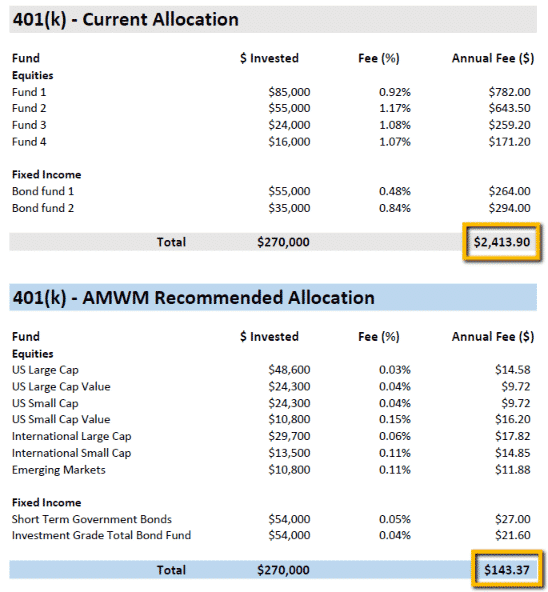

Fee-only fiduciary advisors are unique in that we’re only motivated by your best interests.

As fee-only advisors, we are only paid through the fees we charge clients for our financial advice and ongoing management of their investment accounts. Unlike fee-based and commission-based advisors we do not sell investments, insurance, or any other products. Why does this matter? Fee-only eliminates hidden fees and conflicts of interest. Your best interests are our only motivation.

Additionally, as CFP® professionals, we are true fiduciaries. That means we are legally bound to always place your interests above ours. That’s not the same as other “fiduciaries” who are only bound by suitability. What’s “suitable for you is often not in your best interest. Our number one priority is always and only your best interests.

If we don’t happen to be a good fit for you, we’ll help you find another fee-only, fiduciary advisor.

Our financial planning and wealth management services include advice on all things financial, including:

Other topics – we’ll answer one-off questions like:

No matter your financial problems, the experienced fee-only fiduciary advisors at AMWM will solve them. You can remain focused on your busy life, career, and family. We’ll provide unbiased guidance and expertise to help you execute a plan to achieve your goals.

Learn more – Let’s get started!