Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Should you buy additional life insurance from your employer, or through a private policy from an insurance company?

Anyone is able to buy life insurance directly from an insurance company. Most likely, if you are employed you also have the ability to buy life insurance as part of your employer’s benefits. So what option is best?

They each have their advantages and disadvantages, but here’s a few things to think about:

If you are buying life insurance directly from an insurance company we typically recommend term insurance. With a term policy, you have a fixed premium for a certain amount of insurance. If you buy a 20-year policy, you will have the same payment for 20 years.

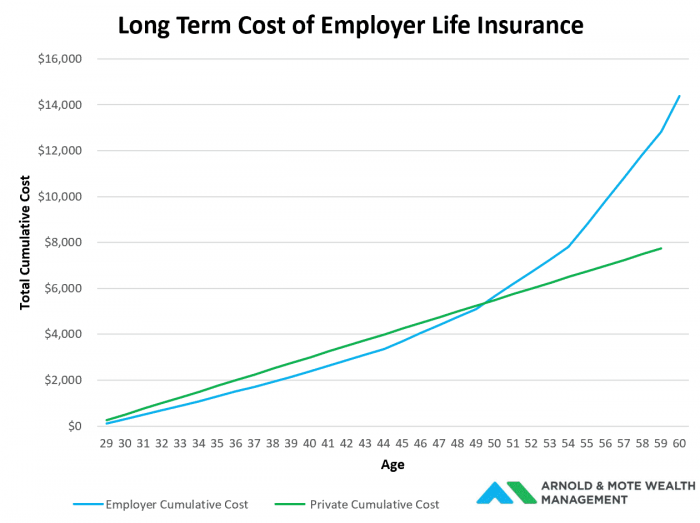

When you buy group life insurance through your employer, you will likely find that your cost increases each year as you get older. In general we find that there is typically a breakeven between employer provided insurance and private policies.

If you are looking for 20 or 30 year life insurance policies, going directly to a private insurance company will likely save you money

If you just need insurance for a short term, especially if you are young, buying through your employer may be a better option.

This calculation is always dependent on your employer though. Usually larger employers have cheaper rates for insurance for their employees. If you work for a smaller company, it may be worth looking for a private policy regardless.

One other benefit of employer insurance plans is that the death benefit of the policies are generally tied to your salary. For example, you may see that your death benefit is 2x your salary. If you make $75,000 per year, this equates to a $150,000 benefit.

As your salary increases, many forget to reconsider their life insurance needs may change as well if they have a private policy. By electing coverage through your employer, your death benefit will automatically increase with your salary.

There are a few other things to consider too besides just the cost. Buying insurance through your employer ties that insurance to your employment. If you lose your job, you likely lose your insurance. It may be smart to have some amount of insurance not tied to your employer.

Also, company provided health insurance may be able to be raised and lowered without health examinations. If you have poor health, using your employer for additional life insurance coverage may be cheaper or the only way to get additional insurance.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.