Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Updated February 2024 to include 2024 IRMAA brackets.

How can you avoid IRMAA, or Medicare’s Income-Related Monthly Adjustment Amount, and save money on your Medicare premiums? It takes understanding what contributes to IRMAA, developing an annual withdrawal plan, and then putting a long term plan in place to ensure you won’t get caught up in IRMAA for decades of your retirement.

IRMAA is an additional surcharge to your monthly premium payments for Medicare Part B and Part D. The fee is based on your annual income from previous years.

To calculate your added fee, Medicare looks at your income tax return from 2 years prior. So for 2024, your 2022 income will determine what income bracket you fall in for the IRMAA surcharge and determine the added fee to your base premium for Medicare.

IRMAA is common for retirees with large IRAs or for those who have IRAs that make up a majority of their retirement savings, those with large pensions, or those who have high expenses in a single year.

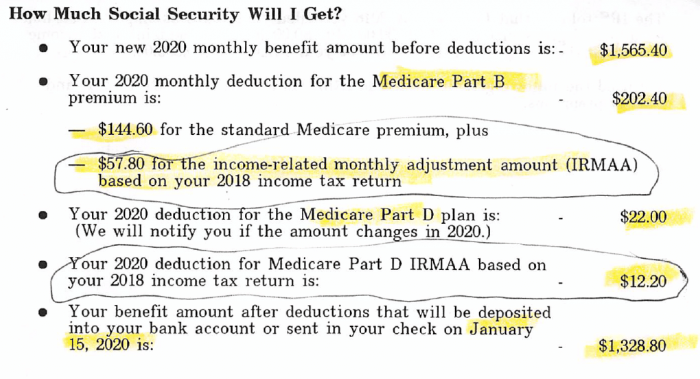

You will receive notice from the Social Security Administration if the IRMAA monthly premium surcharge will apply to you.

If you are also collecting Social Security benefits, it will detail the amount taken from your yearly income from Social Security:

IRMAA is unique in that it is one of the few taxes that has no phase in with respect to income levels. If you are one dollar above the income threshold tier, you will pay significantly more for your Medicare plan premium.

Exactly how much IRMAA adds to your Medicare premiums will depend on your annual income from 2 years prior. IRMAA is calculated each year and is only dependent on a single year of income.

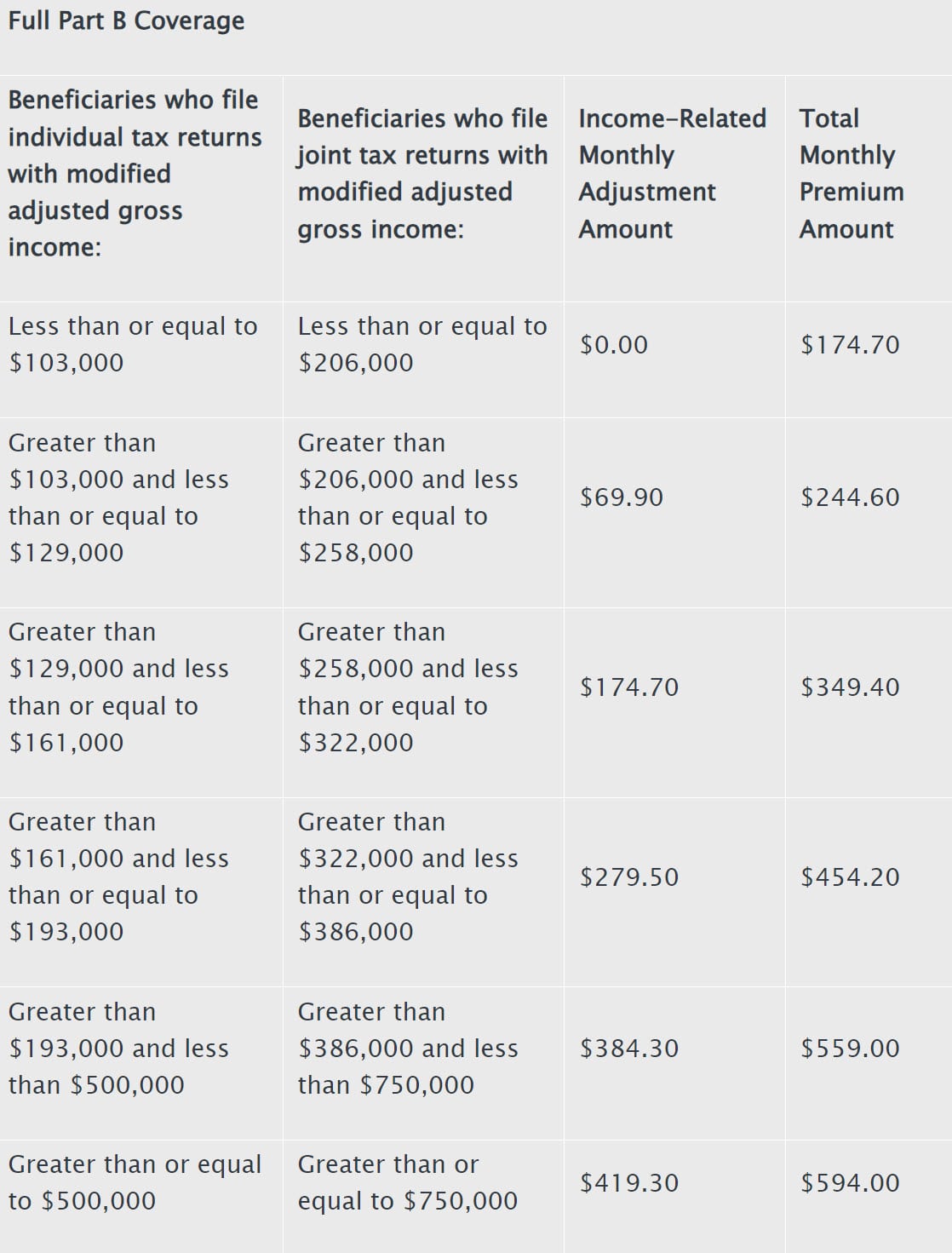

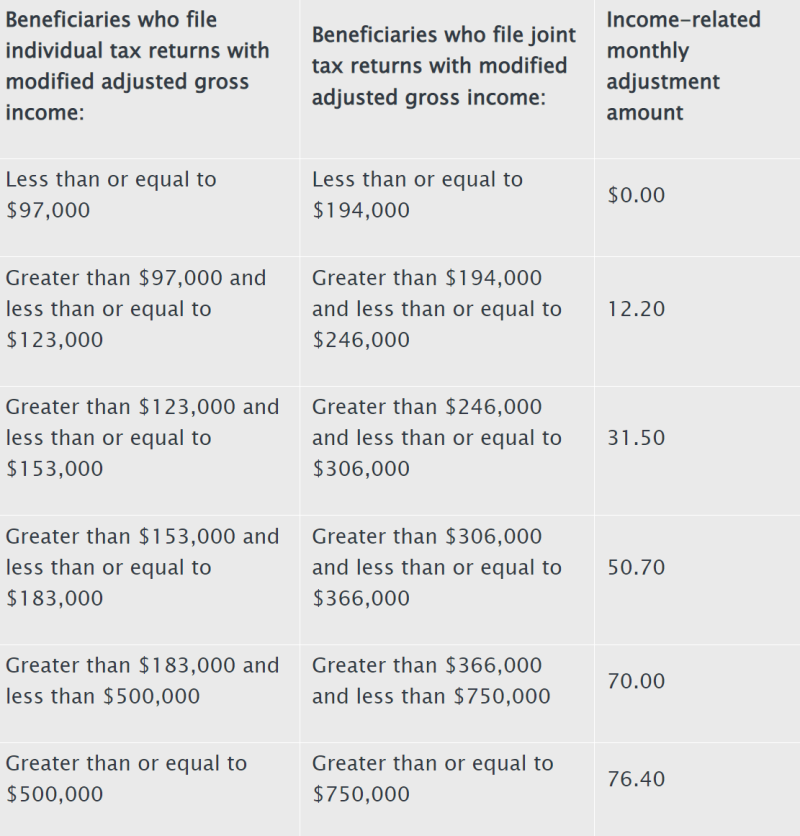

For example, in 2024 the IRMAA brackets look like this:

For example, in 2024, if a married couple on Medicare had income of $206,000 in 2022, each person will pay $174.70 per month for Medicare Part B.

If they have income of $206,001, (just $1 more!) they will each pay $244.60 per month. That 1 dollar in extra income can cost a married retired couple about $140 per month, or $1,680 per year in additional Medicare Part B premiums.

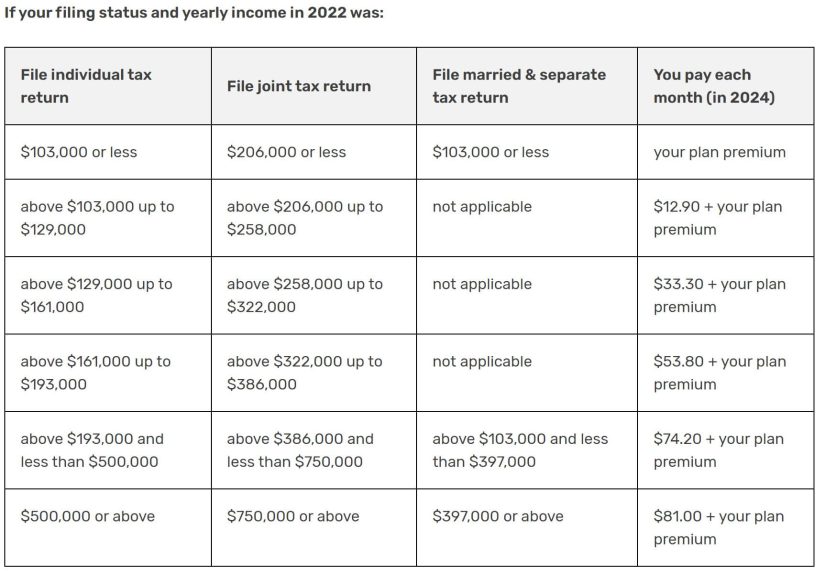

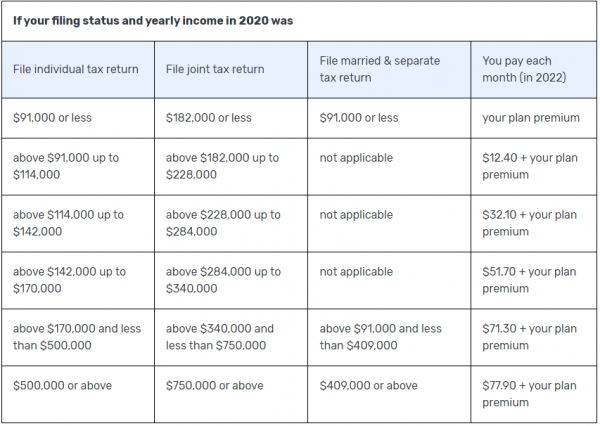

IRMAA also adds to your monthly prescription drug coverage premium (Medicare Part D) as well. While not as large as Part B standard premium, this can have not noticeable impact as well:

IRMAA does not impact Medicare Parts A, or Medigap plan premiums.

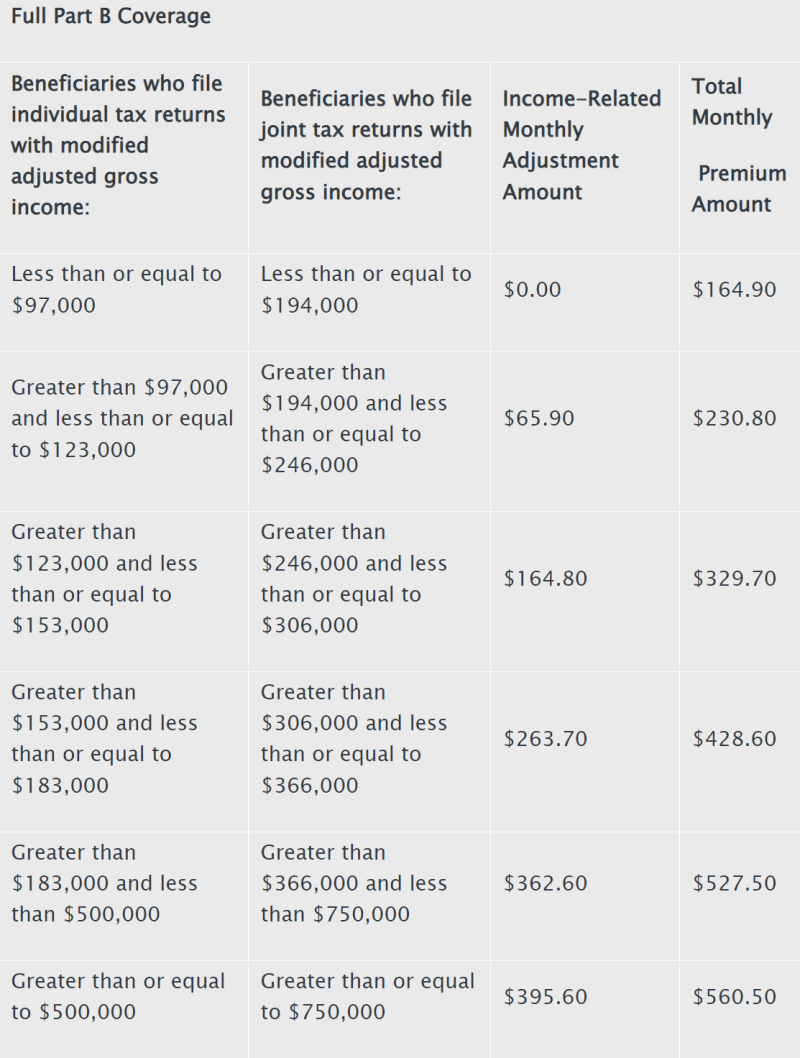

For example, in 2023 the IRMAA brackets look like this:

For example, in 2023, if a married couple on Medicare had income of $194,000 in 2021, each person will pay $164.90 per month for Medicare Part B.

If they have income of $194,001, (just $1 more!) they will each pay $230.80 per month. That 1 dollar in extra income can cost a married retired couple about $130 per month, or $1,560 per year in additional Medicare Part B premiums.

IRMAA also adds to your monthly prescription drug coverage premium (Medicare Part D) as well. While not as large as Part B standard premium, this can have not noticeable impact as well:

IRMAA does not impact Medicare Parts A, or Medigap plan premiums.

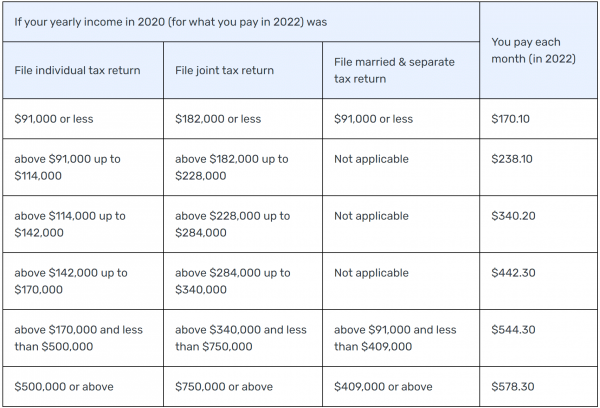

The income amounts that trigger the IRMAA surcharge change every year. For 2022, Medicare will look at your 2020 income (specifically your 2020 MAGI – modified adjusted gross income):

Part B:

Part D:

The most recent Medicare IRMAA brackets will be updated on Medicare.gov as well

In total there are 6 different brackets for Medicare premiums – And so, knowing where those income thresholds are, is a very important place to start.

Unlike your income tax rate, or capital gains tax rate which is determined by your “Taxable Income” on your tax return, IRMAA is based on “MAGI”, or modified adjusted gross income.

How do you calculate your MAGI for IRMAA? It can be tricky as it is not a number that directly appears on your Federal Income Tax Return.

First you have to know what types of income make up your MAGI and therefore determine your IRMAA bracket.

To calculate your MAGI for IRMAA purposes:

First, start with your AGI, or Adjusted Gross Income. This is line 11 on your 1040 from of your Federal Income Tax Return.

AGI consists of:

Add those up and then add line 2a of your Federal Tax Return, which is tax exempt interest income. This usually consists of:

Adding up these two totals will determine your MAGI with respect to the IRMAA surcharge. Compare this number to the IRMAA brackets shown above to determine what your monthly premium for Medicare Parts B and Part D (Medicare’s Prescription Drug coverage) will be.

There are a few things retirees can do to limit the impact of IRMAA and keep yourself out of those higher brackets.

First, see if you qualify for an appeal. We have more on how to appeal the IRMAA surcharge here.

The link above is much more thorough, but for a quick summary, the IRMAA appeal process is as follows:

First, to qualify for an appeal, you must have experienced a “Life changing event”. This can be any of the following:

You can select which event applies to you on the appeal form, update Social Security Administration on your estimated new income, and provide the necessary documentation.

If your appeal process is approved you will receive a notice of your new monthly Medicare insurance premium payment, along with a refund of any additional premium you had paid unnecessarily.

If you are not eligible for an appeal, consider analyzing your retirement plan and withdrawal strategy to see if you can limit your income.

For example, you can withdrawal money from a Roth IRA or taxable brokerage account during the year instead of traditional IRAs. This will help reduce taxable income that counts towards the IRMAA limit.

If you don’t have investments in a Roth account, you can consider doing Roth conversions which may not help you avoid IRMAA surcharges this year, but can help prevent it in future years.

Also, you can be flexible with your spending, and spread out large withdrawals over multiple years.

For example, if you intend to buy a car in January, maybe you can withdrawal half of the money in December of the year prior, and the remaining half in January to spread the income between 2 different tax years.

Health care is often one of the largest expenses over retirement. Knowing how to invest and spend your retirement assets to avoid IRMAA can help reduce that cost.

Helping our clients avoid unnecessarily paying extra for Medicare is just one benefit we offer to our clients. To see how we can help you, schedule a free, no-obligation 30-minute meeting to talk with us.