Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Your Adjusted Gross Income (AGI) and Modified AGI (MAGI) determine tax rates, deductions, credits, and eligibility for key financial benefits.

Proactively managing AGI and MAGI with strategies like delaying Social Security, tax-loss harvesting, and maximizing pre-tax contributions can reduce taxes and open planning opportunities.

Understanding how AGI and MAGI affect areas like Roth IRA contributions, ACA subsidies, and Medicare IRMAA is essential for long-term tax-efficient retirement planning.

One of the key items on your tax return is a set of figures called Adjusted Gross Income, often called AGI, or Modified AGI, often called MAGI.

These numbers determine what tax rates you pay, what tax deductions and tax credits you’re qualified for, and control your eligibility for many other tax-related benefits. Creating a plan based on your AGI and MAGI each year can save you money and prevent unnecessary extra taxes.

You can lower AGI and MAGI with smart moves like delaying Social Security, withdrawing from post-tax accounts , tax-loss harvesting, contributing to an HSA, and maximizing pre-tax retirement contributions.

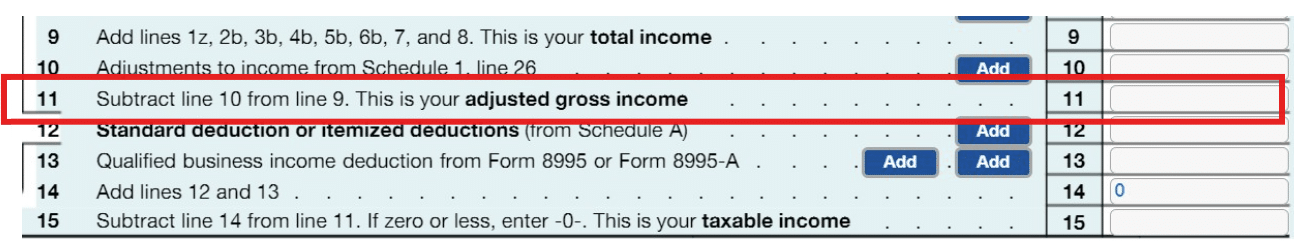

Your adjusted gross income (AGI) is calculated by taking your total income from all sources and subtracting specific deductions (known as “above the line deductions”), as outlined in Schedule 1 of Form 1040.

Your AGI is calculated before you take your standard deduction or itemized deductions on Form 1040. For that reason, your AGI will be higher than your taxable income.

Some of the key tax items impacted by AGI and MAGI are your eligibility for:

There are various credit and deductions available for parents and students in college. For example, the American Opportunity Credit is a tax credit worth up to $2,500 for each child. However, the full credit is only available if your MAGI is below a certain amount (For 2025 that is $160,000 for married filers, and $80,000 for individual filers).

Other credits and deductions available include the lifetime learning tax credit, the deduction of student loan interest, and the ability to cash out series EE savings bonds and series I savings bonds tax free for education expenses.

For much more detail on taking full advantage of the tax credits and deductions available see our webinar here:

The Best Way to Pay for College This Fall

If you retire and lose employer health insurance before you are age 65 and eligible for Medicare, you may end up purchasing a policy on Healthcare.gov.

There are very valuable tax credits available to offset the cost of these policies for those with income below certain levels. The specific tax credits available to you depend on your income and your state of residence, but will be clearly noted when you fill out your application:

While 401k and other workplace retirement plans have much higher contribution limits, being able to save additional money in a traditional IRA or Roth IRA can be incredibly beneficial.

However, the ability to contribute to these accounts is dependent on your MAGI, and your access to a workplace retirement plan.

If your income is near the limit to make a Roth IRA contribution, there can be great benefit in lowering your MAGI in order to allow for additional contributions.

IRMAA, or the income related monthly adjustment amount, is a monthly Medicare surtax added to your Medicare Part B and D premiums if your income is above certain thresholds.

This is a huge topic for retirees and we have written extensively on the topic here:

Three common steps you might take to adjust your AGI/MAGI are:

Delaying Social Security benefits until age 70 not only guarantees you a higher monthly payment for the rest of your life, it also can be a smart tax move!

For a recent retiree, delaying Social Security can keep your AGI lower early in retirement. This provides great opportunity for additional Roth conversions , recognizing capital gains at a 0% tax rate, reducing ACA health insurance premiums, and avoiding IRMAA to reduce your Medicare costs.

Having a tax-efficient withdrawal strategy is a cornerstone to a successful financial plan. Understanding how withdrawals from different types of retirement accounts impact your MAGI and AGI is critical to avoiding the added tax rates and surcharges noted above.

For those who are living off of their retirement savings, this might mean strategically withdrawing from your Roth accounts, Health Savings Accounts, or high-cost basis investments in a brokerage account.

We give more detailed examples of how we help clients create these plans in a webinar here:

Creating a Tax-Efficient Retirement Withdrawal Plan

If you are still employed, retirement plan contributions to your 401(k)s, 403(b)s, SIMPLE IRA, and other retirement plans can provide the opportunity lower your AGI by tens of thousands of dollars.

If you are working and covered with an employer’s retirement plan, your ability to receive a tax deduction for traditional IRA contributions may be limited. (For 2025, you must have a MAGI of under $146,000 to do this).

But, one option that many households miss is the increase in income limits for making deductible IRA contributions for a “non-covered spouses”, or those whose spouse does not have a workplace retirement plan. For 2025, this income limit is $246,000!

This opportunity regularly comes up when one spouse is retired, but the other spouse is still working. The non-working spouse is able to use the household income to fund a “Spousal IRA”, and potentially receive a tax deduction for doing so.

If you have investments within a taxable brokerage account, you have the ability to sell investments that have declined in value and receive a tax deduction.

Tax loss harvesting can reduce your AGI in two ways:

First, up to $3,000 in losses can be used to offset income.

And, losses can also offset an unlimited amount capital gains or capital gain distributions. If a large portion of your AGI is from these sources, strategically using losses at a time when you need to lower your AGI can have great benefits.

If you have the ability to take advantage of tax loss harvesting, it is incredibly important that you understand all of the ins and outs of tax loss harvesting. See more in our Guide to Tax Loss Harvesting.

If you are in a high-deductible health insurance plan and eligible to contribute to an HSA, contributing to your Health Savings Account is not only a smart long-term move, it will also reduce your adjusted gross income.

If you are a business owner or self-employed, you have a lot of unique opportunities to lower your adjusted gross income that many salaried employees do not.

You’ll want to make sure you are working with a tax professional to ensure you are maximizing your SEP or Solo 401(k), deducting eligible business expenses, self-employed tax, health insurance premiums (as able), and accelerating or deferring income as able to your advantage.

For a comprehensive list of above-the-line deductions that lower your AGI, see the IRS’s Schedule 1 tax form.

There are a wide variety of other deductions available to select individuals depending on your career and personal situation. We’ll briefly list some of these below, but if these apply to you, be sure you are maximizing these deductions:

Many times, we see someone doing everything right to get the deductions they are eligible for and lowering their AGI. But, what gets lost is sources of income, investment choices, and other tax decisions that are unintentionally increasing their AGI.

Mutual funds, and particularly actively managed mutual funds, can regularly distribute capital gains at the end of each tax year. For those who are closely managing their AGI, this may not only lead to an unnecessary tax liability, but also trigger a host of other taxes and surcharges.

Consider moving investments to ETFs, or passively managed index funds, to reduce these distributions.

Moving fixed income investments within a taxable brokerage account to municipal bonds can lower your AGI.

However, it is important to note that many of the calculations for MAGI add municipal bond income back in.

So, municipal bonds may be more advantageous for those looking to reduce their AGI to qualify for additional SALT tax deductions, the lifetime learning credit, or the enhanced senior deduction. But, if you are looking to eliminate IRMAA, switching to municipal bonds may not move the needle.

Before making the decision to utilize these for tax-exempt interest, be sure you know what it is you are optimizing your MAGI for!

While it may not be a surprise that IRA withdrawals will increase your AGI, what many retirees fail to plan for is how much their RMDs will increase over time.

As you get older, your RMD amounts will likely continue to increase each year. Over time, this may push you into higher tax brackets, or AGI levels, than you are anticipating now.

One way to reduce your RMDs it by utilizing QCDs, or qualified charitable distributions. By donating through QCDs, you can withdrawal money from your IRA without any impact your AGI.

If increasing RMDs are an issue, you will likely want to evaluate a Roth conversion strategy as well. While this will increase your AGI in the short term, it may provide much more substantial long-term benefits.

Lowering your AGI in order to reduce your taxable income is an obvious benefit. But your AGI and MAGI impact many other areas of your financial plan.

The Net Investment Income Tax is a 3.8% tax surcharge that gets applied to all investment income. For most, this is interest, dividends, capital gains, certain annuity income, rental income, and more.

If you receive a significant portion of your income from these investment-related sources, lowering your AGI could have a further benefit of reducing your NIIT.

See more in our article here: Net Investment Income Tax (NIIT) – When it Will Apply, How to Avoid

How much of your Social Security is taxed depends on your “combined income”, which is calculated very similarly to many MAGI calculations.

If you are at a point where additional increases to your MAGI is causing additional Social Security income to be taxed, doing everything you can to reduce your AGI may have very good benefits.

If you’re benefiting from tax credits for health insurance obtained through the ACA exchange, you’re likely aware of the advantages of lowering your income. However, a lack of understanding of what factors contribute to your MAGI, which determines eligibility for these essential credits, can lead to trouble. Miscalculating or underestimating your income when applying or renewing annually might result in those tax credits being reclaimed.

Tax planning is just one of the services we offer to our clients . Whether you are still working, or well into retirement, monitoring your MAGI and AGI can open up opportunities for numerous tax deductions and credits.

We create a tax report each year for our clients to highlight where they fall in the tax brackets, and what credits or deductions are available to them. Here’s a sample of a tax report:

Please reach out for an in-depth tax analysis if you have further questions about lowering your MAGI.

*Note: This article has been updated with current information on September 23, 2025.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. Arnold & Mote Wealth Management is a flat-fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.