Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Backdoor Roth contributions allow anyone, regardless of income, to be able to effectively contribute to a Roth IRA. They can be incredibly valuable for higher earning households who are able to save more for retirement.

Here’s what to know about backdoor contributions, and what to lookout for:

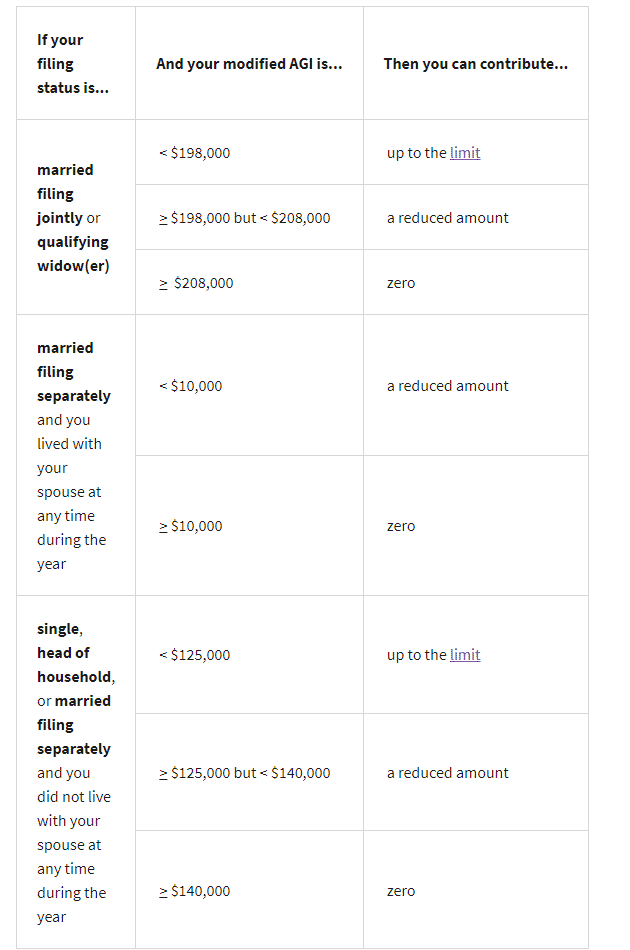

Roth IRAs are a great place to save for retirement. However, the IRS limits who is eligible to make contributions to Roth IRAs to only those who fall under a certain level of income.

These limits change each for, and vary based on your tax filing status. But for 2021 they are:

Many people believe that if you earn more income than the level set by the IRS, that you are unable to contribute to Roths. However, there is one special way that you are able to effectively make contributions to Roth IRAs regardless of your income, this trick is what is known as a Backdoor Roth contribution.

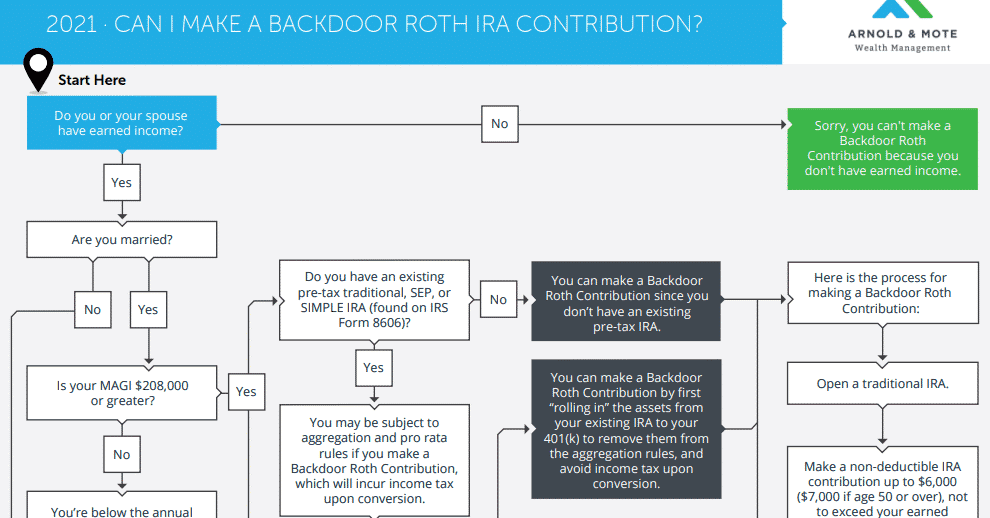

With this loophole, you are allowed to make a contribution to a traditional IRA in what is called a non-deductible IRA contribution. Anyone can do this regardless of the amount of income you have.

Then, the next step is to perform a Roth conversion of this new non-deductible IRA contribution. As long as there are no earnings or interest from your original contribution, no additional taxes will result from doing this conversion.

This process makes full Roth contributions available to anyone, regardless of income.

One important note though – This option is easiest for those without any balances in traditional, or pre-tax IRAs. Money in a 401(k) is fine, but if you have money in a traditional IRA it may result in some additional taxes you want to be aware of.

So, there are a few important caveats and fine print to this rule. And it also adds a little complexity when filing your taxes each year. So, if you are unsure of anything, be sure to reach out to a financial advisor to help walk you through the process and ensure it is the best option for you.

If backdoor Roth contributions are something you are interested in, but wondering if they are right for you, reach out and let us help! We can walk through the pros and cons of the strategy, and determine the best, most tax-efficient way for you to do your retirement savings.

For example, here’s part of our flowchart for guiding clients through the decision to do a backdoor Roth IRA:

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.