Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Flat, transparent pricing – Arnold & Mote charges one fixed fee for financial planning and investment management, rather than commissions or percentage-based fees that rise with your assets.

Conflict-free advice – As fee-only fiduciaries, they provide unbiased guidance that isn’t influenced by product sales or growing account balances.

Comprehensive planning included – The flat fee covers a wide range of services, from tax and retirement strategies to estate, insurance, investments, and more.

We are excited to announce that Arnold & Mote Wealth Management is now a flat-fee financial advisor.

Our clients have one flat fee, billed monthly or quarterly, for both financial planning and investment management services. That fee does not change based on assets under management or whether the stock market goes up or down.

Our flat fee for wealth management is $13,200 per year for couples, or $11,600 for individuals. That is billed $3,300 or $2,900 per quarter directly from client Charles Schwab accounts.

Our flat fee for financial planning, our service without any investment account management (also known as “advice only planning”), is $9,000, billed $750 per month, or $2,250 per quarter.

As you know, we have always been a fee-only, fiduciary advisor. That means that we don’t receive commissions or payments from insurance and investment companies if we recommend their products.

This has reduced conflicts of interest and better ensures that the financial advice we give is independent and in your best interest.

Being a flat, fixed fee advisor now takes this one step further. Your cost for advice and wealth management is completely transparent.

Interested in working with a flat fee financial advisor?

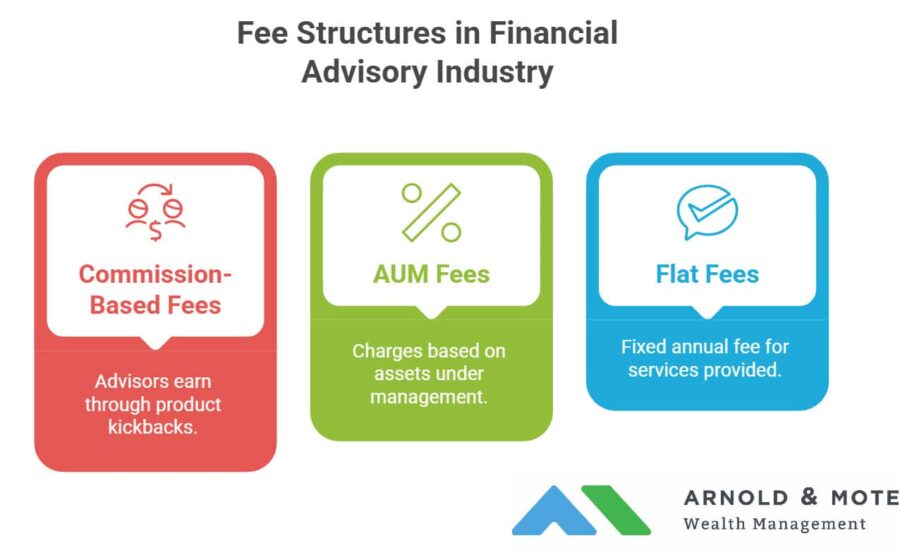

You probably know that the vast majority of the financial advice industry operates under a commission-based service model. These fee-based advisors make their money by recommending financial products such as life insurance and mutual funds that pay them a kickback.

Another significant portion of the industry works on a fee that is based on “assets under management”, or AUM fee. They charge a percentage-based fee on your investment accounts. If an AUM advisor charges a 1% fee, and you have $1 million, your fee is $10,000 per year. If your account grows to $1.2 million, or you just deposit another $200,000 into the accounts, your fee is now $12,000.

At Arnold and Mote Wealth Management, we are one of only a small number of firms that charge a flat fee for all financial planning and investment management services. That fee does not change based on whether you buy any insurance, invest in specific mutual funds, or deposit more money into your accounts.

There are a variety of fee structures in the financial services industry. We believe a flat fee structure is the most fair and transparent fee for our clients.

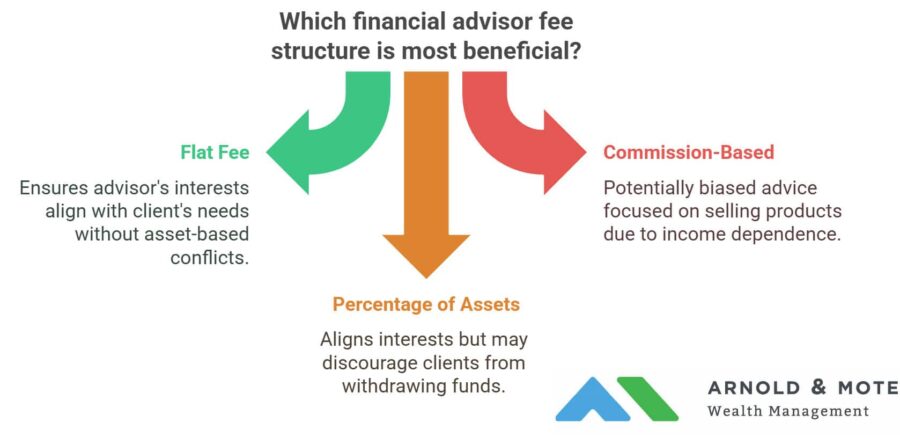

You should be able to very quickly see the inherent conflict of interest for any commission-based financial advisor. If the only way to make money is to sell a life insurance policy, you are going to be pitched the benefits of a life insurance policy.

These “advisors” might say they will help with your Social Security strategy, investment asset allocation, withdrawal and other tax strategies, or any other non-insurance related issue. But, we all know their time will be focused on insurance and investment product sales.

Advisors working under a percent of assets fee are generally better aligned with your interests than commission based advisors. However, conflicts still exist.

If you have extra cash that you want to save into your investment accounts, that will raise your fee.

In addition, if you ask an advisor billing a percentage of asset fee on your large account balance whether it is best for you to pay down debt, or buy rental property, or do anything to take money out of their management, just know that their compensation depends on convincing you to keep money invested under their management.

These examples highlight why we believe a flat fee model from a fee-only Certified Financial Planner is the best choice for our clients.

It allows us to work with only your best interests in mind. We are paid no more, or no less, based on what you want to do with your money. You are welcome to move money in or out of your accounts for car and home purchases, paying down debt, or purchasing bank CDs, without worrying that our advice could be clouded by a fee based on the assets in the account.

Here’s a detailed list of the 39 essential elements we believe every financial plan should include.

1. Annual Tax Review

Regardless of your situation, there are loads of tax credits, deductions, and surcharges that may apply to you. Here’s a sample report showcasing how we review annual tax returns to identify opportunities for savings

2. Roth Conversion Plans

If you haven’t seen our webinar and blog post on creating Roth conversions, see it here.

3. Tax Loss/Gain Harvesting Check

Have a brokerage account? Tax loss harvesting can provide up to $3,000 in tax deductions each year.

4. Paystub, Pension, Social Security W-4 Tax Withholding Review

Avoid unexpected tax bills and penalties by ensuring your tax withholdings are accurate year-round.

5. Charitable and Family Giving Plan

Whether you plan on giving $100 or $100,000,000, giving in a tax-efficient manner provides you the biggest tax deductions, and leaves the most money for the loved ones and charities you care about.

6. Tax Letter and Organizer

Know what tax documents to expect each year, and avoid costly mistakes of forgetting to report income.

Plus, we pay for our wealth management clients to get their tax returns done each year with one of our trusted CPAs.

7. Health, Medicare, and Part D Insurance Policy Reviews

Should you opt for a high-deductible plan with an HSA? Is Medigap or Medicare Advantage a better fit for your needs? The right health plan can save you thousands of dollars.

8. Employee and Retiree Benefit Review

We’ll help you compare your employer benefits to options available elsewhere.

9. Long Term Care Insurance Review

Long-term care insurance can be costly and complex, with various types to choose from. We’ll help you determine if it’s necessary and identify the best fit for your needs.

10. Disability Insurance Review

You are more likely to be disabled than die. Disability insurance can protect against decades of added costs and lost income.

11. Life Insurance Review

Of course we’ll help determine if you need life insurance. We’ll also tell you when you can stop paying on those old policies.

12. Auto/Home/Umbrella Review

Often neglected by “advisors” that sell life insurance, your home, auto, and umbrella policies can protect your assets in a worst case scenario. Here’s a sample report to show how we help our clients save on premiums and ensure their protection is adequate.

13. Beneficiary Review

Proper beneficiary designations can help your assets get to your loved ones quickly, and in the most tax-efficient manner.

14. Review Wills, POAs, and Trust Documents

You estate documents play a vital role in making sure your wishes are fulfilled once you pass.

15. Estate Plan Illustrations

Visualize how your assets are dispersed once you pass.

16. Trusted Contact On File

As the number of financial scams and fraud rapidly increase, a financial advisor and trusted contact can provide added protection for your accounts.

All of our clients receive free access to the Wealth.com platform, where they can create and update their estate documents for no added cost.

17. Investment Policy Statement Review

What portion of your portfolio should be in stocks? How should that change over time? We’ll provide a portfolio allocation based on your risk tolerance and Nobel prize research.

18. Support rebalancing of client’s investment accounts

Every investment account needs regular maintenance. We’ll monitor accounts to make sure they remain in balance and continue to work for you.

19. ETF & Mutual Fund Fee Evaluation

Unknowingly investing in high–cost funds can cost you thousands of dollars per year in added fees. As fees change over time, we’ll make sure your investment strategy is focused on the right selection of funds.

20. Benefit Claiming Plan

The correct Social Security claiming strategy can increase your lifetime benefits by tens or even hundreds of thousands of dollars, and better protect you from longevity risks of outliving your retirement savings.

21. Social Security Statement Review

The Social Security Administration processes more than 100,000 reports of misreported earnings each year. These errors can cause reduced benefits for the rest of your life.

22. Required Minimum Distribution (RMD) Amount

Once you reach a specific age, you’ll be required to withdraw a set percentage of your retirement accounts annually. This can have a significant impact on your withdrawal plan and your taxes.

23. Withdrawal plan review

Which account(s) should you use to fund your retirement? We’ll create a tax-efficient withdrawal plan to help you reduce your tax liability and improve your plan’s chance for success.

24. Inherited IRAs/Roths

New laws have made required distributions from inherited accounts very complex. You may have not only annual required withdrawals, but also a 10-year requirement to liquidate the account.

25. Guardrails for Spending

Our clients know how much they can afford to withdrawal from their accounts each year, and portfolio balances that would require that to change.

26. Monte Carlo Analysis

Can your portfolio survive a period of low investment returns? Our Monte Carlo analysis tests your portfolio with over 1,000 simulations of various stock market returns to help you understand the risks your portfolio and retirement face.

27. Pension, Workplace Retirement Plan Options

When can you retire, and when is the best time to start your retiree benefits?

28. Cash Flow Report Review

We’ll cover detailed cash flow reports with you showing projected annual income, expenses, and withdrawals for the rest of your retirement.

29. Current Savings Plan

Should you be saving in a Roth 401(k), or pre-tax 401(k)? A brokerage account or non-deductible IRA?

30. Cash Options

Cash plays a crucial role in any asset allocation, but there are better alternatives than low-interest checking accounts. We help with money markets, CDs, Treasury Bonds, and more to ensure you get more interest from your savings.

31. 401k Statement Review

Even if we are not directly managing the investments, we’ll provide recommended fund allocations, saving amounts, and help with rollovers after you leave work.

32. Goal, Expense Review

Understanding your goals and expenses helps us invest your accounts correctly, and create a tax-efficient plan for using your assets in retirement.

33. College Tax Strategies

Whether you are saving for college or paying for college, there are numerous strategies available to help make costs as reasonable as possible.

34. Review 529 Investments

529 college savings accounts are great, but like your retirement accounts they need to be invested properly. Even though we do not manage these assets directly, we will help ensure your accounts are being used to their best potential.

35. Financial Aid

Whether you need help with FAFSA, or deciding how much (if any) Federal student loans to use, we’ll be with you every step of the way as you piece together your plan for paying for college.

36. School Choice and Funding

We’ll create a plan to find a school that is affordable for your family, and tell you exactly how to pay for it.

37. Cybersecurity Reminders

Tens of billions of dollars are lost every year to financial fraud. We’ll help you understand potential risks and equip you with strategies to safeguard your accounts.

38. Credit Report

Errors on your credit report can cost you thousands in added interest over time, and can impact everything from your rental apartment application to your chances for employment.

39. State Treasure Hunt

More than 30 million people have a combined $70 billion in unclaimed or abandoned assets today. We help our clients search through these databases and find what belongs to them.

Are you wondering if a flat fee financial advisor is a good fit for your needs? Here are a few situations where our pricing model can provide value:

Working with an advisor on a flat-fee model is one way to allow your advisor to reduce conflicts of interest and is not compensated differently depending on what products you purchase or investments you choose.

The following questions address common concerns that prospective clients often have when comparing financial advisors. These have not been answered directly in the article above, but naturally follow from its content:

A flat-fee financial advisor charges a fixed cost for financial planning and investment advice instead of a percentage of your assets. It’s designed to be transparent, predictable, and aligned with your goals regardless of how your portfolio changes.

Flat-fee advisors charge one set price for planning and advice, while AUM-based advisors charge a percentage of your investment balance. Fee-only is a broader category that includes both models, but not all fee-only advisors use a true flat-fee structure.

This model tends to work well for retirees, pre-retirees, professionals with high savings rates, and anyone who wants transparent pricing instead of fees tied to their portfolio size.

Yes. Investment management is included. Your fee does not change based on how much you have invested, allowing you to make portfolio decisions without worrying about higher advisory costs.

Yes, it is not required for us to manage your investments in order to work with us. Our financial planning service is also on a flat fee and will allow you to keep assets wherever you’d like.

A robo-advisor can help you get invested in index funds as part of your initial portfolio construction and keep an investment allocation over time. A robo-advisor will not help you with the many other, more important, parts of your financial plan, such as tax planning.

We do not have any asset minimums. Our fixed fee is paid regardless of the assets you have.

No, it is very common to have some assets in a 401 (k) plan, an annuity, or other accounts (such as Treasury Direct). There are many instances where it makes sense to keep some assets in places other than your IRA, Roth IRA, or brokerage account. We are more than happy to accommodate and advise on assets outside of our management.

Yes. As a fiduciary, we are legally required to act in your best interest at all times when providing advice, recommendations, and financial planning guidance.

The investments we use do have small percent-based fees known as expense ratios. Because our investment philosophy is rooted heavily in the benefits of low-cost, passively managed index funds, this fee is very minimal. These fees will depend on the exact investment allocation used, but they typically range between 4-6 basis points (0.04% to 0.06%). This fee does not go to Arnold and Mote Wealth Management, but to the managers of the investment funds we use or recommend (Charles Schwab, Vanguard, iShares, etc.)

Our fee is based on the complexity of your financial situation, not your investment balance. It stays consistent each year unless your planning needs change significantly.

Yes, we are more than willing to include your CPA or attorney in one of our meetings.

We will provide a new client with a list of documents to send to us before our first meeting. This allows us time to prepare and enter information into our financial planning software and get a first look at your financial plan.

Our first meeting is a “getting organized” meeting, where we will ask any questions we have about your current plan and propose an agenda for the next several meetings.

We typically meet with new clients 4-6 times in the first year. Ongoing clients typically meet twice per year thereafter.

We communicate monthly through our client newsletter, and we are always available for meetings as the need arises.

Yes. While we serve many clients in Cedar Rapids, Iowa City, and surrounding areas, we also work virtually with clients across the country.

Ready to take the next step? Schedule a complimentary conversation with us to discuss your financial plan and explore how we can help you with these topics. Click here to get started.

Our advisory fees are debited from client investment accounts directly, each quarter. This is no different than how AUM fees are deducted from any other financial advisor. The benefit of our fixed fee structure is that your fee will not increase just because your asset balance increases.

Clients are provided with quarterly reports showing recent investment portfolio performance, their current investment allocation, and our fee that was deducted from the account.

We provide flat-fee financial advice for clients across the country. If you are interested in working with a flat fee advisor, please schedule a free introductory meeting with us to see if we are a good fit.

We are members of two great organizations:

NAPFA – The National Association of Personal Financial Advisors.

Both groups are made up solely of fee-only financial advisors. Though, very few are flat fee.

Financial planning and quality investment management make a tremendous difference in the lives of our clients. We are proud to take this next step to offer financial plans at a fair, transparent price to you.

This post was updated on July 23, 2025

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management, a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?