Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

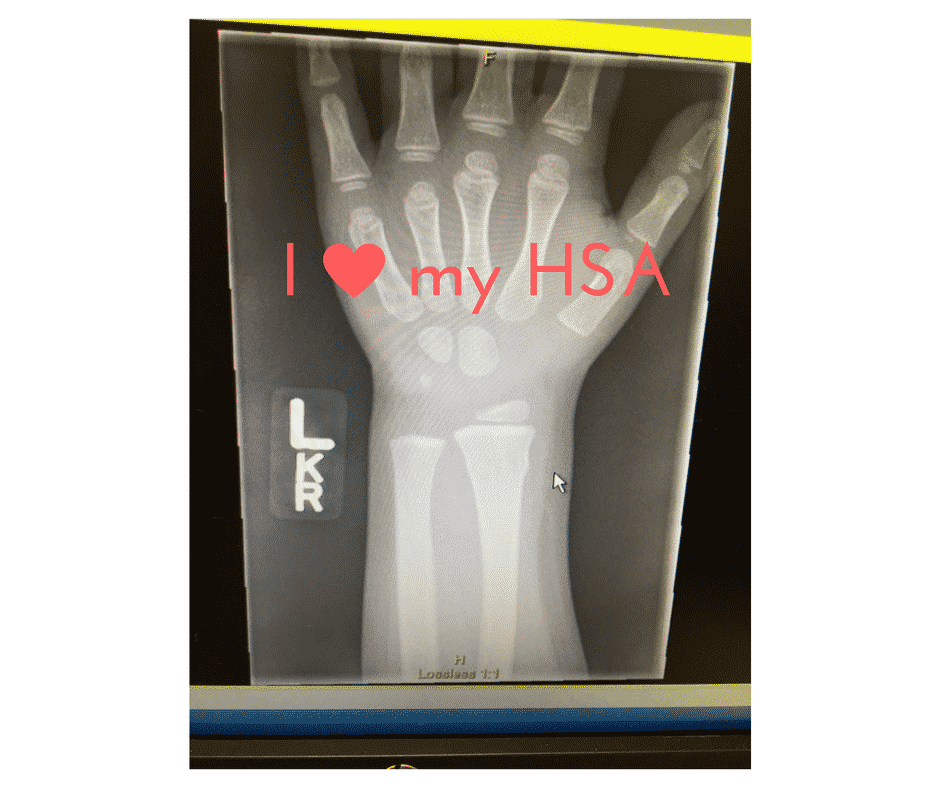

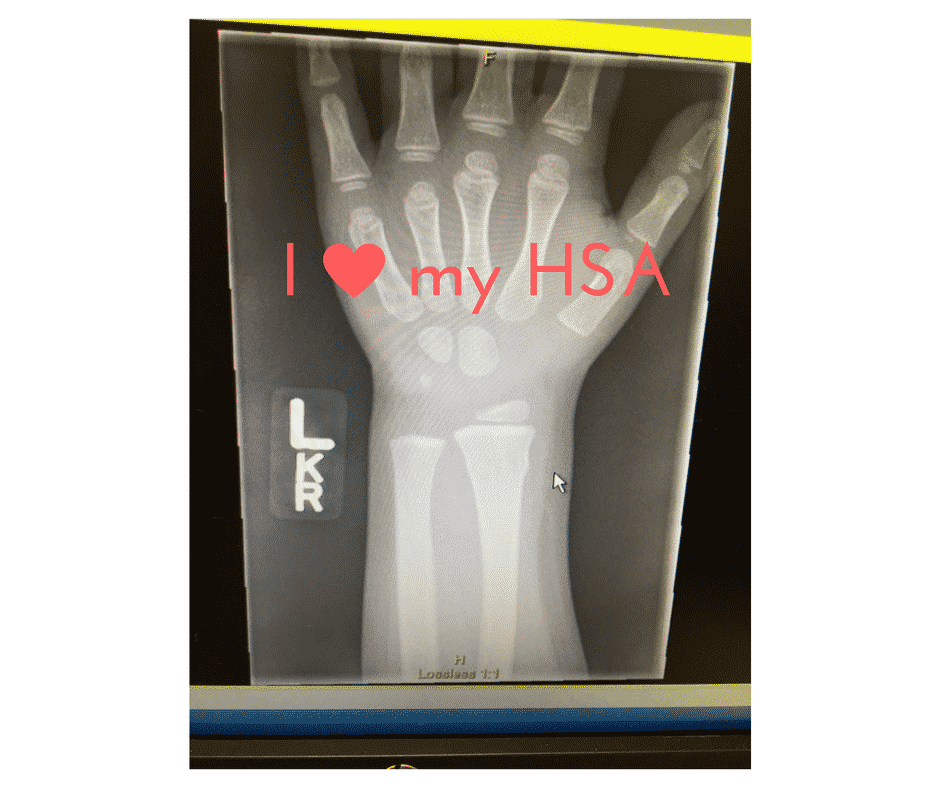

My younger son is pretty active and remarkably tough. His older brother is too, but the younger is that kind of little brother who always wants to play with the big kids, and can handle his own. So, it shouldn’t have been a surprise when we got the call a recent Thursday afternoon from his daycare. He’d fallen off the jungle gym, right onto his left arm, and we were off to the urgent care, ready to spend some serious dough on a shiny new arm cast. You might think I’m being crass, suggesting that the doctor’s bill is the worst thing from this little episode, but my son is a tough little bugger. I’m fairly certain the not-inconsequential medical bill IS the worst thing to come of it!

Fortunately, I have an HSA account tied to my health plan at work. If you’re eligible to use an HSA, you need to start saving with this account immediately. It’s more critical for your long-term financial success than even your 401(k) plan!

Health Savings Accounts, or HSAs, are a near-perfect way for you to use pre-tax savings to pay for medical expenses. You can use earnings in the account (and you can invest these funds) without paying taxes. In the same way that a 401(k) or other retirement plan allows you to save on taxes planning for retirement, you can use an HSA today to save on your medical bills.

There are some caveats on which expenses they cover, and there are some loose qualifications on who can own an HSA. Check out WageWorks (an administrator I am not affiliated with) for a decent FAQ on the ins-and-outs.

If you’re like me (having children = medical bills), the advent of the high-deductible health plan at many employers has meant that you need to think ahead for big medical costs. Sure, you still have health insurance, but if you use it for anything serious whatsoever, like a four-year-old’s broken arm, be prepared to pay through the nose. You’re not going to be sent into bankruptcy with this kind of coverage, since eventually the deductible limit will kick in. I hope, however, that you have several thousand dollars available for that ER/doctor/lab/specialist bill making its way to your inbox.

The HSA is your out, your safeguard. If you take advantage of funding that HSA, you’ll have the cushion necessary to pay this year’s deductible.

It’s the difference between taking a relaxed breath after you find out your kid will be just fine in 6 weeks in a cast, and sweating how you’re going to pay that $3000 bill about the same time the cast comes off.

Besides being an emergency source for medical expenses, your HSA can function as a long-term savings vehicle, and it’s even better than your retirement plan through work. Why?

Consider: you’re going to have medical expenses in the future. Very few of us make it through life with zero major medical events for us or our families. Just like you can plan on having a retirement (for which you’ll need that 401(k)), you need to also plan on paying for medical bills in the coming years.

Unlike your 401(k), on which you will be taxed when you take the money out eventually, an HSA is NEVER taxed if you use the funds for qualifying expenses. Plus, any earnings within the HSA are also not taxed. How cool is that? You can avoid paying taxes on some of your income forever. You’re limited in how much you can funnel through the HSA: $3,400 for individuals and $6,750 for families (in 2017), but that’s a good chunk of money for most people. If you are 55 or older, you can even do an extra $1,000 ‘catch-up’.

Get started using your HSA if you’ve ignored it up to this point. You can make changes to your HSA deduction at any time (it generally doesn’t need to be elected only during your company’s annual enrollment period).

I know you’re thinking: great, one more thing I need to come up with money to fund. Here’s the key: you’re going to have to pay for medical expenses anyway, and doing it through your HSA saves a heapin’ helping of tax along the way.

This is a simple step you can do now. Go fund that HSA!

Want to learn more about setting up and using an HSA, and how a smart strategy can save you thousands and ensure a more secure retirement? Setup an appointment.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network.