Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?![Why We Own Bonds in Today's Low Interest Rate World [Webinar Replay]](https://arnoldmotewealthmanagement.com/wp-content/uploads/2020/09/one-dollar-bills-672x372.jpg)

![Why We Own Bonds in Today's Low Interest Rate World [Webinar Replay]](https://arnoldmotewealthmanagement.com/wp-content/uploads/2020/09/one-dollar-bills.jpg)

![Why We Own Bonds in Today's Low Interest Rate World [Webinar Replay]](https://arnoldmotewealthmanagement.com/wp-content/uploads/2020/09/one-dollar-bills.jpg)

Bonds remain an important stabilizer in a portfolio, providing safety and predictable income even in today’s low interest rate environment.

While rising rates and inflation can temporarily reduce bond values, holding to maturity and reinvesting in higher-yield bonds helps preserve long-term returns.

Not all bonds are equal—Treasuries and investment-grade corporates offer stability, while high-yield or convertible bonds add risk that may not serve retirees well.

Should you still invest in bonds with today’s low interest rates?

Below is a recording of a webinar we did on April 3rd, 2020 for clients of Arnold and Mote Wealth Management.

As interest rates were falling, many investors found themselves wondering if they should continue to own bonds. Here’s our answer, with a transcript of the webinar below:

Webinar Transcript:

Before we get into more details on bonds, I wanted to spend 2 minutes on the basic idea of a bond.

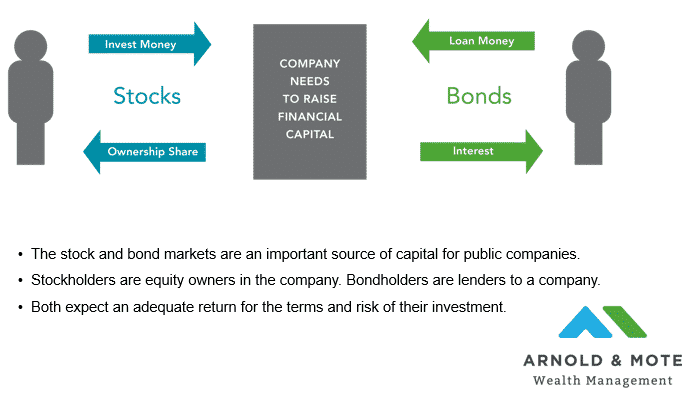

We use two different types of investments for clients – Stocks and bonds.

You have probably heard us say a hundred times about bonds being for safety and stocks being for growth. But why is that exactly, why are returns different, and why is one asset considered so much safer than the other?

When you own stock in a company, you become an owner. You may get dividends, and you can go to annual meetings and give management a piece of your mind.

I like going to the Berkshire Hathaway annual meetings in Omaha each year, which is Warren Buffett’s company. And even there, as a shareholder, I can get up and tell Warren Buffett and Charlie Munger how I think they should run their company. I can ask for other shareholders to vote on an issue, and if others agree with me, we can change how Berkshire operates. So owning stock is truly buying ownership in a company.

And historically, that has produced very good returns. The primary goal of all business owners is to grow the value of their companies, and most of the time, on average, that is what happens.

But, when things don’t go as planned and businesses struggle, stocks get hit hardest because there is very little legal claim equity owners get if the business goes bankrupt. Equity holders usually end up with an amount very close to $0 if a stock they hold goes bankrupt.

And that’s where bonds come in as a safer asset. As a bond investor, you are under legal contract to receive a payment from the company. This payment is the interest on your bond, which is just another way of saying a loan to the company. If the company does well, you don’t receive any more money or value like maybe a stock holder would get, but if the company does poorly, they still must pay you.

If they don’t pay you, you have the right to make a claim for assets of the company. That means you are entitled to your share of the cash in the company’s bank account, its property, and all its other assets – its all up for grabs.

And this gives bond holders an additional safety net to protect their investments. There are very tangible things that back the value of a bond. Cash, buildings, inventory, etc.

Just as an example, over the last 40 years senior bond holders have had recovery rates of about 60%. Meaning, even if the company declared bankruptcy, on average, senior bond investors got 60% of their money back after the company liquidated assets or restructured. Obviously not a great scenario, but there is a big difference between losing 40% of your money and 100% of it!

And this helps to explain why bonds are usually considered safer than equities.

The last thing we want to make sure you understand before we get going is the relationship between a bond’s yield, and its price.

When you buy a bond, you pay a certain price, and get a yield, or the annual interest payment the bond pays.

So, if you buy a bond for $1000 that has a 3% yield. You get $30 per year.

But what happens if over time interest rates go up, and new bonds get offered at 4%?

If you are looking to sell your 3% bond, no one is going to want it because they can get a higher yield on the other bonds that are out there. So, you’ll have to sell it at a lower price so that the $30 you are collecting in interest equates to about 4%. In other words, the price on the bond must go down.

One last important note – This price movement is of no concern to a bond investor if they plan on holding the bond until it matures.

So, you buy that bond for $1,000, and collect a 3% interest payment for the life of the bond, and then when the bond matures, after however many years, you get your $1,000 back. You do not get less than the $1,000 once the bond matures if interest rates have risen. Remember, as a bond holder you are in a legal contract to get your principal back.

This is only of concern to an investor if they need to sell the bond before it matures.

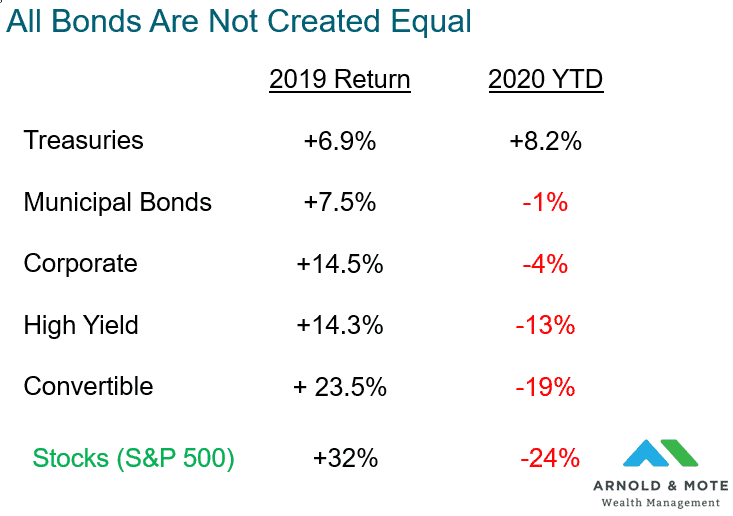

Not All Bonds are Created Equal – Performance of Different Types of Bonds

The term bond can mean many things, and they can be very different.

Widely considered the safest investment is a US Treasury bond. That is because the only way treasury bond investors would not get paid is if the US government defaults. And since they control the printing press, that is considered to be pretty unlikely.

Then you can get more and more risky with other types of bonds from here.

Municipal bonds are states and local governments. They can’t print money like the federal government, but they can still tax property, sales, and incomes, which creates a pretty safe source of income to pay back bond holders.

Corporate bonds are bonds issued from companies, think Apple or Microsoft. The performance for the corporate line listed here is for investment grade bonds, which means bonds from companies that have been audited and deemed to have a very strong likelihood of paying back their bondholders.

Just to give you a general idea on the strength of these companies, throughout history, less than 5% of investment grade bonds have resulted in default. That is lumpy, some years more than 5% default, some much less…but long term average 95% or more of investor dollars in investment grade bonds have returned as expected.

High yield bonds are also called junk bonds, these are from companies that have much worse financial strength. Investors have flocked to them recently since they typically have yields of 8% or more. But they are risky, as we’ll see in a second.

Lastly, convertible bonds are generally issued by companies who can’t afford high interest rates, smaller, start up companies. Here, instead of offering 8% interest rates, they offer to convert your bond into common stock. For example, the car company Tesla has been doing this, where their bonds only pay 1 or 2%, but after 5 years you can convert the bond into a certain number of shares of Tesla stock.

These create very high returns when the stock market goes up, since the value of the bonds are also tied to stock price.

So, we see the returns here. And you may be asking – Why don’t we invest more in high yield and convertible bonds, since returns are so good? And in fact that is what many investors have done lately as yields on treasuries have dropped lower and lower.

But, what happens when things aren’t so rosy – like what we have seen this year so far?

Then, investors are forced to realize that those bonds that had those great returns previously, are not exactly risk free.

So look at these returns in red, imagine you are retired and withdrawing money each month from your retirement account. If that money was in high yield or other risky bonds, you are having to sell 20% more of your investments to produce that same amount of cash.

Now you start to see why when we allocate 30 or 40% of a clients money in bonds, why it is in safer investments like treasuries, or investment grade corporate bonds. That bond allocation is made to safeguard your investments. And those riskier bonds that tempt you with higher yields, certainly do not provide that same protection when you need it most.

Realize that even if these returns were a little lower, 2% or 3%, there is still tremendous value in treasury bonds for times like today. Almost no other investment provides the guarantee that these treasury bonds can provide. So, know that part of the value of these bonds in your portfolio is not so much the interest payments they kick out each month to you, but the ability for them to preserve your money when you really need it.

Having an allocation to bonds today means that we will be able to ride out this storm we are seeing in the stock market today, and avoid selling investments that are temporarily down, and use these treasury bonds for cash, and for rebalancing purposes, where we can see these bonds that have gone up in value, and buy into stocks that are now lower in value.

So that covered a lot about how bonds have performed, and why we prefer some bonds over others.

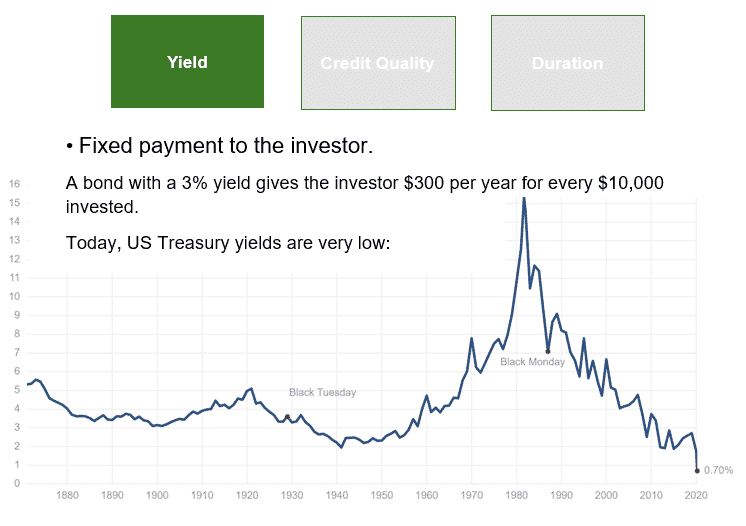

Now we want to get into what produces future return for bond holders, or trying to estimate what you can expect in the future from your bond holdings.

There are 3 main components to the return of your bond investments, and all 3 come together to produce what you see as a total return over time.

The first is yield. This is the simple one. You buy a bond that pays a certain coupon, or a certain interest rate, and that is what you get.

If you buy a 3% bond, that payment is never going to be changed to 5% later. This is the portion of your return that you are locked into.

For this component, expected future returns have been dropping, as you know interest rates have been coming down for 30 years.

This is the chart of 10 year treasury yields over the last 150 years or so. You can see we are at the lowest point in history.

Now realistically, that does mean a portion of the calculation that goes into your long term bond return is lower.

But there is more to your bond allocation’s return than just the interest rate on the 10-year treasury.

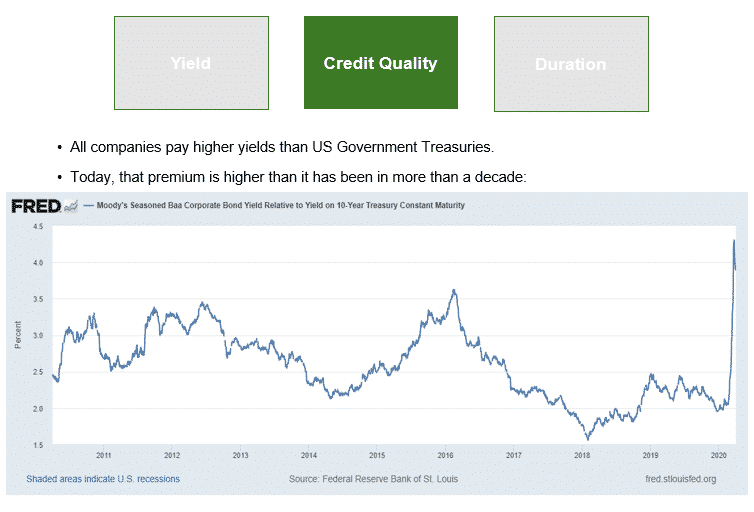

Remember that there are also other types of bonds, corporates and municipal bonds for example. For our clients, you either own a fund with the ticker symbol DBIRX, SWAGX, or SCHZ. These funds also own some bonds other than treasuries.

And the expected future returns on these bonds has gone up much higher over the last month.

This is a chart of the spread, or the difference in the interest rates from investment grade corporate bonds compared to treasuries.

So, for example if the spread is 3%, that means an investment grade corporate bond has a 3% higher interest rate than a treasury.

Notice this spread is much higher very recently. That means corporate bonds will have a higher future return compared to just a few month ago.

Now, there is a cost for this. As we showed in an earlier slide, corporate bonds have lost 4% in value or so. So, if you had $100,000 in corporate bonds at the start of the year, it is now about $96,000. But, that drop is temporary, because now that fund is buying higher yielding bonds, which is going to produce higher future returns for you.

So, this is a good thing for bond investors.

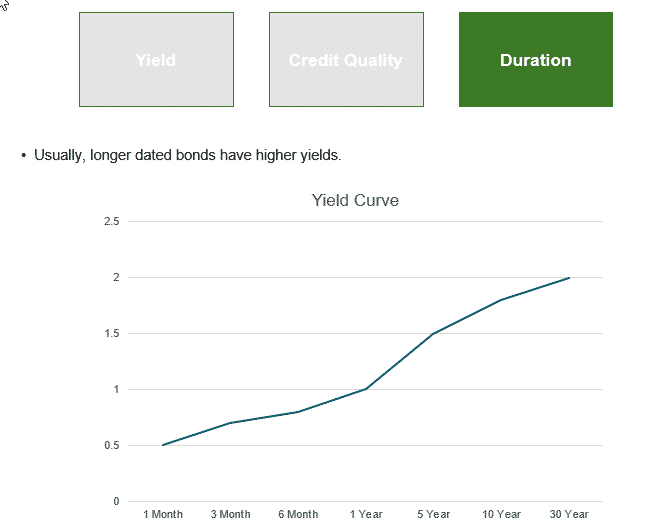

The last main component of your bond investment return comes from duration.

Duration is how long a bond stays outstanding until it is paid back. If a bond is to be paid back in 5 years, it has a shorter duration than a bond to be paid back in 10 years.

And, longer duration bonds typically have higher interest rates. Just like how a 30-year mortgage has a higher interest rate than a 15-year mortgage, the same principal applies to all other bonds.

And economists plot out this increasing yield over different durations and create what is called a yield curve. As you can see, a shorter duration bond has a lower yield than a longer term bond.

And the steepness of this yield curve tells us the last component of your bond investing return. Because remember in our early slide we talked about how as yields fall, prices rise? Well this yield curve helps clue us in on how a bond’s value can rise over time.

So, pretend you buy a 5 year treasury bond today. Over time, as a couple years go by a 5 year treasury begins to trade more like a 3 year treasury. We know from the yield curve at the time that a 3 year treasury bond yields lower than a 5 year, so as long as the yield curve remains unchanged, our 5 year bond will increase in value.

The steepness, or the slant, of this yield curve tells us how much that bond could rise in value.

Now, this can be a topic of an hour long webinar all by itself, so we are really simplifying a few things here…but know that recently, the steepness of the yield curve has become higher than over the last year. That means that this component of a bond investors return has can be expected to increase over time.

So, those 3 parts of a bond return come together to produce your total return.

But what are the risks to that return?

There are 2 primary risks we want to quickly cover. Rising interest rates, and inflation, and then we’ll look at what we can do to hedge those risks for you.

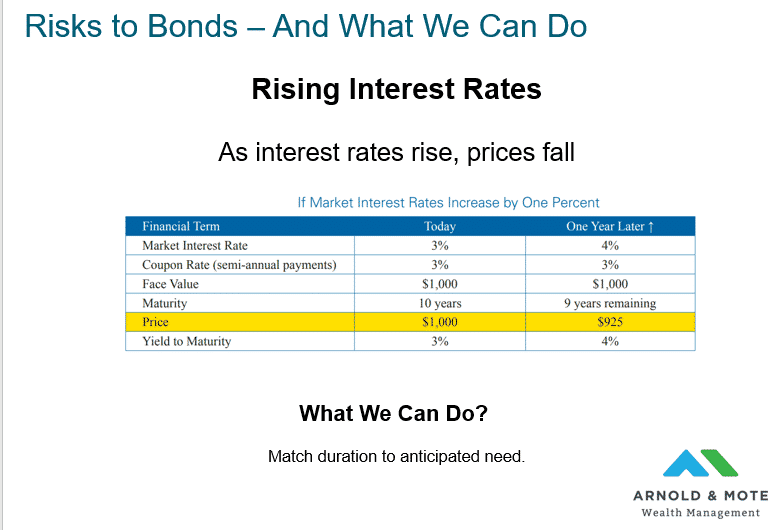

First is rising interest rates.

As we said before, if interest rates rise, the value of your bond can go down.

We show an example here on how the price of a bond can change as interest rates rise.

If you have a 10-year bond and interest rates rise 1%, you could see the value drop by nearly 10%.

But, we can hedge this risk away.

Know that this decline is only recognized if you need to sell the bond before it matures. If you hold the bond until it matures, you get your $1,000 back, not $925.

So, where people get in trouble with fixed income investing is when they buy a bond with a much longer duration than they need. If your savings for next year is in a 30-year treasury bond, you subject yourself to this risk.

If your savings for next year is in a 1-year bond, you have completely removed this risk.

So, we can match your bond duration to your need. For many retirees this means owning shorter duration bonds, since that money is there for your more short term needs.

Inflation

Another risk to your fixed income investment is inflation.

Most bonds pay a fixed interest rate for the life of the bond. That means as inflation rises, the purchasing power of your interest from a bond decreases.

This images shows how the actual purchasing power of the interest from a bond declines over time under even modest 3% inflation.

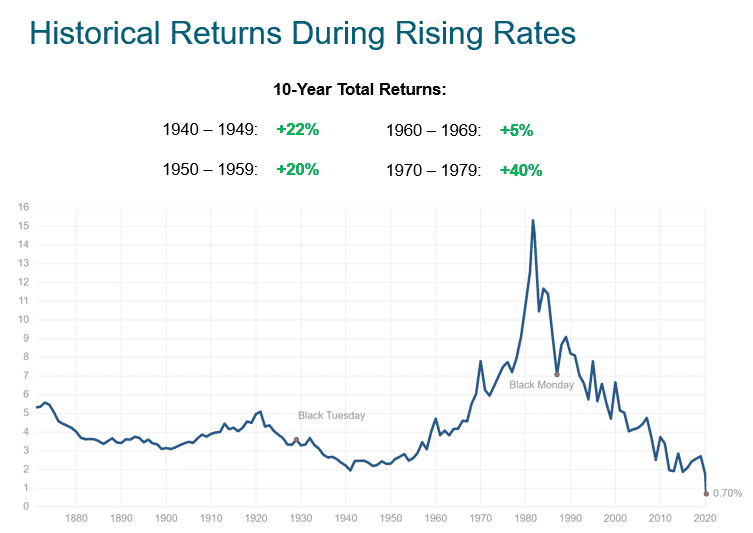

A big fear from investors today is that interest rates will rise and make their bond investments lose value.

So, I wanted to end on a slide that shows the returns that investors have had during the last period we had of significantly rising interest rates.

Many fixed income investors view a period like the 1970’s with high and rising inflation as a worst case scenario.

And while returns in historical periods of rising rates were hardly stellar, they were also not as terrible as you may have initially thought.

This is mostly because although rising rates will cause the value of your current bonds to temporarily decline in value, your bond fund will also be buying those new bonds with higher interest rates.

Over time, that means higher returns for you.

No investment is without risk. But even today bonds play a valuable role in your portfolio.

Quinn worked for nineteen years in HR consulting and corporate finance before realizing he wanted a more direct way to help people improve their lives. When he's not working with clients, you’ll probably find him tag-teaming the work of raising two boys with his wife, Brie. If there’s time left over, he'll be catching up on the Netflix queue or reading his way through an ever-growing stack of books. As a flat fee advisor for Arnold and Mote Wealth Management, Quinn is a CFP® Professional and member of NAPFA and XY Planning Network. Arnold & Mote Wealth Management is a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas.