Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

High yield bonds, also called junk bonds, are fixed income investments issued by companies with low credit ratings. While they offer very high yields that are attractive to many investors, they also offer many disadvantages to other investment options available.

In this video and post below, we discuss the features of high yield bonds that make them poor investments and reasons why we do not use these in any client portfolios that we manage on a flat fee basis.

Note: We recently did a webinar on 4 types of investments we don’t use for clients. Below is just the portion of the webinar that discussed junk, or high yield, bonds.

The link for the full webinar is here if you would like to see the entire webinar, which also discussed covered call income strategies, buffered funds, and commodities.

Webinar Transcript:

These bonds are a huge market, with about $300 billion in publicly traded mutual funds and ETFs, and a total market size of $1.7 trillion. That difference is a lot of pension funds, hedge funds, other private investment funds, etc.

This is a larger market than the municipal bond market!

What makes these different? Unlike some other investments we’ll look at in this webinar, these are not necessarily complex at all. They are just bonds, so think of it like a loan from a company to an investor. An investor gives the company money in exchange for interest.

High yield, or junk, bonds are just the term used for bonds issued by companies below a certain credit rating.

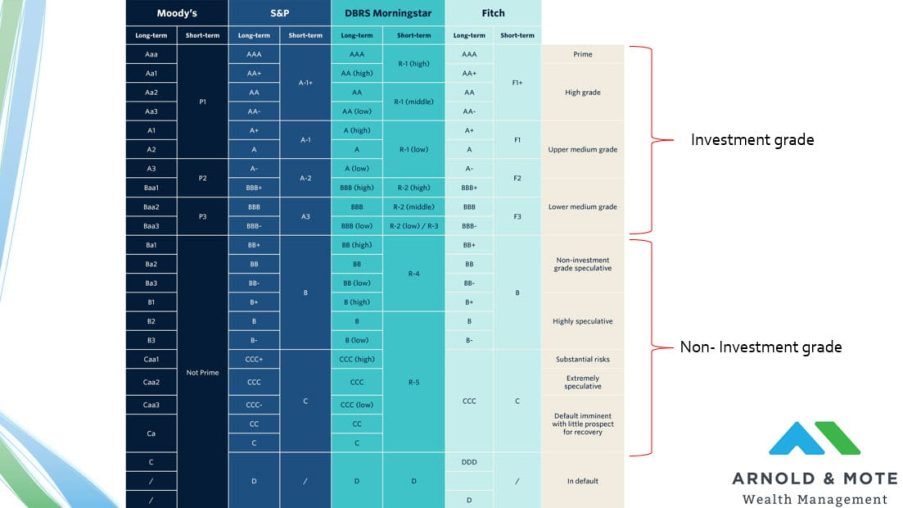

What does credit rating mean exactly? Well there are lots of companies out there that grade company bonds based on the strength of the company’s balance sheet. Moody’s, S&P, and Fitch are the big ones.

And they all have their own grading systems as this chart tries to show here. But, all you need to know is that these junk bonds are bonds issued from companies below a certain rating. This level is the line in the sand between what is called investment grade, which are companies in relatively good financial health, and non-investment grade, which are companies that are struggling more.

So what attracts all this money to junk bonds? I think for most it is the high yield that these funds offer.

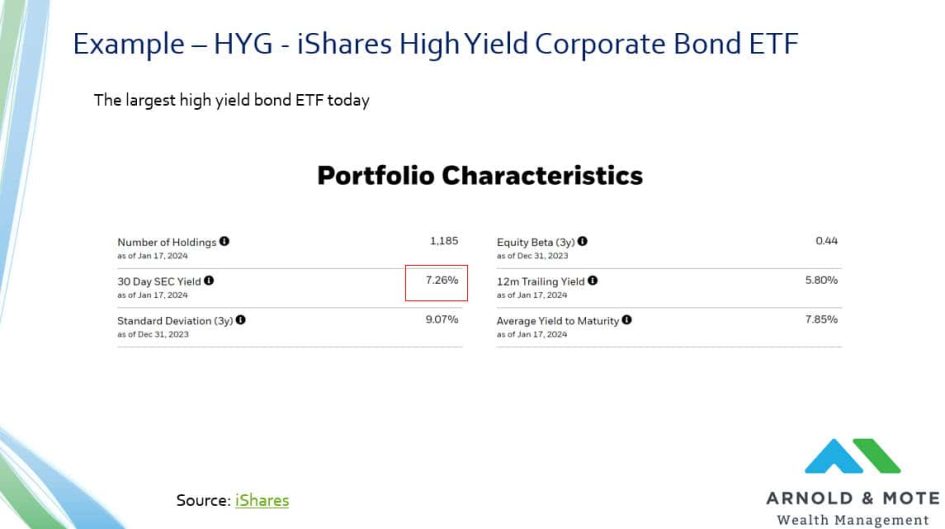

For the next few slides, I’m using a fund from iShares, with the ticker symbol HYG as an example. This is the largest junk bond ETF out there today, so I’m not just picking some obscure fund here.

And right now, potential investors in this fund are looking at a yield of somewhere over 7% – That’s great right? What’s not to love about a 7% yield?

To begin to understand why we don’t believe these funds need a place in your portfolio. I want to first look at the historic yield that these types of bond funds have had.

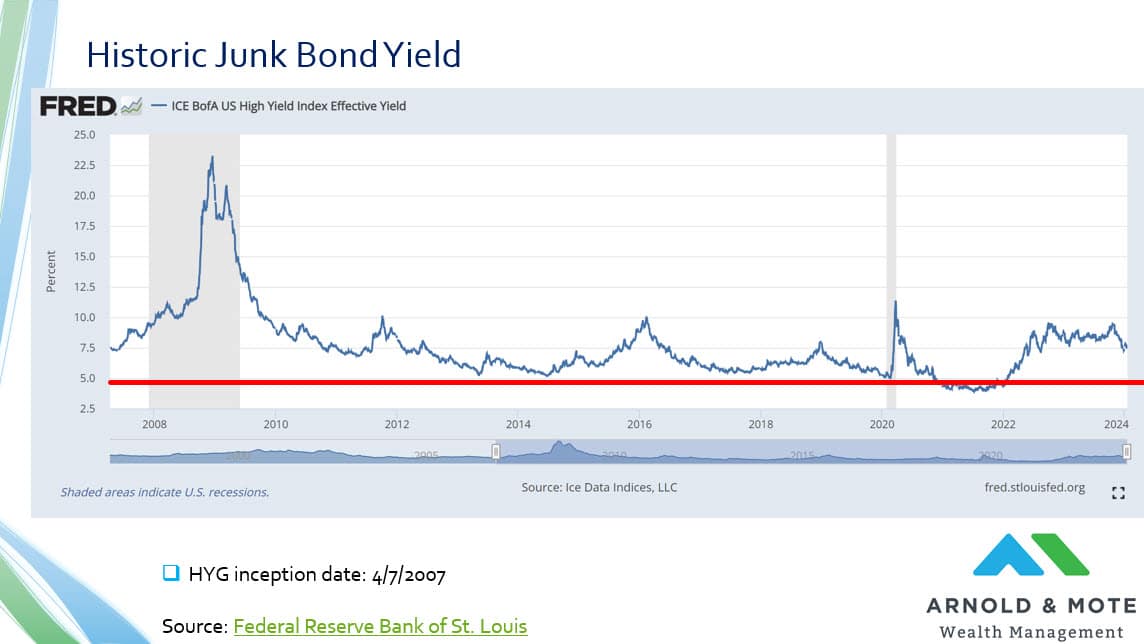

Shown here is a chart from the St Louis Federal Reserve, and it shows the yield of a junk bond index since April 2007.

Why did I pick April of 2007? That is because that fund we just looked at, HYG, was launched in April 2007.

So over that time, this chart shows the yield of these types of bonds.

You’ll see a horizontal red line at the 5% level. You’ll see why I picked this level in the next slide, but for now I just want you to notice that for most of the time since 2007, the yield of these high yield bonds has been well over 5%, right?

If you purchased a fund in 2007 that held these bonds, this should be tracking what yield you received over time.

So here’s the big question. If you purchased HYG in April of 2007 and collected these yields – What do you think your average annual return would be?

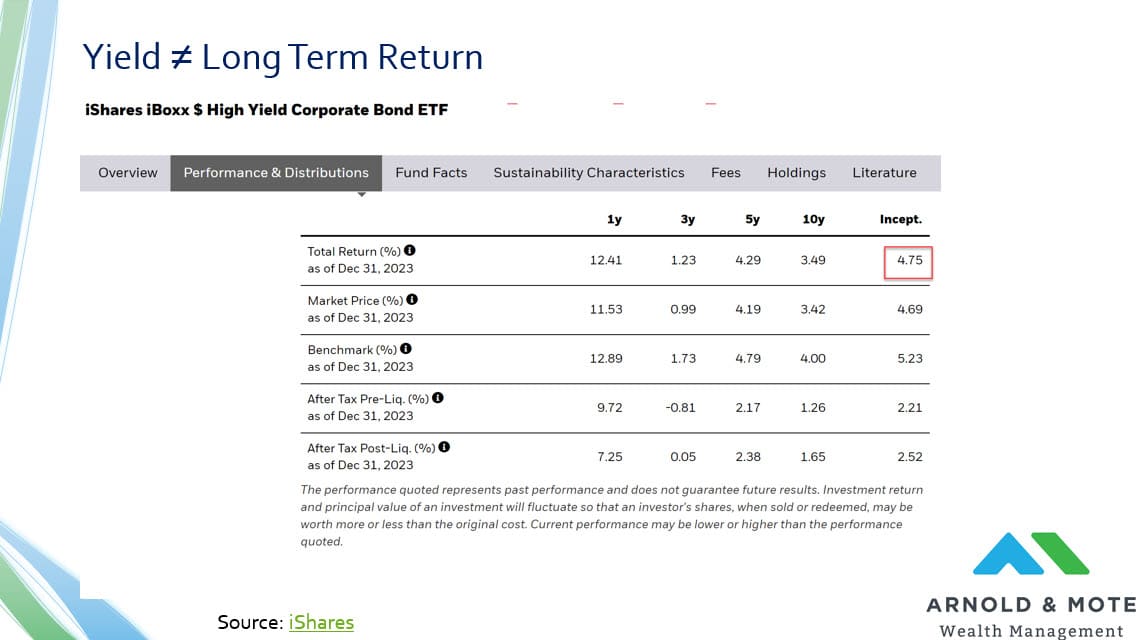

Well thankfully the SEC requires funds to publish their performance.

And this is a screenshot right from the fund’s website – It shows an average annual return since April 2007 of 4.75%.

4.75% average annual return – Why is that so much lower than the yields on the bonds an investor would have received in just about any single year they held this fund?

That’s because yield only tells part of the story for how these types of investments perform.

What you also need to consider is the number of bonds that default.

Remember, these are bonds issued by companies that are not in great financial shape. And if a company goes bankrupt, the owner of that company’s bonds can lose all of their investment.

Default Rates

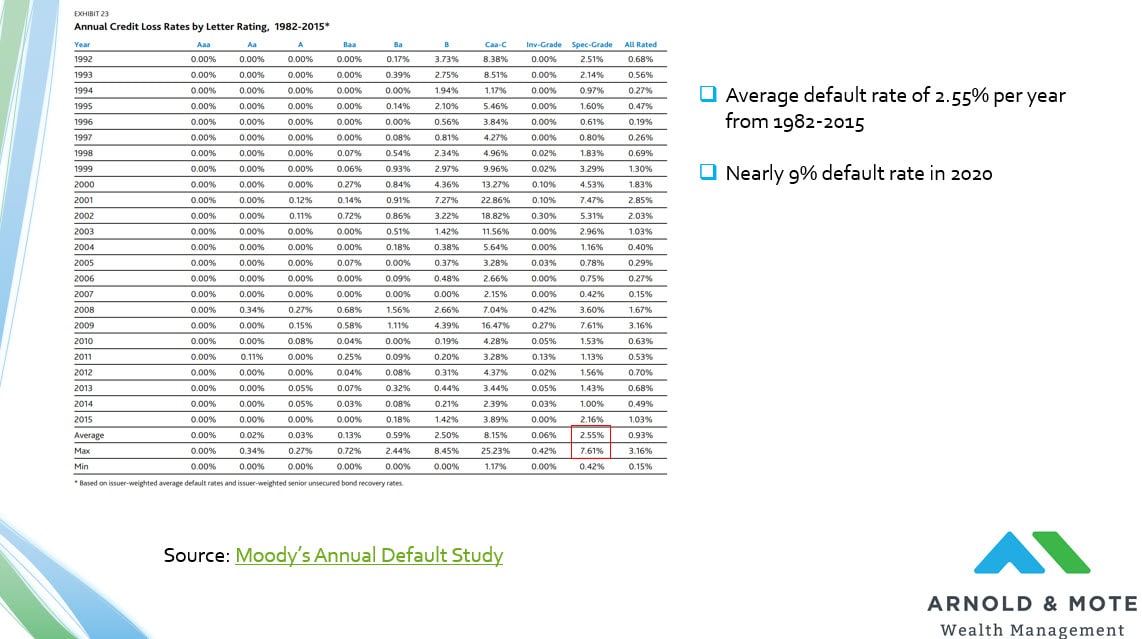

This is a chart from a study from Moody’s that details default rate of bonds from all different credit ratings since 1982. Now this is more information than you probably want, but what you should know is that a not insignificant number of these junk bonds default each year. From 1982 to 2015 it was about 2.5% on average each year, with some years much higher.

Outside of the data from this study, but in the COVID pandemic the default rate on these lower quality bonds reached nearly 9%.

What does this default rate mean to you? This is principal you are losing. If you get 7% in yield but lose 2.5% in principal, your total return is now 4.5%.

So, don’t just buy a fund because it has a high yield.

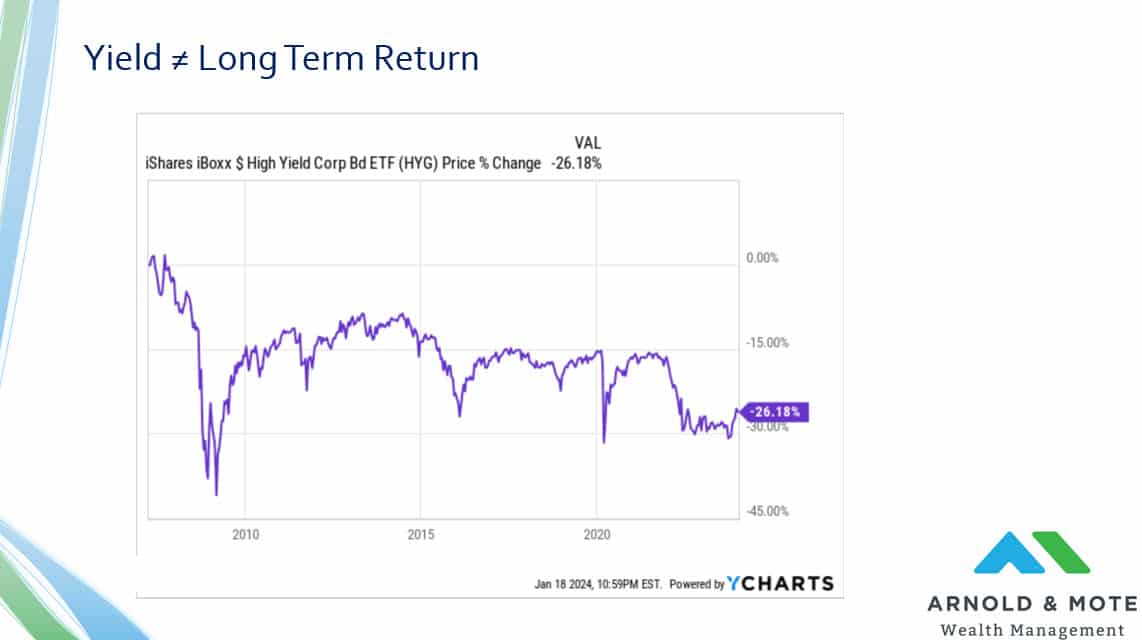

And just to show this another way, here is a chart of the share price of HYG since April 2007. You can see even after more than 15 years, an investor who purchased this fund in April of 2007 is down 25% on their principal investment. This takes a huge chunk out of their total return!

Besides this default dynamic. There’s a few other things to know about funds that invest in these types of investments.

First, fees are going to be much higher than you are used to with more basic bond funds.

Morningstar says the category average for an expense ratio for high yield bond funds is 0.90%.

To be fair, the HYG fund I have been featuring is one of the better ones, with a fee of “just” 0.49%.

But still, a half of a percent to a percent in fees every year is going to really eat into your long term returns.

And also, if you buy these funds outside of a retirement account, you’re going to be paying income taxes on the interest you receive. Very roughly, this means a 7%-10% higher tax rate than what you’d pay on qualified dividends or long term capital gains.

Finally, just as part of the bigger picture. How do high yield bonds fit into your portfolio?

The big problem that I feel high yield bonds have is that they are just in this unnecessary middle ground between 2 very good types of investments that you already have access to – Stocks and investment grade bonds.

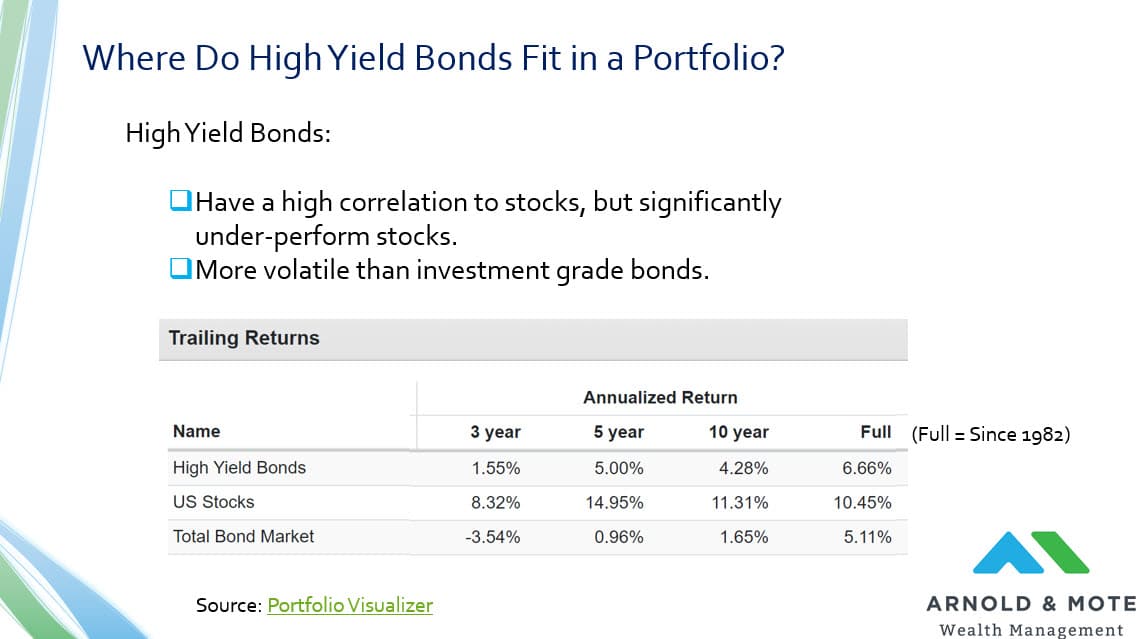

High yield bonds have outperformed higher quality bonds over time, but they have also significantly underperformed stocks.

This chart here just shows the long term performance of high yield bonds compared to US stocks and an investment grade bond fund, which is called total bond market here.

And, High yield bonds tend to be highly correlated to stocks, just meaning that when stocks decline in value, so do these bonds. So unlike higher quality bonds, they don’t provide the protection that things like U.S Treasury bonds do.

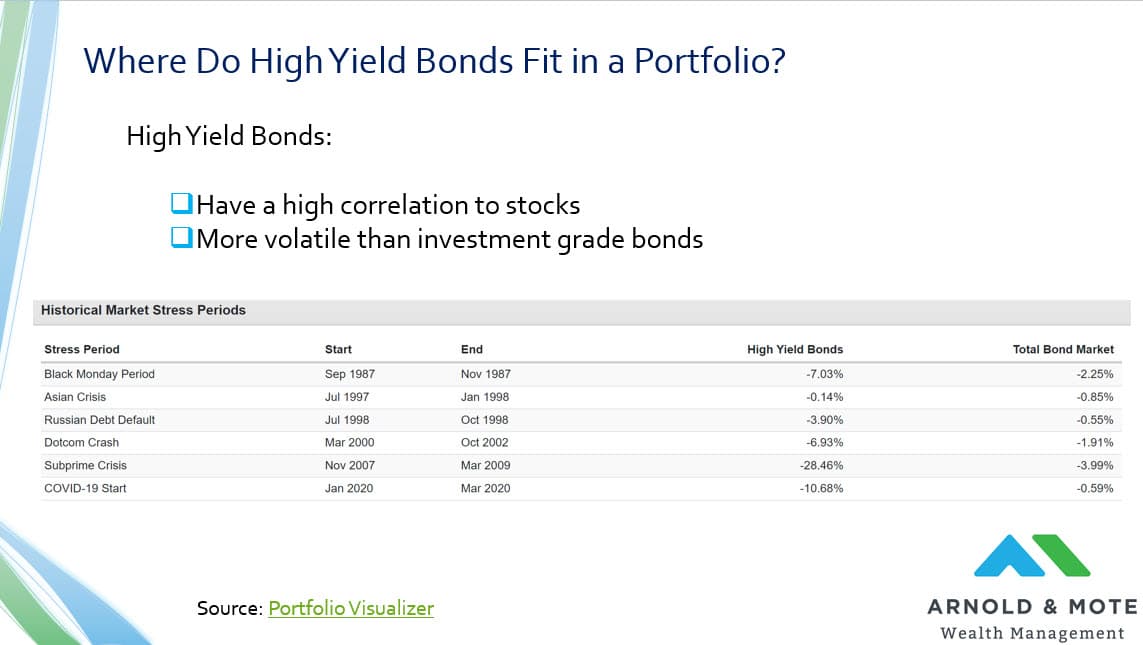

And that volatility is shown in this chart. You’ll see how high yield bonds performed during some notable times of market stress.

Maybe most notably, the 2008 subprime crisis, where high yield bonds lost nearly a third of their value, compared to just a few percent loss for higher quality bonds.

Remember that this was also a time when your stocks were down 40 or 50%. So if you were holding these bonds thinking they would provide some safe and steady income and returns for you, you received quite a shock in seeing a big decline!

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.