Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Scholarships let you withdraw from a 529 penalty-free—you can take out the exact scholarship amount without the 10% penalty.

Unused 529 funds have flexible options—you can save them for grad school, pay up to $10k in student loans, or transfer to another family member.

New SECURE Act 2.0 rule allows 529-to-Roth IRA rollovers—up to $35,000 lifetime, with strict eligibility requirements.

529 accounts have withdrawal rules that allow for penalty-free withdrawals if your child receives a scholarship.

Utilizing a 529 plan can be greatly beneficial toward anticipating the expenses ahead; however, it is difficult to predict what may be received in grants and scholarships in the future. When a student receives additional financial aid, it poses a question regarding what will happen to funding saved in 529 accounts that is now being covered elsewhere. Thankfully, there are a variety of different options that can be pursued in this circumstance.

Update: The recently signed SECURE Act 2.0 adds a provision to allow 529 account balances to be transferred to Roth IRAs. This topic is not mentioned in the video below, but is discussed in the text below.

Normally, withdrawing from a 529 plan for nonqualified education expenses comes with potential taxes and penalties. However, if the withdrawal is a result of a scholarship being received, the penalty will not be applied. 529 plans will allow money to be taken out for the exact amount of the scholarship or grant that has been awarded.

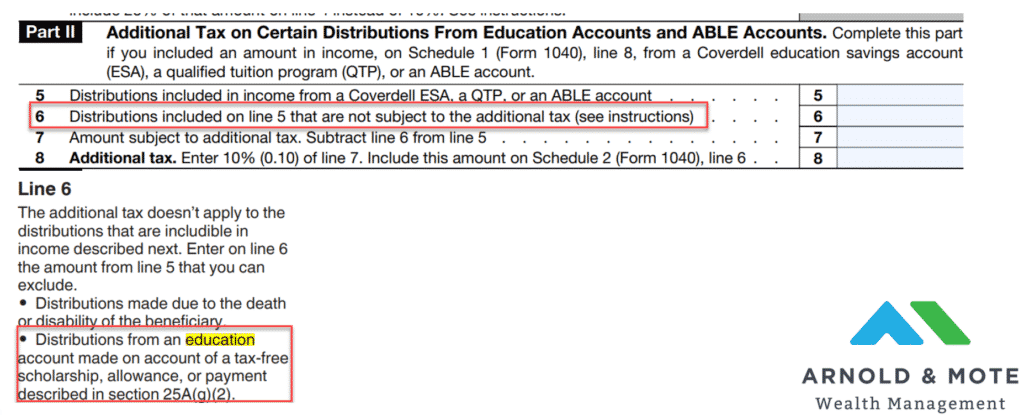

Here is where you will record the amount of your 529 withdrawal, and designate how much of that withdrawal is not subject to penalties:

So, if the potential for a scholarship has been making you hesitant on saving in your child’s 529, this is generally not a cause for concern. If you have unused funds in your 529 because of a scholarship, you are able to get that savings out without penalty.

One option available is to leave the funds within the 529 plan for a future use. Often, there are additional expenses that could come up such as graduate school, study abroad programs, or other expenses. This is a great option toward taking full advantage of the scholarship funding received to use 529 savings toward educational expenses or opportunities that you did not originally anticipate or expect to achieve.

Up to $10,000 of a 529 account can also be used towards student loans as well. So if your child, or another beneficiary you’d like to transfer the account to, has student loans outstanding, any leftover 529 assets could also be used to pay down those loans.

It is worth noting that not all states allow earnings from 529 accounts to be used towards student loans without penalty or tax impact. For example, Missouri does not allow 529 assets to be used towards student loans. While you will get a Federal tax break, you will be taxed at the state level for this withdrawal. It is important to double check with your specific state’s 529 plan.

Another option is to designate the funds to another child or future grandchild for educational use. It is simple to reallocate the 529 funds to a different beneficiary for continued use within the family. Otherwise, planning to fund another family member’s educational expenses such as a future grandchild or relative can be extremely beneficial toward educational expenses ahead.

It is important to check with your state’s 529 plan to ensure you are following rules with your plan. For example, in Iowa, a 529 may be passed to the “member of the family” to the original beneficiary. A “member of the family” is defined as:

There are many options available toward the use of 529 plan savings when scholarships are received. Deciding what solution is the best fit for your situation may take some thought and consideration. Our team can help when making these decisions to ensure that you are taking full advantage of additional aid that you may not have expected. Please feel free to reach out if you have questions regarding the implementation of your 529 plan.

A new option for unused 529 funds will exist beginning in 2024. A new law signed at the end of 2022 allows for 529 amounts to be rolled into Roth IRAs. However, there is a lot of fine print and we will need to wait for clarification from the IRS on a few points. But, here’s the basics:

While there is some fine print to navigate to make sure you are eligible to transfer 529 money to a Roth IRA, this is a very valuable option for many. This provision alone should greatly reduce the worry of overcontributing to a child’s 529 for most families.

Want to learn more about the details of your state’s 529 plan and advanced college savings topics? We recently did a webinar for clients exploring the finer details of Iowa’s 529 plan and some potential planning topics that many don’t consider. You can watch a recording of our 529 webinar here.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management, a flat fee, fiduciary financial planning firm serving individuals and families in Cedar Rapids and surrounding areas. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.