Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

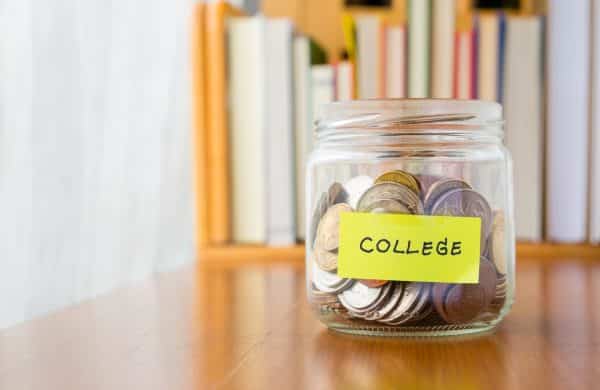

When looking ahead at future expenses, it is often easy for parents to see that the cost of college is a colossal one. It seems logical that a parent would want to help to reduce the expenses taken on by their children as much as possible. However, does tackling this expense now mean more challenging times after retirement?

When navigating the question regarding whether to save for retirement or for your child’s college expenses, it is important to consider all aspects of the decision.

As a parent, it is only natural to want to look after your child. College costs have been increasing each year up to amounts that are not easy for a student to conquer on their own.

With all of the scary information that is available today regarding the harmful effects of large student loans, it is easy to become frightened by the idea of your child taking on this expense. Therefore, many parents have taken it upon themselves to begin saving for their children to attend college. While it is important to help your child in many ways, there are many things to consider when trying to pay for college expenses.

Have you ever heard the analogy; you cannot save a sinking boat if your own boat has a hole in it? This example feels very fitting when debating whether to allocate funds toward your future retirement or toward your child’s educational expenses. In order to be able to help your children, you must make sure that you are fully supporting yourself first. The idea of ensuring that your own account has enough before helping pay for your child’s expenses is not selfish. There are many factors such as rising inflation and predictably high retirement costs that indicate it is extremely important to save now so that you can live comfortably (and help out your children) later.

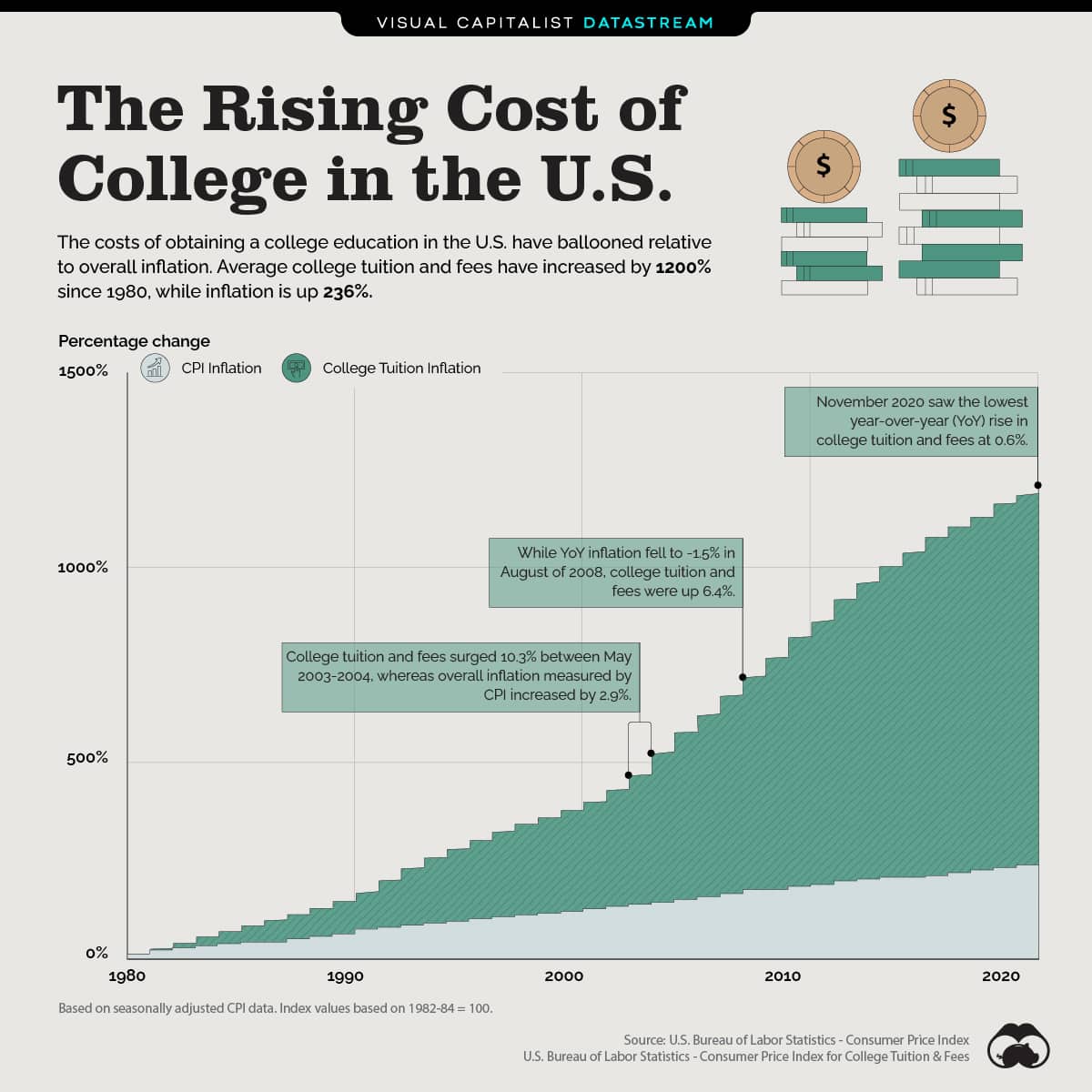

Be sure you are not sacrificing your own retirement before aggressively saving for your child’s college expenses. We help clients determine required savings rates to achieve their retirement goals, and help determine what is available help with future education expenses.

It is important that you first help yourself by making sure that you are saving enough for your retirement to live comfortably. Otherwise, this can create larger issues later. If you are not funding your future retirement needs, then who will be? Allocating more funds toward your child’s education rather than your own retirement can lead to your child having to support you after retirement if you did not save enough yourself. This financial burden can be even more harmful to your children than taking out student loans.

Often, the most important piece of educational funding is fully understanding what financial aid options are available to your student. It may be necessary for a child to choose a school based on the quality of the education they are getting and at a reasonable price rather than picking based on a certain reputation or brand. There are many options available for students to reduce the cost of education. For instance, students can apply for scholarships, begin at a community college, pursue a paid internship, or delay schooling until they have more saved. These options may not all seem ideal, but when it comes to educational expenses, they can be extremely useful to consider.

It is extremely important that you are taking care of yourself first before attempting to tackle your child’s educational expenses. Of course, as a parent, you want to be able to support your child in any way possible. However, it is important to consider all options available and make decisions that will impact everyone positively. The best way to help your child is to ensure that you will not be a financial burden to them later because you tried to fund their expenses now.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.