Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

An Iowa 529 college savings account is usually the best way to save for future education expenses for you, a child, or a grandchild. Iowa offers 2 different 529 plans, one administered by Voya, and another by Vanguard. What are the differences and which one is better for you?

The main difference between the two is the Voya 529 option exists only for financial advisors and their clients. If you have an Iowa 529 through Voya, it has been sold to you by a financial advisor.

The Voya Iowa 529 option’s website is here: https://529ia.voya.com/

The Vanguard Iowa 529’s website is here: https://www.collegesavingsiowa.com/

And while we certainly believe financial advisors can deliver a lot of value, that is not the case with the Voya 529 program. Why?

The Voya option has much, much higher fees compared to the vanguard option. Even before considering the fee your advisor will charge, typical fund expense ratios are 5 to 10x higher than those in the Iowa Vanguard 529 plan. Most funds in the Voya plan have expense ratios in excess of 1%, while most Vanguard funds have fees around 0.2% or less.

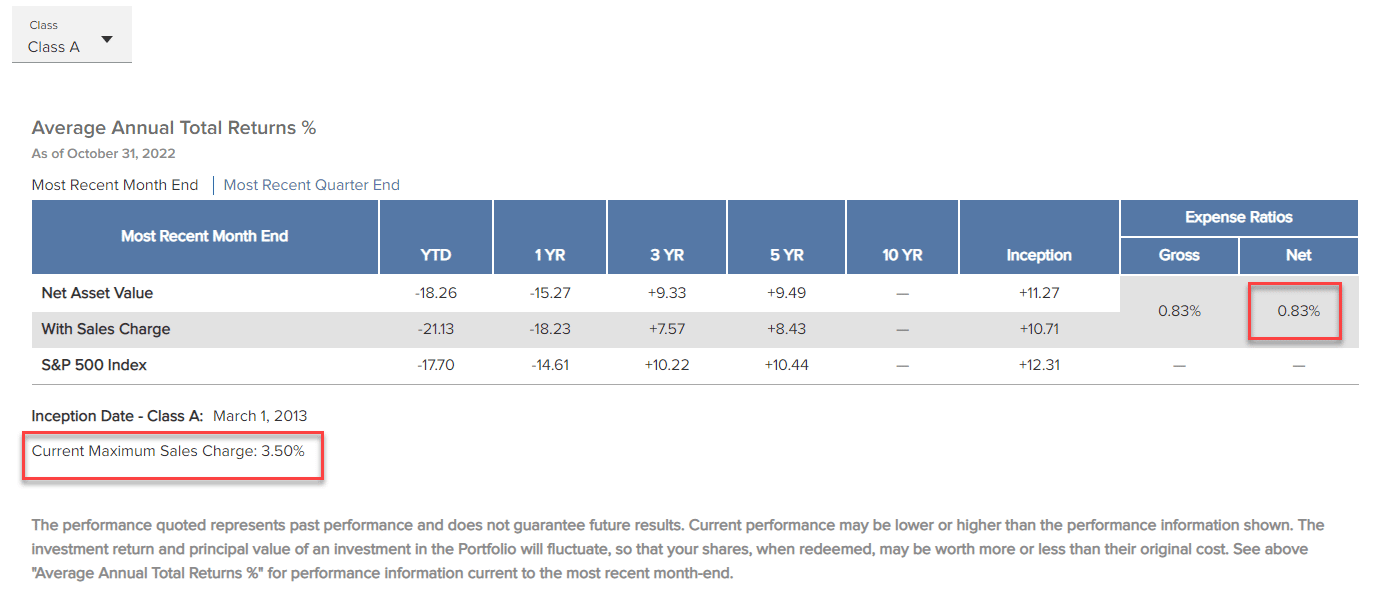

For example, here is the investment option for large cap stocks in the Voya 529 plan:

Notice that the fund has an expense ratio of 0.83%, and a sales charge of up to 3.5%.

That means there will be a fee of up to 3.5% on each contribution. Then, you will pay 0.83% per year on your account value. And you will pay your investment advisor’s fees as well!

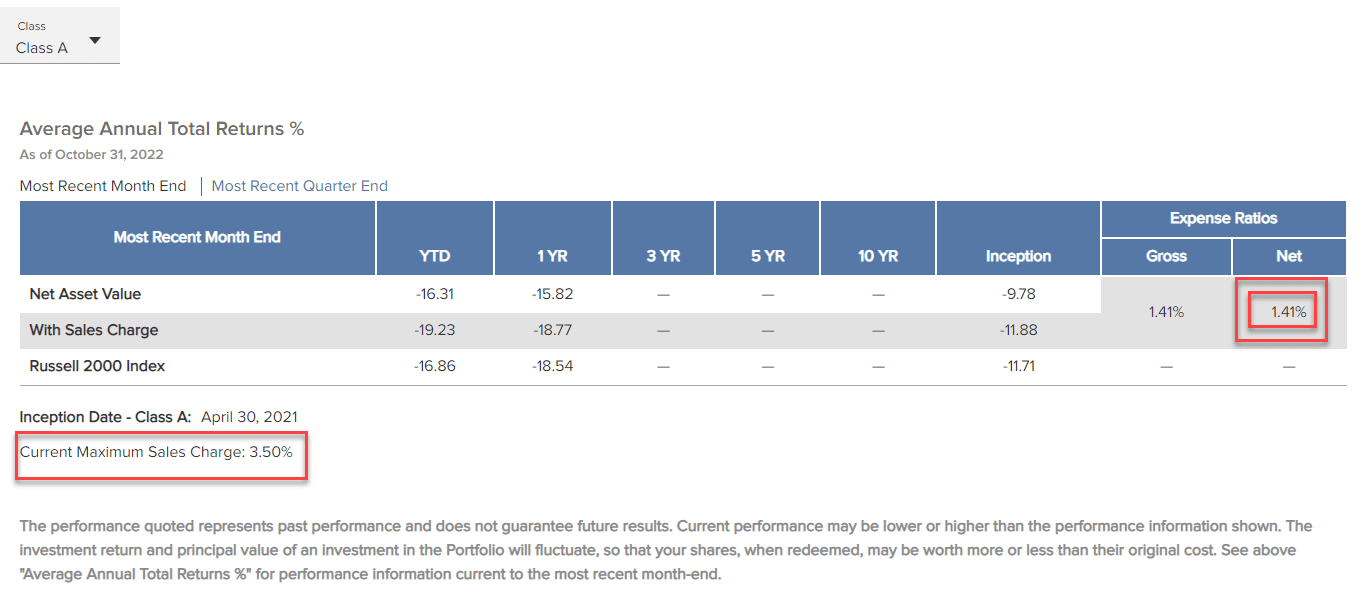

And it can get much worse! Here’s the small cap investment option:

1.41% in fund fees!

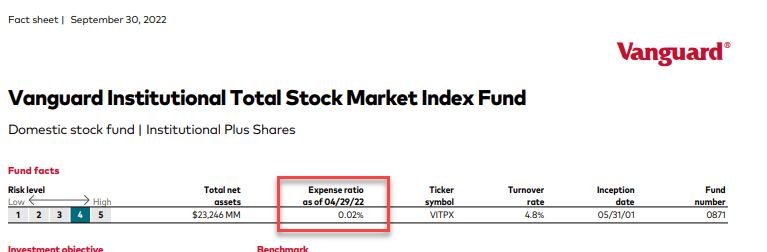

In contrast, here’s the large cap investment option in the Iowa Vanguard 529 plan:

Notice that this investment has no upfront sales charge, and has an annual fee of just 0.02%!

For a family saving $3,000 per year over 16 years, this fee difference can amount to as much as $5,600 in added fees and lost growth.

The Vanguard 529 plan is the best option for most Iowans because of the vastly superior investment options.

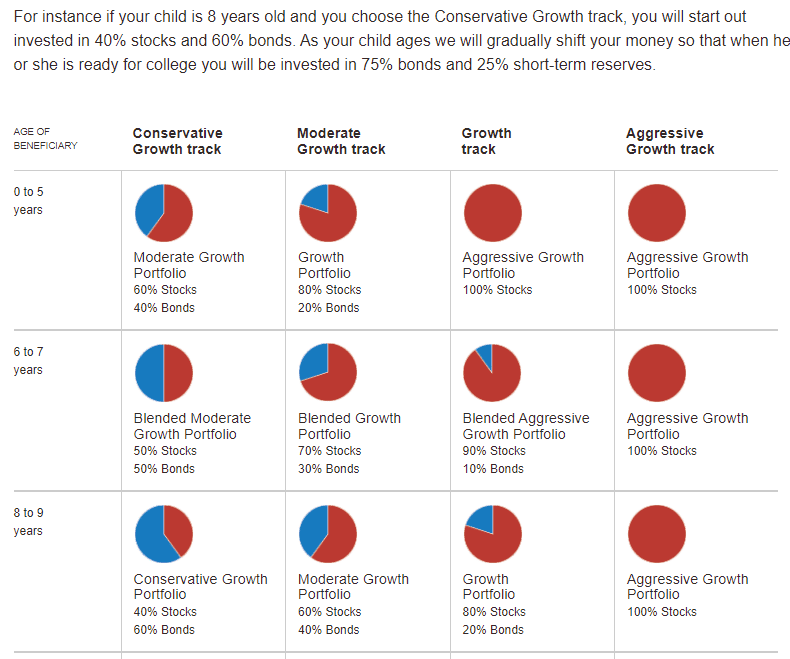

Even if you are uncomfortable managing investments, the Iowa 529 plan through Vanguard offers what they call “age based track” investments. This option automatically reduces the risk in your investments as your child or grandchild gets closer to college age.

These types of investments can not only comfortably put your college savings on autopilot, but also save you thousands of dollars in fees compared to the Voya plan.

If you are looking for help with your college savings plan, we offer one time, fixed fee options for financial planning that allow you to get the help you need without the very high ongoing fees through your current advisor and the Voya 529 plan.

We have more on Iowa 529 investment options in our video here.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.