Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Long-term care is costly, and Medicare won’t cover extended stays.

Traditional LTC insurance offers the most flexible, cost-effective coverage.

Policy choices—benefit amount, duration, inflation, and elimination period—determine both protection and price.

Long term care insurance is not cheap. But, it can be very important. Here’s how to know if you need it, and what to look for in a policy.

This is a replay of a webinar we did for clients to help them shop for long term care insurance. If you are currently looking to purchase a policy, or wondering if long term care insurance is something you need – Let us help. Contact us today to hear how we help our clients with long term care.

Why is long term care insurance such a focal point for many retirement plans?

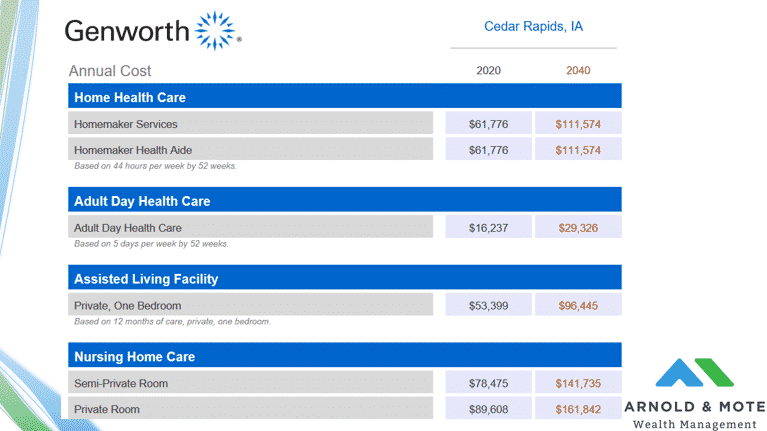

This image here shows the average costs for different levels of care here in Cedar Rapids, Iowa. And there are many different levels of care here, but that stat that is normally highlighted here is full nursing care. If you want a private room, currently you are looking at nearly $90,000 per year.

These numbers come from Genworth. And their site is very useful for finding information like this for almost anywhere in the United States. At the end of this webinar we have a slide for a few helpful resources so you will see this name again.

But if you are concerned about planning for long term care, it is important to check costs where you are, or where you are thinking about where you want to retire. Just for example, costs for full nursing care in the state of Florida rise about $25,000 per year from what you see here. New England is another very expensive region. Costs are not cheap in Iowa, but prices here are certainly lower than a lot of other places in the country.

And then of course, like any medical related costs, these costs have been increasing. These numbers here assume a 3% annual increase over the next 20 years. This is important to consider as we start to plan around the potential for long term care, and as we look at different ways to insure against long term care costs.

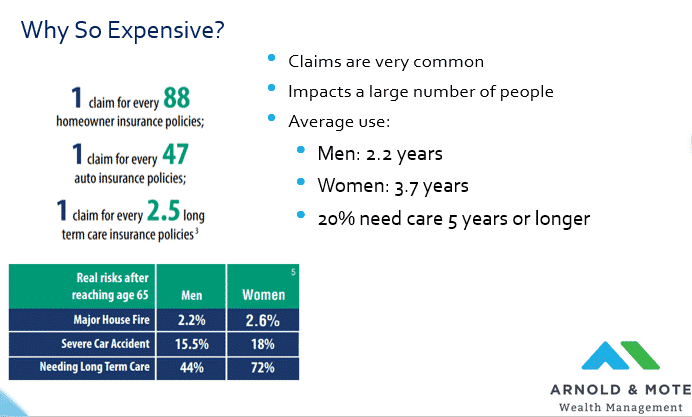

It might not be a surprise to you to learn that long term care insurance is not cheap. We will look at exactly how much this insurance can cost in the next few slides, but I thought these statistics were interesting to try and help you relate to the likelihood of needing some kind of care in your life.

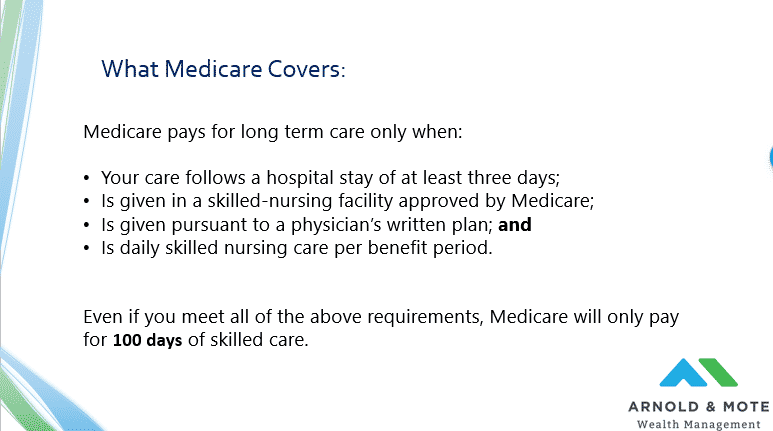

And, a lot of people think that Medicare will cover their long term care costs. But that is not always the case, and it will certainly not cover you for long stays in nursing care facilities.

To be eligible for Medicare coverage, you must meet all of the first 4 bullet points here. You have to come from a hospital, where you stayed at least 3 days. You have to be in an approved location, you need doctor’s orders, and you need to be required to have a certain level of care.

If you meet those requirements, Medicare will pay for the first 20 days.

If you have a supplemental or Medigap policy, you may be covered for stays ranging up to 100 days. If you do not have a Medigap plan, you will have to pay a certain daily limit out of pocket before Medicare pays anything, which today is $176 per day.

But then, regardless of what Medicare plans you enroll in, after 100 days you will be on your own to pay out of pocket.

And so, for what most retirees are worried about, that is needing long term care for years, Medicare will not be there to insure you. So that is why this long term care insurance industry exists.

So the first thing you need to answer in this process is do you need long term care insurance in the first place? Of course that’s really tough to answer, but we can help.

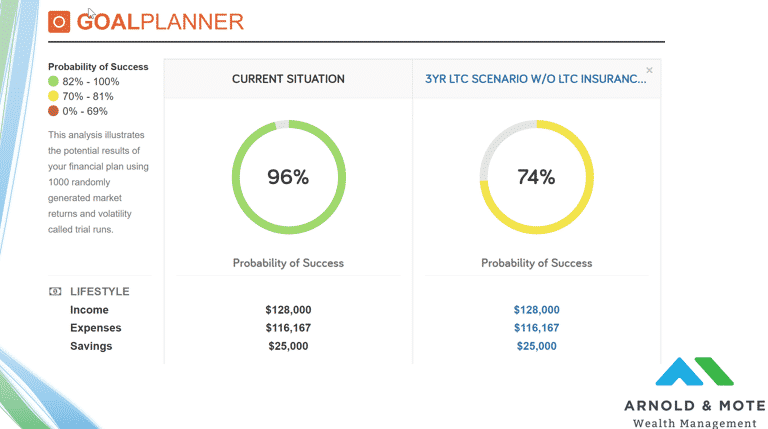

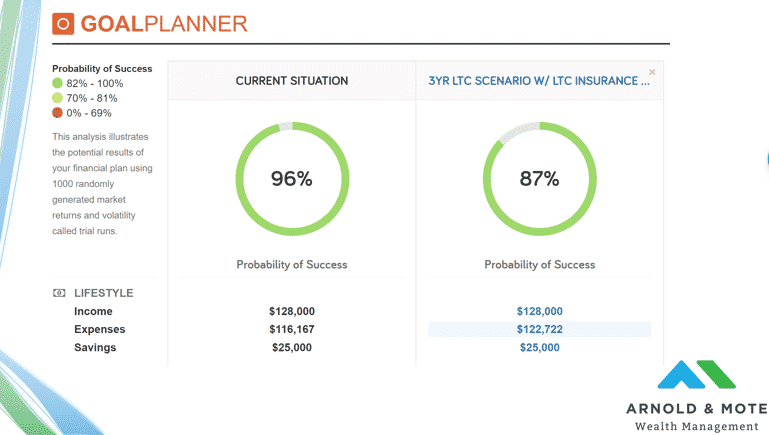

Many of you are familiar with this screen, which is the goal planner for our financial planning software that we use to compare different scenarios. We usually use it to show impact of retirement dates, or spending levels. But one other thing we can do is simulate a scenario where you or your spouse needs long-term care, and stress test your retirement plan.

And this is just an example of what we usually see. Long term care is expensive, and if you need to pay for 3 or more years of nursing care for example, it is going to have an impact on your plan.

But this can give us a starting point on how much coverage to shop for. This is an example of a client who is not in a terrible situation actually, obviously a long term care event lowers like probability of success to meet all their goals in retirement, but this client still has a likely chance of being able to pay $90,000 per year for 3 years without needing to cut back spending elsewhere.

This client may not need a very large LTC policy, maybe we would start by looking for a policy that can just supplement the costs instead of a policy that would need to pay for every dollar of the care.

If this number fell to something much lower, say 40 or 50%, we may know to start looking at larger policies that provide more protection.

Benefits of Long Term Care Insurance to Financial Plan

And then of course we can add those different policies on top of these LTC scenarios to see the impact.

And just for example here, we were showing a client that if they purchased a certain policy that was within their budget, the risk of a long term care event is reduced significantly.

Now these are just examples of course, but we wanted to show you some tools we have to help you make some initial decisions on whether or not you need long term care.

Now we want to move into the process of actually buying a policy. We’ll assume we ran a few scenarios and it showed a risk for your plan for a long term care scenario. What are your choices for adding insurance to help protect against this cost?

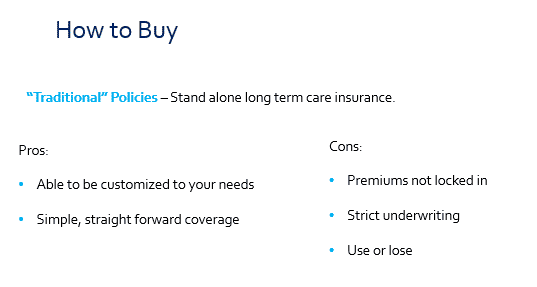

The first type of insurance, and what we’ll be spending the most time covering today, is just traditional long term care insurance. This is simple, straight forward coverage that involves an annual premium that you must pay, and in return it pays for a certain amount towards long term care coverage when you need it.

These policies have some big advantages we think.

LTCi Policy Options

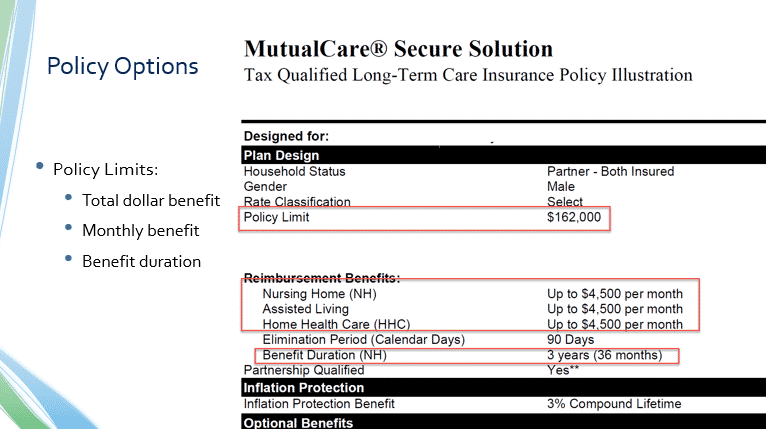

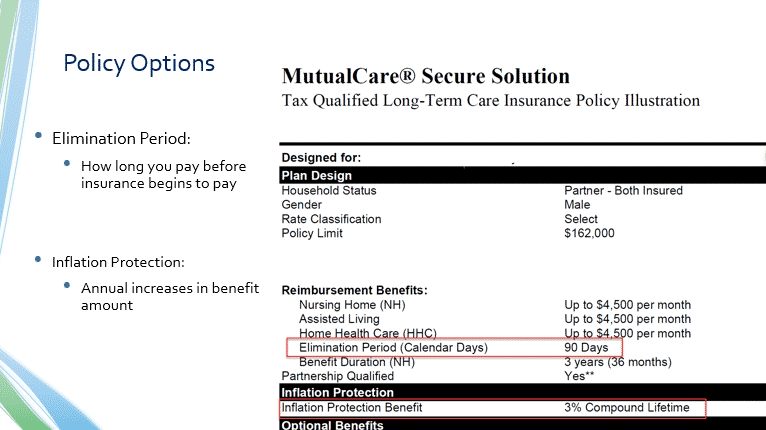

When you shop for LTC insurance, you are going to have a lot of options to choose from. So, we wanted to go through some of the most important options of your policy that you will have to choose from.

First is just the dollar amount that you want the insurance to pay. Policies will have a total lifetime benefit, that is of course the most the policy will pay out to you over your lifetime.

It will also have a maximum daily or monthly limit. This is the most the policy will pay during those periods.

And policies will have a duration, and that is how long the policy will pay out for.

Limits of a Policy

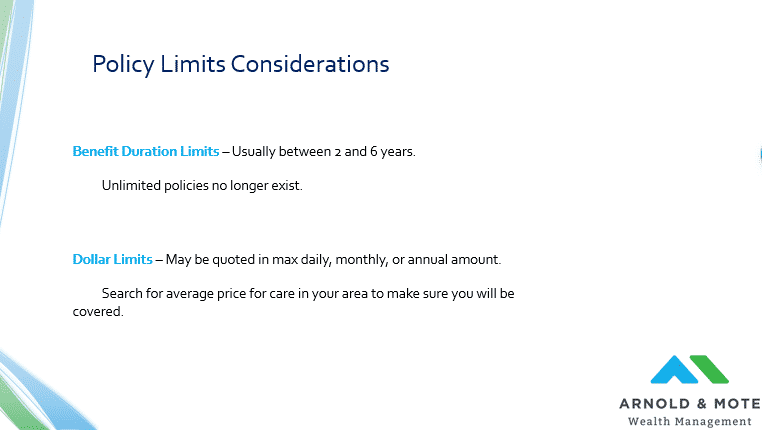

You will have flexibility to adjust all of these options, but there are still some constraints.

First on the duration limit. Most insurers will only give you the option to choose between 2 and 6 years of coverage.

Now, a decade ago or so, you were able to buy policies that offer unlimited coverage. You might have parents or friends with these policies, but if you do not own them already, you will very likely not be able to buy an unlimited duration LTC policy today.

LTC insurers really got burned with these policies they offered 10 or 15 years ago, so they have cut back on the lengths of coverage they offer.

We will talk later about a couple strategies that do still exist to help you insure against longer stays.

You will also choose the maximum benefit the policy can pay. This is where it is important to research costs in your area, and make sure you are covered. A person who plans to retire in Iowa can probably have lower coverage than if that same person planned to retire in Florida, for example.

But again these are just two of the levers we can pull to find a policy that is both affordable for you, and offers you enough protection. You may not need coverage that pays a full $90,000 per year, and only have a need for a policy that would pay for a smaller amount, but you could then afford to add duration to that policy.

So instead of 2 years of coverage for $90,000 you may find a policy with 6 years of coverage for a max of $45,000 per year for a similar price. This might help protect you from a longer stay, which can be harder on a plan financially than just one or two expensive years.

Other options you will have to choose from:

Elimination period. This is how long you have to pay out of pocket before the insurance kicks in. Think of it like a deductible for your long term care.

And you also have the option to add inflation protection to your benefits. We showed in the first slide how costs can significantly rise over time. If you are 60 years old today and buying a policy without an inflation adjustment, by the time you are 85 and use your insurance, your policy may only pay a small fraction of your total costs.

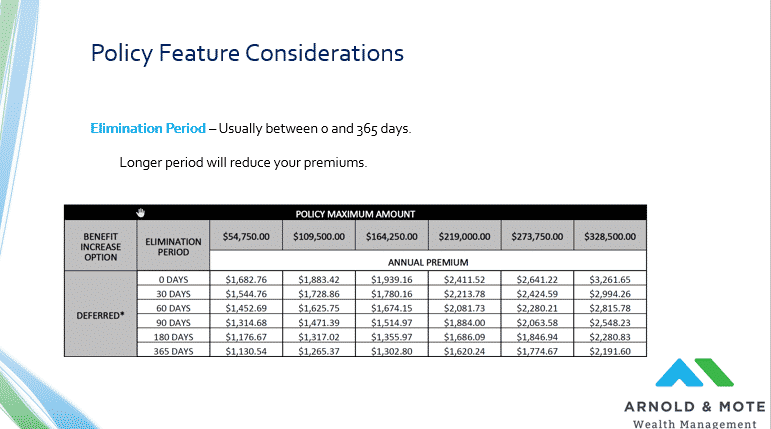

For your elimination period. This is another variable that can be tailored to what you need. Elimination periods usually range from 0 to 365 days on most policies.

I included a chart here that is the premiums for a hypothetical 63 year old male, who was looking for 3 years of coverage.

You can see here how increasing that elimination period can decrease premiums pretty significantly. Just for example, if you were looking for $109,000 in annual coverage, you can reduce your premium by 30% depending on the elimination period you select.

And again, this is just one more level you can pull to help design the best insurance policy for you. There’s no right or wrong answer per say, so this should be tailored to your needs. If most of your retirement income is from fixed income, say a pension and social security but you don’t have a lot of liquid net worth, you may not want a long elimination period.

Whereas if you have a more liquid net worth, no pension but a larger 401k for example, you may have more flexibility in choosing a longer elimination period to help reduce the costs of the premiums.

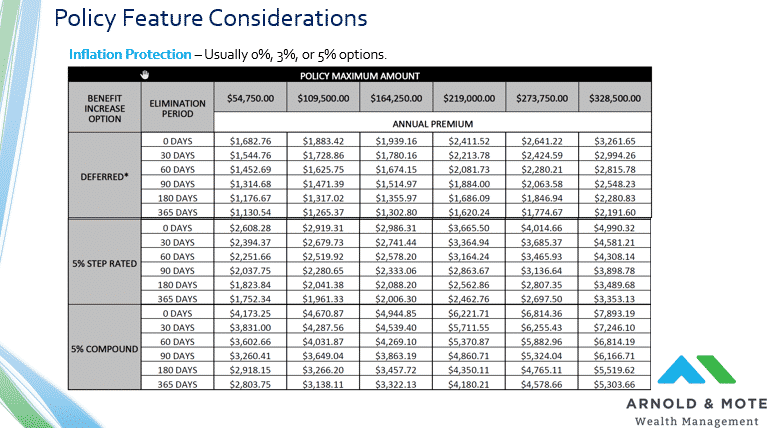

Then the last important feature we wanted to discuss was the addition of inflation on your benefits.

Usually you are choosing between 0, 3, or 5% inflation and then also choosing compound inflation or a fixed rate inflation. Of course higher compound inflation is going to provide you the most protection in rising costs over time, but the policy will be much more expensive.

Again just to show you a hypothetical example so you have some idea on how the numbers play out in this decision.

Here is that same policy we looked at on the last slide, a 63 year old male, but now with options for adding the highest inflation protection. So, this is showing you the 2 extremes here, no inflation and high inflation protection. There is a lot of middle ground as well that we’re not showing.

But, again as a very rough estimate, adding the highest level of inflation protection will cause your premiums to increase 100 to 150% or so. So this protection comes with a cost for sure.

Again, there is no right answer here. If you are young, and by young I mean maybe in your 50s and buying a policy, this might be very important because you could very likely be looking at 20 years before you need to use the insurance.

If you are buying later in your life, maybe its worth considering a higher initial policy with no inflation protection.

And so, we wanted to introduce you to some of the most important options when it comes to selecting a policy, but there are a couple other things to consider.

First, we get asked a lot when should you buy LTC insurance.

As an absolute max, many insurers do have a max age. We’ve seen ages between 75 and 79 as the absolute latest.

If you are in your 60s and retiring soon or just retiring, its not too late to be looking for a policy.

The reason to buy earlier is to get coverage before health problems begin to show up. I think insurance agents will push for signing up a little earlier and they will say that is to get coverage in while it is still more likely to be able to qualify for coverage. Of course the downside is that you may have more years of paying premiums. So, this just depends on the risk you want to take in waiting compared to the savings you could have in waiting.

How much coverage should you buy?

You want to have an idea on what costs are in your area to start. That will help point you in the right direction for determining a coverage amount.

Then, you need to select a duration. Which again the right answer is going to depend on your situation. But, one other popular feature of policies that we hadn’t discussed yet is what is called Shared Care policies. These are policies that allow for a pool of coverage to be shared between spouses. Maybe 2 spouses share 8 years of coverage, just for example.

This can help protect you in the instance of one spouse needing a longer duration of coverage and a more affordable price than if both spouses purchased long policies. Of course there is a little less coverage in this instance too, but this is a good option to consider we think.

Options for Affordable Long Term Care

In addition to regular LTC insurance like we discussed, there are a few other alternatives available.

One is deciding on a retirement care community. Selecting the right retirement community can really help control long term care costs in a few different ways.

First, they may save you money by allowing you to stay in independent living longer and not have to move into an assisted care facility so early.

Next, they may offer caps on long term care costs. For example, Cottage Grove here in Cedar Rapids advertises that if you buy in to the community, your long term care costs will be capped at an amount that is well below the market price for nursing care should you need it in the future.

Now, going to full nursing care at Cottage Grove is still going to be expensive, and you still may want insurance, but knowing what the cost will be ahead of time, and knowing that it may be lower, might help you be able to select a LTC policy with a lower premium for example.

And lastly, several of the LTC retirement communities in the area are supported with large endowments or funds that will effectively pay for your care should you exhaust your resources. In other words, as long you meet their financial requirements when you initially enter the community, they will not kick you out if you deplete your resources while staying there. This provides a very good option for those worried about very long term nursing care needs, where costs can really impact your financial plan.

And we will have a future webinar on retirement communities if you are interested in more on this topic. We also have a series on our blog with interviews and a look at a few of the local communities around here if you want to learn more.

One other option you will see advertised a lot is what is called hybrid policies.

We are including this here because these are very popular for insurance agents to sell. So if you start reaching out to some insurance brokers, you will very likely be presented with one of these policies. So, we wanted to be sure we covered them here.

These hybrid policies are effectively LTC tacked on top of life insurance like whole life or universal life, or an annuity.

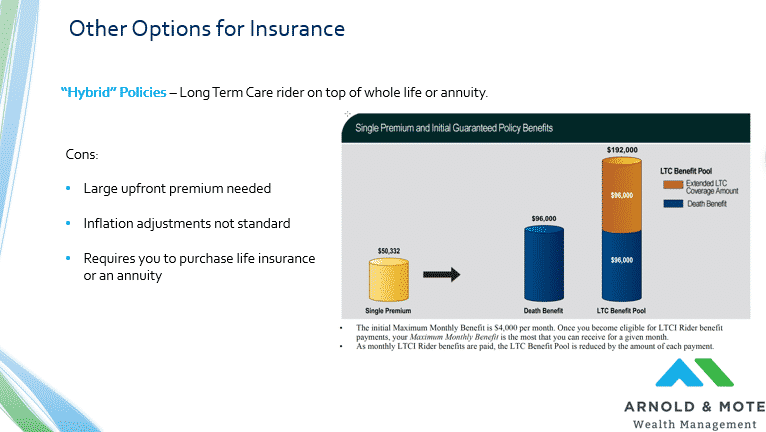

And while there are a wide variety of these policies available, generally they require large upfront payments, and you buy into an insurance contract where some of the benefits can be used for LTC costs. For example, this image here is from a 53 year old male who was looking at using the cash value of their life insurance to buy LTC coverage. Effectively, with a $50,000 upfront payment now, they could receive up to $192,000 in LTC coverage.

So, a few quick observations. First, putting $50,000 down at age 53 for only $192,000 in coverage, and this is coverage that does not increase over time with inflation, is not a great deal necessarily.

$50,000 could pay for decades of premiums, or you could also just keep $50,000 in a taxable brokerage account and invest and self insure that way.

But there could be a few “pros” to these policies. If you have a very large whole life, or universal life policy, transferring that policy via a 1035 exchange may be your best option.

Some people like the idea of being fully paid up for LTC insurance. Whereas traditional LTC insurance has annual premiums that may increase, here once you put in the required amount, the insurance is funded.

And lastly, sometimes these types of policies will have less strict underwriting. You may not be able to qualify for traditional LTC insurance, but you may be able to use a policy like this to provide some amount of protection.

So in general, we tend to point clients towards traditional policies. But, of course that doesn’t mean that is always the best course of action for everyone.

More info – Where to Shop for Long Term Care Insurance

And lastly, if you want to learn more obviously please reach out to us. We have used these two companies on the right here before for clients, and they work well with fee-only financial advisors like ourselves.

I am putting up their names here because they have good resources on their site if you just want to learn more. But let us know before you contact them, and we can help do some of the admin work and analysis for you in the application process.

And lastly, Genworth is a good resource if you want to find cost of care in your area. They have a very nice calculator that shows costs of the various levels of care based on your ZIP code, and also how those costs have increased over time.

They also have online quotes they provide without collecting phone numbers and emails, so you can get a very rough idea on coverage available to you and the costs.

By now we hope you realize that there is a lot of planning that goes into purchasing a long term care insurance policy. We help walk our clients through the process, determine their need for insurance, and find the best policy for them.

If you’d like help finding a policy for you, reach out today!

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.