Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

If you don’t need your RMD (required minimum distribution) to cover ongoing living expenses, you are required to still take it. Here are 3 options that can help you reduce taxes and continue to grow your wealth from an unneeded RMD:

Although the large majority of Americans end up spending their IRA’s Required Minimum Distribution (RMD) each year, some of our clients want to know what to do with the amount if they don’t need it right now.

The calculation to determine the amount of your required distribution is based on your age, and the balance of any pre-tax qualified retirement accounts on December 31st of the prior year.

What type of tax-deferred retirement accounts have RMD requirements and apply here?:

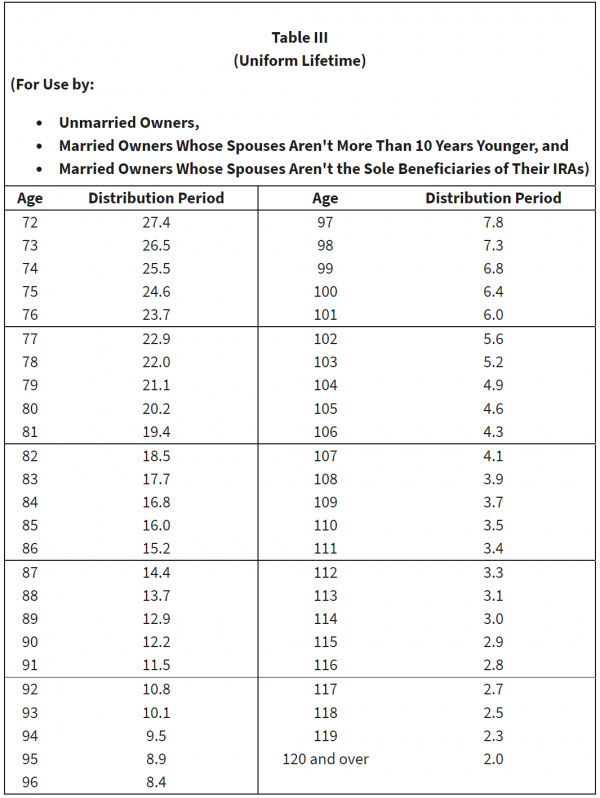

If your spouse is the primary beneficiary and is 10 years or more younger, their age may apply into the calculation as well and will change the calculation.

Then, you need to know the “Distribution Period” for your age from the IRS’s Uniform Lifetime Table, which is found in Publication 590b and is based on average life expectancy. Here is the table for 2024, but it may vary in future years:

For example, if you are age 74 with $2 million in pre-tax qualified retirement accounts and your spouse was not 10 years or more younger than you, your Distribution Period would be 25.5. Therefore, your RMD would be $78,431.37 ($2,000,000 / 25.5)

You can also use an RMD calculator, like this one from Schwab.

Now once you consider that this income comes in addition to that of Social Security and pensions, you may see why those with large tax-deferred accounts may have RMDs that are not needed and in excess of what they will spend during the year.

If you are required to take an RMD from your IRA, 401(k), or other qualified retirement accounts (See IRS for specific rules on RMDs) – You have to take a withdrawal out of the account, that’s not negotiable. The IRS imposes a 25% tax penalty of the amount not removed each year. (This penalty was reduced from 50% by SECURE 2.0 Act, and may be as low as 10% if fixed promptly) Even if you don’t need the money, failing to meet your RMD is usually a bad idea that will result in added taxes.

Here’s 3 popular options we advise our clients who don’t need their RMDs to do each year:

One option for what to do if your RMD if not needed – If you are over age 70.5, you have the ability to perform QCDs, or Qualified Charitable Distributions.

These donations are done to a qualified charity directly from your IRA and count towards your RMD amount for the year. For those over age 70.5 years old, and especially those over 72 who don’t need their RMDs for living expenses, this is the most tax-efficient way to donate to charity.

QCDs allow you to avoid any taxes on up to $105,000 in required minimum distributions! This amount is 2024’s limit, but is adjusted for inflation each year.

For example, if your RMD was $10,000 for the year, you could donate $10,000 directly from your IRA to a charity via a QCD. After that, you will not be required to withdrawal any additional amount from your IRA or other qualified retirement plan. You will pay no taxes on the withdrawal of $10,000 from your IRA, and it will have no impact on your taxable income subject to the income tax brackets, or for other additional taxes, (like Medicare’s IRMAA surcharge).

In order to qualify, the money has to go to a recognized charity, and be processed as a check directly from the IRA. The money can not go to your bank account first.

How do QCDs work? For our clients, we provide them a checkbook that is to be used only for charitable contributions. You can then write a check, and everything will be processed to count towards your RMD and not cause any additional tax burden.

Besides offsetting your RMD amount, QCDs are one of the most tax-efficient ways to give to charity. The fact that QCDs do not count as income at all makes them far superior for tax liability reduction than the charitable deduction you can claim for regular charitable contributions.

For more on developing a tax-efficient charitable giving plan, see our webinar here: How to Create a Charitable Giving Strategy

There’s no rule that you have to spend the money, you can also reinvest your required minimum distribution in a taxable brokerage account!

While this will require some taxes to be paid, a large majority of your withdrawal can then be reinvested and grow in a taxable brokerage account where it will be subject to much less in taxes later. Unlike withdrawals from your IRA, which are taxed at ordinary income tax rates, investment gains in a taxable brokerage account are taxed at long term capital gains tax rates, which are lower.

If you know that your RMDs will regularly not be needed in the future, developing a Roth conversion plan may be very beneficial to reduce future tax burden from your RMDs.

While Roth conversions do not count towards your RMD amount, money that is withheld for taxes does. So, you can withhold the entire amount of your RMD to pay Federal and state taxes for a Roth Conversion. This is an alternative idea that has to be done correctly, but can be a powerful way to get more Roth savings and dramatically reduce your future tax bills.

For more on creating a Roth Conversion Strategy, watch our webinar here.

If you are in a position where your RMD is not needed, you are likely in a position where tax focused financial planning would be very beneficial.

At Arnold and Mote Wealth Management, we specialize in this type of tax planning to reduce tax liability for our clients during their retirement. We focus on withdrawal strategies, targeting specific tax brackets, Roth conversions, and more.

Click below to set up a free 30-minute meeting with us to see what we can do for you.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.