Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

A QLAC, or a Qualified Longevity Annuity Contract, is a unique type of deferred income annuity that is popular for those looking to reduce their RMDs early on in retirement and secure additional income for later in their lifetime.

As with all insurance financial products, careful consideration must be made to the long-term consequences of purchasing. In this article, we briefly discuss the basics of QLACs, their benefits, and some potential QLAC disadvantages.

A qualified longevity annuity contract is a form of deferred annuity. You provide an upfront, lump-sum payment to an insurance company in exchange for guaranteed monthly payments in the future.

These are funded with pre-tax retirement savings accounts such as traditional IRAs, 401(k)s, or 403(b)s. To purchase, you will transfer an amount from your qualified retirement account to an insurance company. You will lose access to these funds until the annuity begins monthly payments.

Withdrawals from QLAC annuities are taxed just like any other qualified annuity. Any distribution from a qualified longevity annuity contract is taxed at ordinary income tax rates. See our blog post here on annuity taxation.

QLACs have several features that make them attractive for retirees:

First, any balance in a QLAC is not subject to general RMD rules like other qualified retirement savings or other types of annuities. The unique feature of a QLAC is that payments from the annuity can be delayed until as late as age 85. The balance does not need to be factored in while calculating RMDs for all other accounts during this deferral period. This makes the money you save in a QLAC not subject to required minimum distributions for an extra 10 years compared to other retirement investments.

This can be very advantageous for retirees looking to reduce taxable income early on in retirement, which may make room for Roth conversions, or reduced tax rate on Social Security, or other investments.

Second, these are great investments for those who are worried about outliving their general retirement savings or want to make sure additional income will be available to them later in retirement for high expenses, like medical care or long-term care. Because the assets in the QLAC can be deferred for longer, they will generally provide higher monthly payments than traditional deferred annuities.

Lastly, these are very straightforward insurance products. Unlike many other types of annuities (variable, non-qualified, MYGA, etc), we find that these are easy for our clients to understand.

However, there are some rules to be aware of:

First of all, you can only invest a maximum of $200,000 into one of these annuities. So, depending on your need for income or risk tolerance, it may not be able to fully meet your fixed income needs. Note that these requirements are as of 2023 and have recently changed with the passing of Secure Act 2.0.

Be sure you are seeking out up-to-date information. There is no longer a 25% account limitation, and the amount has increased significantly from when QLACs were created in 2014.

These products can have set payout schedules for life-only (which means once the holder of the annuity passes, all payments stop), joint-life (which means that the monthly payments can continue as long as you or your spouse is alive).

Some provisions will guarantee a return of premium. For example, if you purchase a $200,000 QLAC at age 55 and pass away before the periodic payments begin, your beneficiary will receive $200,000 as a death benefit.

A joint-life payment plan and any premium guarantees will reduce your monthly income payments from the annuity, though.

Interested to learn more? We recently did an in-depth webinar on QLACs for our clients that you can view here:

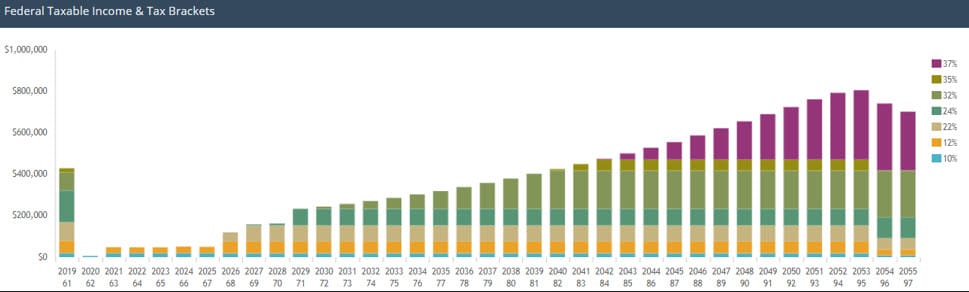

While QLACs do delay RMDs, for those with significant qualified retirement savings, additional deferral is ultimately just kicking the can down the road. This may subject you to much higher taxes later in life.

We find that if you have about $700,000 in pre-tax retirement accounts or more, you need to take action early in retirement to reduce your future tax liability. Any deferred income annuity will only worsen the tax obligation that will come later in retirement.

This reduction in future tax liability is done through the creation of a withdrawal or Roth conversion plan, and is something that we help our clients with every day.

You also risk significant inflation with these products. You must consider not only what income a QLAC can provide, but also what purchasing power that income will have many decades in the future. If you set up a deferred annuity with a $5,000 per month payment that begins in 15 years, will that $5,000 be enough to pay for your living expenses? If you can elect an option for future inflation adjustments from your insurance carrier, it should be strongly considered.

Lastly, these products remove a lot of the flexibility that savings within a 401(k) or IRA have. Once you purchase a QLAC, you will not be able to take extra withdrawals from it to cover large one-time expenses or perform tax-optimizing tasks like Roth conversions. You must be comfortable knowing that the assets within a QLAC are restricted and not available to you in the future.

If you are looking to create an additional retirement income stream and defer taxes, these may be a great addition to your retirement plan. These can be great products for those with significant retirement savings who are looking to ensure they will not overspend early in retirement, or be at risk for higher expenses later in life, such as long-term care.

Please reach out and schedule an introductory meeting for us to discuss QLACs, and other strategies to create a tax-efficient retirement plan. We provide an objective point of view from your insurance agent because we are a flat-fee, fiduciary, fee-only financial advisor. We are not compensated in any way by recommending these products to our clients.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.