Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Understanding how annuities are taxed, and specifically how they fit into a tax-efficient retirement withdrawal plan, is a common pain point with many people we talk to. The tax rules of annuities can be complex, and you may be wondering if an annuity is really your best option for retirement income.

To understand your annuity withdrawal tax consequences, you need to know what type of annuity you have. There are 2 main types of annuities that have very different tax implications – qualified and non-qualified annuities:

If you have a qualified annuity, this investment was funded with pre-tax money, maybe from a qualified retirement plan such as a 401(k) or traditional IRA. Any annuity payments from a qualified annuity will be taxed at your ordinary income tax rate.

If you have a non-qualified annuity, it was funded with after-tax dollars. The money you used to initially fund the annuity is your cost basis and is withdrawn without tax consequences.

However, there is still a portion of your withdrawal that is taxable with a non-qualified annuity. Any growth on the investments in the account will still be taxed at ordinary income rates. When you take any withdrawals or you actually annuitize the annuity and begin receiving fixed payments, a portion of your payment will be taxable, and a portion will not. The taxable portion and the portion that is returned tax free is based on the exclusion ratio, which is determined by the IRS.

Regardless of the type of annuity contract you have, there will also be additional taxes, penalties, and fees that may apply. Some examples are early withdrawal penalties and surrender charges that can be significant. These additional fees are outside of the scope of this post, but are covered in other articles linked at the bottom of this post.

Annuities are commonly sold with an insurance company salesman talking up the tax advantage of tax deferred growth.

And that is true to some extent. While you are saving into these annuities you will not be subject to taxes on the growth, or any dividends or interest, in the account. This will result in short term tax savings for those purchasing a non-qualified annuity.

However, note that this benefit is useless if you are using retirement savings from a qualified plan such as an IRA or 401(k) to purchase the annuity, since those accounts are already tax deferred.

Also, tax deferral is not always the best long term option. In fact, you may be setting yourself up for quite a large tax bill later in life!

What doesn’t get talked about enough is that this tax deferral comes at the cost of potentially much higher taxes later in retirement as you begin to withdrawal money from the annuity.

Like your 401(k), or IRA savings, annuities are pushing tax obligations to later in retirement.

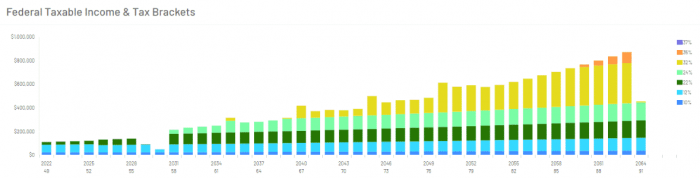

The general consensus is that you will be at a lower tax rate in retirement, so it makes sense to delay income until later in your plan. However, when you combine your Social Security benefits, other pre-tax dollars, other pensions or deferred compensation plans to the annuity withdrawals, we often find that retirees can be at a much higher tax rate in retirement than they thought they would be at!

When we work with clients, we create a projection of future tax liability to determine if it makes sense to defer taxes. Often, the case is that after accounting for RMDs (required minimum distributions), Social Security, and other retirement income, retirees often find themselves in a higher tax rate than when they were working!

And in fact, for some this makes nonqualified annuities a very poor choice instead of simply investing in a ordinary brokerage account. That is because investments within a brokerage account are taxed differently than investments within an annuity.

In a brokerage account, investment gains are taxed at long term capital gains rates, which is always lower than your income tax rate that will apply to annuity income payments.

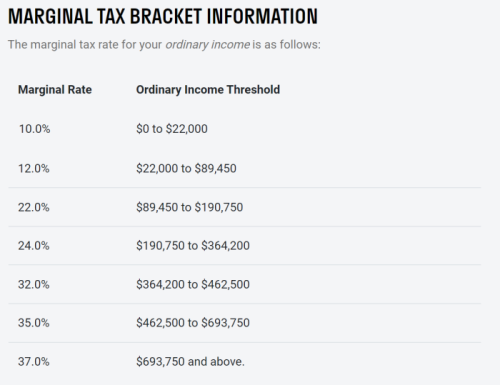

For example, here are the Federal income tax brackets for a married couple in 2023:

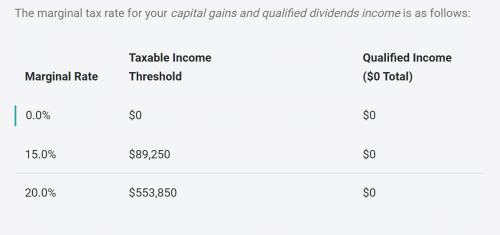

Whereas long term capital gains are taxed at the following rates:

Notice for any level of taxable income, long term capital gains are taxed at a lower rate than ordinary income taxes.

That means that a stock, ETF, or mutual fund investment in a brokerage account will have a lower tax liability in retirement than the periodic payments from an annuity. And in fact, depending on your income in retirement, you may be able to recognize capital gains at a 0% tax rate if you keep investments outside of an annuity!

Before entering retirement, be sure you understand the implications of how your annuities are taxed, depending on the tax treatment of your insurance contract. Be sure to look at what the exclusion ratio (which is based on your life expectancy and other variables) means for long-term tax obligations in your retirement plan.

Bottom line: If you will also have significant RMDs from IRAs, 401(k)s, or other tax-deferred retirement accounts, the additional tax liability from annuities, particularly non-qualified annuities, may be substantial.

We help our clients determine the role an annuity plays in their financial plan, and develop a tax efficient way to get money out of the annuity, or otherwise utilize it in your retirement plan.

The taxation of annuities and the management of annuity funds are complicated topics in retirement planning. These products are complicated investments with some potential tax pitfalls if the annuity payment schedule is poorly planned, so please reach out to a fiduciary financial advisor like us or a tax advisor if you have questions on an annuity you own or are considering. Uncle Sam may like poorly thought-out retirement plans with annuities, but we don’t.

While the regular monthly payments from annuities can be a great addition to a retiree’s income stream, careful consideration must be made for how annuities are taxed in your retirement plan.

Matt worked for the Department of Defense as a material scientist before changing careers to follow his interests in personal finance and investing. Matt has been quoted in The Wall Street Journal, CNBC, Kiplinger, and other nationally recognized finance publications as a flat fee advisor for Arnold and Mote Wealth Management. He lives in North Liberty, where you will likely find him, his wife Jessica, and two kids walking their dog on a nice day. In his free time Matt is an avid reader, and is probably planning his next family vacation.